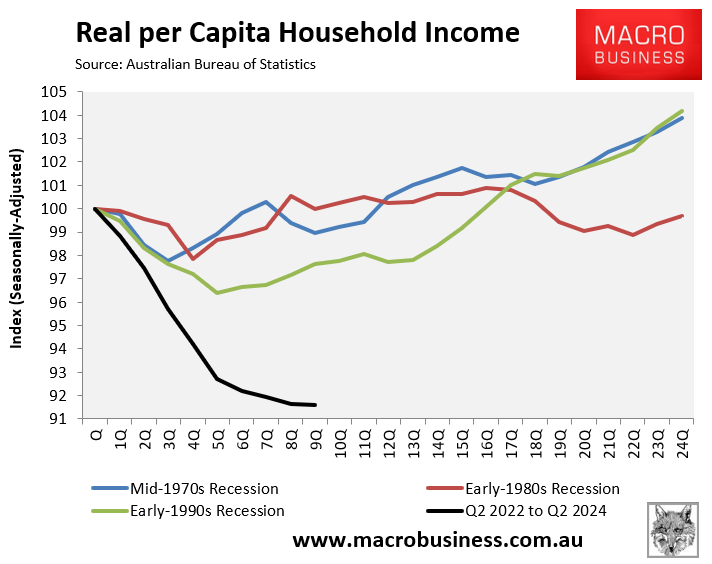

The Australian Bureau of Statistics (ABS) Q3 national accounts showed that real per capita household disposable income has collapsed by around 8% from its Q2 2022 peak, the most significant decline in recorded history.

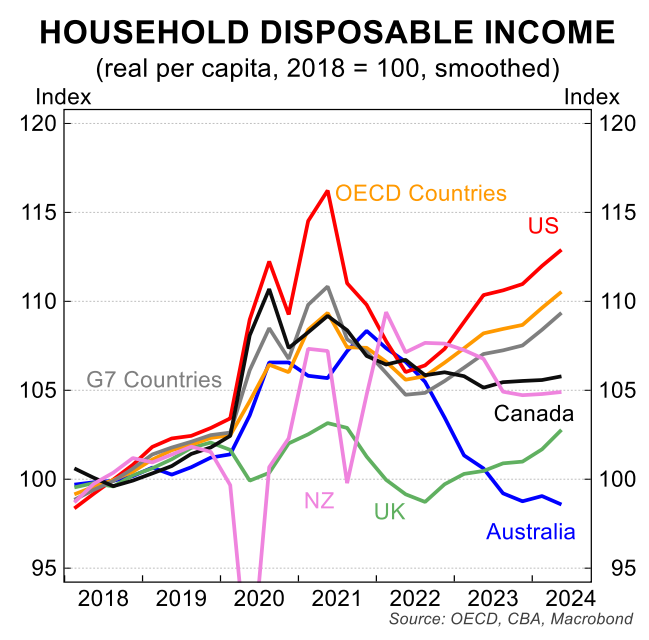

This also represented one of the greatest declines in real per capita disposable incomes in the advanced world.

