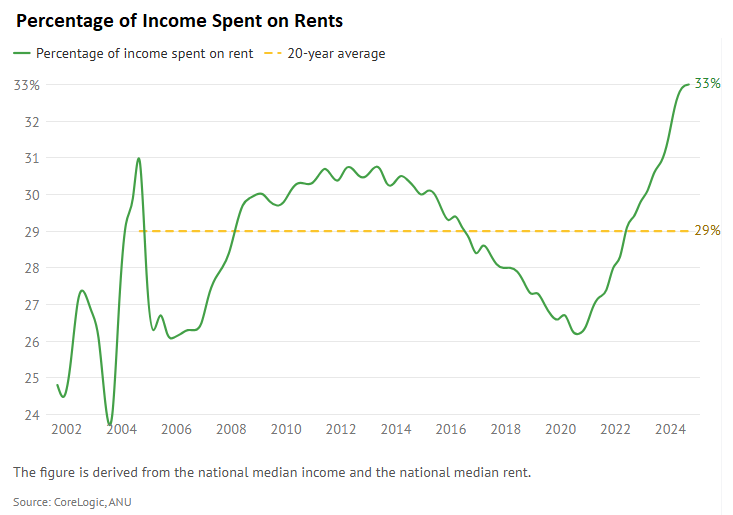

In January, Domain published the following chart showing how the proportion of income a median household needed to pay the median rent hit a record high 33% in Q3 2024.

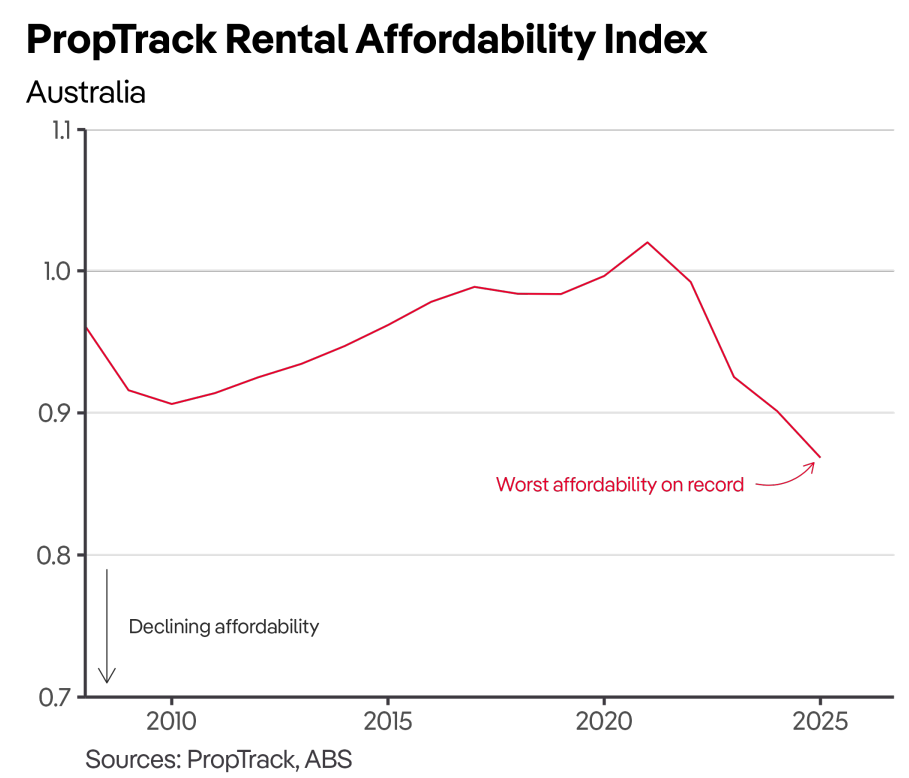

REA Group has released its Q4 Rental Affordability Report, which found that rental affordability is at its worst level on record, driven by surging rents far outstripping income growth since the onset of the pandemic.

