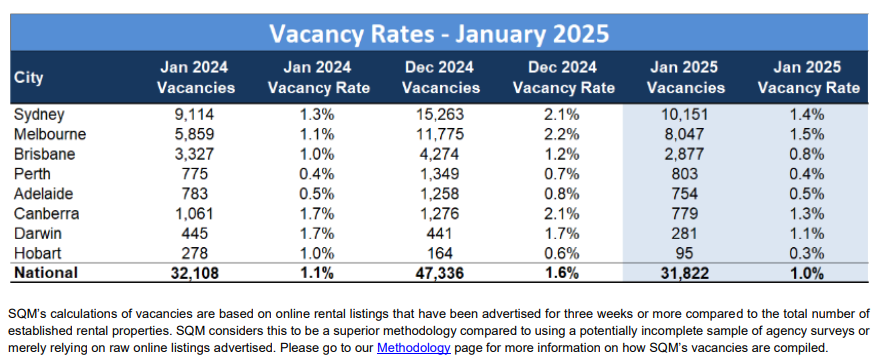

This week, SQM Research revealed that Australia’s rental crisis reignited, with the national vacancy rate falling to 1.0% in January, down 0.1% year-on-year.

In his commentary on the results, managing director Louis Christopher suggested that a resurgence of net overseas migration may have tightened the rental market.

“The sharp decrease in rental vacancies strongly indicates Australia’s rental market crisis is not over and has potentially deteriorated at the start of 2025”, Christopher noted.

“Could there have been another surge in migration levels in recent weeks? We don’t know for sure, but clearly something has driven this retreat in rental vacancies”.

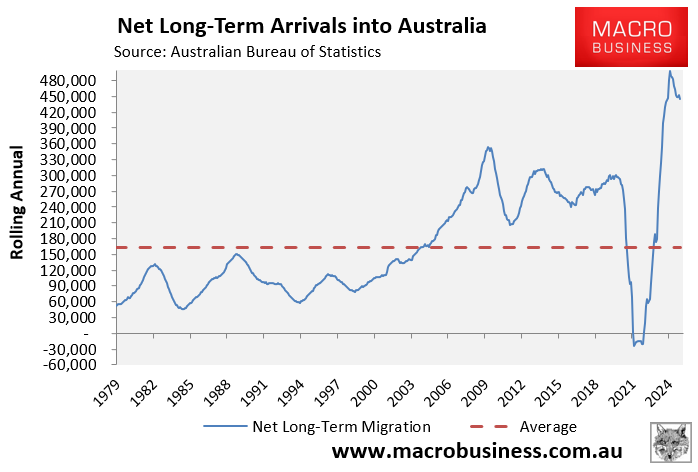

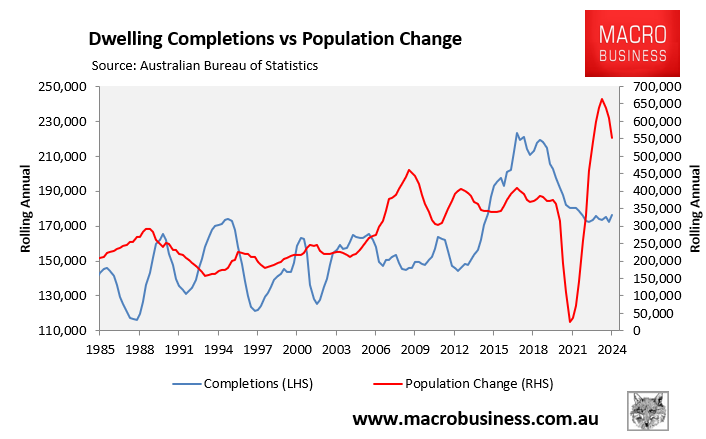

While it’s too early to determine if net overseas migration tightened in January due to the lack of available data, net permanent and long-term arrivals remained strong in 2024, tracking only slightly below 2023.

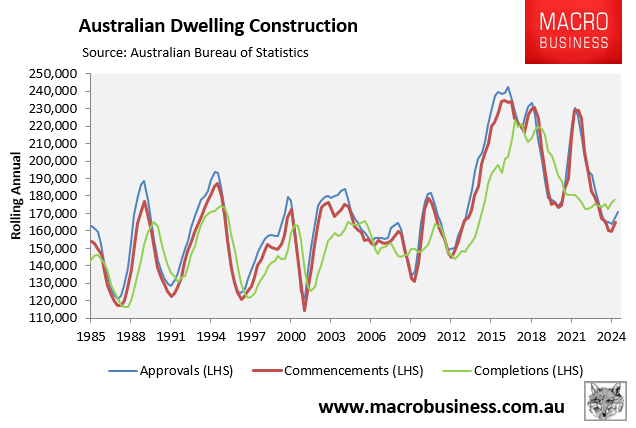

At the same time, indicators of housing construction—approvals, commencements, and completions—are tracking near-decade lows.

As a result, demand via population growth (immigration) continues to track well ahead of supply.

