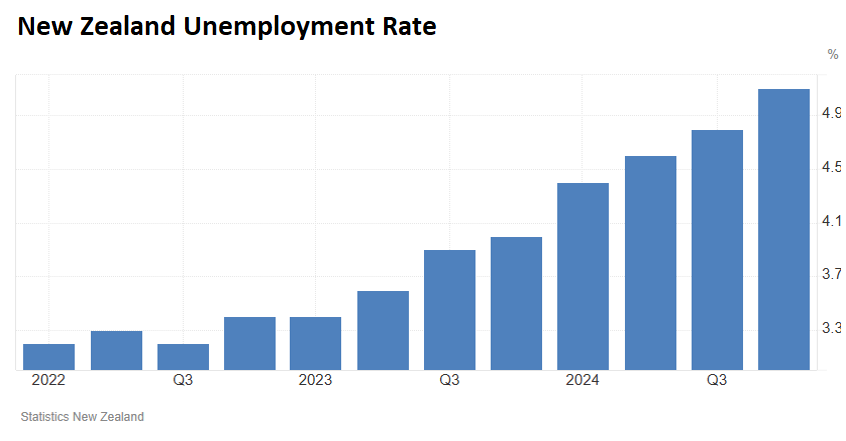

Statistics New Zealand released the Q4 Labour Force Survey this week, revealing that employment fell over the quarter and the unemployment rate hit a 4-year high of 5.1%.

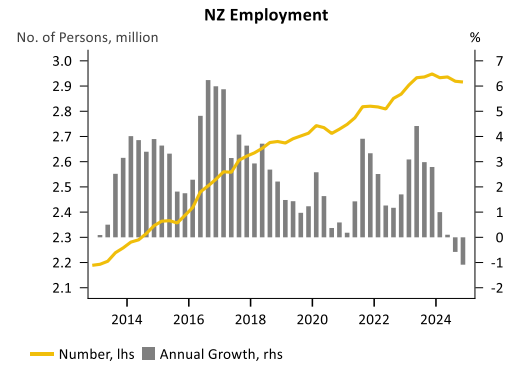

New Zealand employment fell 0.1% in Q4, the second consecutive quarterly decline, to be 1.1% lower than a year ago.

Overall, the New Zealand economy shed a net of 32,000 jobs in 2024. The quarterly decline in employment was the largest for full-time employment (-0.3% QoQ, -1.7% YoY), depicting a weakening jobs market.

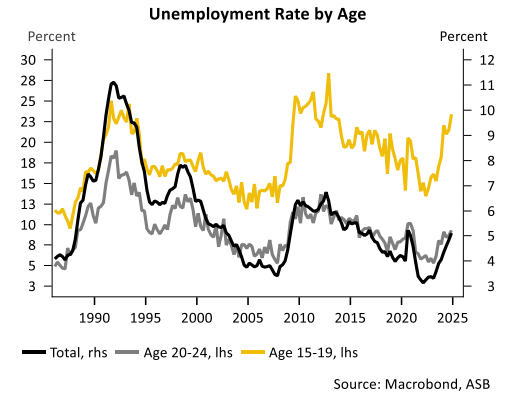

The labour market slump has hit young Kiwis especially hard.

The unemployment rate for Kiwis aged 15-19 hit 23% in Q4 2024. This was the highest unemployment rate in more than a decade, with 15-19-year-olds losing a net 17,000 jobs over 2024, more than half of the total.

More than 70% of the 32,000 net jobs lost over 2024 were for those aged 15-24.

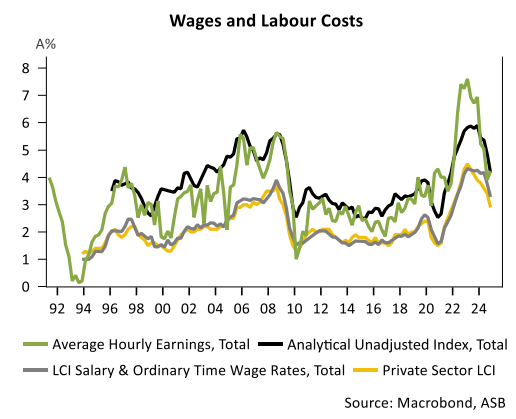

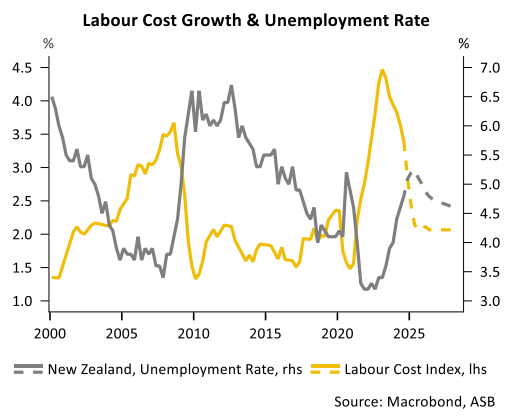

Labour cost growth also eased to a 3-year low and is moving in a direction consistent with inflation settling in the Reserve Bank’s 1-3% inflation target range.

The following chart from ASB summarises the situation, with wages falling in tandem with the surge in unemployment.

ASB believes the labour market will “continue to soften given a subdued outlook for economic activity and likely cost-cutting by firms struggling to rebuild battered profitability. We do not expect to see discernible signs of improvement in hiring until well into 2025”.

The bank believes the poor labour market prognosis will prompt the Reserve Bank to cut the official cash rate by 0.5% at its 19 February meeting, with the official cash rate falling to 3.25% by mid-2025, down from last year’s peak of 5.50%.

“The RBNZ will be wary of the wider economic, social, and labour market costs from keeping overly restrictive OCR settings for longer than is necessary”, ASB wrote.

In other words, the Reserve Bank must cut to pull the economy out of recession.