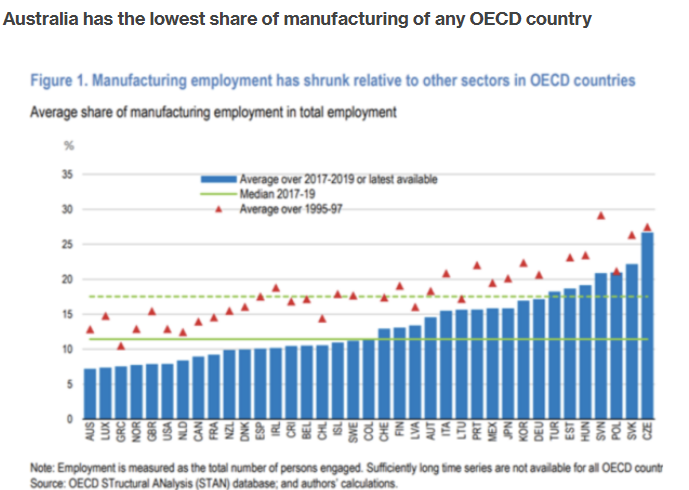

Australia’s manufacturing sector is the smallest in the OECD as a share of the economy.

Manufacturing in Australia is also in terminal decline.

Incitec Pivot, a major fertiliser company, closed its Australian operations in 2022 due to high energy costs.

Qenos, Australia’s last major plastics producer, closed in 2024 due to high energy prices, leaving the country completely reliant on imported polymers from China.

Last month, Orica, the world’s largest manufacturer of mining explosives, chemicals, and agricultural fertilisers, threatened to close its Australian facilities and invest in the United States instead.

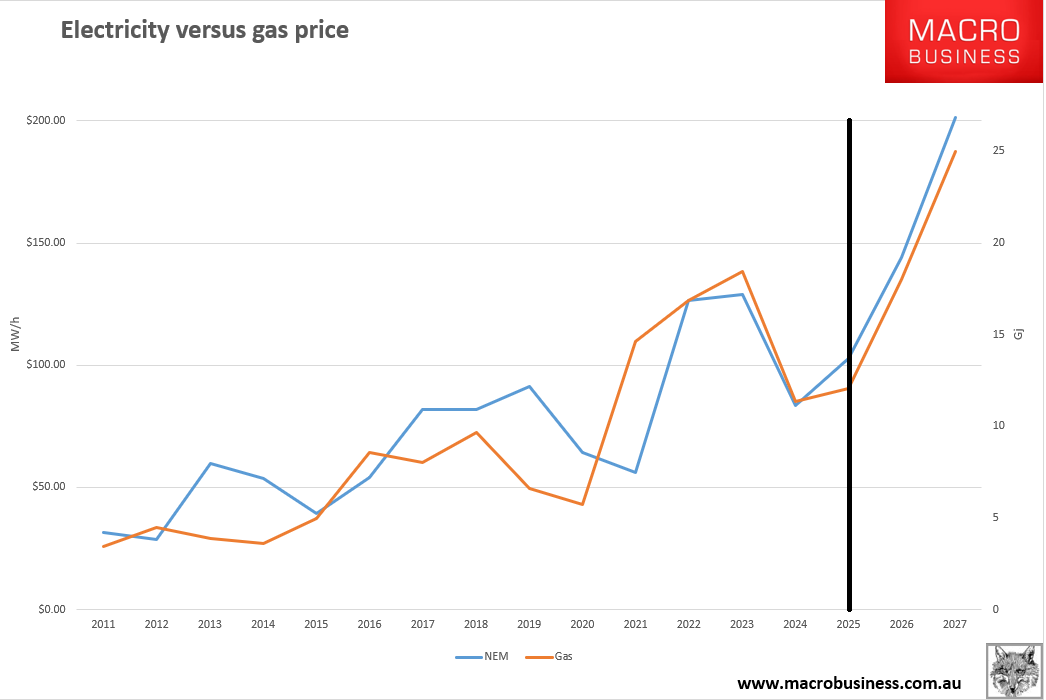

Sanjeev Gandhi, Orica’s managing director, claimed that electricity rates in Australia have tripled in the last decade, gas prices have quadrupled, and renewable energy is expensive.

