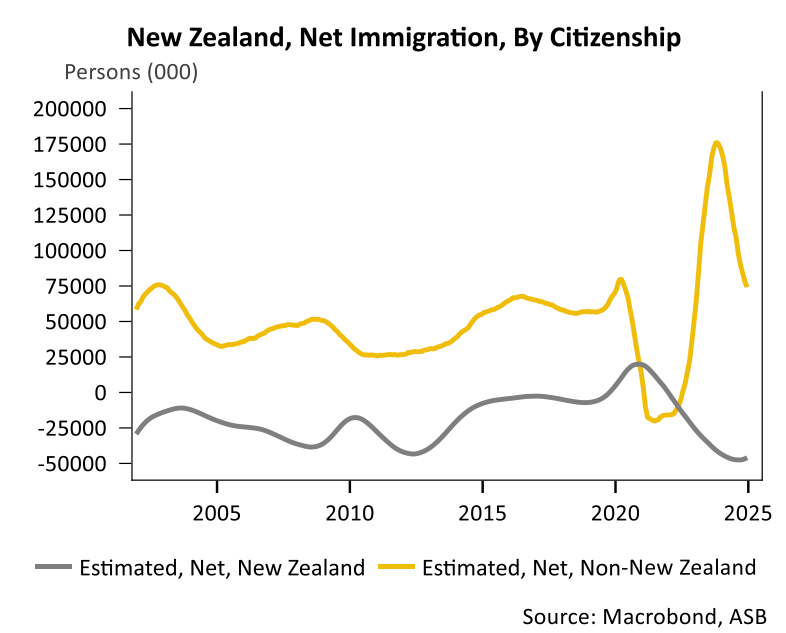

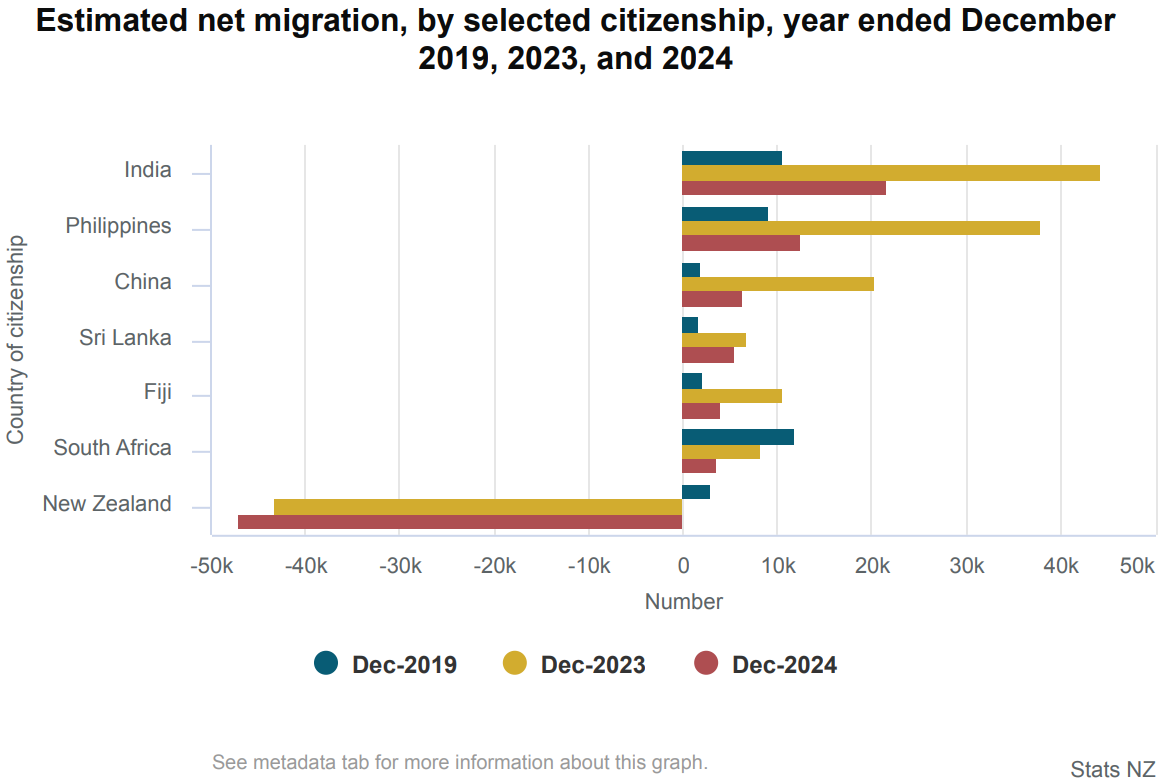

Statistics New Zealand has released net migration data for December, which showed that annual net permanent and long-term (PLT) migration inflows fell to 27,000, the lowest level since December 2022 and well below 135,600 in October 2023.

