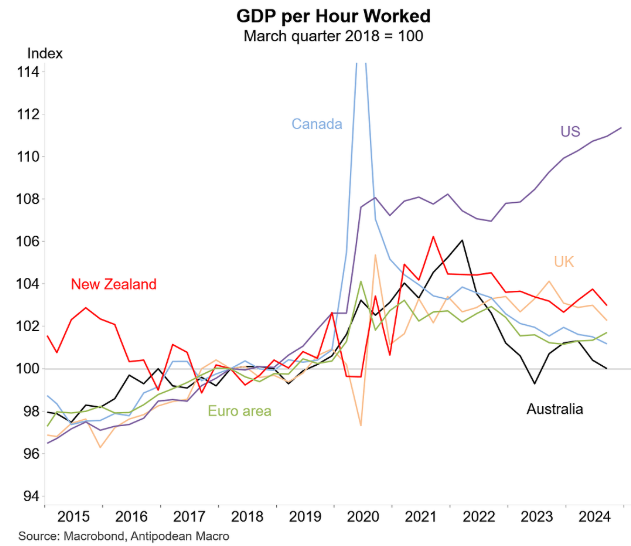

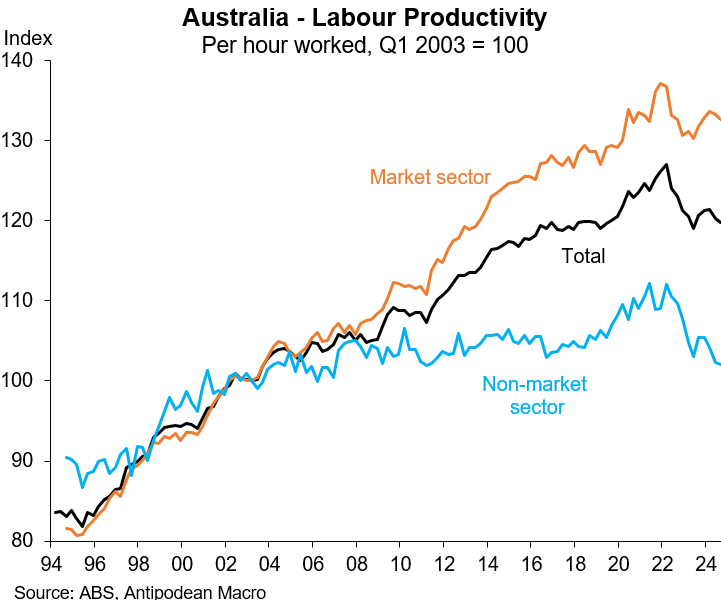

Justin Fabo from Antipodean Macro posted the following update on labour productivity across major advanced nations.

As you can see, Australia has recorded zero labour productivity growth since 2016, the worst performance of the nations sampled.

While the precise causes of the Australian economy’s productivity decline are debatable, I attribute four primary drivers.

