The financial woes of the Victorian government are well documented.

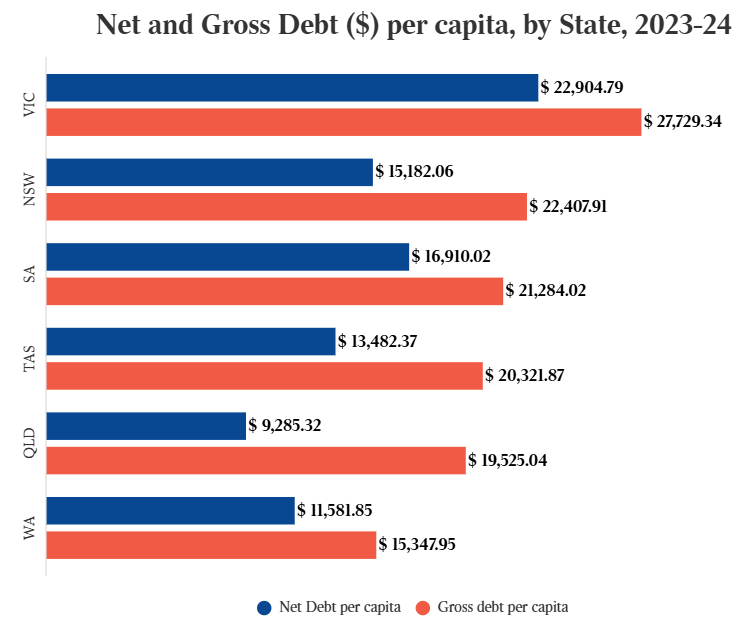

The state had the nation’s highest per capita net debt in 2023-24 and the worst (AA) credit rating.

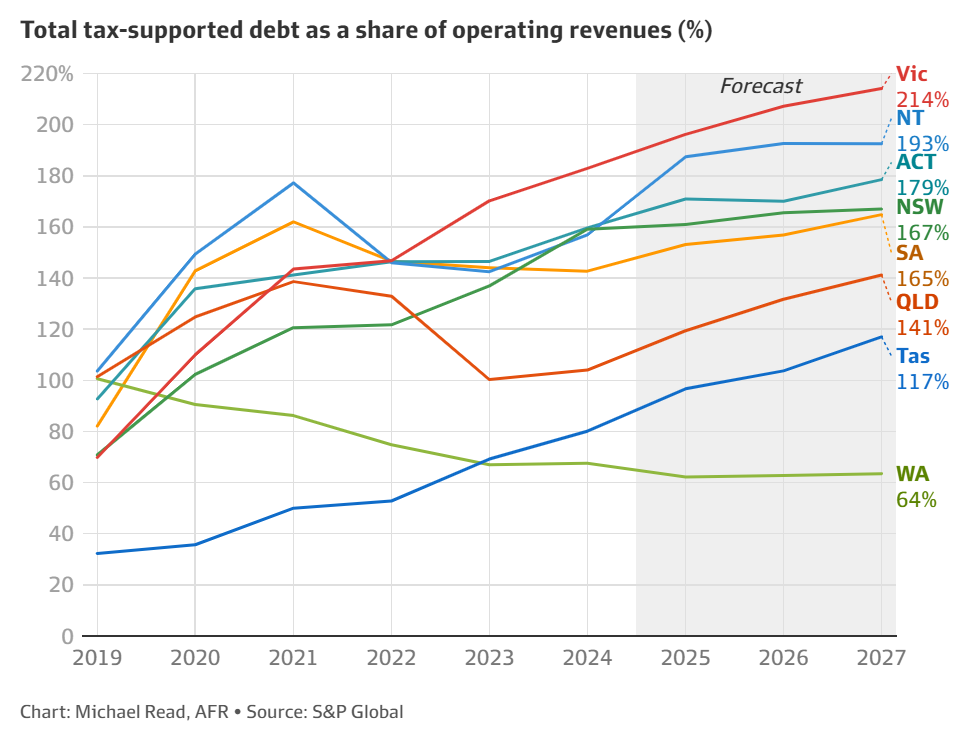

The trajectory of Victoria’s debt is also concerning.

The major ratings agencies—S&P and Moody’s—warned that they could further downgrade Victoria’s credit rating if debt levels are not controlled.

