The pump-priming of Australia’s housing market is in full swing.

Australian Treasurer Jim Chalmers has already announced that he has instructed Australia’s financial regulators to relax home lending regulations for millions of Australians with home loans.

Under the changes, a borrower’s student debt will be excluded from mortgage serviceability calculations if the bank feels the borrower will repay their loans in the “near term”.

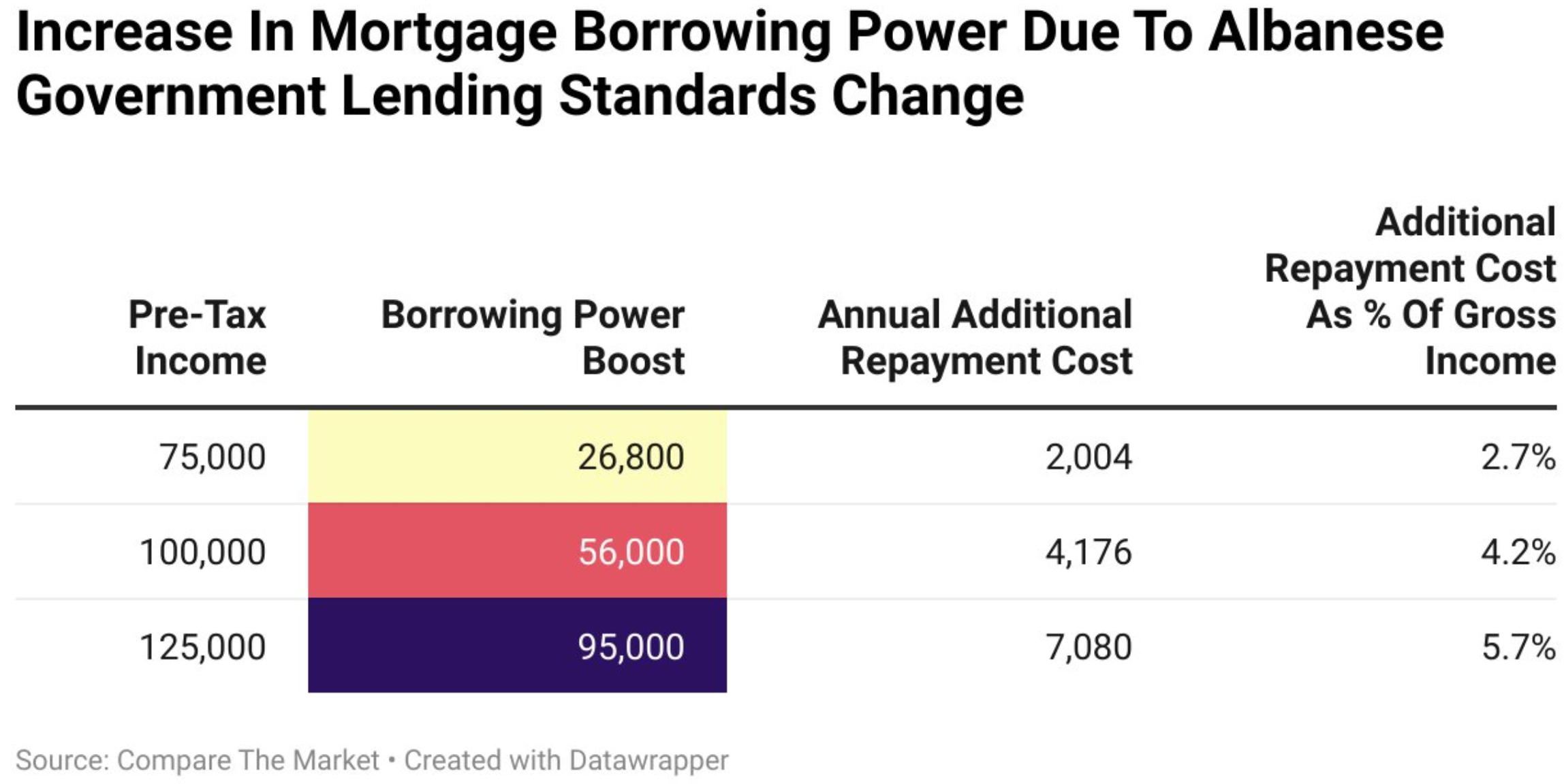

Compare the Market estimates that prospective home buyers with student debts could borrow between $26,800 (lower end) and $95,000 (higher end) more under the changes, depending on their income.

