DXY

is bank. Overcooked EUR in reverse.

AUD went down with the ship.

Led boots are made for stability.

Oil down, gold up.

Copper is the new gold.

Miners are not.

Nor EM.

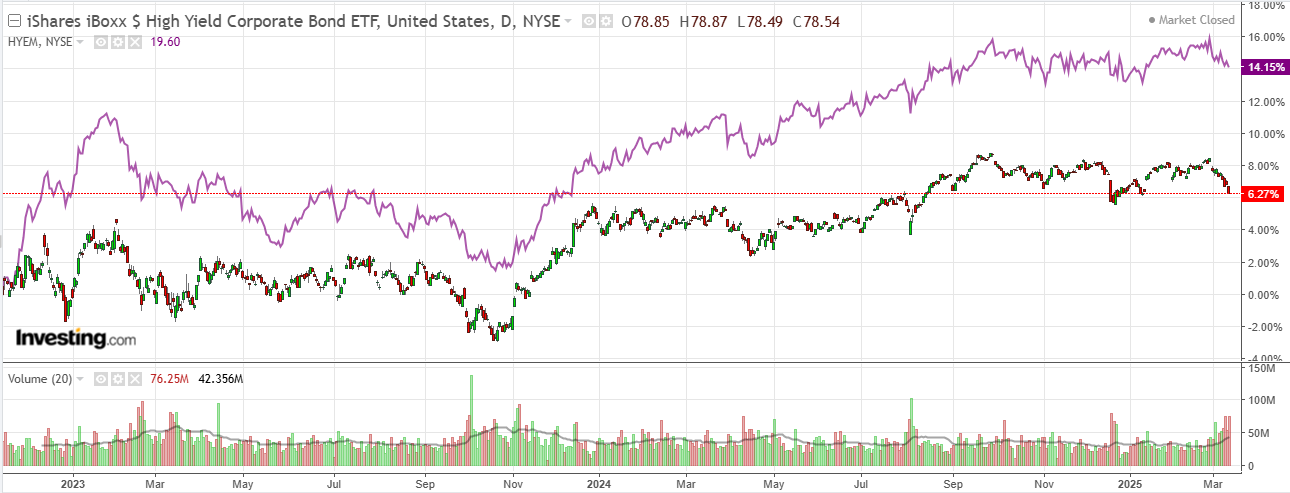

In better news for stock bulls, junk is breaking down.

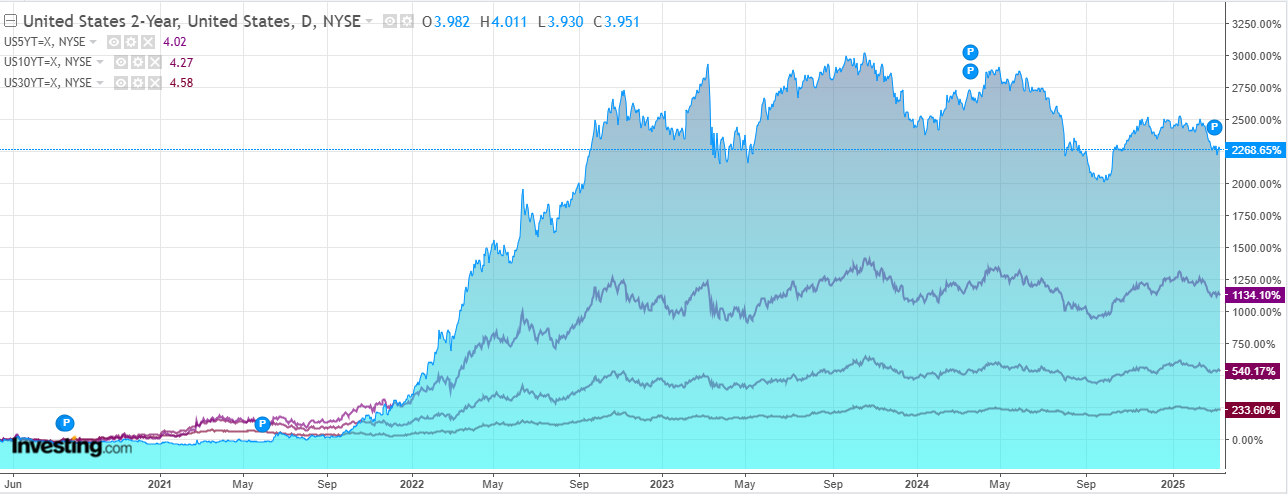

Yields fell too.

The US PPI was soft. There’s still no sign of DOGE in unemployment claims, Trump spewed tariffs every which way, the US government shutdown is back as a risk and Putin laid out come tough conditions for ceasefire.

Not much coherence in that little lot and it showed in risk off which is rarely good for AUD.

The roll in junk in offering the beginnings of hope that US economic weakening is getting more serous but it’ll need to fall much further yet before phase one of the Trump is complete.

AUD is still at risk while this transpires.