Gareth Aird and Stephen Wu, economists at CBA, published a report (presented below) explaining how the Reserve Bank of Australia’s (RBA) February Statement of Monetary Policy (SoMP) lowered the neutral estimate of Australia’s cash rate to around 2.9%, down from its previous estimate of 3.5%.

This lowering of the neutral cash rate increases the likelihood that the RBA will cut the cash rate further.

Indeed, CBA forecasts three additional 0.25% rate cuts this year, which would take the cash rate to 3.35% by the end of 2025.

If the neutral rate is indeed closer to 3%, monetary policy could be eased further in 2026, although this would depend on what happens with fiscal policy.

The RBA has downwardly revised its estimate of neutral

By Gareth Aird, head of Australian economics at CBA and Stephen Wu, senior economist at CBA.

Key Points:

- The RBA noted in its February 2025 Statement on Monetary Policy that there has been a downward shift in some of its modelled estimates of the nominal neutral cash rate in Australia.

- We calculate that the average of the RBA’s seven models that estimate the nominal neutral cash rate put the current nominal neutral cash rate at ~2.9%.

- Such an outcome is materially below the RBA’s previous point estimate of the nominal neutral cash rate of ~3.5%.

- The downward assessment of the neutral cash rate more closely aligns to our thinking on where the neutral cash rate sits.

- The RBA Board should feel more confident to ease policy through 2025 based on its re-assessment that the neutral cash rate is lower than it previously assumed.

Models, models and more models:

In June 2024 RBA Assistant Governor Christopher Kent delivered a speech titled Restrictive Financial Conditions in Australia.

The speech articulated the RBA’s assessment around the degree of policy restrictiveness in Australia. And Dr Kent opined on the RBA’s estimate of the nominal neutral cash rate in Australia.

The neutral cash rate was defined by Dr Kent as, “the level of the cash rate that would neither stimulate nor restrain demand; in other words, it would underpin a balance between demand and supply of goods and services and in the labour market, with inflation consistent with the inflation target.”

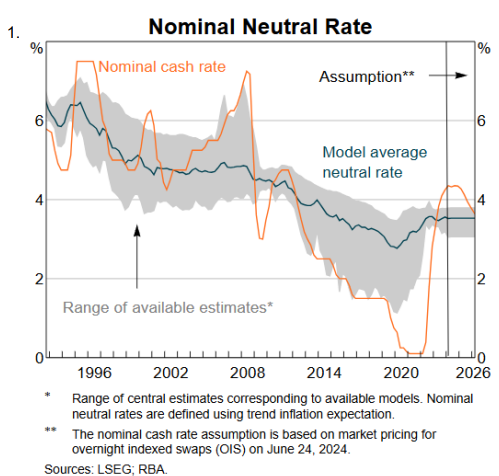

And more importantly, Dr Kent highlighted a chart that concluded the RBA’s point estimate of the neutral cash rate was ~3.5%. The point estimate was calculated by taking an average of a range of models that the RBA use to assess the neutral rate (chart 1).

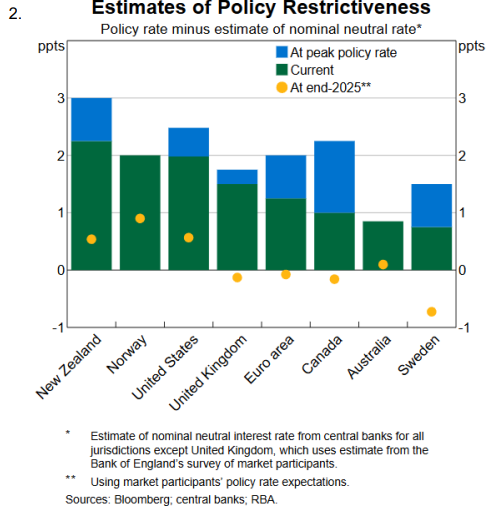

The RBA’s view of the neutral rate is important as the Bank uses it to help inform its assessment of the degree of monetary policy restrictiveness. And in the November 2024 Statement on Monetary Policy (SMP) the RBA produced a chart that concluded policy was not particularly restrictive in Australia when compared to other advanced economies (chart 2).

However, in the February 2025 SMP, released earlier this week, the RBA shifted its thinking on the neutral cash rate. We believe this updated view flew under the radar given so much of the commentary following the Board’s decision to cut the cash rate by 25bp to 4.1% was on the decision itself.

