Aside from oil, Australia has almost every natural resource the world requires.

Australia has significant reserves of coal, gas, uranium, cobalt, nickel, copper, and lithium.

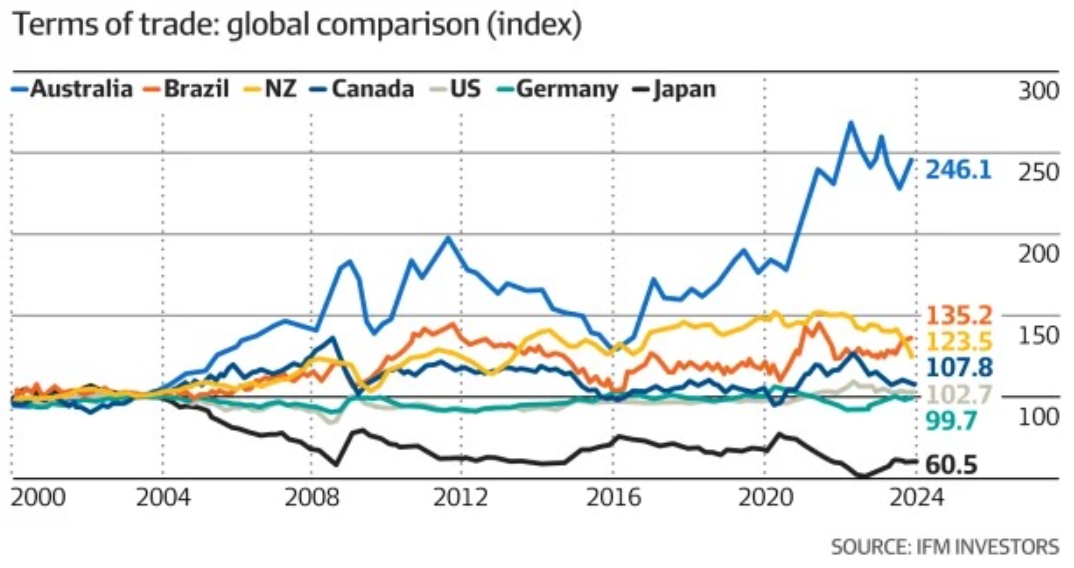

Over the past two decades, Australia has reaped the greatest benefit from global commodity prices.