“The US is pro-manufacturing, they’ve got cheap energy, they’ve got good gas supply and reserves”, Gandhi said.

Oceania Glass, Australia’s only architectural glass manufacturer, closed this month after 169 years in business, citing excessive energy prices and Chinese dumping.

The latest insolvency data from ASIC shows that almost 1390 manufacturers nationwide have become insolvent since 2022-23.

On Tuesday, Industry Minister Ed Husic told parliament that the government was committed to rebuilding manufacturing capability, which he said was crucial for Australia’s economic and strategic interests.

“We need to be able to stand on our own two feet and not be dependent on broken and concentrated supply chains, only relying on a handful of nations for the things that are really important to our country”, he said.

Husic continued to spruik Labor’s billion Future Made In Australia (FMIA) program to boost local manufacturing, which includes billions of dollars in subsidies to promote local green iron and steel making.

$13.7 billion worth of FMIA tax breaks for critical minerals processing and green hydrogen production passed the upper house on Monday night with the support of the Greens and crossbenchers.

As long as gas and electricity prices continue to rise, Australia’s manufacturing sector will shrink.

Moody’s last week published a detailed analysis of Australia’s green energy transition, warning that it could increase real wholesale power prices (excluding transmission costs) by 5%-15% by 2035 and retail energy bills by 20%-35%.

Moody’s estimated that Australia will need to invest $150 billion to $190 billion in today’s dollars on new infrastructure and transmission over the next decade to satisfy renewables targets. These expenses will be factored into retail power bills.

Moody’s stated that because renewables are intermittent and unreliable (due to weather), significantly more renewable energy capacity (about three times) must be created to cover the equal amount of dispatchable fossil fuel electricity.

Moody’s said that gas-fired power generation will become increasingly important as a bridge fuel to close the gap between user demand and intermittent renewable supply.

In reality, energy costs are likely to rise significantly more than Moody’s forecast since East Coast gas prices will continue to rise, making firming power more expensive.

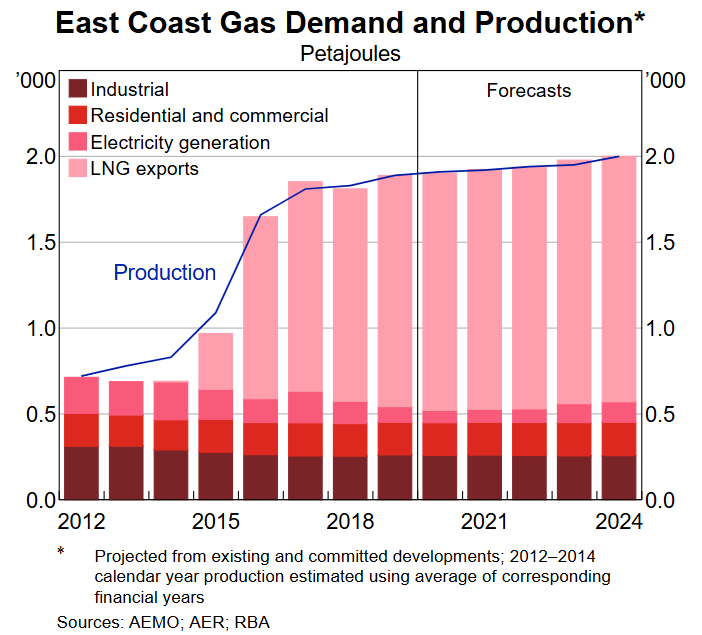

Due to the lack of a local reservation policy on the East Coast, nearly three-quarters of gas is exported, primarily to China, resulting in shortages and rising costs at home.

The gas prices will rise further as LNG import terminals open in New South Wales, Victoria, and South Australia, which will also drive up electricity prices.

Instead of wasting billions of taxpayer dollars on picking winners as part of its Future Made In Australia policy, the federal government should dramatically slow the renewables rollout and impose East Coast gas reservation with traditional cost-plus pricing regulation and gas export levies.

Australia has plenty of energy, so its power costs should be among the lowest in the world.

Policy failure and the stubborn pursuit of ‘net zero’ are depriving Australians of affordable energy.

Do we want an economy where the only viable manufacturing in Australia depends on government subsidies and poorer Australians cannot afford to heat or cool their homes?