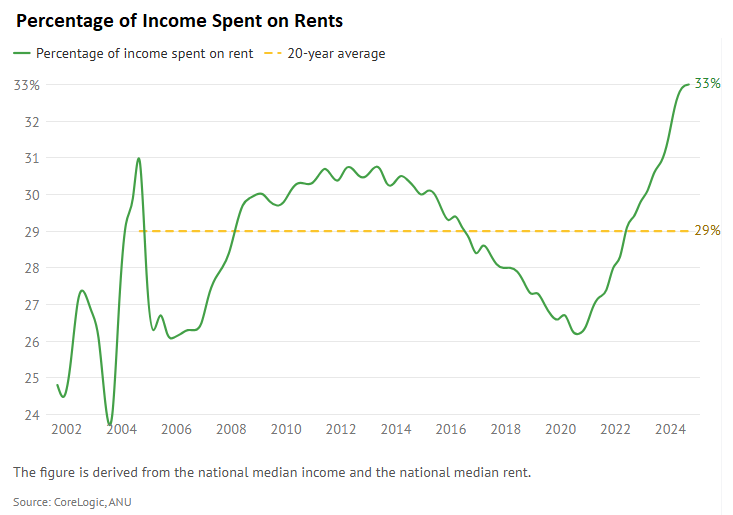

CoreLogic data shows that national rental affordability hit an all-time low at the end of 2024, with 33% of median household income spent on the national median rent.

According to CoreLogic, this followed a 37% increase in asking rents over the past five years, whereas PropTrack reported a 47% increase in rents over the same period.

Thankfully, the rental market has reached an affordability ceiling, with CoreLogic reporting a halt in rental growth during the second half of 2024, driven by declining rents in Sydney and Melbourne.

Source: CoreLogic

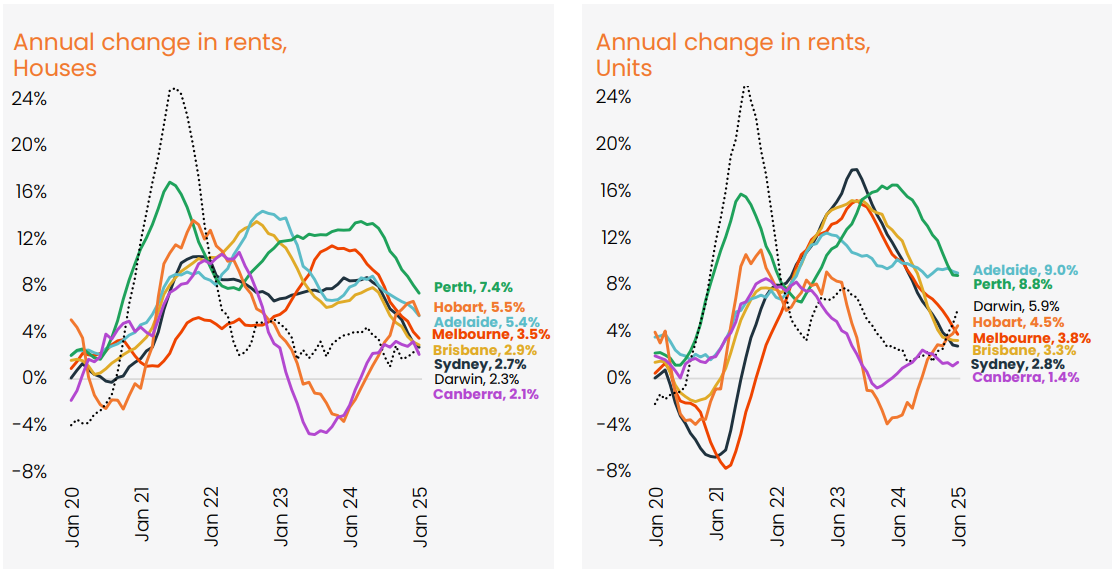

“The six-month trend in rental growth has turned negative across the two largest markets, Sydney and Melbourne, with rents down 0.4% and 0.6% respectively, with larger falls across the unit sector”, CoreLogic’s January housing report noted.

“The remaining state capitals have all recorded a clear slowdown in rental growth as net overseas migration and larger households help to ease rental demand”.

“Finally, renters are seeing some relief after a period of extreme rental growth”, CoreLogic Research Director Tim Lawless said. “Over the past five years, capital city rents have surged by 37%”.

“Regional rental conditions have been stronger relative to the capitals, with the combined regionals rental index up 1.6% over the past three months compared with a 0.3% rise in rents across the combined capitals”, CoreLogic noted.

The slowing in growth reflects the fact that rents are ultimately tied to incomes.

Households are now economising on rental costs by moving into shared accommodation or staying at home longer. This has slowed rental demand, as has the decline in net overseas migration.

Australian rents have finally hit an affordability ceiling.