Goldman’s excellent Andrew Boak takes on the third rail of Aussie economics.

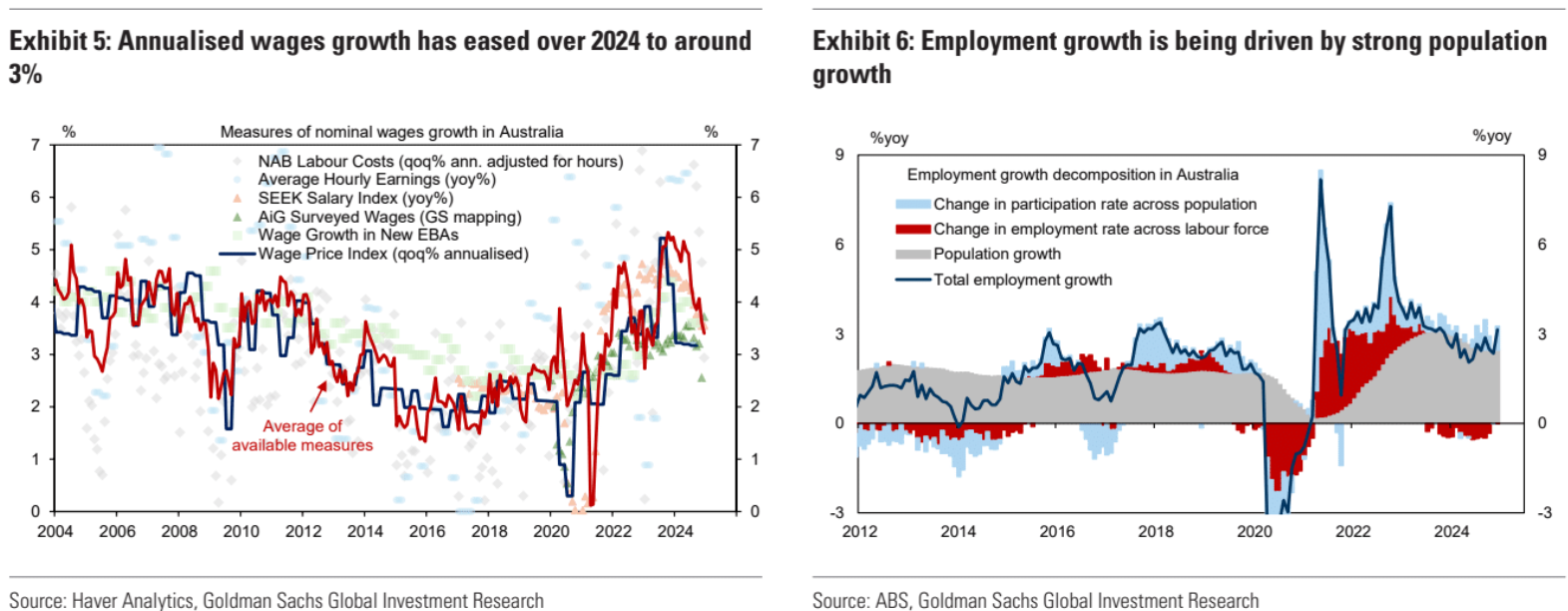

Looking at the labour market, some indicators like employment growth, labour force participation and job vacancies do remain strong and appear to work against the case for easier monetary policy – however, our analysis highlights three reasons why these measures are overstating the current strength of labour market conditions and reconcile with the observed sharp deceleration in wages growth (Exhibit 5) and inflation.

First, the post-pandemic immigration surge boosted labour supply, and this increased overall employment but put downward pressure on wages growth (Exhibit 6).

Second, Australia’s unique wage-setting mechanisms limits the ability of many workers to bargain for higher nominal wages in response to surging global inflation, resulting in an increase in labour market churn and the stock of unfilled vacancies – while simultaneously reducing the usefulness of job vacancies as an indicator of labour demand and wages growth (Exhibit 7).

And third, we estimate that around 40% of the 500k ‘social assistance’ jobs created in connection with the National Disability Insurance Scheme (NDIS) reflect an ‘informal to formal’ employment measurement issue rather than an actual increase in labour activity (Exhibit 8).

In view of these three caveats, we put more weight on other indicators pointing to a softening in labour market conditions in Australia, consistent with the signal from weak GDP growth and easing inflation pressures.

And that, my friends, is a wrap. The immigration-led, labour market growth model creates its own labour supply. Doh!

What has this done to inflation?