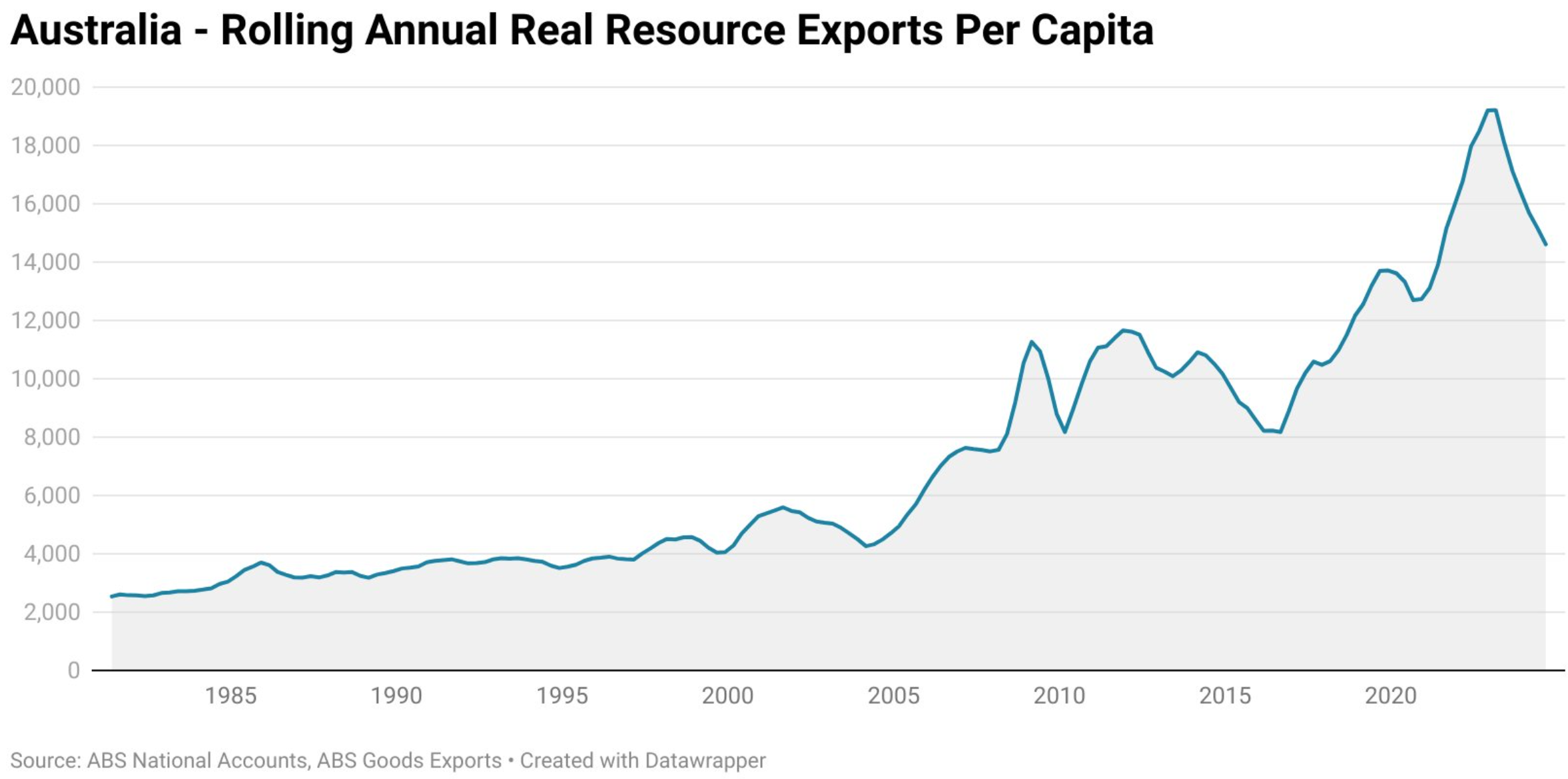

The following chart from independent economist Tarric Brooker shows the extraordinary growth in Australian resources exports in per capita inflation-adjusted terms:

“It’s astounding that since 2008, per capita exports have surged, yet living standards have gone almost nowhere”, noted Brooker on Twitter (X).