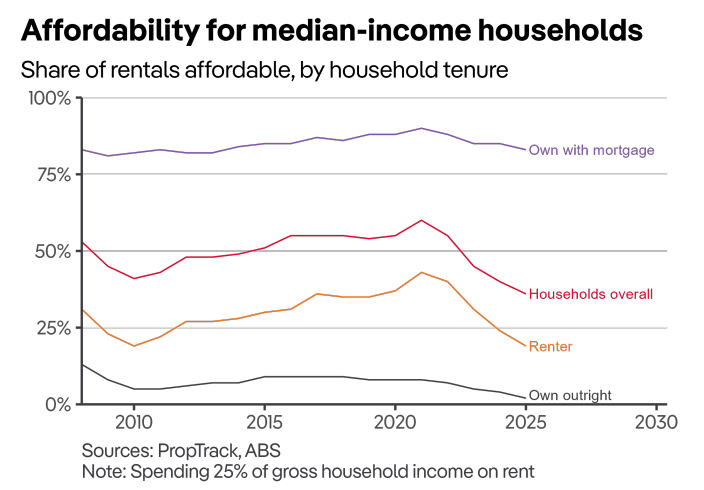

The PropTrack Rental Affordability Index shows that, in the six months from July to December 2024, households across the income distribution could afford to rent the smallest share of advertised rentals since at least 2008, when its records began.

While rents grew slower in 2024 than in 2023, rent growth still outstripped income growth, further worsening already challenging rental affordability.

Households earning a median income of roughly $116,000 can afford to rent the smallest share of properties in at least 18 years, when REA Group records began.

