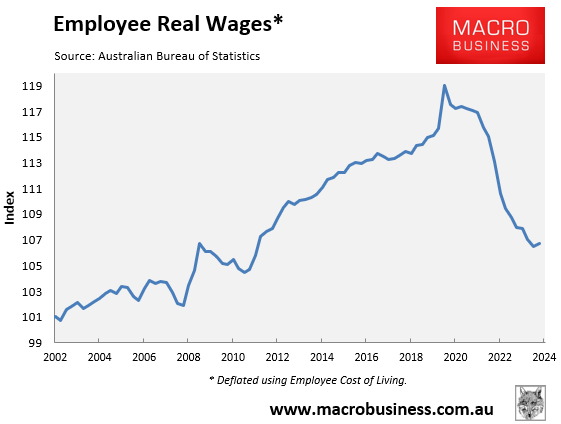

On Thursday, I presented data showing that real Australian wages have fallen by 10.3% since the Q2 2020 peak and were tracking at late 2021 levels as of Q3 2024 (latest available data).

This calculation was derived by deflating the Australian Bureau of Statistics (ABS) wage price index with the employer cost-of-living index.

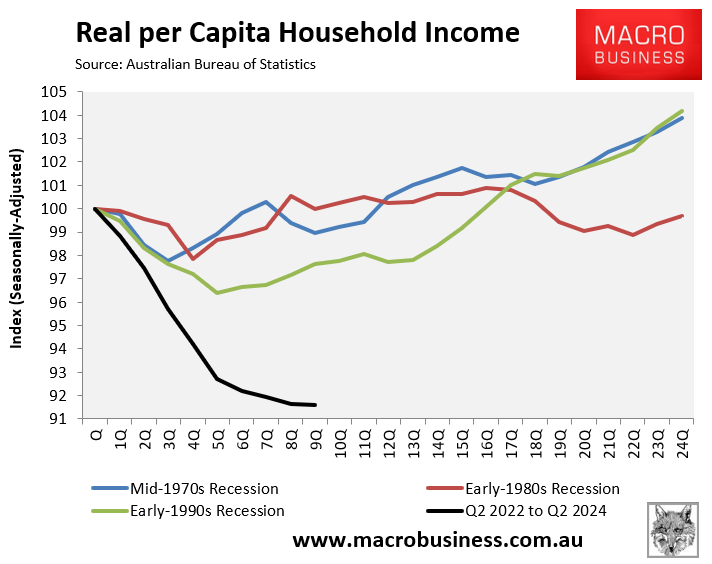

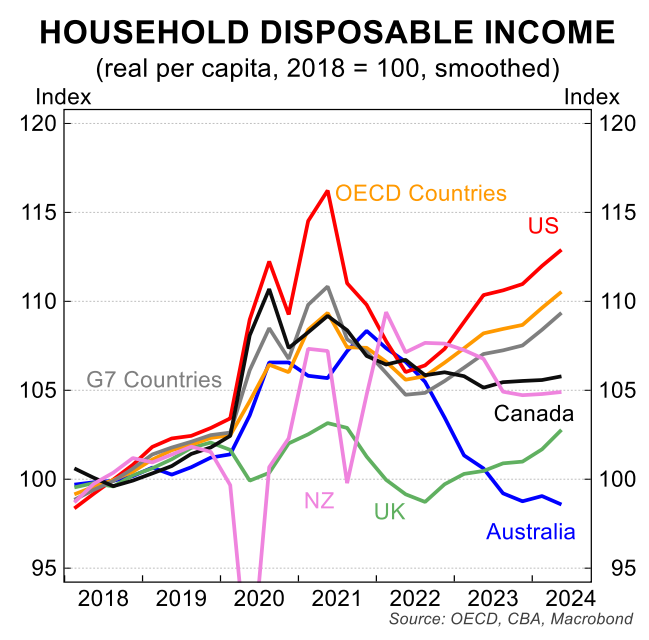

Separate data from the ABS national accounts show that real per capita household disposable income has collapsed by around 8% from its Q2 2022 peak.

This represented one of the largest real per capita disposable income declines in the developed world.

