A heroes parade is on for those who predicted the gas crisis. Rod Sims leads us off.

Former head of the competition regulator Rod Sims says he has been warning the Victorian Labor government about gas shortages for a decade but was ignored, after wild storms left more than 45,000 homes and businesses in the state without power on Monday.

…Mr Sims, who led the Australian Competition and Consumer Commission from 2011 to 2022, told The Australian Financial Review he was first asked to review the concerns in 2015. At the time, the ACCC concluded that “meeting future domestic … demand will require extensive development of undeveloped gas reserves and resources.

To my memory, Mr Sims only once mentioned domestic gas reservation, after I harangued him into it.

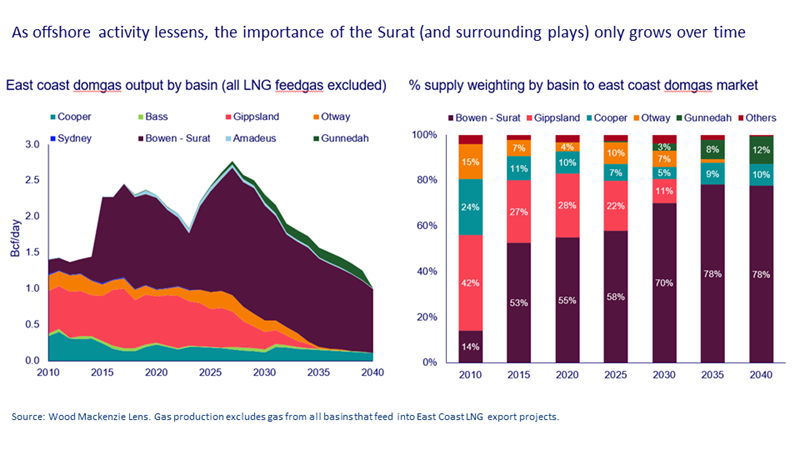

More supply will not fix the issue because the problem is not a lack of supply. The problem is a gas export cartel that sits on 83% of East Coast reserves, and within a decade they’ll own all of it as Bass Strait drains away.

It was before Rod Sim’s time, but it was the ACCC who approved the merger of Arrow Energy—the last independent reserve—with the cartel.

Another self-referential wanker today is Richard Holden.

In the grand tradition of smart-arse academics-cum-columnists telling politicians “I told you so”, I co-authored a report for the McKell Institute in 2017 that argued for charging a 10 per cent royalty on offshore gas projects and establishing a domestic gas reservation scheme.

What, if anything, can be done to fix it?

We shouldn’t retrospectively apply a gas reservation scheme to existing supply such as in Queensland. That screams, “sovereign risk”, will deter future investment, and risks retaliation from the Trump administration on behalf of the US companies operating in Australia.

But we could encourage the development of new domestic supply – such as from the North Bowen basin – combined with sufficient new pipeline capacity. As Tony Wood observed on these pages recently, this will take time. That doesn’t mean we shouldn’t start.

FFS, grow some balls. It’s a cartel, mate.

It’s already dominated and killed hydrogen. It’s trying to monopolise storage. It’s tried to monopolise LNG imports. Tony Wood’s Grattan Institute is on the cartel payroll.

The moment LNG imports start, the cartel will further restrict local supply to ensure import parity prices become the local marginal price setter.

The only way to prevent this is the one thing nobody will do. Retrospective 15% domestic reservation of East Coast reserves and/or some kind of gigantic tax recycled as rebates.

Otherwise, LNG imports will trigger a cascading inflationary shock that will wipe out the Australian economy, as we know it.

Not least because they are timed to coincide with the unfolding crash in iron ore such that every time the AUD falls, the domestic gas price will go up.

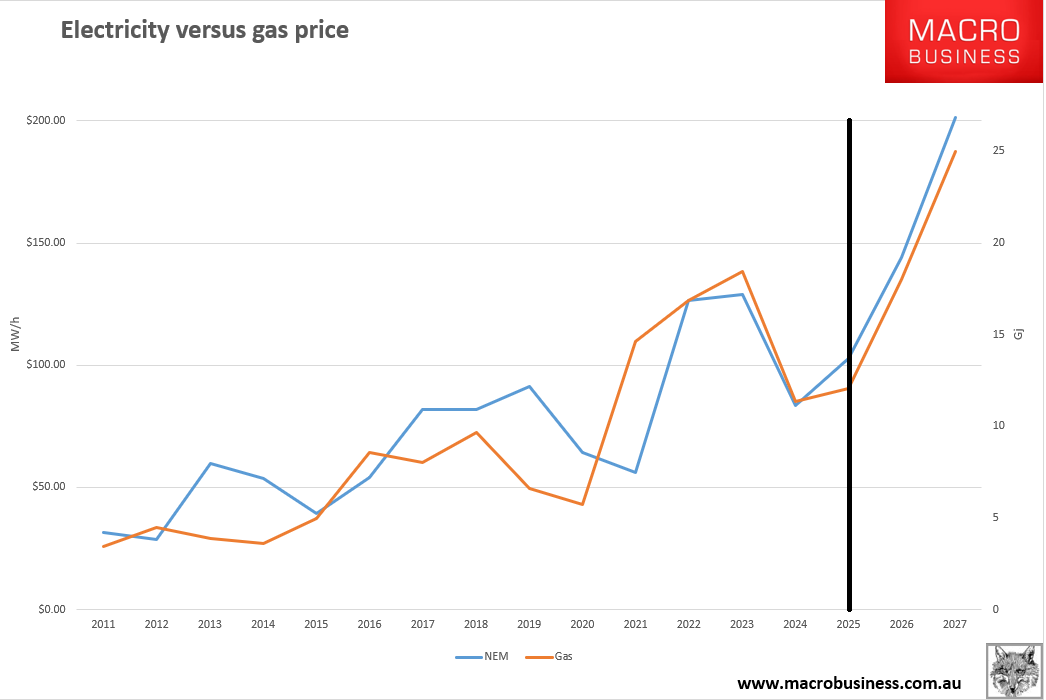

The forthcoming LNG imports 2026/27 gas and electricity price shock is huge, adding 4% to CPI and double that with spillovers.

Do these heroes want to see the RBA forced to hike interest rates into an enormous national income shock as iron ore revenues collapse while gas prices soar?

The result will be.

- Collapsing house prices.

- Collapsing living standards.

- Collapsing governments.

- Collapsing support for the energy transition.

In short, chaos. Is that preferable to upsetting Tokyo and Beijing for a couple of weeks?

Get your collective hands off it.

15% blanket East Coast domestic gas reservation and an export levy above $7Gj now.

Or Australia dies.