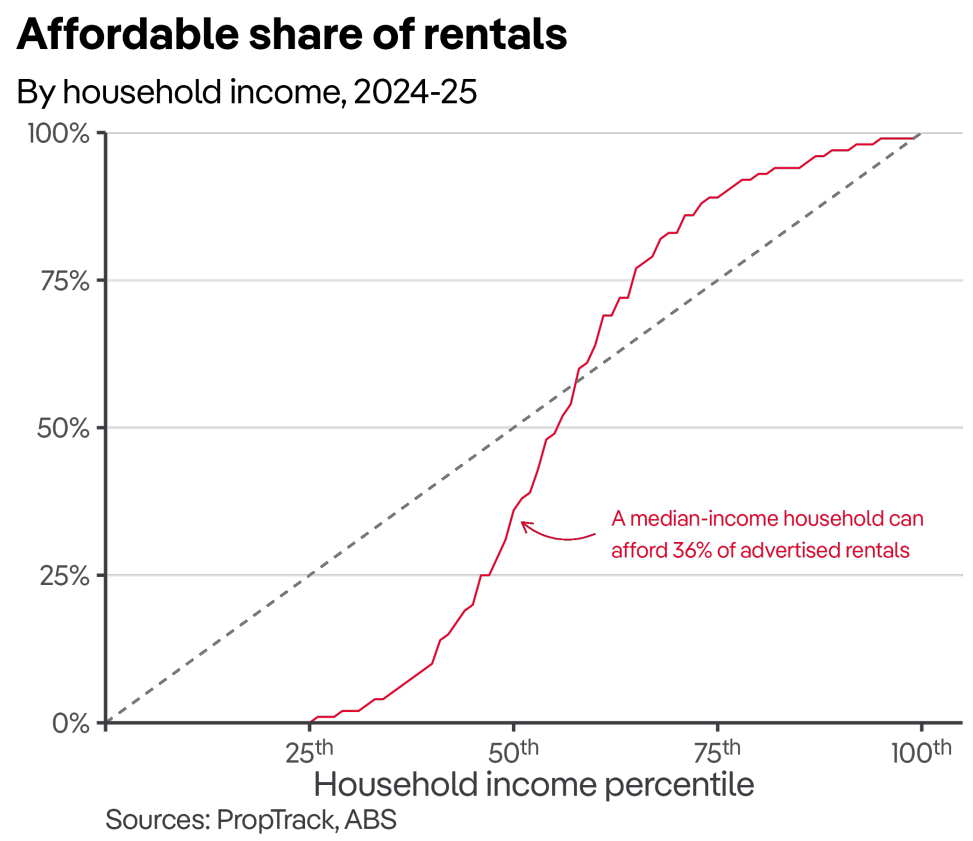

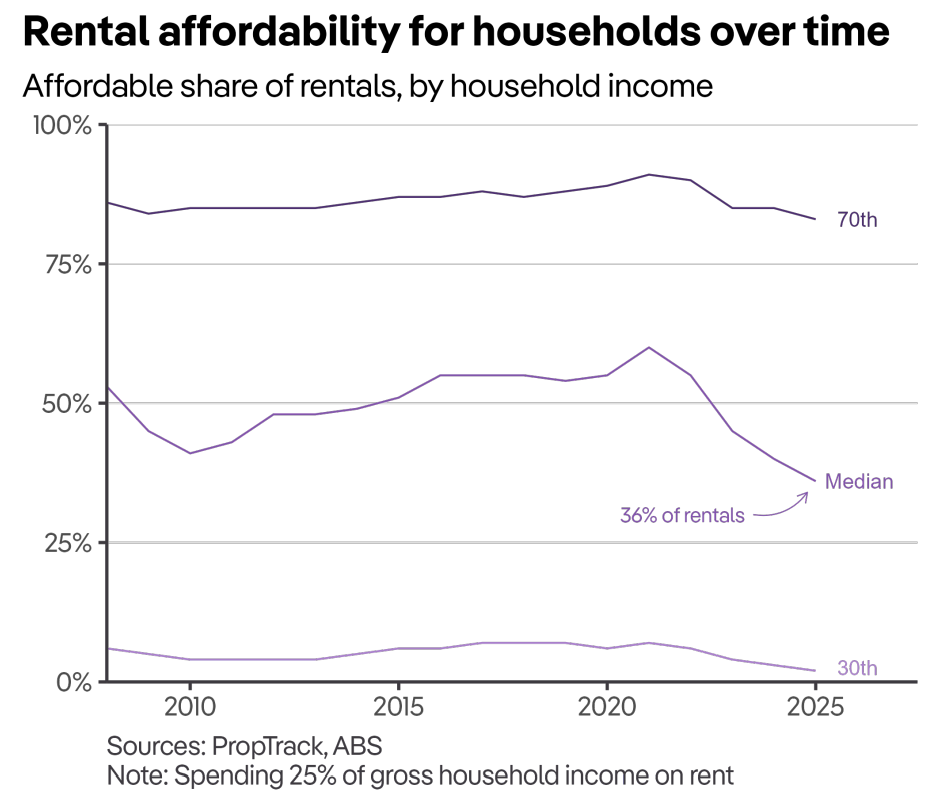

Typical-income households spending 25% of their income could afford just 36% of rentals advertised on realestate.com.au over July-December 2024.

This represented the lowest share since records began in 2008, and a drop from the (already lowest-on-record) 40% households could afford in 2023-24.

Even relatively high-income households earning about $177,000 a year—the top 30% of Australians—face more challenging rental conditions than they have in some time. These households could afford 83% of advertised rentals in 2024-25.

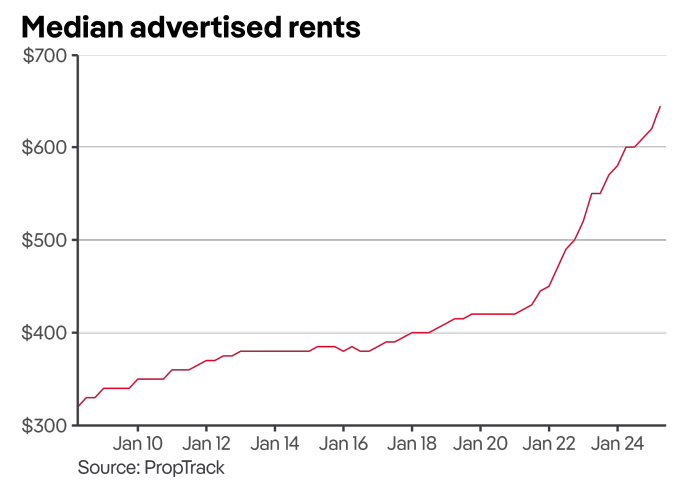

The key factor behind the declining affordability is the surge in rents.