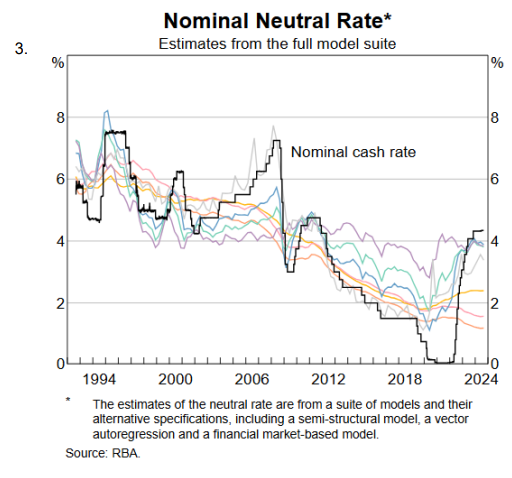

It was noted in the February SMP that, “the RBA has recently refined how the models account for the pandemic period, following the techniques of other central banks. This has led to a shift downward in some estimates of neutral and is consistent with our assessment, based on a broader range of indicators, that financial conditions remain restrictive and the observation that private demand has been weak for some time.” (our emphasis in bold).

The February 2025 SMP contained a chart comprising seven point estimates of the nominal neutral cash rate as produced by a suite of RBA models (chart 3).

We calculate that the average of the seven models produces a nominal neutral cash rate point estimate of ~2.9%. This is ~0.5ppts lower than the RBA previously thought.

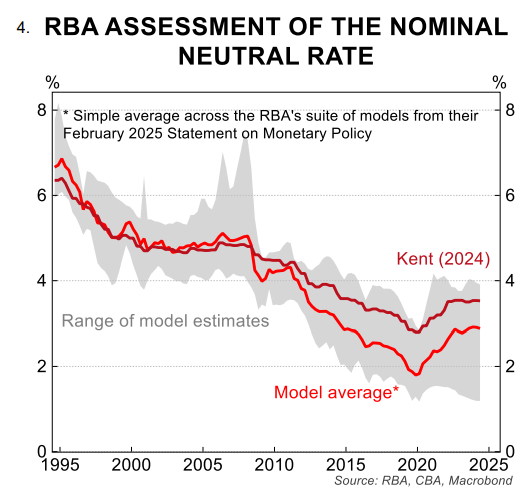

In chart 4 we have compared the RBA’s previous point estimate of the neutral cash rate to its updated assessment by taking an average of the seven model estimates contained in the February SMP.

We consider the shift in the RBA’s calculation of its estimates of the neutral cash rate as significant. And the updated models more closely align with our own thinking that the neutral rate is closer to 3% than 3.5%. Indeed the RBA’s updated view marries up with an analysis of the debt serviceability ratio (DSR).

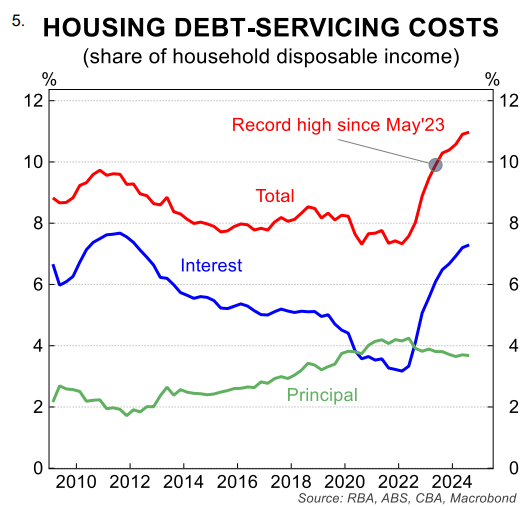

Mortgage repayments as a share of household disposable income are currently at a record high (chart 5). A cash rate closer to 3.0% is consistent with a DSR of ~8% (around the pre-pandemic 10 year average).

