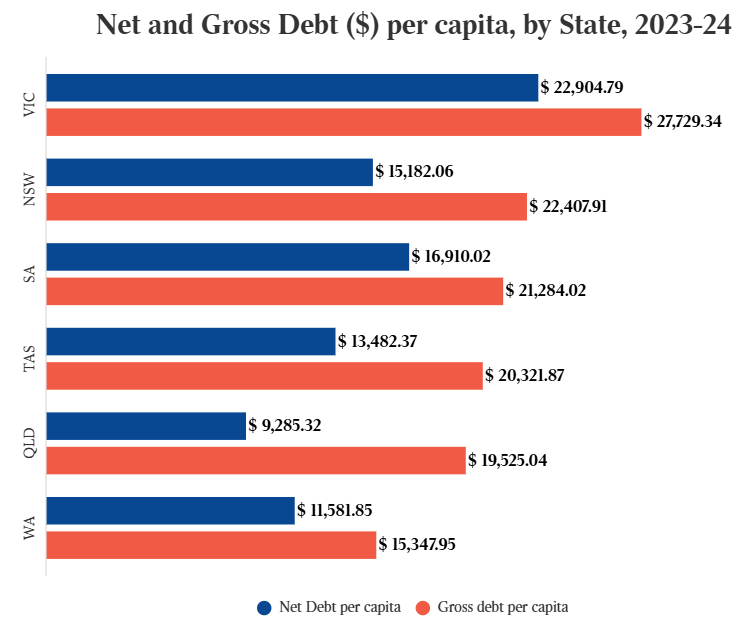

Victoria has the nation’s highest per capita net debt and the lowest credit rating.

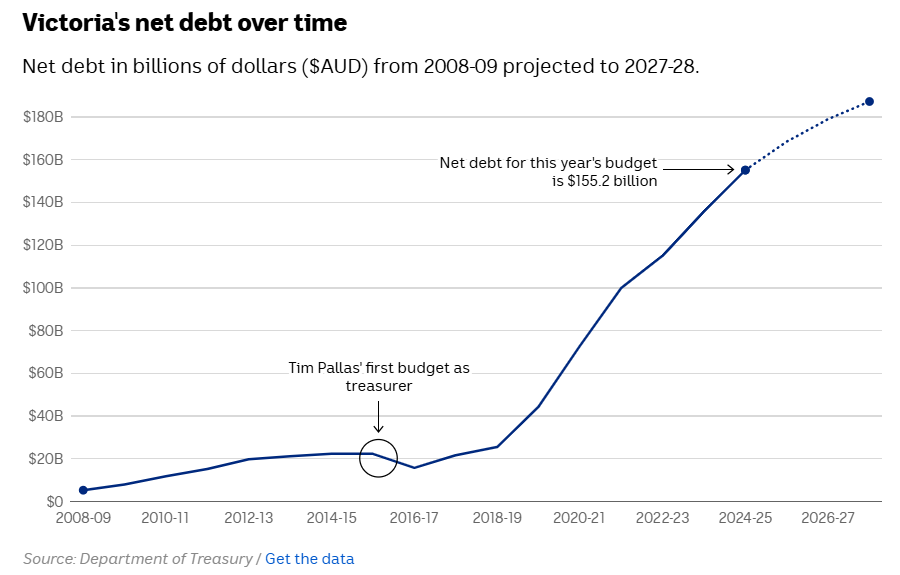

Victoria’s net debt is also projected to increase over the forward estimates.

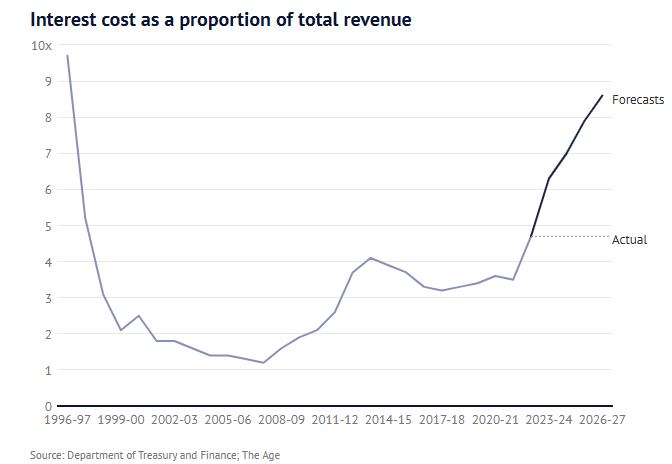

The growth in Victoria’s net debt is forecast to dramatically increase the amount of taxpayer money spent on interest payments.

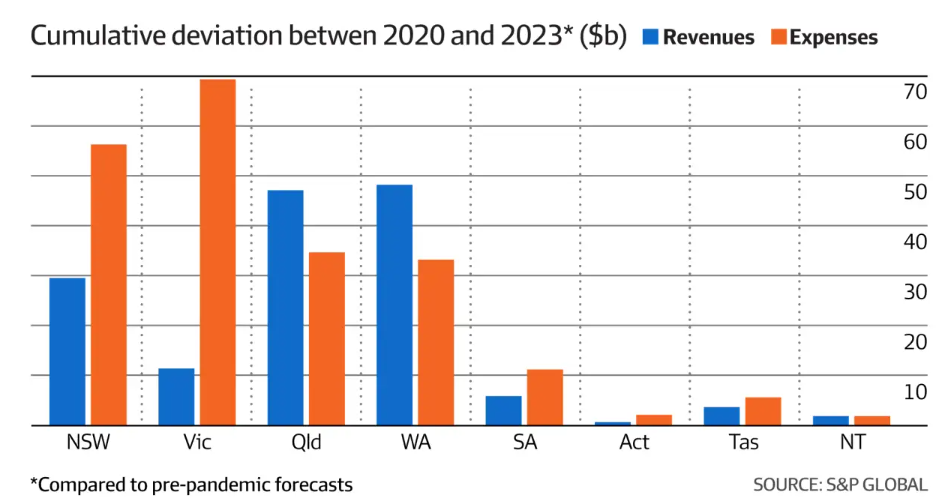

A new analysis from leading global ratings agency S&P, published in The AFR, showed that Victoria suffered the largest shortfall between revenue and expenses between 2000 and 2023.

S&P warned it would downgrade Victoria’s credit rating if the debt situation were not controlled.

“States continue their spendthrift ways”, the S&P report said.

“Victoria continues to use its growing revenues from new taxes like its Covid debt levy to fund new spending”.

“The relaxed approach to fiscal consolidation is causing us to increasingly question our views that many states have exceptionally strong financial management on a global scale”.

S&P has previously warned that Victoria’s credit rating risked being downgraded if it forged ahead with the first phase of the Suburban Rail Loop (SRL) without funding from the federal government.

The 2023-24 state budget projected that the first phase of the SRL would cost around $34.5 billion, but the state has only locked in $11.8 billion of funding.

Source: Victorian Budget 2023-24

The Victorian government wrongly assumes the federal government will match this funding, with the rest expected to come from extra state revenue raising — “value capture”.

In light of Victoria’s deteriorating finances, a downgrade seems inevitable, resulting in increased borrowing costs and debt.

Premier Jacinta Allan’s pigheaded decision to ignore expert advice and sign contracts to build the SRL will bury Victorian taxpayers deeper in debt and divert infrastructure investment away from growth areas in Melbourne’s West and North.

Allan has trapped Victorians into decades of debt slavery.