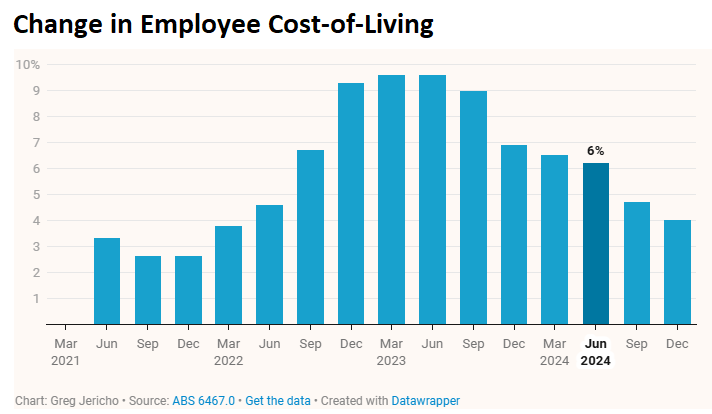

The Guardian’s Greg Jericho produced interesting data on the drivers of the rising employee cost of living, driving the decline in real wages and household disposable income.

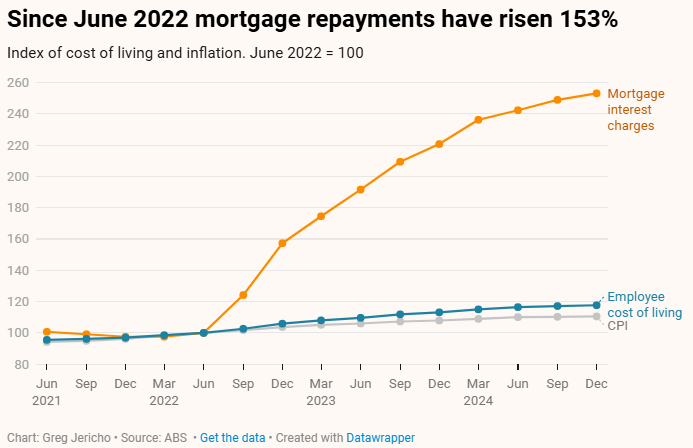

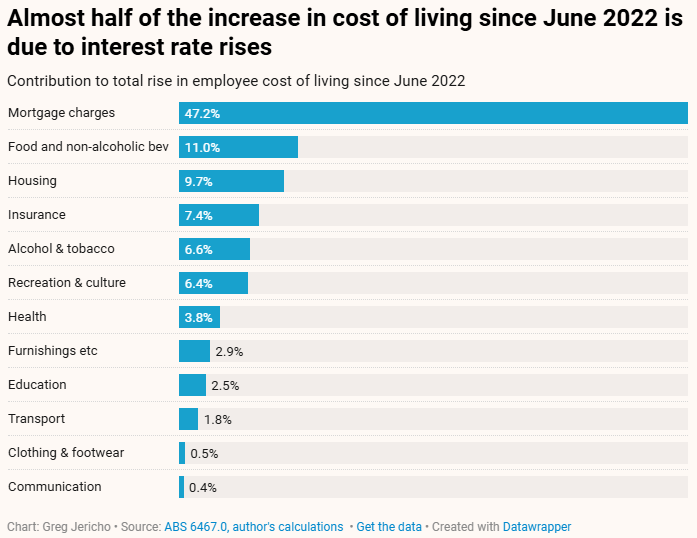

Jericho shows that increasing mortgage costs are the main reason employee living costs have grown well above CPI inflation.

“So great is the impact of interest rate rises that, since June 2022, mortgage repayments have accounted for nearly half of the total increase in the cost of living for employee households”, Jericho wrote.

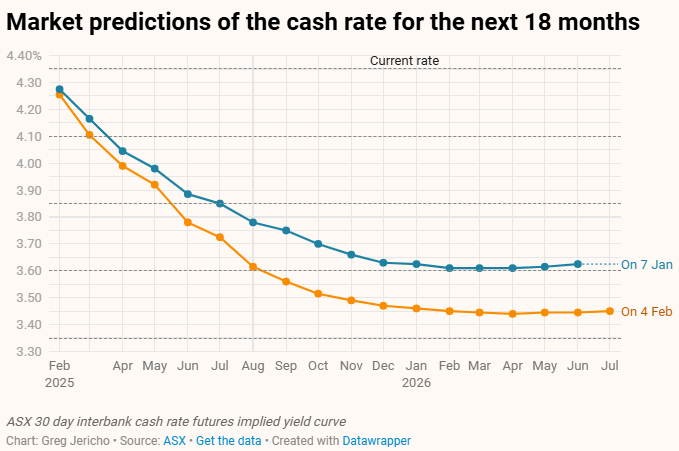

The only upside is that the Reserve Bank of Australia (RBA) is tipped to commence an easing cycle on 18 February, which will be followed by further rate cuts throughout the year.

If these rate cuts arrive, then employee living costs will rise below CPI inflation and wage growth, resulting in a rebound in real household disposable income and real wages.

If Peter Dutton wins the election, the Coalition will be able to take credit, even though it will have been driven by the RBA.