According to PropTrack, rents nationally have risen by 48% since the beginning of the pandemic.

This compares to a 19% increase in median income over the same period.

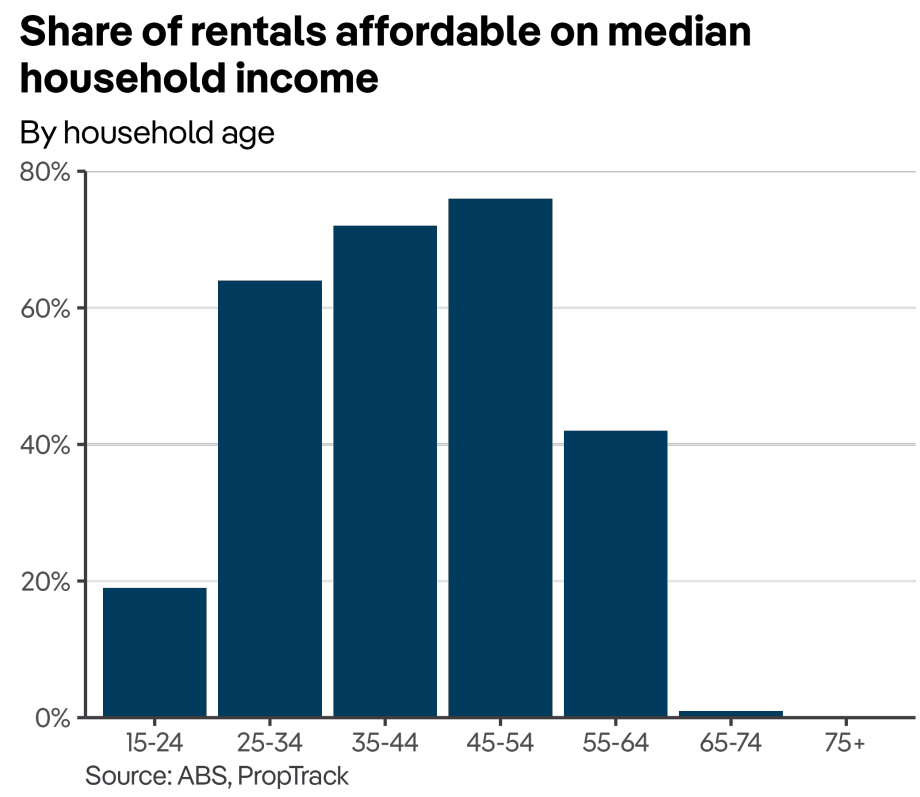

The situation is worse for younger and lower-income households.

Among 15–24-year-old households, 84% rent, and among 25–34-year-old households, 56% rent.

However, only 19% of rentals advertised between July and December 2024 were affordable for a median-income 15–24-year-old household.

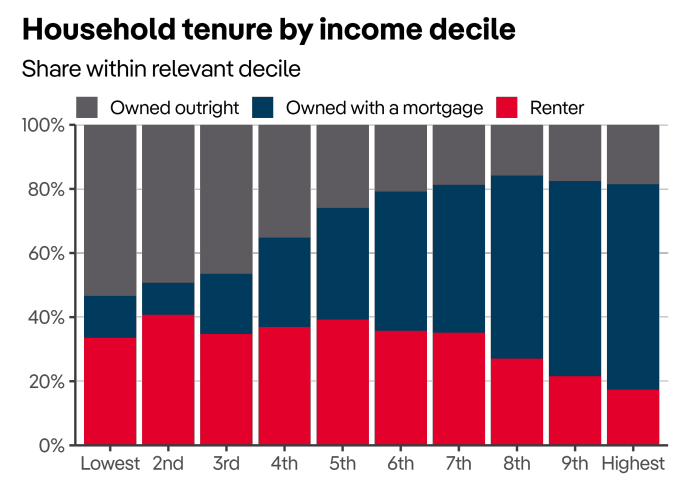

Renter households are also overrepresented among lower-income deciles.

More than half of renter households (58%) earn less than the median income for households overall.

As a result, rental affordability is even more challenging for renter households than it is for households as a whole.