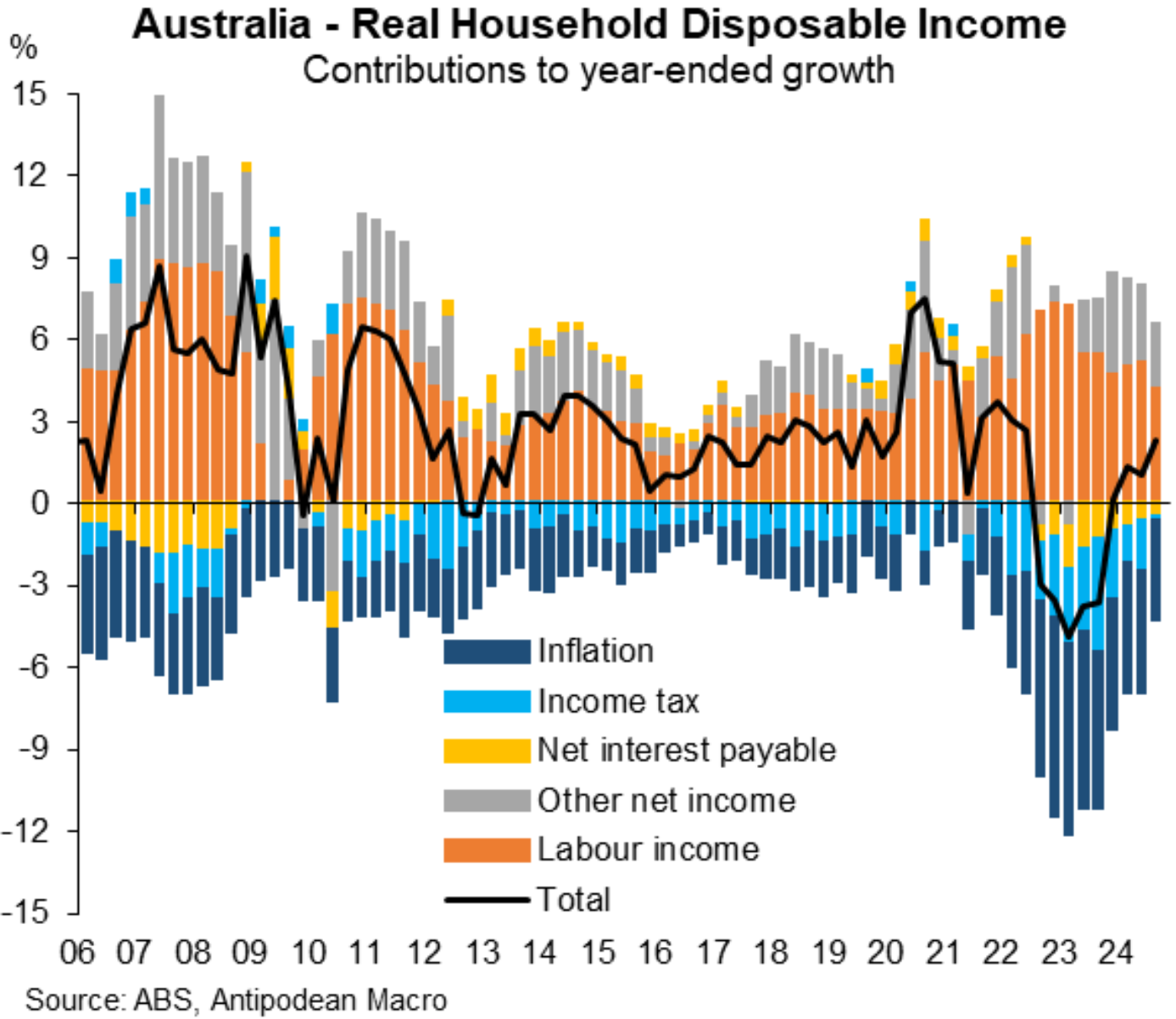

Justin Fabo from Antipodean Macro posted the following chart illustrating the primary causes of Australia’s aggregate real income decline.