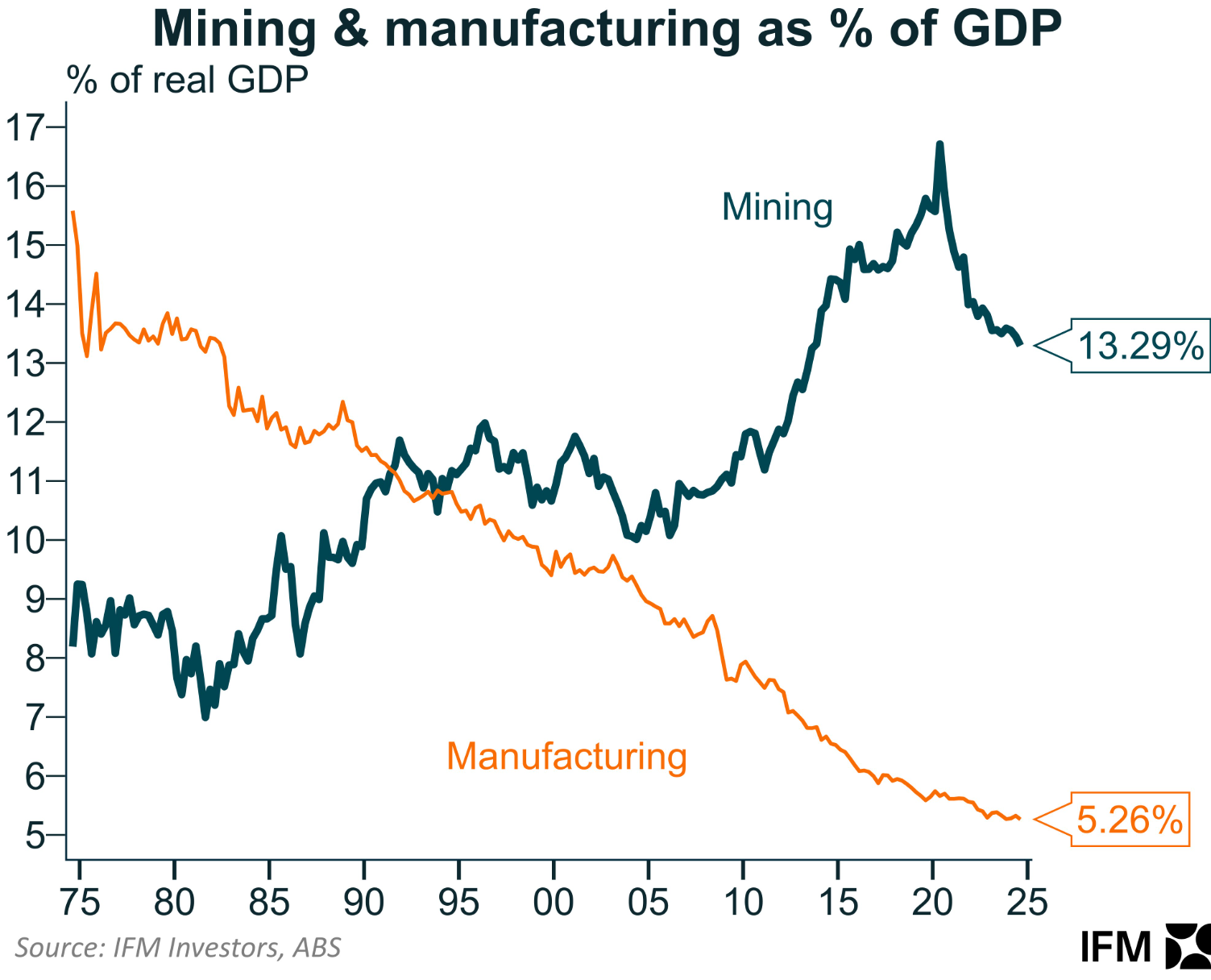

First, the significant appreciation of the Australian dollar following the start of the mining boom contributed to the contraction of Australia’s manufacturing sector, most obviously in the automobile industry.

Manufacturing is susceptible to global competition and relies on capital investment and technological advancements. As a result, it has historically been the industry with the highest productivity growth.

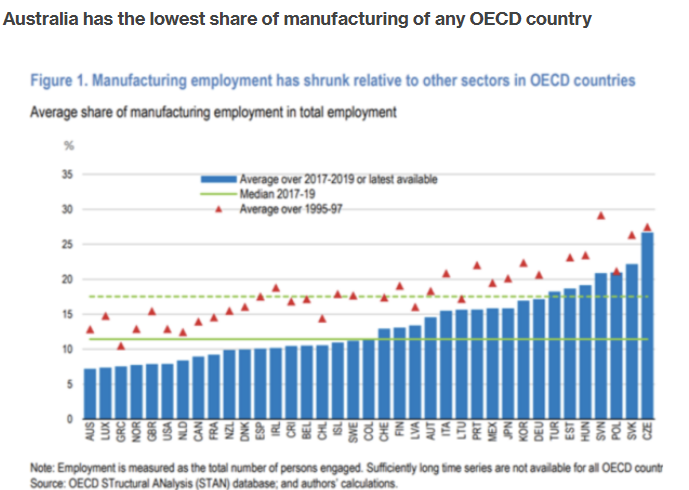

Australia’s manufacturing sector has decreased to roughly 5% of GDP, the OECD’s lowest share, which has contributed to the country’s poor productivity growth.

