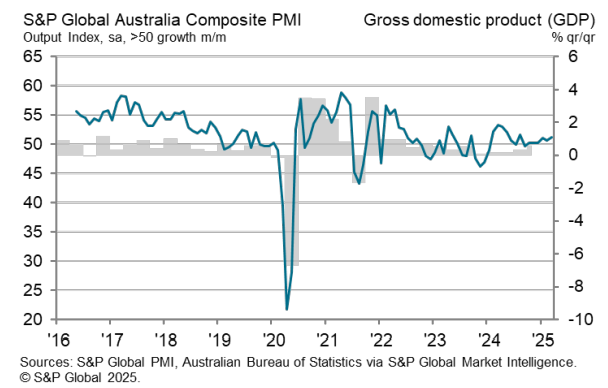

Slightly better and going nowhere fast.

Flash Australia PMI Composite Output Index(1): 51.3 (Feb: 50.6). 7-month high.

Flash Australia Services PMI Business Activity Index(2): 51.2 (Feb: 50.8). 2-month high.

Flash Australia Manufacturing Output Index(3): 51.9 (Feb: 49.7). 29-month high.

Flash Australia Manufacturing PMI(4): 52.6 (Feb: 50.4). 29-month high.

There’s enough for Warren Hogan to have a conniption.

Staffing levels across Australia’s private sector meanwhile increased for a third straight month amidst the solid rise in new work. The rate of job creation was especially strong among service providers, unfolding at the fastest rate since June 2022, though manufacturing employment growth also renewed at the quickest rate in two years. Despite higher workforce capacity, the level of backlogged work increased for the first time in 33 months, though only fractionally.

Improvements in demand conditions led input costs to increase at the end of the first quarter of the year. The rate of overall input cost inflation rose past the series average to the highest in seven months amidst an intensification of cost pressures in both the manufacturing and service sectors. Panellists often mentioned higher raw material, transport and wage costs, aggravated by a weaker domestic currency. Despite higher cost pressures, the rate of output price inflation eased to a four-month low in March.

Shite economy.