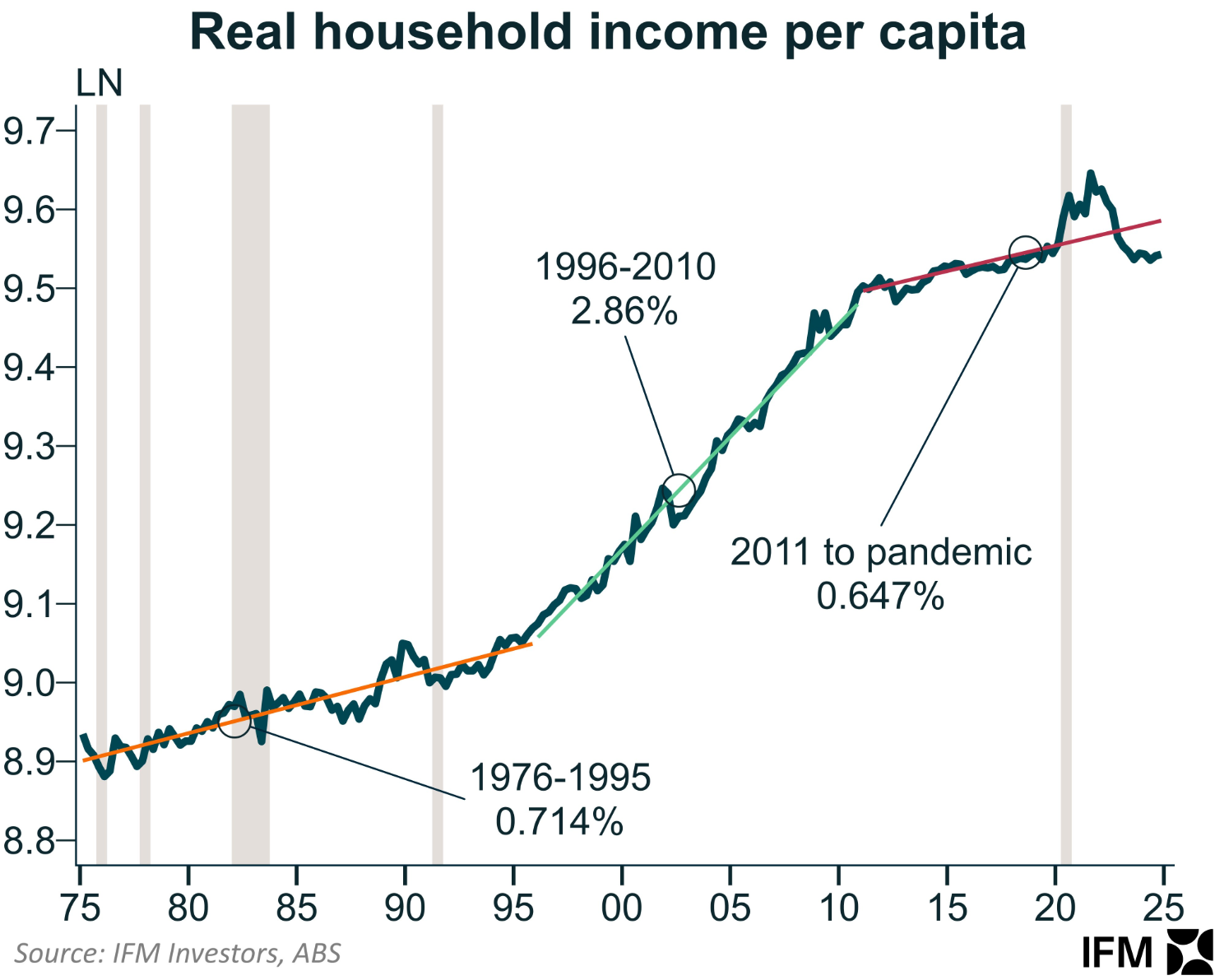

Brooker is right, of course. Despite the surge in national income via the world’s biggest terms-of-trade boom, real per capita household disposable income growth stalled over the past 14 years.

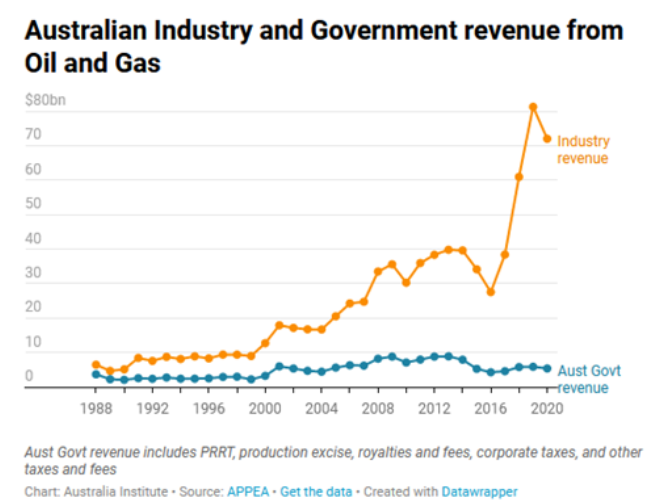

Australian policymakers have failed to tax the resources sector adequately. This has left the federal budget chronically underfunded and subjected residents to soaring energy costs and a deindustrialised economy.

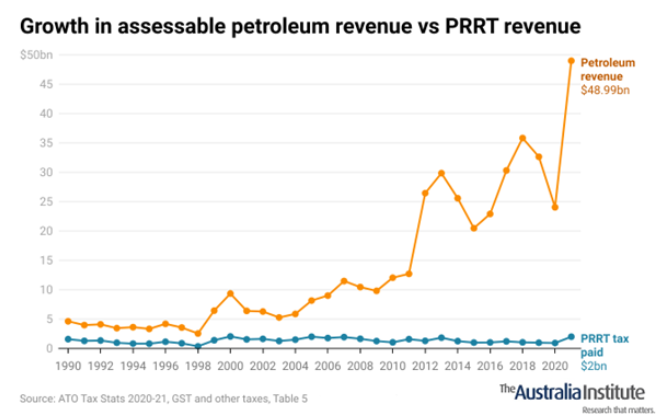

The idiocy is illustrated by the low taxes collected from Australia’s booming gas exports.