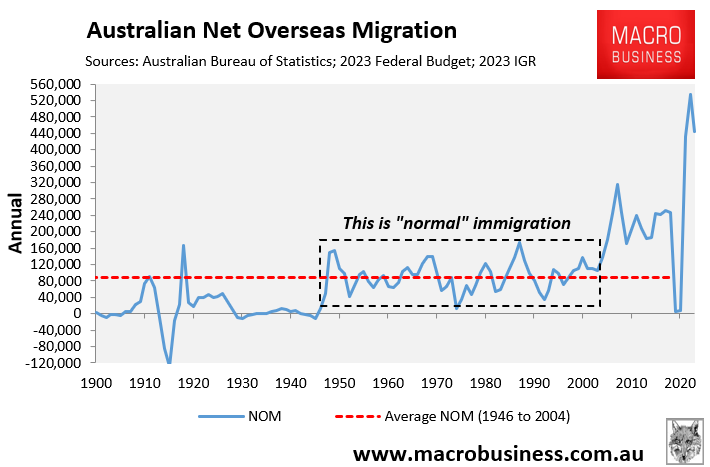

Second, the federal government massively increased Australia’s net overseas migration in the mid-2000s.

Australia’s population growth outpaced business, housing, and infrastructure investment, leaving workers with less capital.

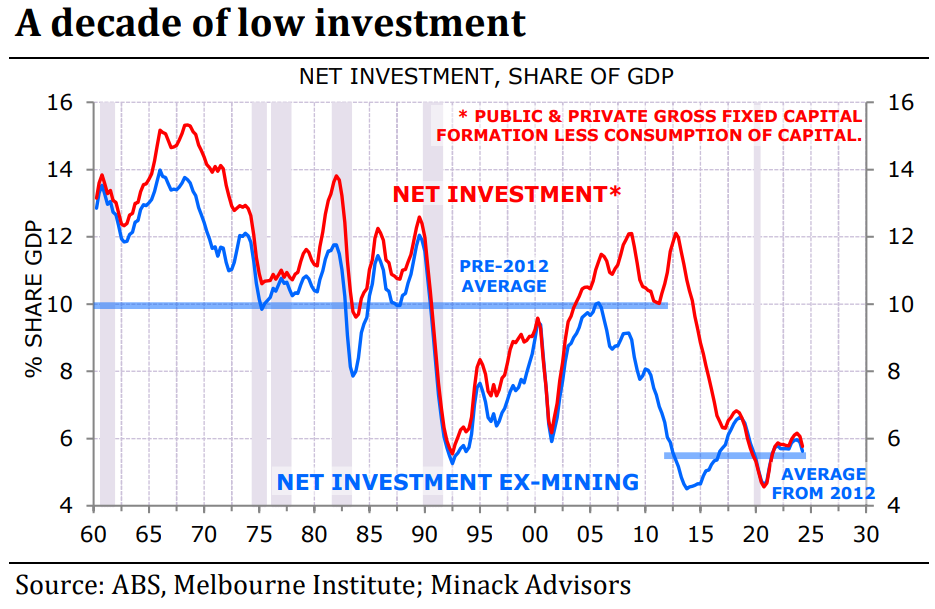

Independent economist Gerard Minack explained that Australia’s “net investment spending (investment net of depreciation) is running at levels previously only seen at the nadir of the 1990s recession”.

This “investment spending has been stretched thin by population growth”.