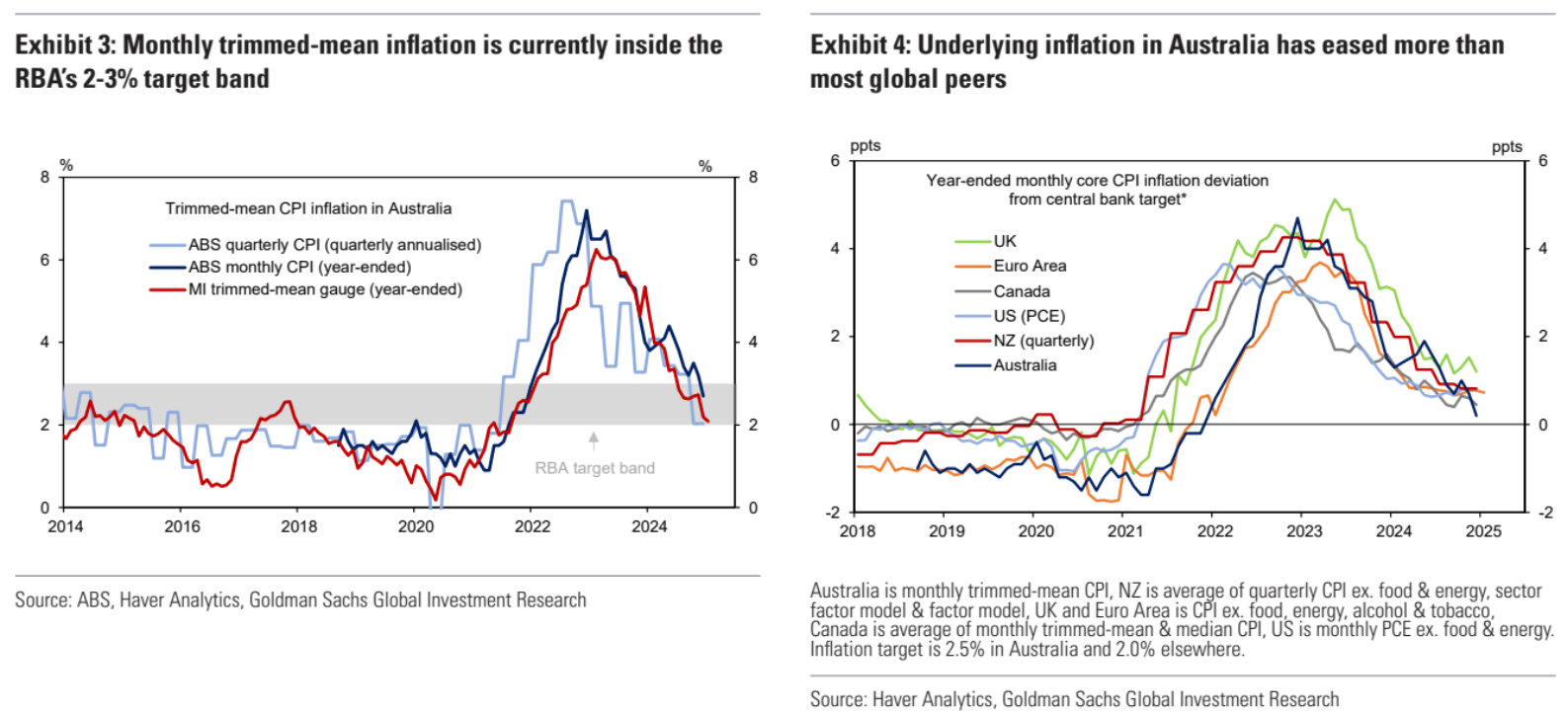

Weaker-than-expected inflationary pressures is the primary reason a dovish pivot in the RBA’s policy narrative is warranted.

While year-ended growth in the RBA’s favoured quarterly trimmed-mean measure is still a bit above the 2-3% inflation target (at +3.2%yoy), sequential momentum in quarterly annualised growth more than halved over 2024 (Q1: +4.1%, Q2: +3.5%, Q3: +3.3%, Q4: +2.0%) and is now tracking at the lower extreme of the RBA’s target band (Exhibit 3).

A broad sweep of alternative measures of inflation like the weighted median (Q4: +2.1% annualized) also highlight that the underlying disinflationary pulse is minimally impacted by price subsidies and is broad-based, with year-ended growth in monthly trimmed-mean measure (+2.7%yoy) now closer to target in Australia than for key global peers (Exhibit 4).

Boak’s conclusion?

We are confident the RBA will commence an easing cycle next Tuesday – our forecast since June 2024 and which is now mostly priced by financial markets.

However, we don’t expect the accompanying RBA statement or press conference to provide clear forward guidance about the path for rates.

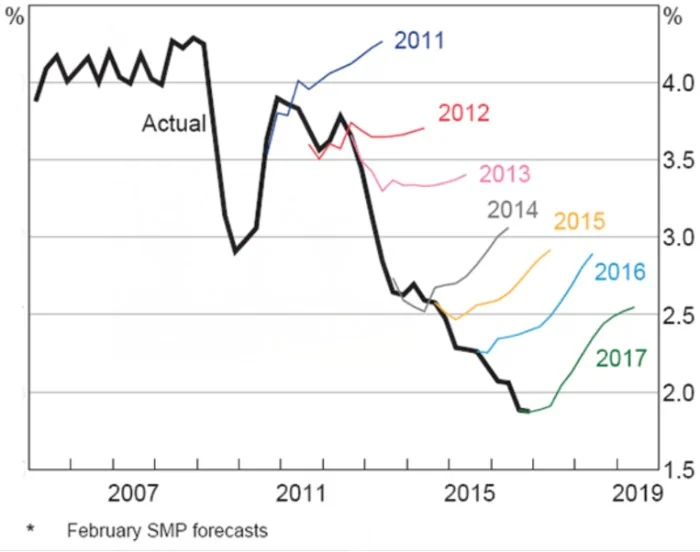

While our base case is that the RBA will do three back-to-back cuts over 1H2025, before delivering a final cut in August (Exhibit 2), we expect Governor Bullock to adopt this path in a ‘two-step’ process.

Firstly, we expect the RBA to cut in February and signal data dependence.

Secondly, we expect upcoming data on GDP, wages and monthly inflation to push the new Board (which starts after February’s meeting) to adopt an explicitly dovish outlook and cut again in April.

We note this would be consistent with the historical pattern of RBA easing cycles, which typically begin with little forward guidance but almost always ultimately deliver back-to-back cuts at the first two meetings.

I completely agree. The RBA has overshot its target, as usual, by ignoring the real dynamics of the Aussie labour market.

Apparently, new or old, it is incapable of learning anything.

Then again, it’s paid to not learn, right?

Finally, let me say that I do not think that four cuts are the end of the cycle. 2026 brings the iron ore smash-a-palooza and giant national income suckhole.

More cuts will come unless energy lunatic Peter Dutton unleashes the gas cartel.

Mwahaha.