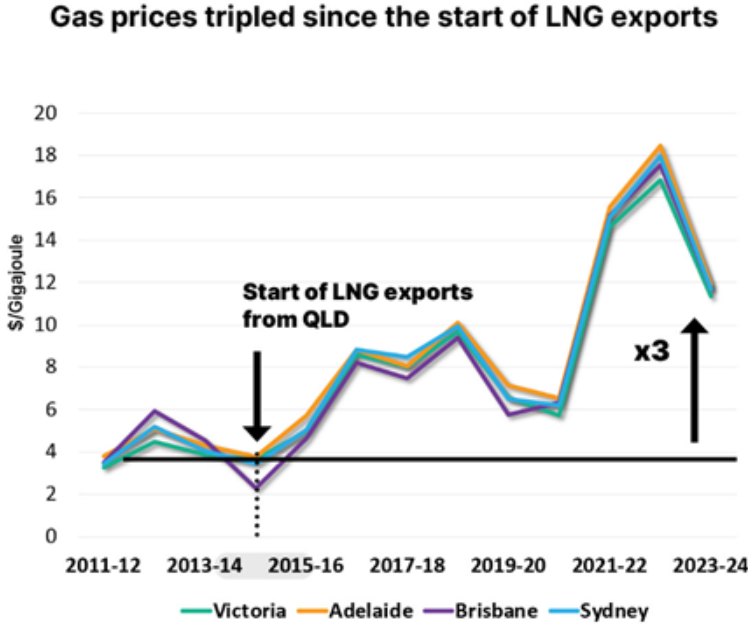

This boom in gas exports has coincided with the tripling of East Coast domestic gas prices since LNG exports began a decade ago.

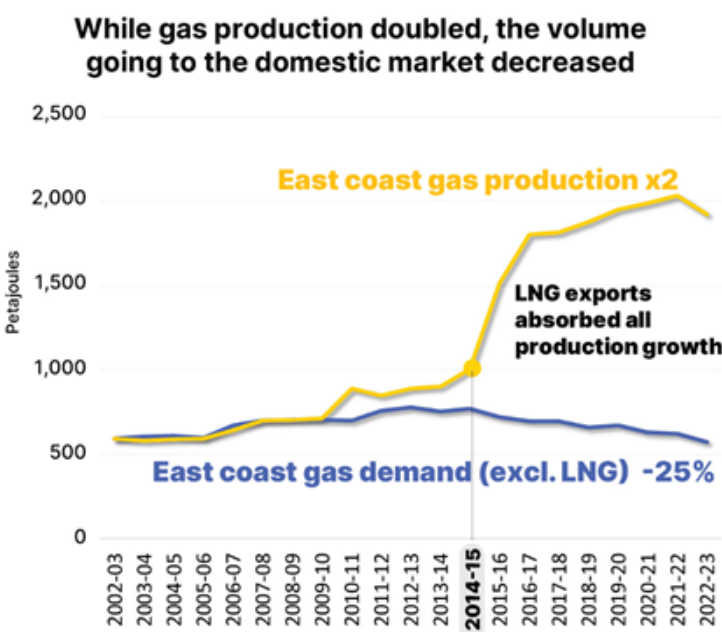

Meanwhile, the export cartel has starved the East Coast domestic market of gas.

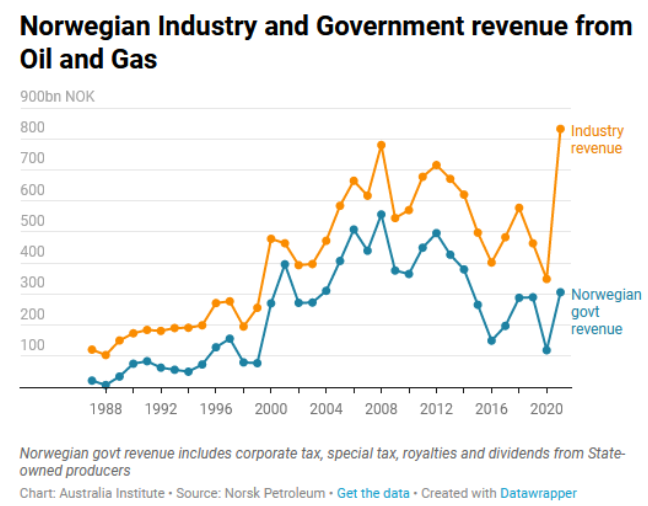

Now compare Australia’s approach to resource taxation with Norway’s.

Norway is Europe’s top oil and gas producer, with a daily output of more than 4 million barrels.

Commercial drilling on the Norwegian continental shelf began in the early 1970s and has since expanded to include offshore activities in the North, Norwegian, and Barent Seas.