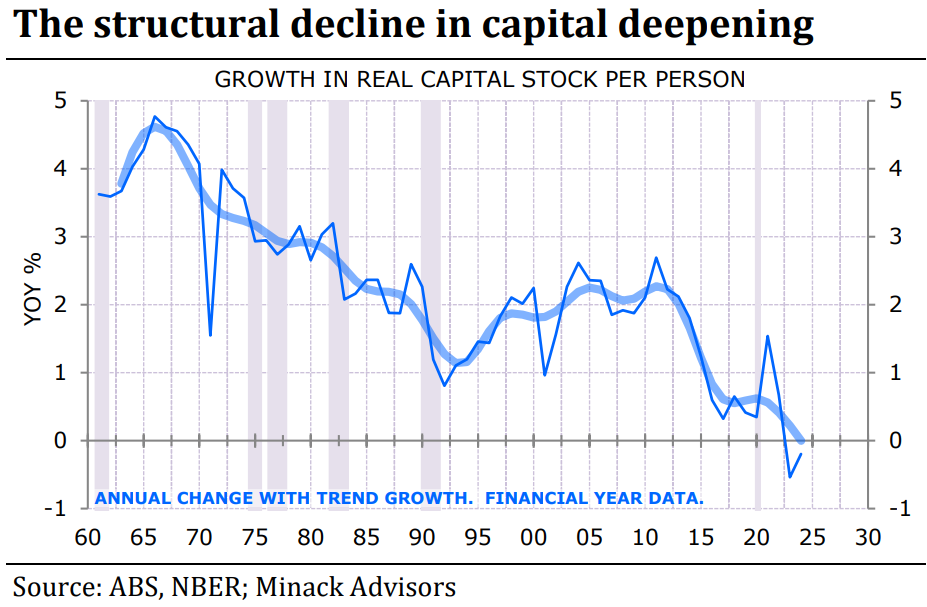

“The fast population growth of the past 20 years, combined with the decline in investment spending over the past decade, has led to a collapse in the growth of per capita capital stock”.

“Less deepening means less productivity growth”, noted Minack.

“Low investment and fast population growth is crushing productivity growth leading to structurally weak income growth”.

As a result, the Australian economy has been caught in a productivity trap because the federal government has run a permanently high immigration program that has exceeded business, infrastructure, and housing investment.