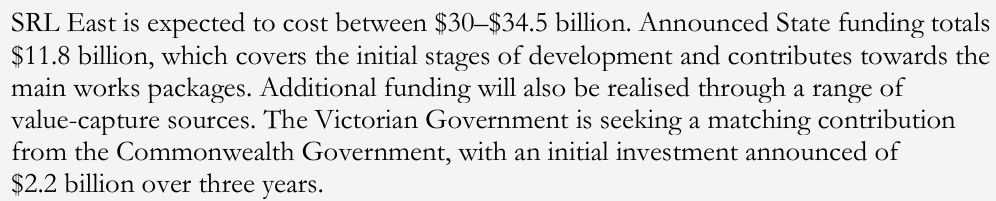

This appears unlikely given that the 2023-24 Victorian Budget explicitly stated that it expects the federal government to provide “a matching contribution” to the first stage of its Suburban Rail Loop (SRL) project, which the federal government has refused beyond its already promised $2.2 billion.

Source: Victorian Budget 2023-24

As a result, the Victorian government has a funding hole for the SRL of $9.3 billion.

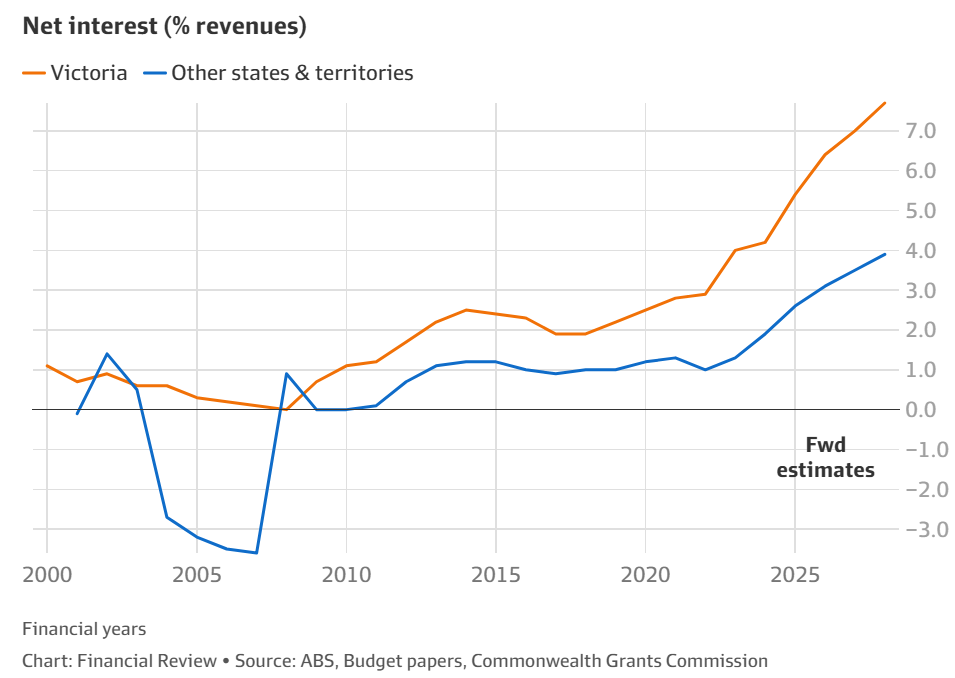

Once Victoria’s credit rating is downgraded, interest payments on its gargantuan debt will increase further, requiring further tax increases and/or spending cutbacks to compensate.

The Victorian government’s financial woes have extended to businesses across the state.

Analysis of new Australian Bureau of Statistics (ABS) data conducted by the Institute of Public Affairs (IPA) revealed that more than 129,000 Victorian businesses shut down last year, or a quarterly average of 4.4% of total companies—the highest of any state.

The number of businesses operating in Victoria has also increased by only 7.5% over the past three years—2% below the average of all other states and territories.

