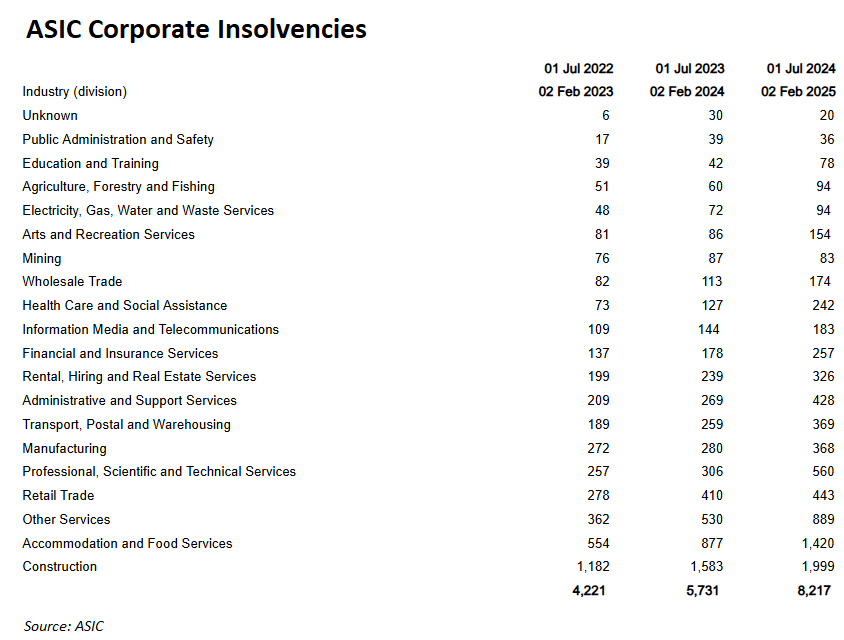

In the 2023-24 financial year, a record 3,000 construction firms in Australia were declared bankrupt (insolvent).

New data from ASIC suggests that construction insolvencies have worsened in 2024-25.

In the first seven months of this financial year, 1,999 construction firms were declared insolvent. This was 26% higher than the same period in 2023-24 (1,583) and 69% higher than 2022-23 (1,182).

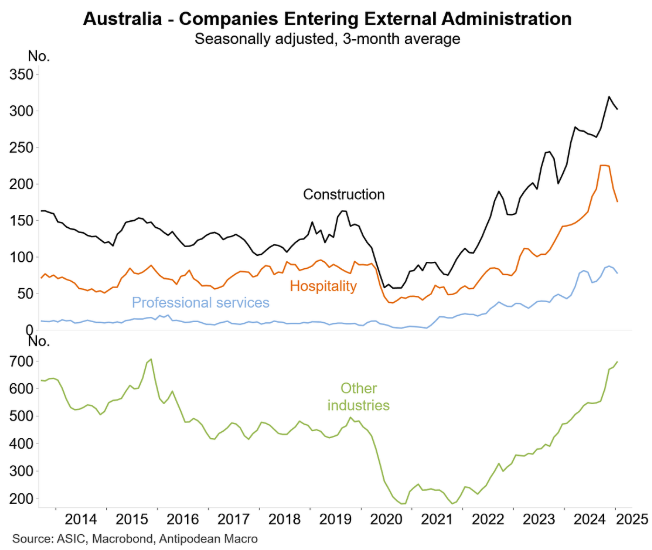

The following chart from Justin Fabo from Antipodean Macro shows the uptrend in construction insolvencies.

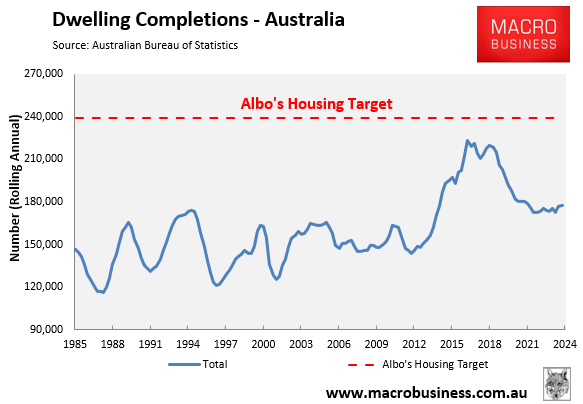

The high number of construction insolvencies thwarts the Albanese government’s target of building 1.2 million homes in five years—a level of construction that Australia has never achieved.