While 36% of rentals are affordable for a median-income household, a median renter household is lower-income ($101,000 versus $116,000) and could afford just 19% of rentals advertised between July and December 2024.

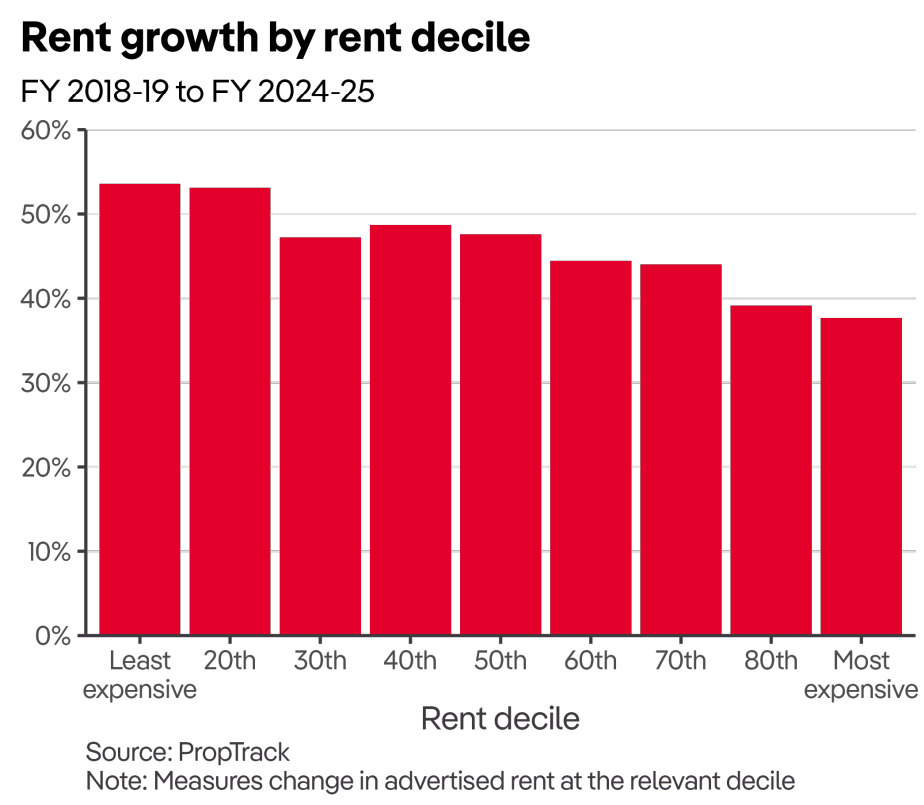

Affordability has worsened even more for low-income renters because rents have increased faster at the more affordable end.

The price for a rental at the 10th percentile (the rent at which 10% of rentals across Australia are cheaper and 90% more expensive) has gone from $280 to $430—a 54% increase in just four years.

While rents have grown enormously, this is faster than at the more expensive end of the market.