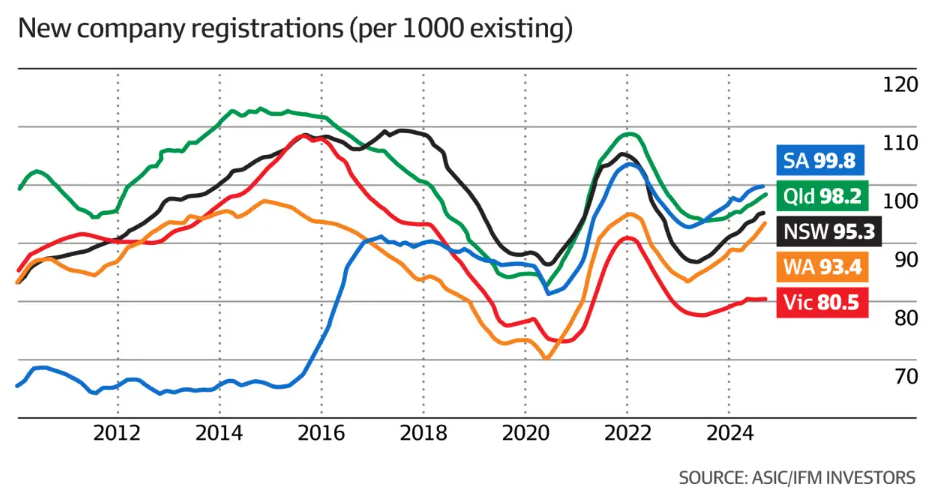

Australian Securities & Investment Commission data also showed that the average number of new businesses registered per 1,000 existing firms in Victoria during the year to September 2024 was 80.5.

This compares with an average of 99.8 in South Australia, 98.2 in Queensland, 95.3 in New South Wales, and 93.4 in Western Australia.

IPA research fellow Lachlan Clark claimed the data showed Victoria had not recovered from the pandemic and remained an “economic basket case”.

“At face value, it is suggestive of a lack of confidence in starting up a business in Victoria. It could also be a response successive waves of tax increases”, independent economist Saul Eslake said.

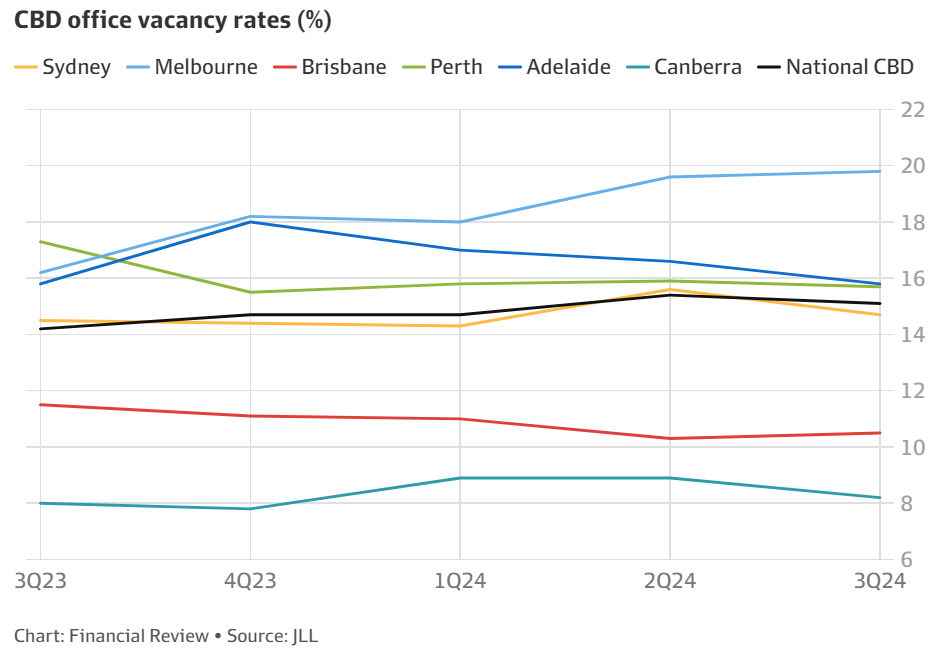

Melbourne’s CBD office vacancy rate also increased to nearly 20% in the September quarter of 2024, well above the other capital cities, which recorded falling vacancy rates.

“Melbourne’s still a basket case”, commented Steve Urwin, the director of tenant advocacy firm Kernel Property.

“Over the last 20 years, Victoria has gone from being one of the country’s richest states to being down there with South Australia and Tasmania, as one of its poorest”, Saul Eslake commented.

“You just need to walk around the City of Melbourne to see how far we have declined. Every lease sign and vacant shopfront is a story of heartache and despair for the business owner who used to have a shop there”, said independent mayoral candidate Arron Wood.

Victoria has become Australia’s bankruptcy state.