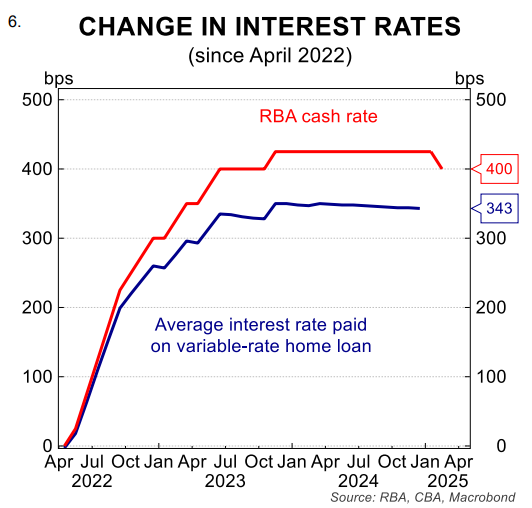

Here it is important to note that competition in the mortgage market in recent years meant that the average standard variable rate rose by ~80bp less than the cash rate during the RBA’s tightening cycle (chart 6). This is significant and raises the level of the neutral cash rate compared to pre-pandemic when assessing the degree of policy restrictiveness through the DSR lens.

Of course, the DSR is only one factor that should be considered when gauging the degree of monetary policy restrictiveness. But it is an important dynamic and one we place a lot of weight on.

How do we reconcile the RBA’s latest inflation forecasts with its updated view on the neutral rate?

We were surprised that in the February SMP the RBA forecast the trimmed mean CPI to settle at 2.7% over its forecast horizon (i.e. a little above the mid-point of the 2-3% target band).

Given the RBA has lowered its implicit estimate of the neutral cash rate to ~2.9%, the underpinning cash rate assumption in the February SMP implies monetary policy remains restrictive over the forecast horizon (the cash rate is assumed to gradually be lowered to 3.4% before settling at 3.5%).

All else equal, this should have led to a lower forecast for trimmed mean CPI over the forecast horizon. That is, a lower neutral rate assumption implies that the current cash rate level is more restrictive on private sector activity in the economy.

But there were very little changes to the RBA’s overall GDP forecasts. It appears stronger-than-anticipated public demand is offsetting weaker expected private demand growth, particularly a softer household consumption outlook.

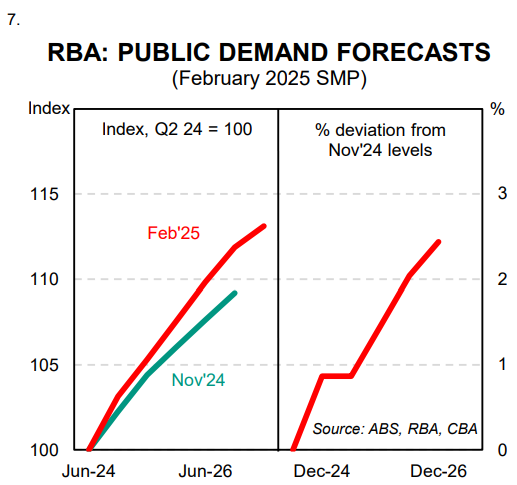

The RBA have noticeably upgraded its profile for public demand from three months prior (chart 7). The upgrades across the forecast horizon reflect more information available on expanded spending plans after federal and state governments’ mid-year budget reviews.

Backing out the level from the RBA’s growth numbers suggests public demand is now forecast to be 2½% higher than previously thought, boosting aggregate growth outcomes. Indeed, it helps to underpin the growth rebound that is anticipated to be currently underway.

Put simply, the RBA views the stance of fiscal policy as slightly more stimulatory than previously assumed. From the RBA’s perspective, this offsets the now lower estimate of the neutral cash rate.

Where does the cash rate go from here?

Overall we remain comfortable with our base case that the RBA will continue to take the cash rate lower over 2025. And we continue to look for three further 25bp reductions in the cash rate at a gradual pace that see the cash rate at 3.35% by end-2025.

In our view, the outlook for policy is more uncertain from there. If the neutral rate is indeed closer to 3% monetary policy could be further eased in 2026. However, the stance of fiscal policy will have a big bearing on where the cash rate finally settles.

The Federal election will be held by May 2025. The prospect of a change in Government naturally adds more uncertainty than usual to the fiscal outlook. And both Government and the opposition often take ‘sweeteners’ to the voting population ahead of an election.

Any such sweeteners generally involve a boost in household income or more promises on the public spending front. A loosening in fiscal policy would put upward pressure on demand and by extension inflation. If such a scenario materialised, the cash rate could remain at a restrictive setting for a more prolonged period.