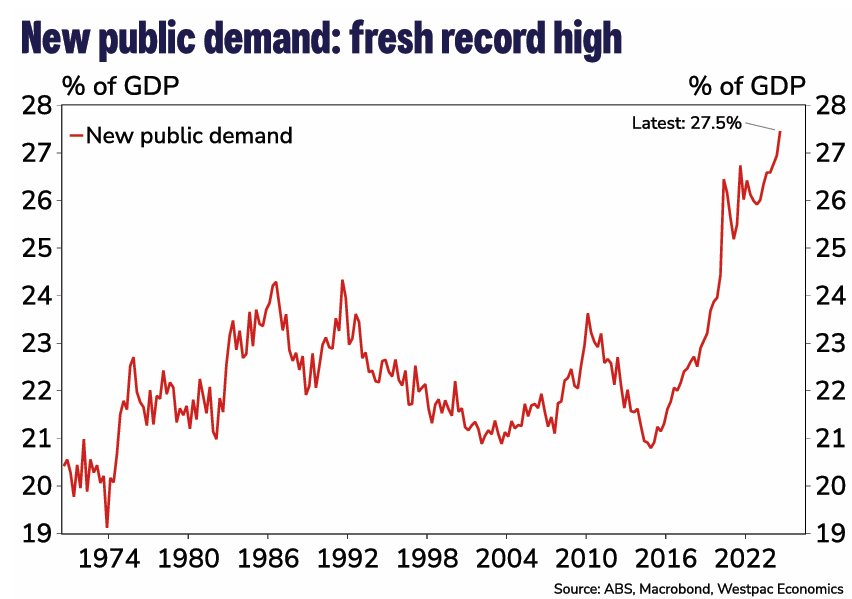

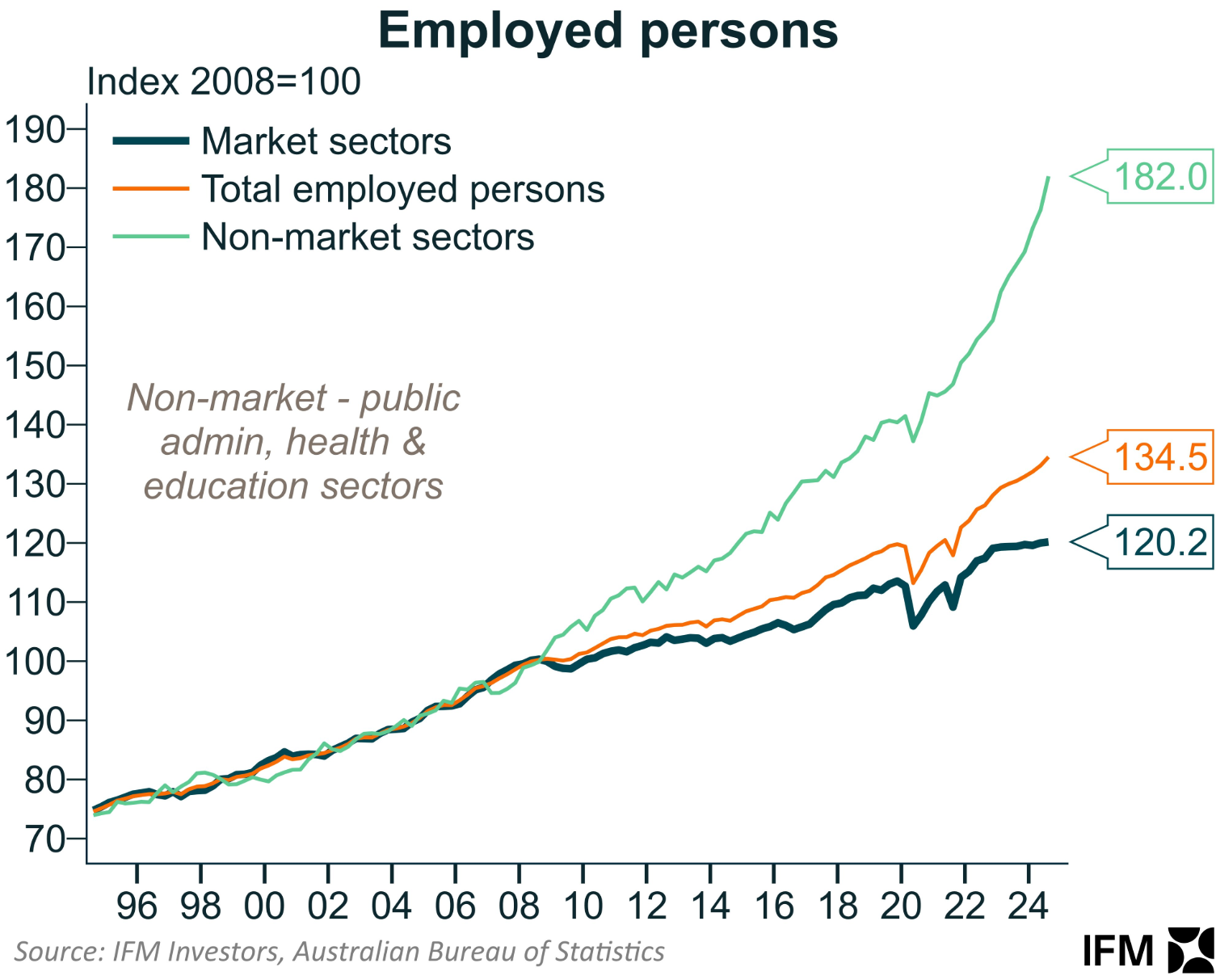

Third, excessive government spending, which accounted for a record high 27.5% of GDP in Q3 2024, has contributed to the Australian economy’s productivity decline.

Much of this public spending has been directed into low-productivity non-market (government-aligned) jobs, which have increased rapidly and squeezed out the market sector.

