The Real Estate Institute of New Zealand’s (REINZ) house price index (HPI) for January was released this week.

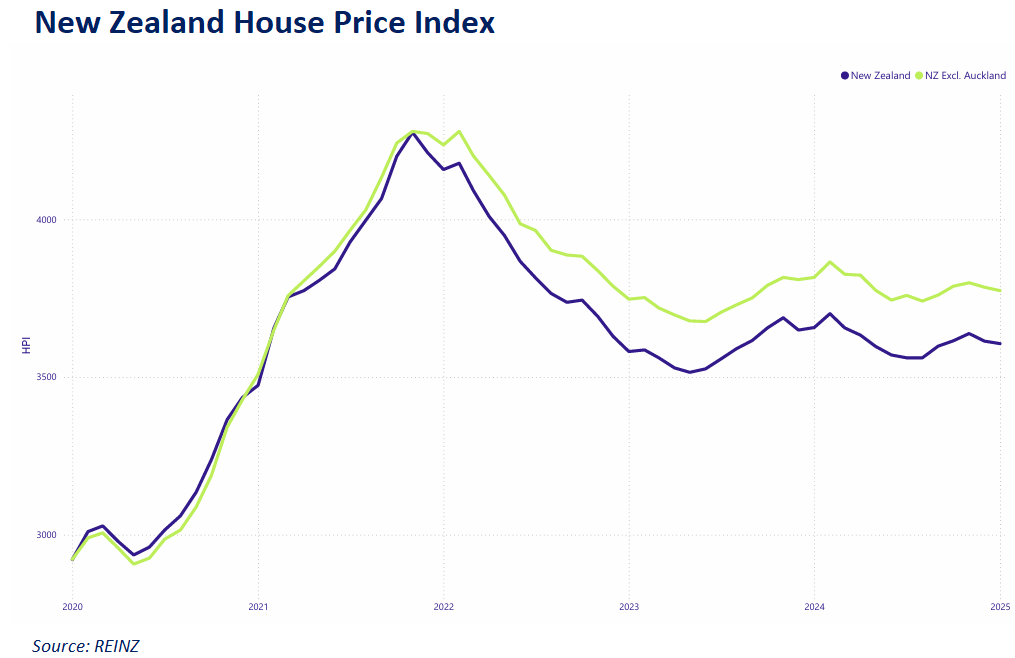

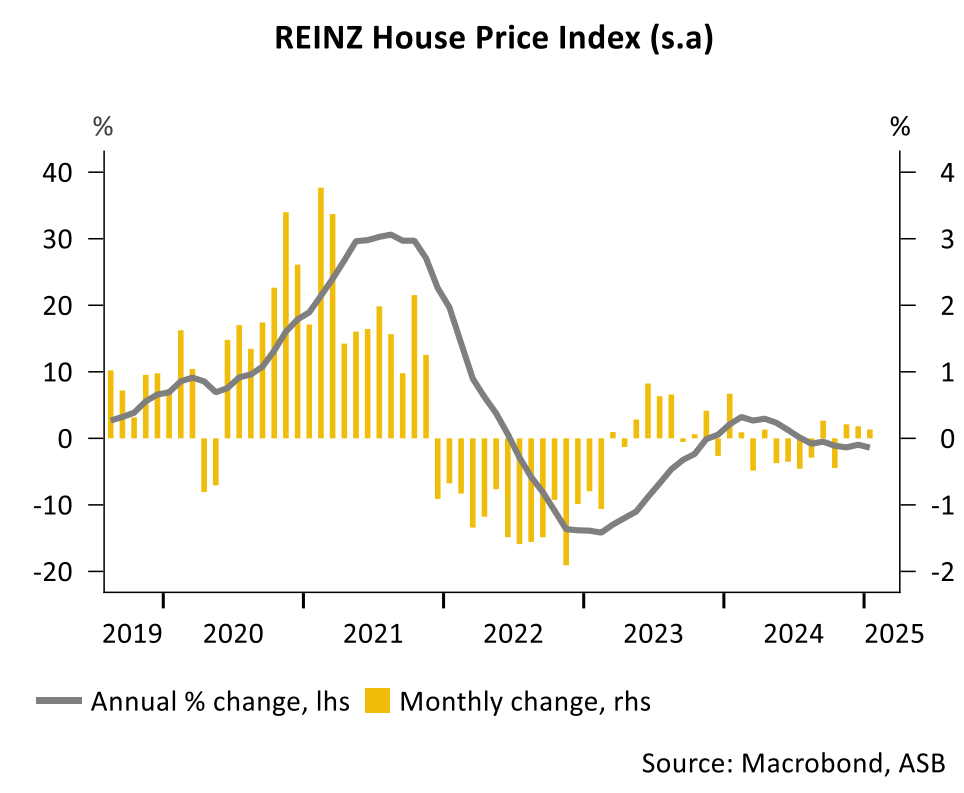

Nationally, home values declined by 0.2% in January to be 1.4% lower year-on-year.

The seasonally adjusted HPI recorded a slight increase of 0.1% in January, which was lower than the 0.7% rise in January 2024.

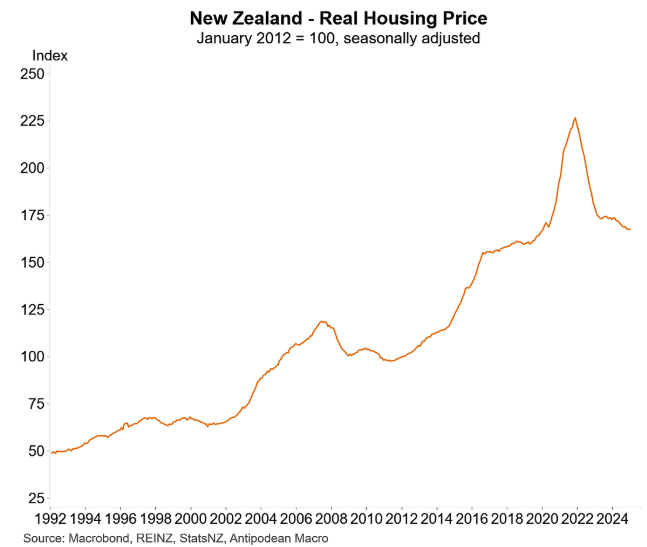

After experiencing one of the world’s largest price booms during the pandemic, New Zealand home values have now crashed back to pre-pandemic levels when adjusted for inflation.

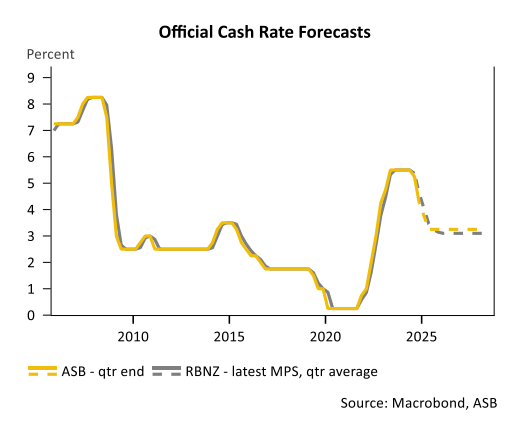

This week, the Reserve Bank of New Zealand cut the official cash rate another 0.50%. This took the cash rate to 3.75%, down from last year’s peak of 5.50%.

The Reserve Bank’s commentary was also more dovish than expected. From here the Reserve Bank has clearly signalled that it will keep steadily cutting the official cash rate.

Major bank ASB believes that two 0.25% cuts look assured but with the risk of a third.

As a result, ABS expects the Reserve Bank to cut the official cash rate by 0.25% at each of the April and May meetings, bringing the cash rate to 3.25%, in line with its assessment of where the neutral rate lies.

In light of the lower expected interest rates, ABS has forecast a gradual recovery in house prices over 2025, with more noticeable improvements expected in the second half of 2025.

“Interest rates will play a crucial role”, ASB says.