DXY is back again as EUR pukes.

AUD whoa!

Gold bubble bursting.

Commods cooked.

Miner massacre.

EM deepsuckered.

Junk unconcerned.

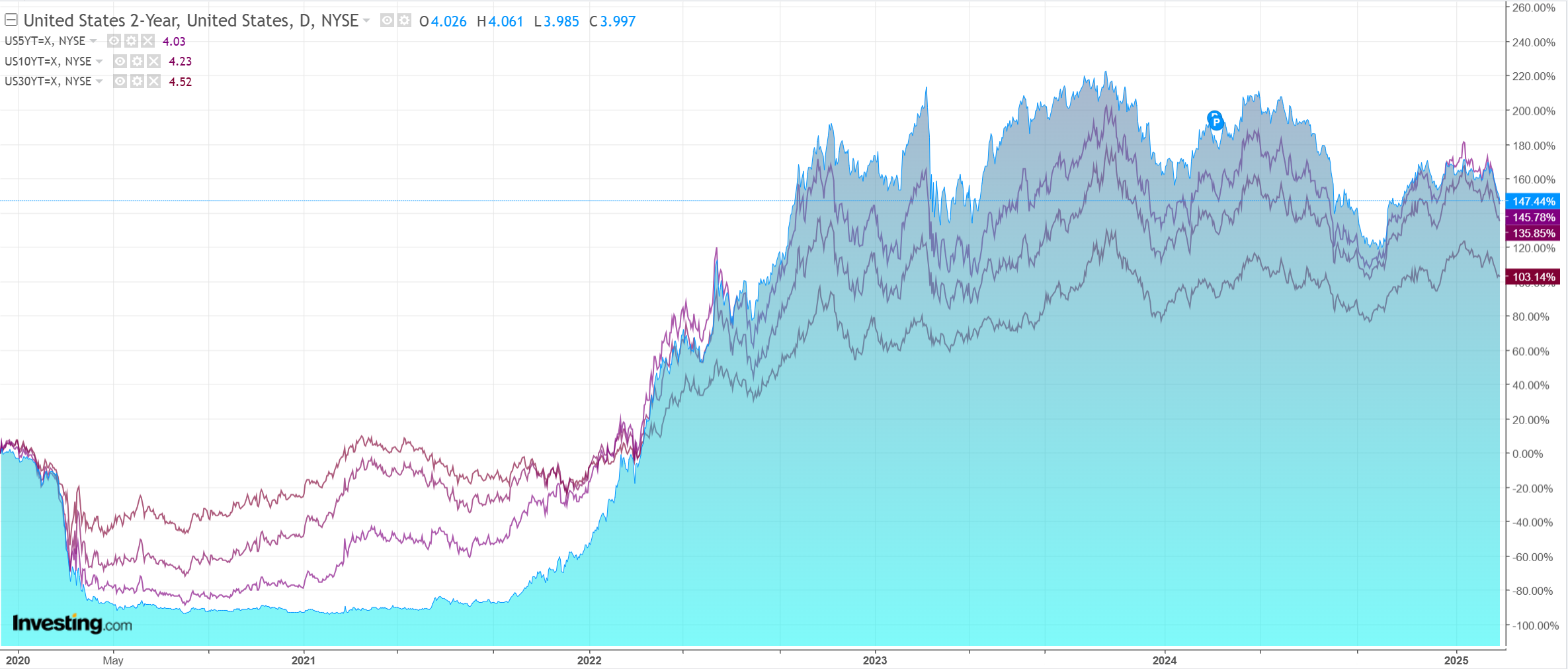

Curve steepening.

Stocks late rescue.

This is ignominious stuff from the child president and his hillbilly cheerleader.

The upshot is no deal to end the war. Though it is all so childish, a complete reversal could come at any moment.

The child president said as much.

“We had a very meaningful meeting in the White House today. Much was learned that could never be understood without conversation under such fire and pressure. It’s amazing what comes out through emotion, and I have determined that President Zelenskyy is not ready for Peace if America is involved, because he feels our involvement gives him a big advantage in negotiations. I don’t want advantage, I want PEACE. He disrespected the United States of America in its cherished Oval Office. He can come back when he is ready for Peace.”

This is the way the market appears to have read it, selling off and then rallying.

That said, AUD was crushed into the 61s and did not lift much from there, so we can hardly say it went well.

We are probably near another bottom here.

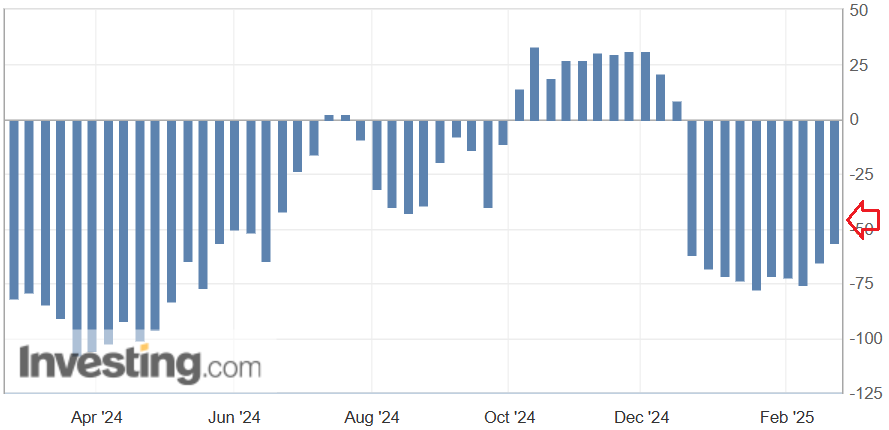

CFTC data had materially cut the big AUD short to -45k contracts before the big puke in the last few days, so that gave us the freedom to move. But it has probably gotten more short again by now.

What now? Difficult to say. The child president is out of control, tariffs are up and down like the anchor crew, the US economy is slowing into the shredding of DOGE, the Chinese NPC is this week, and there is no German government yet.

Lots of cross-currents, but, fundamentally, I do not see big further downside in the AUD until the RBA bullhawks capitulate in H2 and the bulk commodity crash takes over in 2026.

That leaves us vulnerable to pumps and dumps for the time being.