Annual arrivals continued to slow and annual departures hit record highs.

The annual net PLT inflow of non-NZ citizens moderated to 74,200. While it remained above historical averages (48,600), it was significantly lower than the net gain of 171,600 recorded over 2023.

The outflow of NZ citizens strengthened to 47,100, a near-record high, as Kiwis seek greener pastures offshore.

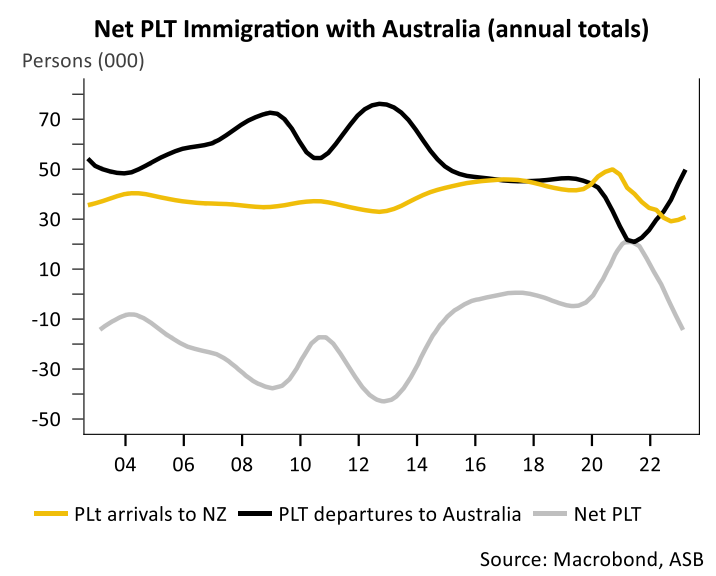

There was a provisional annual net migration loss of 30,200 people to Australia.

Historically, there has been a net migration loss from New Zealand to Australia. This averaged around 30,000 from 2004 to 2013 and 3,000 annually from 2014 to 2019.

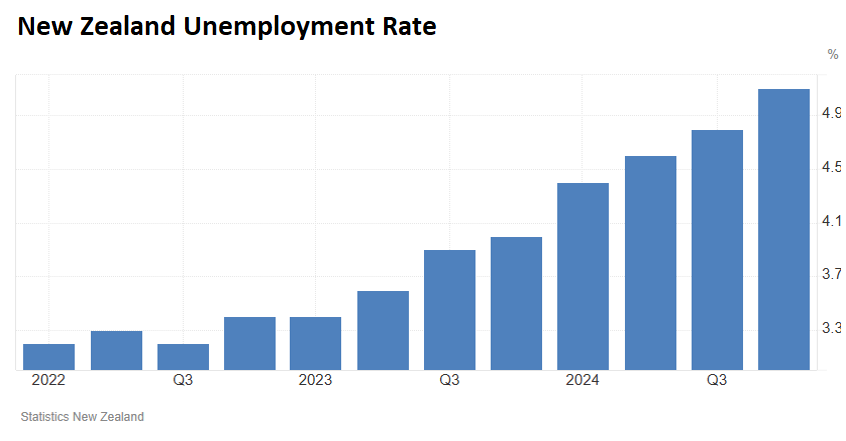

It is easy to see why. New Zealand’s unemployment rate soared to 5.1% in Q4 2024, up from 4.8% in Q3 2024.

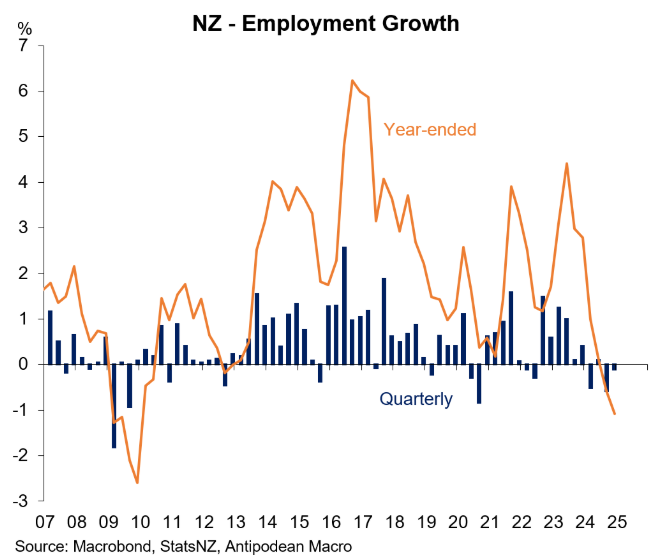

The number of jobs across New Zealand has also shrunk for three of the past four quarters.