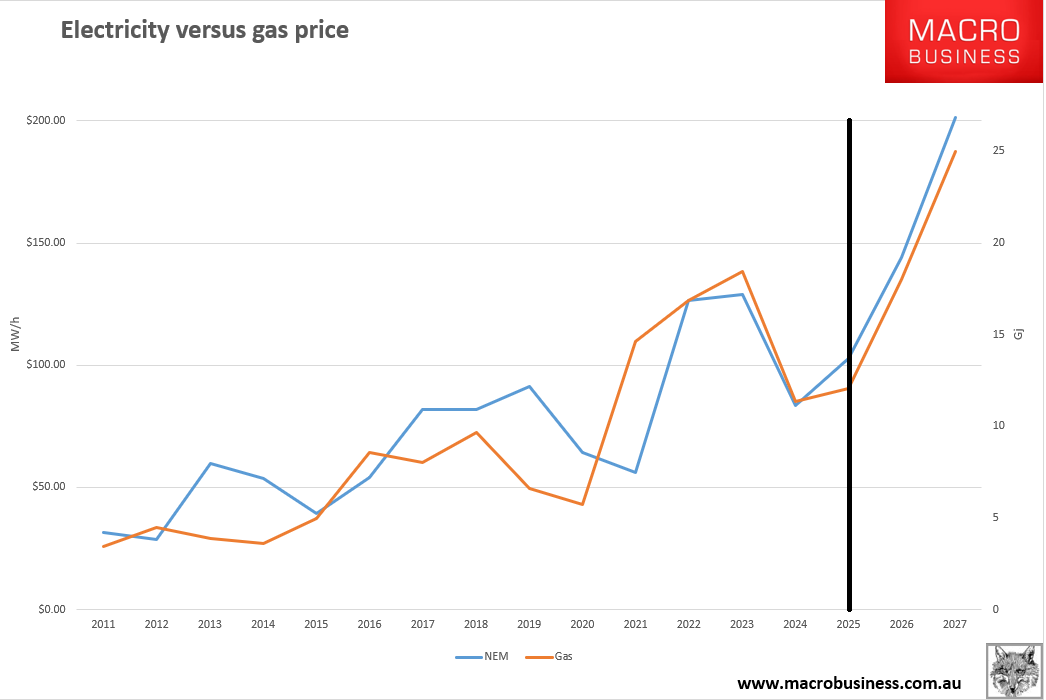

The final reason behind Australia’s productivity decline is linked to the first: rising energy costs.

The structural rise in Australian energy costs—gas and electricity—has helped to shrink the country’s industrial sector, hollowing out the economy, reducing economic complexity, and eroding productivity.

Australia’s manufacturing economy can only be competitive with affordable and reliable energy.

Despite being one of the world’s greatest energy exporters, Australia’s energy cost competitiveness has been eroded by the failure to secure East Coast gas supplies and the abandoning of historically cheap and reliable baseload electricity.

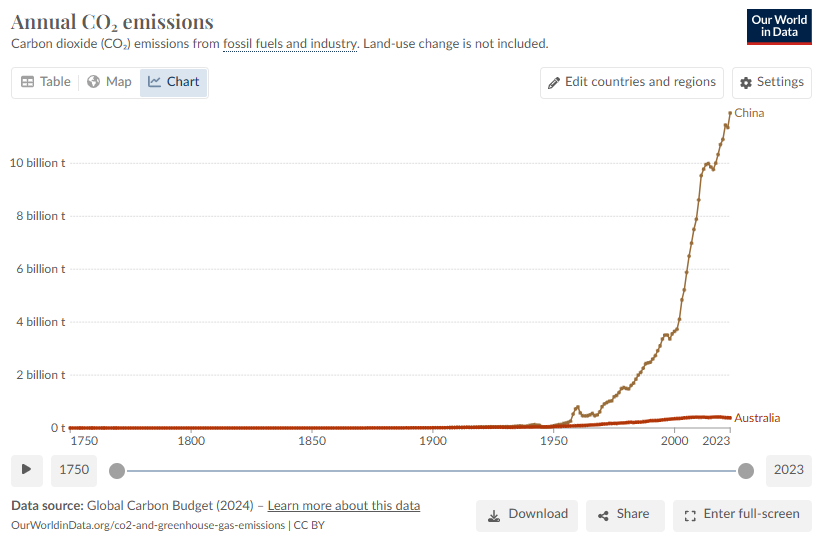

The solution to Australia’s productivity decline must include significantly lower and more highly skilled immigration, domestic East Coast gas reservation, and the abandonment of costly “net zero” policies that raise energy prices and export manufacturing capacity and emissions to China.

To increase overall economic efficiency, Australia should seek broad-based tax reform, as advocated in the Henry Tax Review.