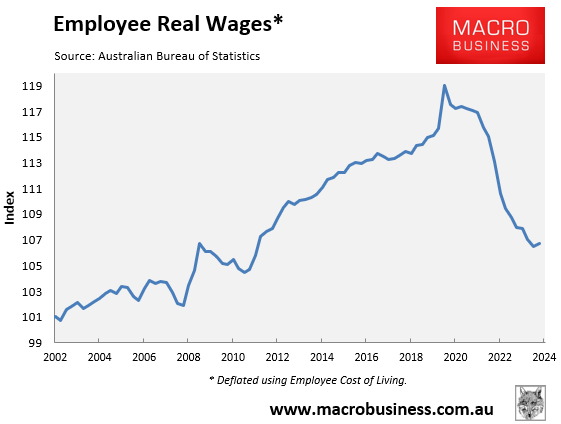

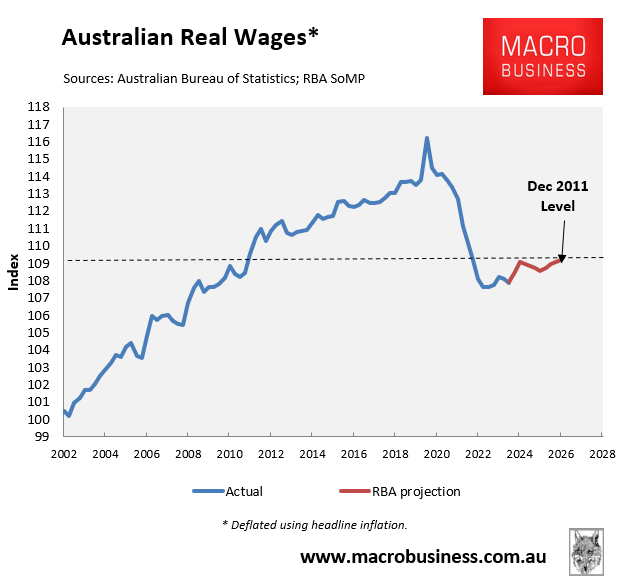

As you can see, CPI inflation has been the number one drag on real household incomes. This makes sense given real wages—i.e., the ABS wage price index deflated by headline CPI inflation—have fallen by almost 7% from their peak, as illustrated below.

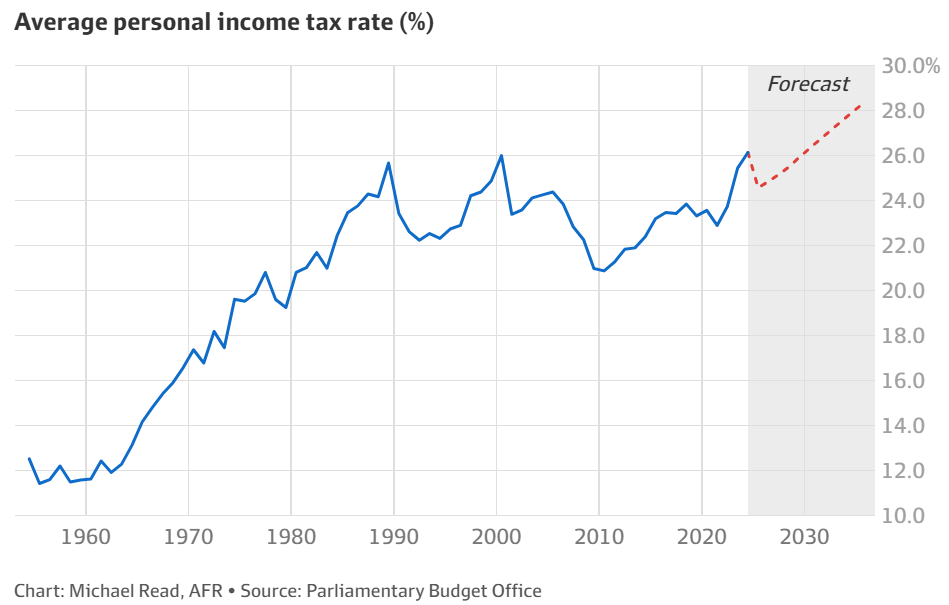

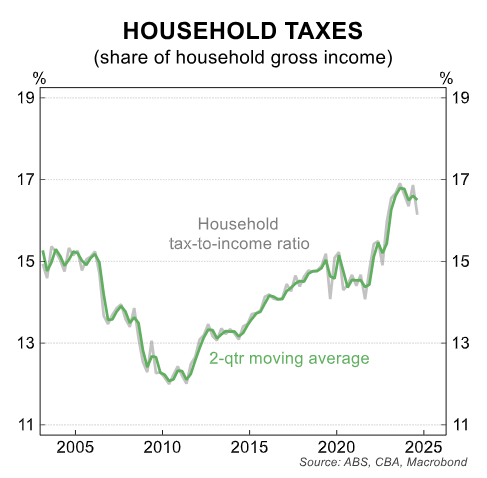

The next major drag on household disposable income is income taxes. Bracket creep and the expiry of the lower-middle-income tax threshold saw average personal income tax rates rise to a record high in Q2 2024.

