DXY is up. EUR has flamed out.

AUD follows EUR.

Lead boots going nowhere.

Oil is back. CTAs next.

The opposite for copper. Sell before Goldman does.

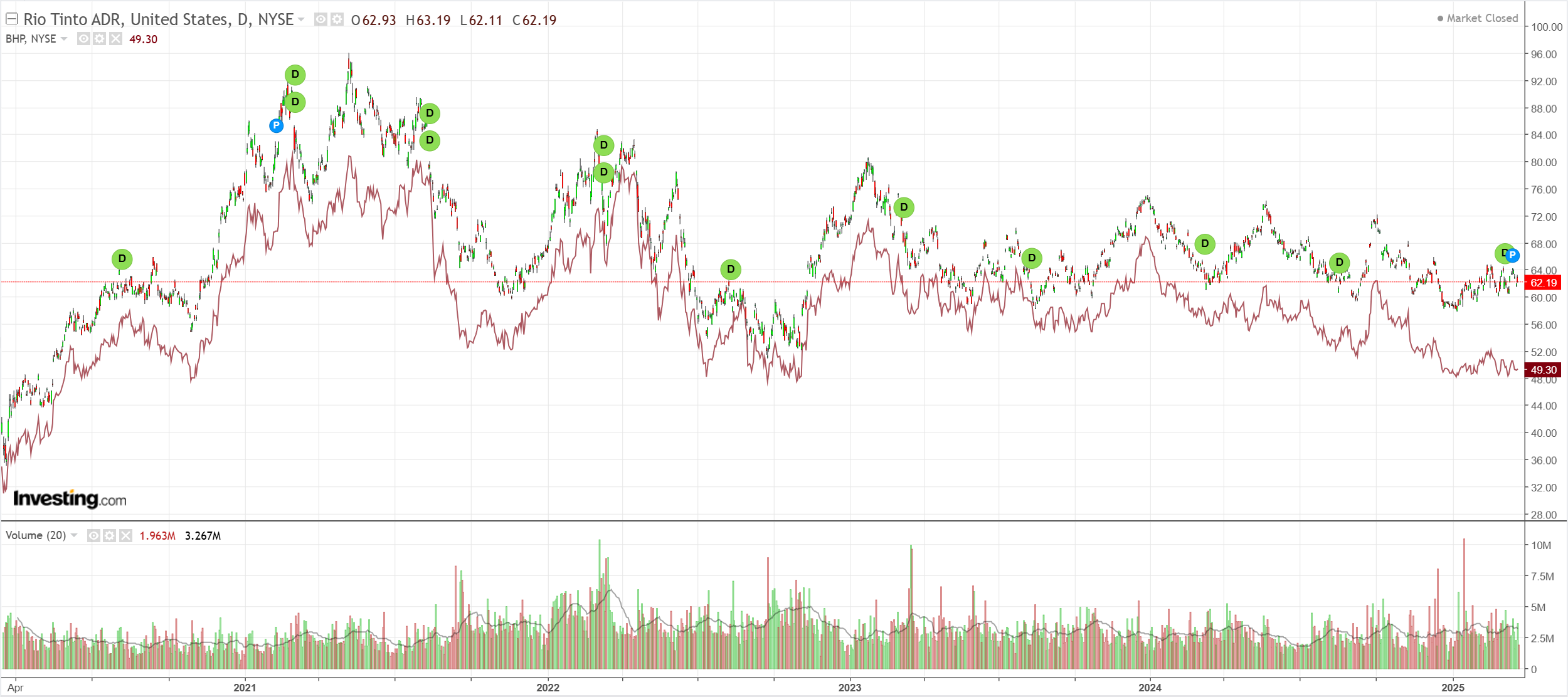

Big mining, big bear market.

EM yawn.

Junk purgatory. No flush here.

