As we know, the RBA is paid to lie about the immigration-led, labour market expansion economic model because if it didn’t, the model would collapse at the ballot box.

It is always amusing, in the usual dark way, to watch as one of the world’s most corrupt central banks dances around the truth.

I noted last week that the February SoMP was a spectacle of misinformation as it managed not once to mention the single most important input into this economy: mass immigration.

Hilariously, this institutional mendacity was accompanied by an asterisk.

Key risk #1 – We have misjudged how much excess demand there is in the labour market.

The central forecast is for labour market conditions to remain tight over the forecast period. However, there is a risk that we have overestimated the extent of excess demand in the labour market. We have incorporated some of this risk by applying a little downwards judgement on the inflation profile.

First, it is possible that we have not taken enough signal in our inflation forecasts from the weaker-than-expected inflation outcome in the December quarter (and/or too much signal from the recent stronger-than-expected labour market data). If the inflationary pulse in the economy proves to be as soft as the December quarter data on their own would suggest, it could imply that we had underestimated how much supply-side constraints were contributing to inflation over the past year and how quickly these had now unwound. It could also imply that the modest easing in the labour market over the past year or so had been adequate to bring the labour market into balance – that is, we are currently around estimates of full employment in the economy. Overall, while we have taken signal from some parts of the weaker inflation outcome late last year, such as for the housing-related components, we judge that recent disinflation has been partly driven by factors that are likely to unwind both in the near term (e.g. subsidies have played a role) and in the medium term as GDP growth picks up.

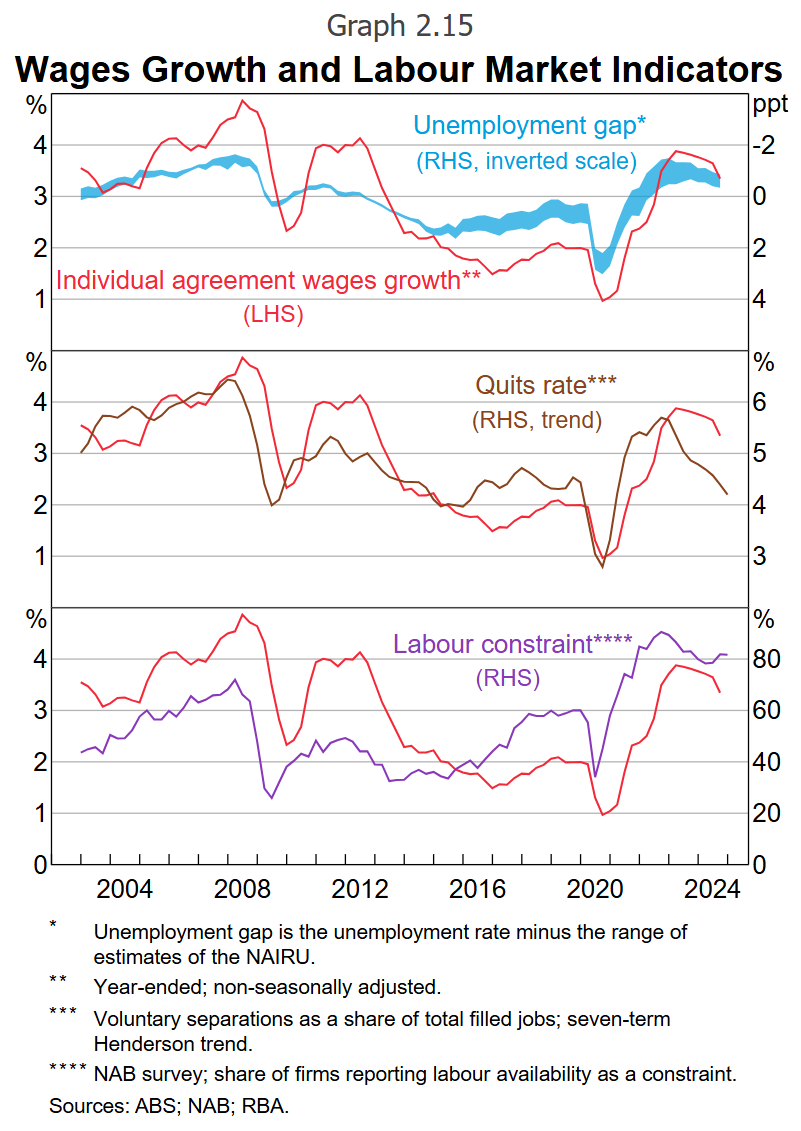

Most labour market indicators, such as the vacancies-to-unemployment ratio and the share of firms reporting the availability of labour as a significant constraint, are consistent with indications from our models that the labour market is tight. However, one factor that could be signalling less tightness in the labour market is the recent decline in the rate of job-switching in the market sector, which suggests there may have been less wage-based competition among firms to retain staff. This decline might indicate less upward pressure on wages than implied by other measures of labour market tightness. This could imply that private sector wages growth, after stabilising in 2024, could begin to moderate again. Our central forecast for wages growth to stabilise around current rates is implicitly consistent with an increase in job-switching as market sector employment growth picks up.

Note that the “quits rate” is the best leading indicator for wages growth.

“Liaison” is bosses whinging about workers for their own benefit. I would argue that the shift in the intensity of boss whinging versus actual wage growth since 2012 is a structural feature of the immigration-led, labour market expansion growth model. Bosses know that they must cry “skill shortages” as a matter of course to advertise Aussie jobs in India.

The “unemployment gap” is coloured by the RBA’s own blundering around the NAIRU, given it has cancelled the impacts of immigration from its thought processes.

The “quits rate” is where the rubber hits the road and cannot be finessed. These are worker decisions made in the stew of the real economy, where competition with Untouchables from India is the known challenge.

Is it any wonder that the “quits rate” soared when the borders closed during COVID and immediately crashed when Albo, the worker’s champion, opened the labour market free for all with India? Of course not.

Is it any wonder that the “quits rate” is back to lowflation levels despite the bosses and the RBA’s alleged rampant labour shortages? Of course not.

Will it be any surprise when wage growth crashes straight back into a 2-handle (it is already there on a quarterly annualised basis) under pressure from 50m unemployed Indians intent upon Australian work? Of course not.

Here is the deeply corrupt Raja Albo planning the next round of wage smashing as he stuffs his face with curry and baksheesh.

You are being had.