The share of income lost in taxes rose to a record high in Q2 2024.

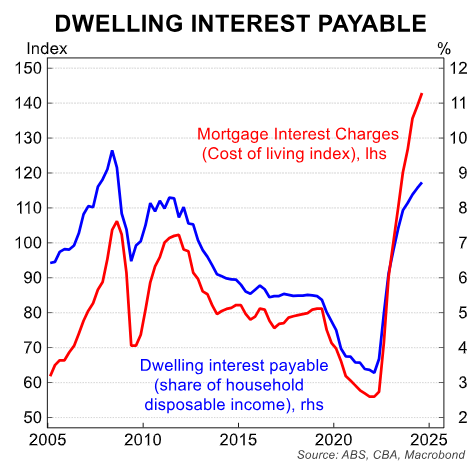

The third biggest drain on household disposable income is rising mortgage rates.

Although principal and interest mortgage repayments have risen by around 50% since the RBA began tightening interest rates in May 2022, only around one-third of households carry mortgages.

Therefore, the overall impact of rising interest payments on the household sector has been less severe.

However, employee households have been hit hard by rising mortgage rates since they have a high share carrying mortgages.

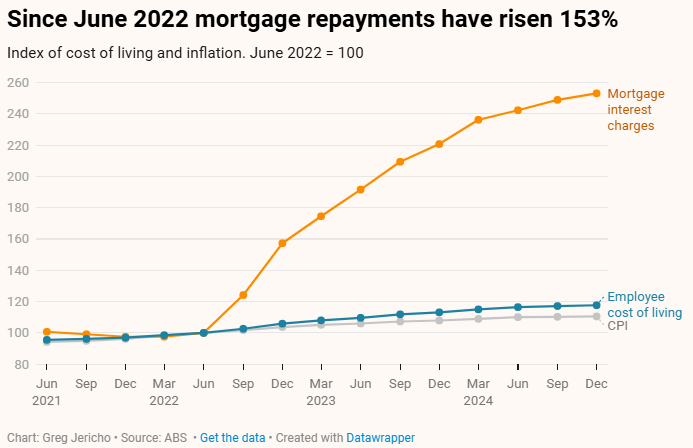

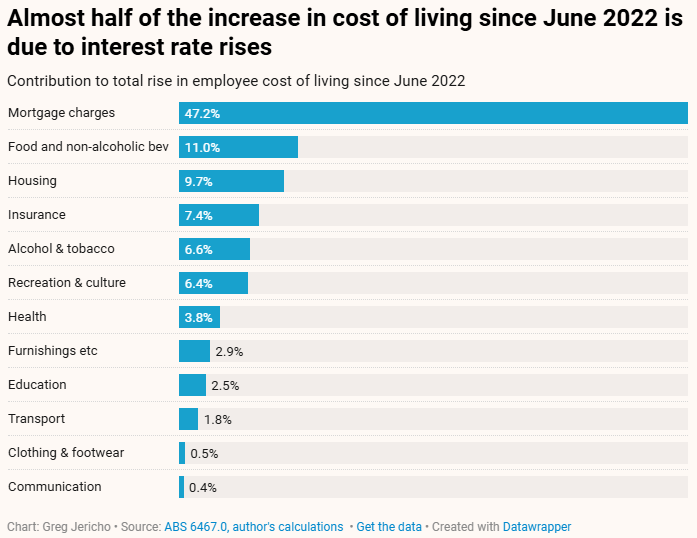

As shown below by Greg Jericho, increasing mortgage costs are the main reason employee living costs have grown well above CPI inflation.

“So great is the impact of interest rate rises that, since June 2022, mortgage repayments have accounted for nearly half of the total increase in the cost of living for employee households”, Jericho wrote last week.

This explains why real wages, when deflated by employee cost of living (~10%), have fallen far further than when deflated by CPI inflation (~7%).