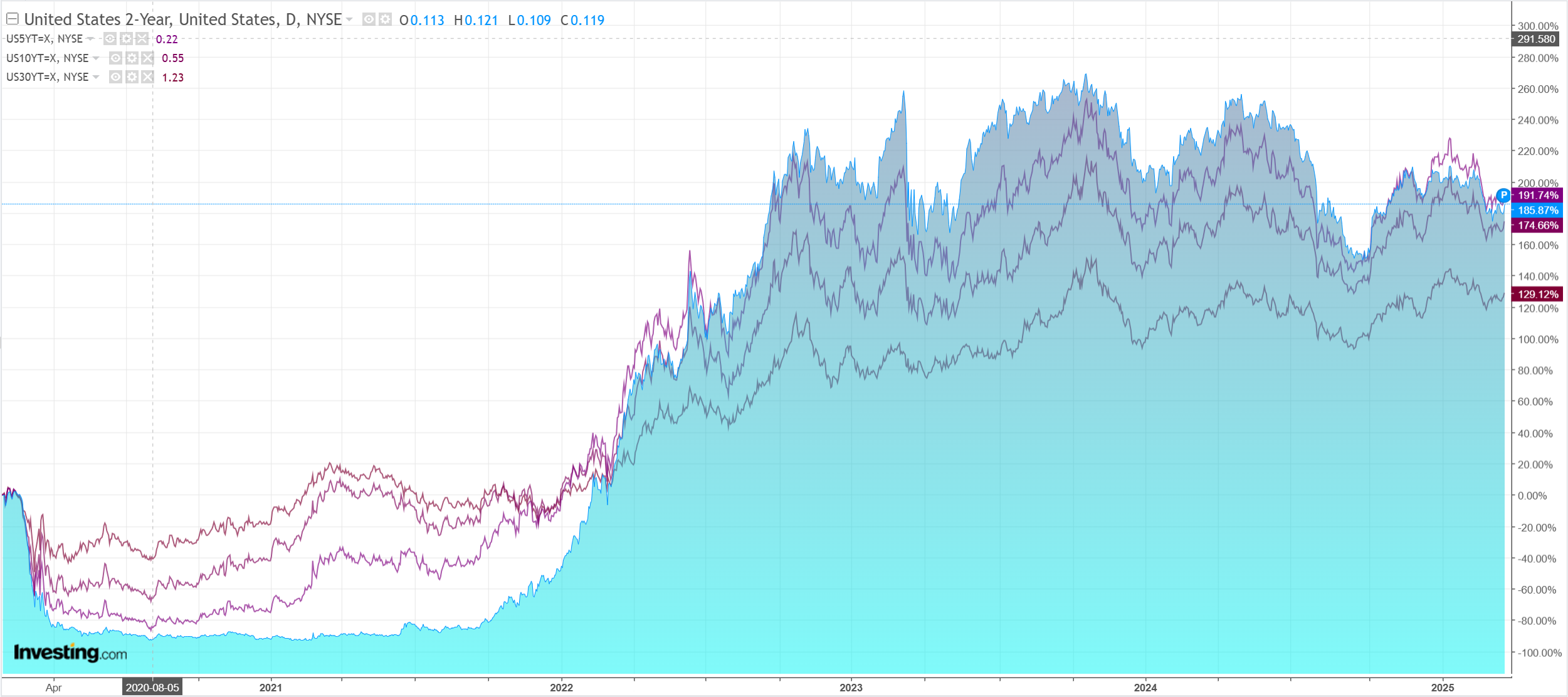

Yields up.

Stocks up.

Trump’s sweeping tariffs are suddenly less so.

President Donald Trump’s coming wave of tariffs is poised to be more targeted than the barrage he has occasionally threatened, aides and allies say, a potential relief for markets gripped by anxiety about an all-out tariff war.

Trump is preparing a “Liberation Day” tariff announcement on April 2, unveiling so-called reciprocal tariffs he sees as retribution for tariffs and other barriers from other countries, including longtime US allies. While the announcement would remain a very significant expansion of US tariffs, it’s shaping up as more focused than the sprawling, fully global effort Trump has otherwise mused about, officials familiar with the matter say.

It’s exhausting keeping up the orange madman.

Anyway, less tariffs > less inflation > more Fed > buy stocks is the basic logic for risk today.

Everything in the DXY > EUR pivot is overcooked so this may be a pullback for AUD.

Then again, maybe it is a pivot.

As the orange madman.