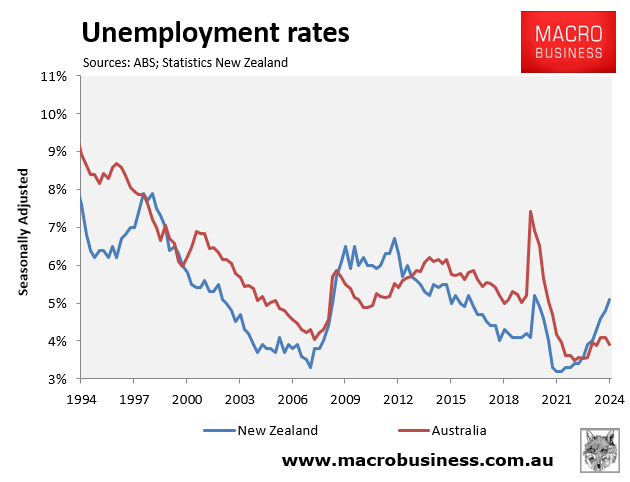

By comparison, Australia’s unemployment rate was 3.9% in Q4 2024 (4.0% in January).

The gap hasn’t been this wide in favour of Australia since Q3 2012 when there was a similarly strong outflow of Kiwis to Australia.

Clearly, Kiwis are seeking the greener labour market pastures of Australia.

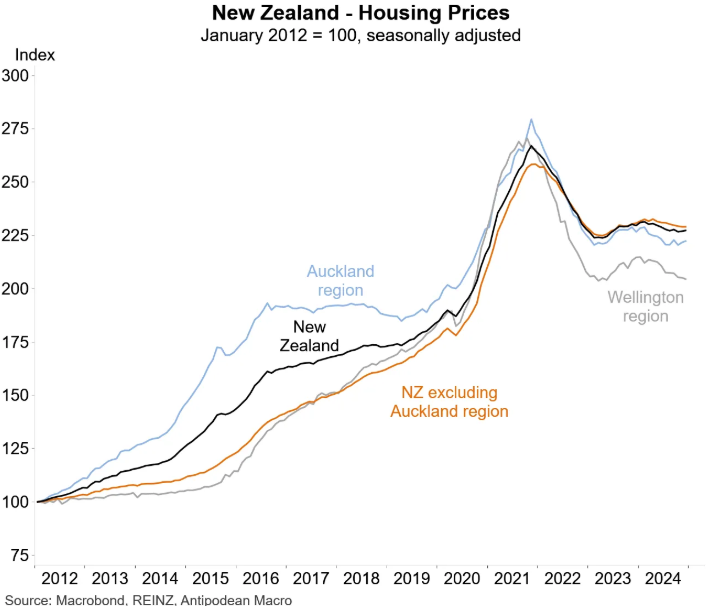

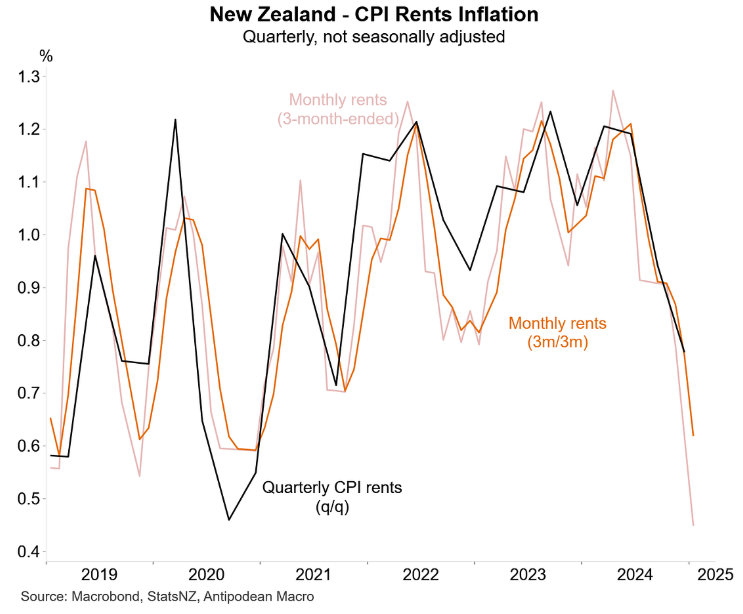

The news is not all bad for New Zealand. The sharp slowing in net migration has significantly improved housing affordability.

New Zealand rental inflation has crashed.

Lower migration has also helped to lower house prices.