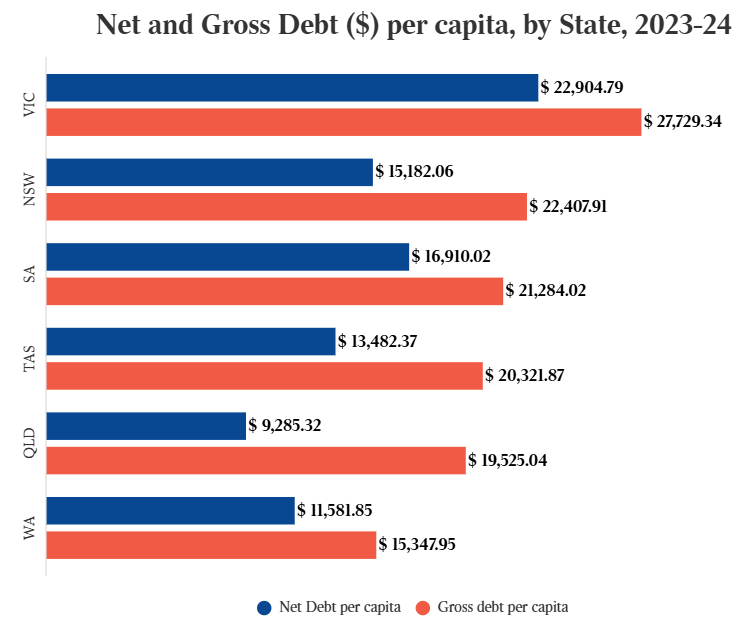

Victoria is the most indebted state in Australia and has the lowest credit rating.

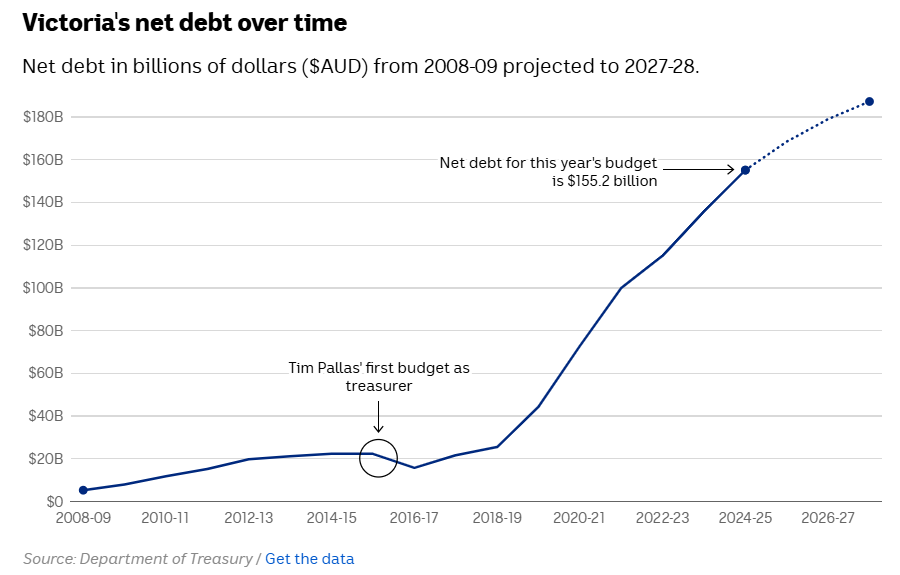

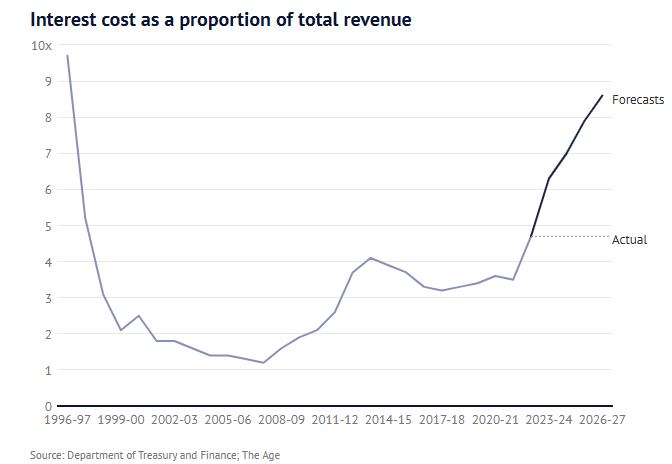

Victoria’s debt is projected to soar in the years ahead, likely resulting in further credit rating downgrades.

When this happens, interest payments will soar, driving up costs for Victorians and resulting in higher taxes and less money for infrastructure and services.

One of the main pressure points for the Victorian budget is the Suburban Rail Loop (SRL) project.

Infrastructure experts advised the government not to proceed with this project because it was unaffordable and the benefits did not outweigh the costs.

The independent Parliamentary Budget Office (PBO) estimated that every dollar spent on the first two stages of the SRL (60 km) will result in social benefits ranging from only $0.60 to $0.70.

Unfortunately, Victorian Premier Jacinta Allan ignored this advice and signed the first major SRL tunneling contracts, committing Victorian taxpayers to finance the project.

The 2023-24 state budget projected that the first phase of the SRL would cost around $34.5 billion, but the state has only locked in $11.8 billion of funding.

Source: Victorian Budget 2023-24

The Victorian government wrongly assumes the federal government will match this funding, with the rest expected to come from extra state revenue raising — “value capture”.

However, the Australian National Audit Office (ANAO) advised that the business case used to request $11.5 billion in federal funding for the SRL’s first stage contained serious information gaps and used questionable methods to quantify the SRL’s benefits.

The federal government has only committed to funding $2.2 billion and appears unlikely to contribute more.

The Victorian government is under more scrutiny following revelations that it sought to prevent the release of a document on the true cost of the SRL project for three years.

The document was written by the SRL Authority’s former CEO Nick Foa in 2020, and outined the significant funding risks associated with the project. Foa recommended that the release of information regarding costings for the project should be strictly controlled.

Concerns were also raised concerning funding through value capture, which is revenue generated through taxes on developments or improved land values around project precincts, and is supposed to deliver a third of the $34.5 billion SRL East’s budget.

Foa warned of a potential “inability to obtain sufficient/expected funding from the value creation and capture” that was a “critical” risk.

The state government subsequently blocked a request from the Coalition in 2021 to access the document via freedom of information laws.

However, the Victorian Civil and Administrative Tribunal eventually ruled in late 2024 that the document should be released.

Emeritus Professor of Environment and Planning at RMIT University, Michael Buxton, claimed the secret document exposed the project’s “appalling” planning and that risks identified by “have been magnified” since 2020.

“What sane government would proceed on a hope and a prayer without a proper risk assessment, or not knowing where the money was coming from, and without considering what other possible priorities were?”, he said.

Premier Jacinta Allan’s pigheaded decision to ignore expert advice and sign contracts to build the SRL will bury Victorian taxpayers deeper in debt. It will also divert infrastructure investment away from growth areas in Melbourne’s West and North, leaving those residents worse off.

Allan has trapped Victorians into decades of debt slavery and shafted those living in the state’s growth areas.