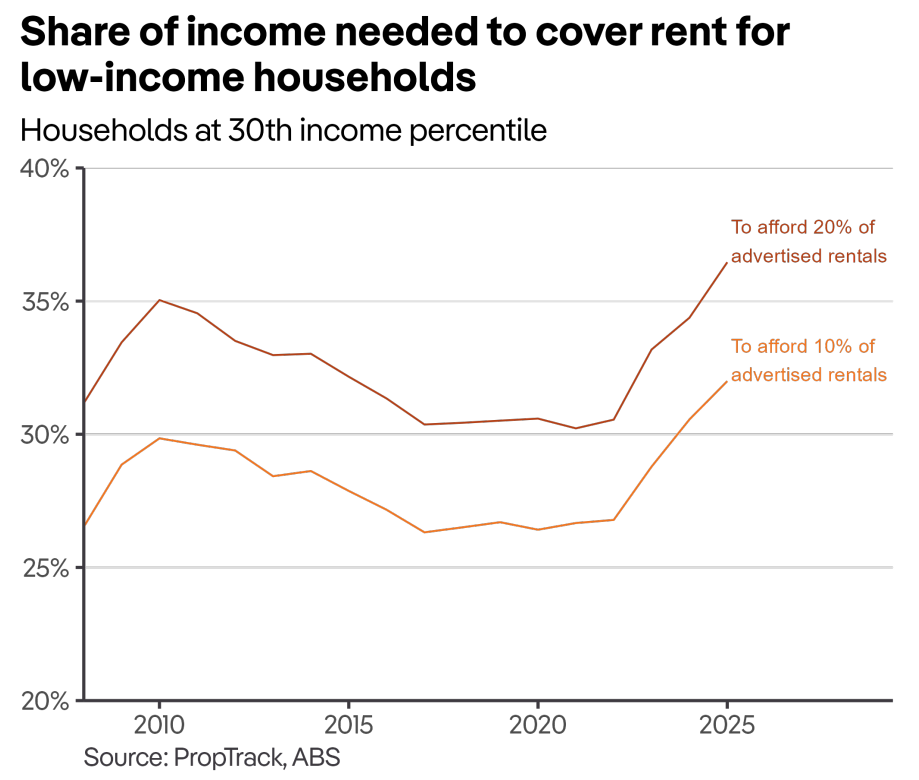

For a household at the 30th percentile of income—equivalent to $70,000 per year—almost no rentals (2%) advertised in 2024-25 would have been affordable (using 25% of pre-tax income as the benchmark for affordability).

To afford even one in five advertised rentals, these lower-income households would need to spend 36% of their pre-tax income.

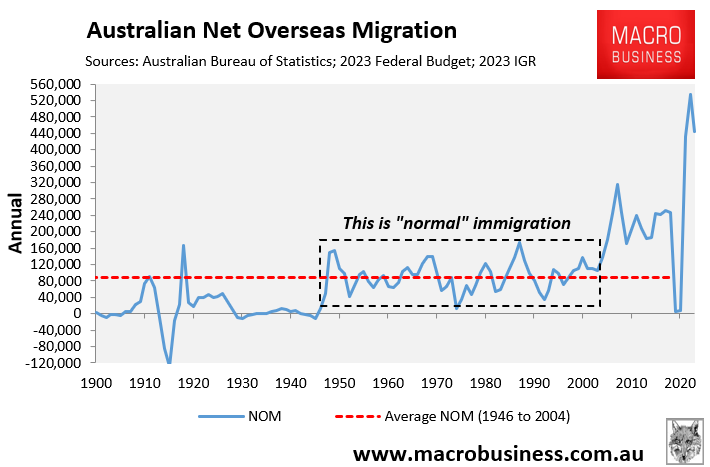

A key factor behind the surge in rents is historically high net overseas migration, which saw one million net migrants flood into Australia in only two years.

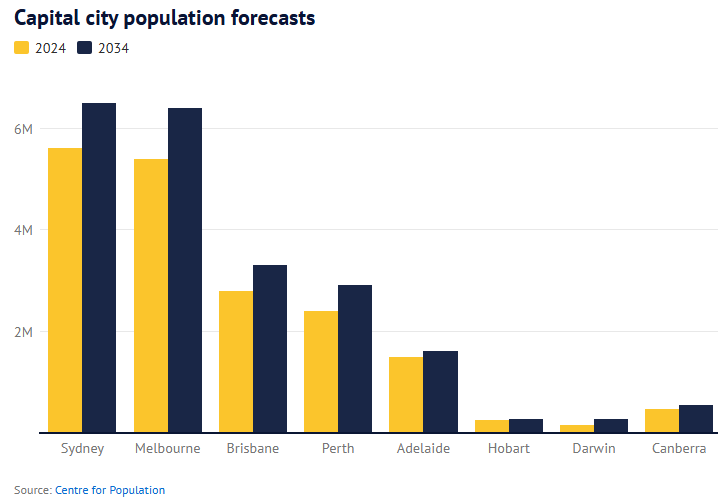

The pressure is projected to continue, with the Centre for Population projecting the nation’s population will grow by 4.1 million over the next decade, with most of the growth occurring in the major capital cities.

Such strong population growth, driven almost entirely by net overseas migration, will ensure that demand continues to outstrip supply, placing upward pressure on rents.