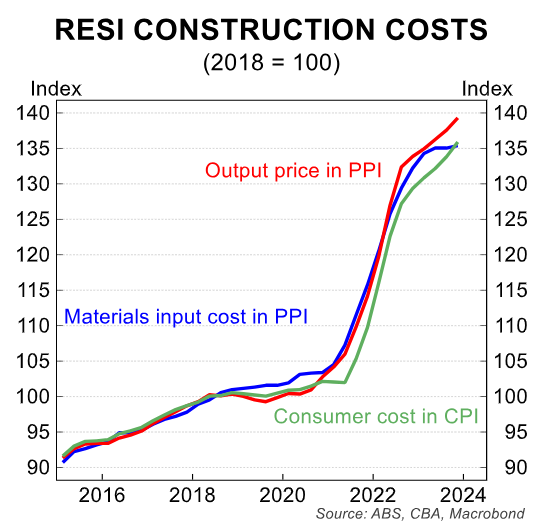

When paired with substantially increased construction costs, mortgage rates, and worker shortages, capacity in the homebuilding industry has been significantly decreased.

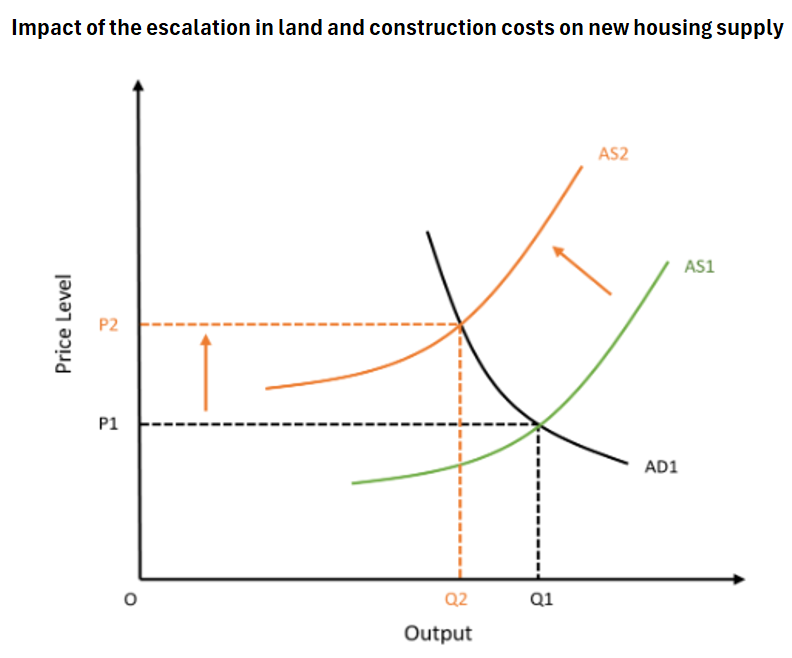

In fundamental economic terms, the supply curve for home building has shifted to the left, limiting the number of units that can be produced at each price point.

To restore market equilibrium, the federal government must significantly reduce demand by cutting immigration.

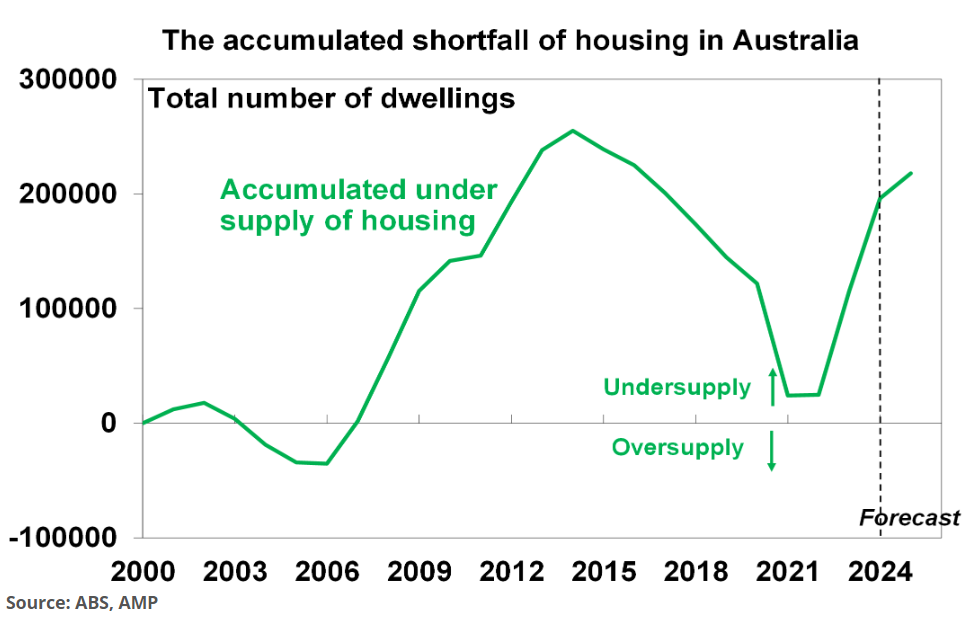

Otherwise, Australia’s structural housing shortage will worsen.