Australia’s housing market is heating up following the Reserve Bank of Australia’s (RBA) 0.25% interest rate cut last month and expectations of further reductions this year.

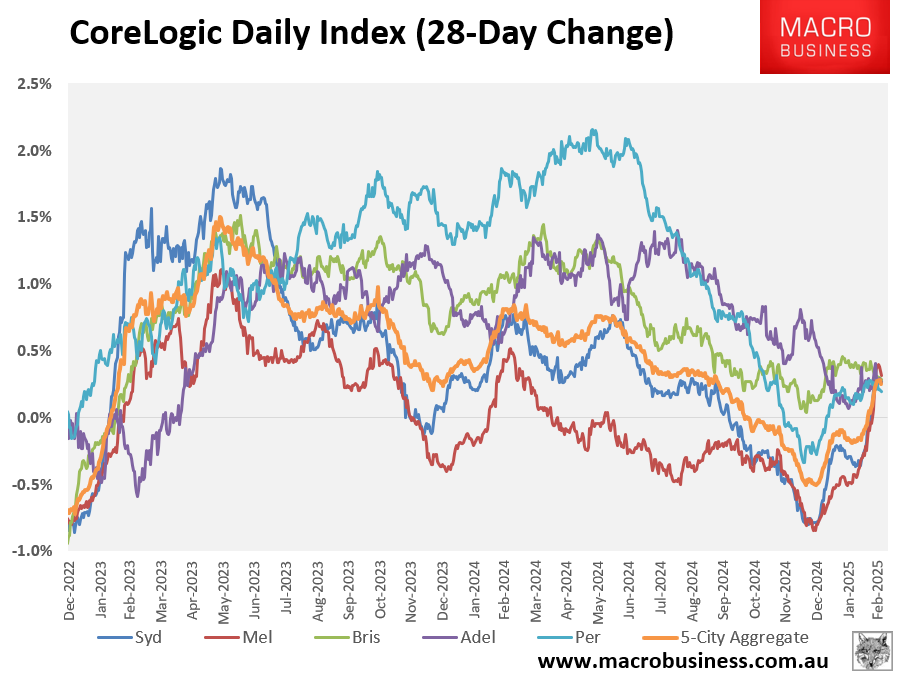

As illustrated in the following chart, CoreLogic’s daily dwelling values index has rebounded strongly, driven by Sydney and Melbourne.

At the aggregate 5-city level, dwelling values have risen by 0.3% over the past 28 days. That is up from a 0.5% decline recorded at the end of 2024.

Sydney and Melbourne dwelling values rose by 0.3% over the past 28 days, up from a 0.8% decline at the end of 2024.

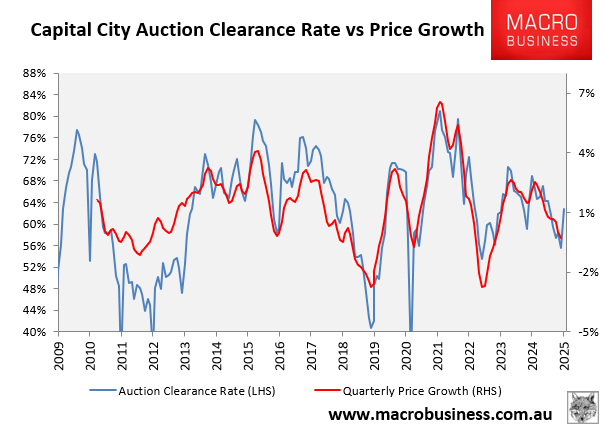

The price rebound is reflected in the auction market, which has recorded a strong bounce in clearance rates.

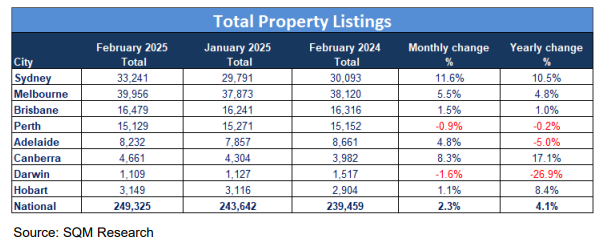

Vendors are seeking to take advantage of the bounce in demand and prices, with SQM reporting a rise in listings in February.

Total nationwide property listings increased by 2.3% over February 2025, reaching 249,325 listed properties. This marked a 4.1% rise compared to February 2024.

The rise in listings was evident across most major cities. Sydney recorded the highest monthly increase of 11.6%, with listings reaching 33,241—10.5% higher than last year.

Melbourne recorded a monthly increase of 5.5%, bringing total listings to 39,956, reflecting a 4.8% annual rise.

Brisbane, Adelaide, and Hobart saw monthly gains of 1.1%, 4.8%, and 1.1%, respectively, although Adelaide recorded an annual decline of 5%.

Most economists expect the RBA to cut the official rate another three times this year, taking the official cash rate down to 3.35%.

Pent-up demand, lower financing costs, and increased borrowing capacity will drive another housing upcycle.