The Opposition has also committed to allowing first-home buyers to use their superannuation savings as a housing deposit and relaxing responsible lending rules, should the Coalition win the upcoming federal election.

These policy measures would significantly boost borrowing capacity, housing demand, debt, and home prices.

Not to be outdone, the Property Council of Australia (PCA) on Monday released its federal election platform, which calls for a cap on interest rates for first-home buyers as part of a scheme for them that would also limit deposits to 5% for new homes or apartments, in a bid to help thousands of Australians onto the property ladder.

Property Council CEO Mike Zorbas said its proposal would give first-home buyers a “realistic chance at accessing finance for housing” and “help first-home buyers save up to $1,087 every month and $13,044 annually”.

“With cost-of-living pressures and housing affordability consistently the two issues of most concern for Australians, the government can and should use its balance sheet to support first-home buyers”, Zorbas said.

The PCA suggested the cap would be set at “either the official RBA cash rate or 5%, whichever is greater, for a period of five years”.

The PCA wants taxpayers to subsidise the interest rate on home loans. The impact would be inflationary, pushing home values even higher, and would be self-defeating from an affordability perspective.

Twenty-five years of empirical evidence have shown that demand-side measures like those outlined above do not work.

Australian home values and loan sizes have been driven to record highs.

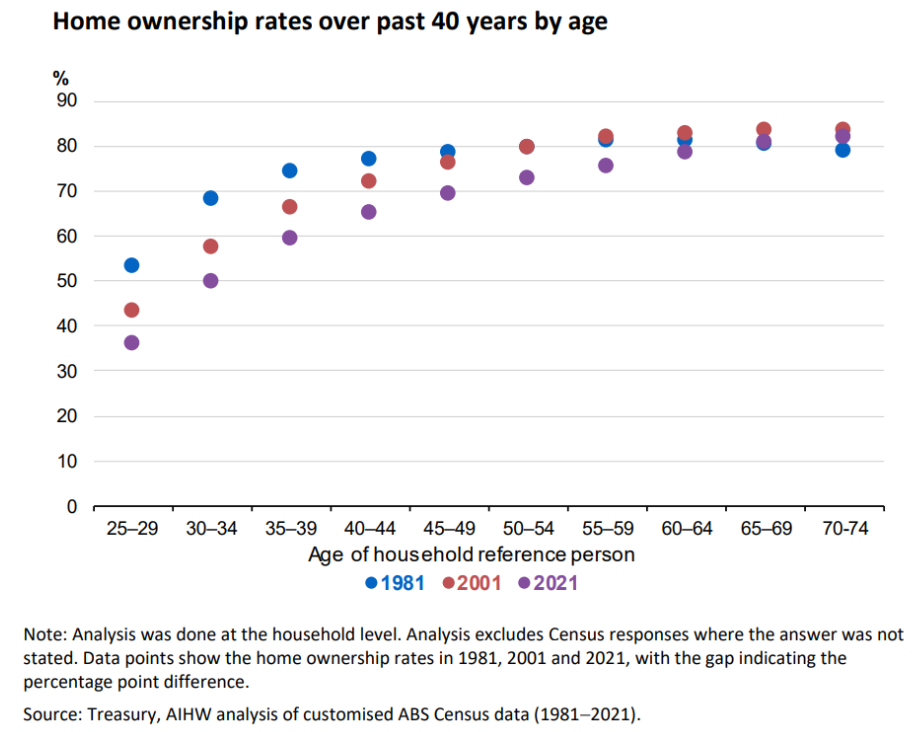

Australia’s homeownership rate has also collapsed.

There looks to be no end to Australia’s housing insanity.