Today, Norway’s oil and gas industry contributes over 20% of the nation’s total GDP.

The industry has made Norwegians the wealthiest people on earth.

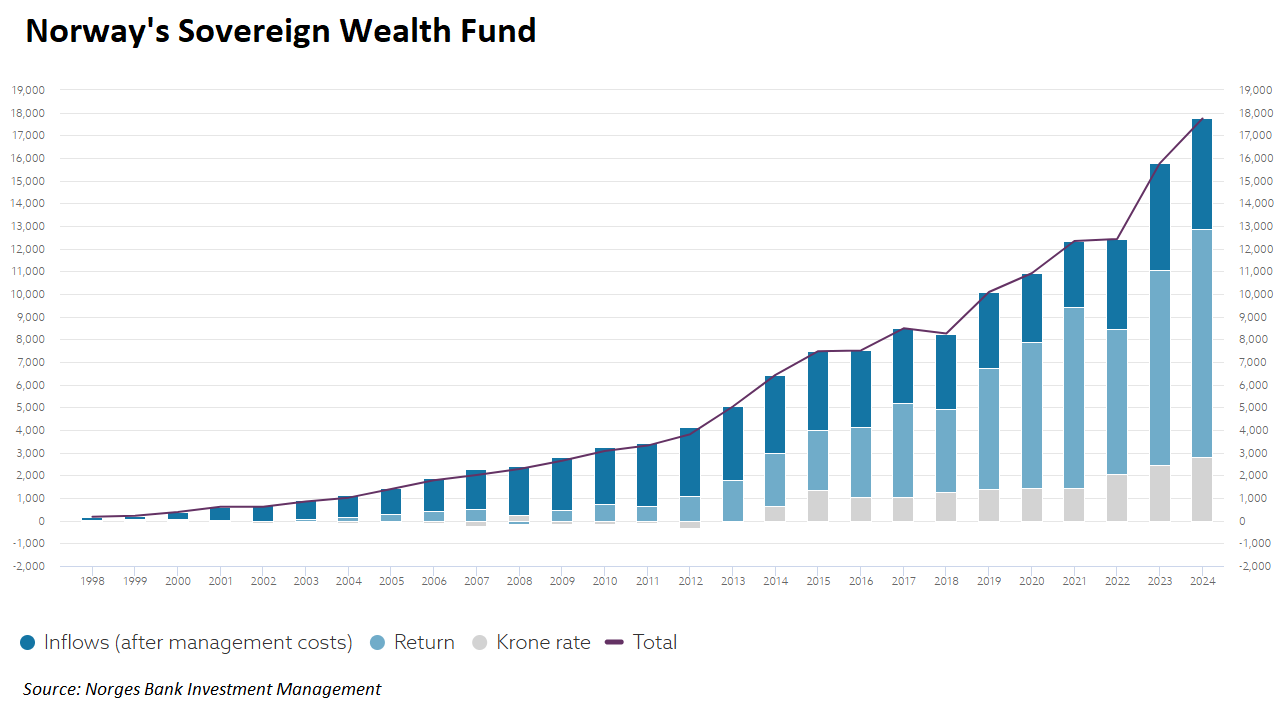

As illustrated below, Norway heavily taxes its oil and gas sector, providing the nation with a massive financial windfall.

Norway has invested its oil and gas windfall in a sovereign wealth fund that is the world’s most significant and valued at approximately US$310,000 per Norwegian resident.

As a result, Norway is doubling down with plans to increase oil and gas investment in 2025, spurred by fresh exploration activity and rising demand for gas.

After hitting record highs this year, Norway’s oil and gas investment is expected to grow even higher in 2025…

The Scandinavian oil superpower is expected to continue investing heavily in fossil fuels in the coming years. Oil and gas companies operating in Norway expect to invest an estimated $24.68 billion in 2025, the industry association Offshore Norge announced in December…

The increase in new exploration projects reflects the growth in demand for natural gas from Norway, following the Russian invasion of Ukraine and subsequent sanctions on Russian oil…

Australia, which is abundant in nearly every natural resource in the world, could have emulated Norway and made its residents the richest in the world.

Instead, policymakers have created massive profits for foreign-owned companies.

They have then impoverished us further by engineering artificial energy shortages, driving up domestic gas and electricity prices while also diluting the nation’s mineral wealth via mass immigration.

Australia is a textbook example of what a resource-rich nation should not do.