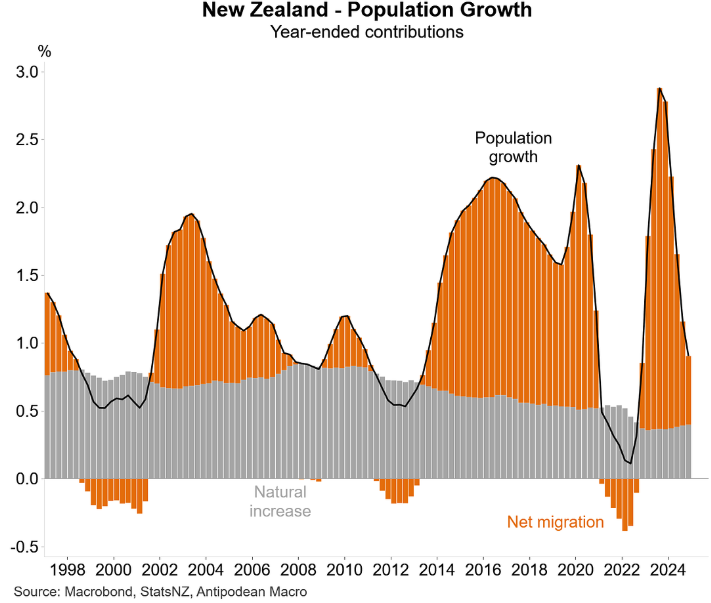

The opposite is happening in New Zealand.

This week, Statistics New Zealand released immigration data for December, which showed that annual net permanent and long-term (PLT) migration inflows fell to 27,000, the lowest level since December 2022 and well below 135,600 in October 2023.

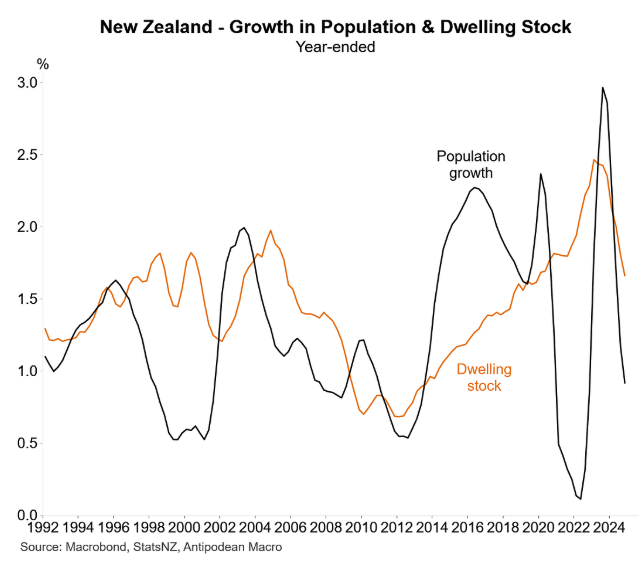

As Justin Fabo from Antipodean Macro illustrated below, New Zealand’s population grew by only 0.9% in 2024.

Fabo shows New Zealand’s population is growing far more slowly than the dwelling stock.

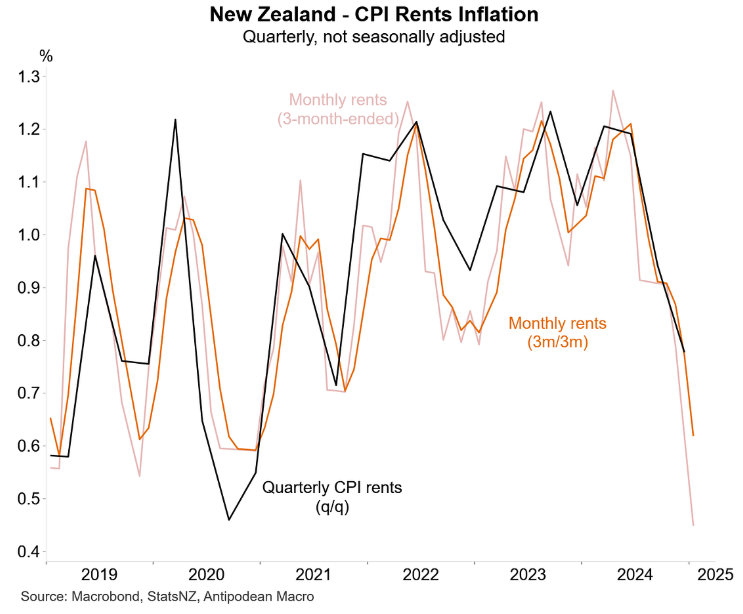

As a result, New Zealand’s rental inflation has collapsed.

Sadly, Australian tenants face the opposite situation, with the population continuing to grow faster than the supply of dwellings.

As long as this situation persists, Australian tenants will remain under pressure.

If policymakers are genuinely concerned about ‘solving’ the rental crisis, they will slash immigration to a level below the nation’s capacity to build housing and infrastructure.

It is the only genuine solution. Everything else is tinkering at the edges.