I hate Victoria. It’s dull, has terrible weather, it’s up itself, and utterly fake left.

The one thing it is not is an energy bludger.

The East Coast gas cartel and its mates in the press have spent years blaming VIC for gas shortages, and it’s total bullshit.

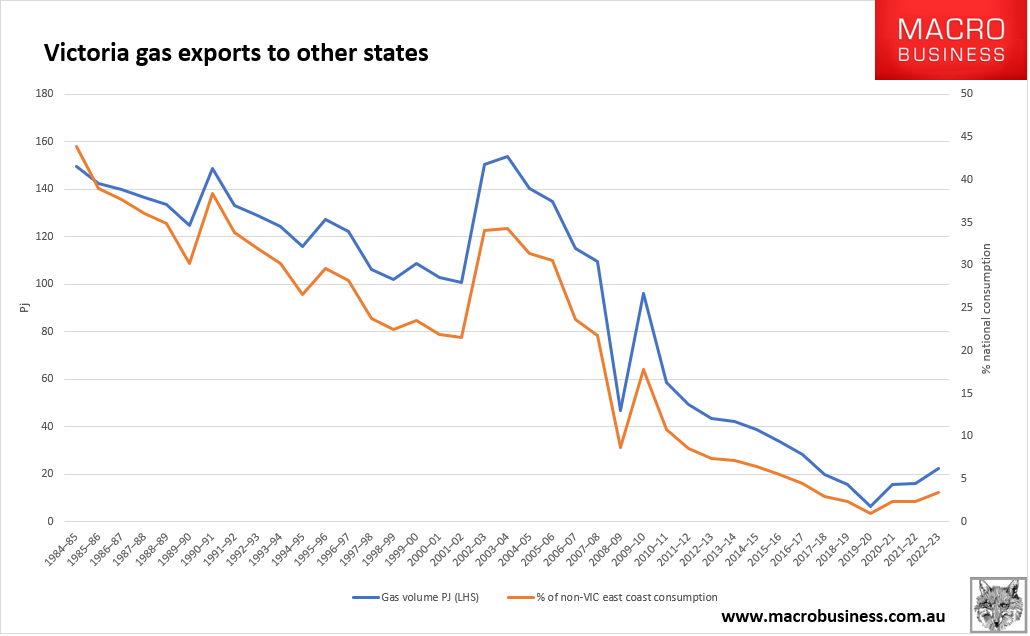

VIC has been the gas powerhouse of the East Coast for fifty years. It has kept gas bludgers NSW and SA in clover, and QLD at times as well, via huge gas interstate exports.

The following chart has some assumptions because I have had to estimate and extract WA demand but it is indicative.

Now VIC is running out of gas in Bass Strait and maybe it has some onshore reserves, though nobody knows for sure. It would be sensible to find out.

So it’s bloody rich of gas interests, pollies and the press to blame boring VIC for the exploding East Coast crisis when it was QLD that created the problem.

In any adult nation that knew VIC volumes were to run low, the northern volumes of QLD would have been positioned as the handoff of new supply.

After all, it is all one country.

Don’t buy the bullshit that QLD reserves would never have been developed without the volumes of exports. They would have had tax incentives and/or government subsidies to ensure it.

All that went wrong was a pack of greedy, gas-guzzling psychopaths blew an LNG plant capex bubble to ship it all to China instead of NSW, VIC and SA.

It should be QLD’s turn to supply southern states, and it needs to get on with doing so while everybody should stop blaming VIC.

Imported gas could soon be flowing into South Australia and Victoria and powering heavy industrial users across the two southern states, as part of a plan to fast-track new gas supplies amid looming shortages in the region.

Dubai-based AG&P LNG, which is finalising a takeover of Venice Energy and its $340m LNG import terminal project north of Adelaide, will apply for state government approvals for the first of its “energy bridge” projects in South Australia within the month, and has longer-term plans to introduce a similar scheme in Victoria.

…Australia’s largest LNG exporter Woodside already has a preliminary agreement to take LNG from its Western Australian gas fields to Viva’s terminal.

Appearing on Sky News Australia on Sunday, managing director Meg O’Neill said that while shipping gas from gas-rich parts of the country to the southern states was part of the solution, there was also a desperate need to unlock new gas developments closer to where it’s needed.

“It has been challenging to get approvals for developments here (in Victoria). And it’s fascinating the big gas sink is in Victoria, but getting permits even for floating regas facilities … it’s been very difficult to get those approvals.

The critical question here is what pricing mechanism is Woodside selling the gas on?

If it is based on the East Coast gas spot price then the damage will be severe but not catastrophic.

If it is based on Asian market prices or an oil price slope typical of LNG, then it will be twice the price, and it will be catastrophic.

Squadron Energy in NSW was planning on buying gas in Asia. Is this what AG&P LNG is doing with Woodside? Using an Asian pricing mechanism for Australian gas?

What we need is East Coast domestic gas reservation.

We only need to keep 15% of currently exported from QLD to secure our entire energy future, energy transition, and industrial base.

It is a drop in the bucket for North Asia.

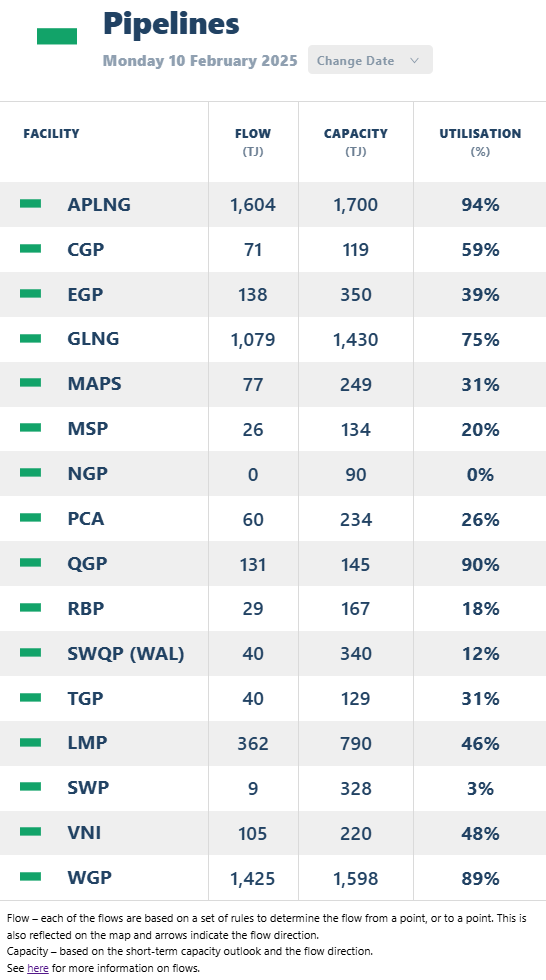

The pipelines to ship it south already exist and are half-empty in the off-season.

SWQP, MSP and VNI are half idle. EGP and SEA pipelines are being reconfigured to pipe gas south as well.

Blanket reserve 15% of eastern gas and put a monster $7Gj export levy on it all to crash the local price to $7Gj, plus collect $10bn plus for taxpayers.

Charge any individual that gets in the way with sedition. Nationalise any pipeliner or gas extractor that gets in the way.

LNG imports are economic death.

Destroy the gas cartel instead.