DXY and EUR stable.

AUD downish.

Lead boots are made for walking.

Gold has entered some kind of new up smash.

Copper doom is here thanks to Goldman. Meh everything else.

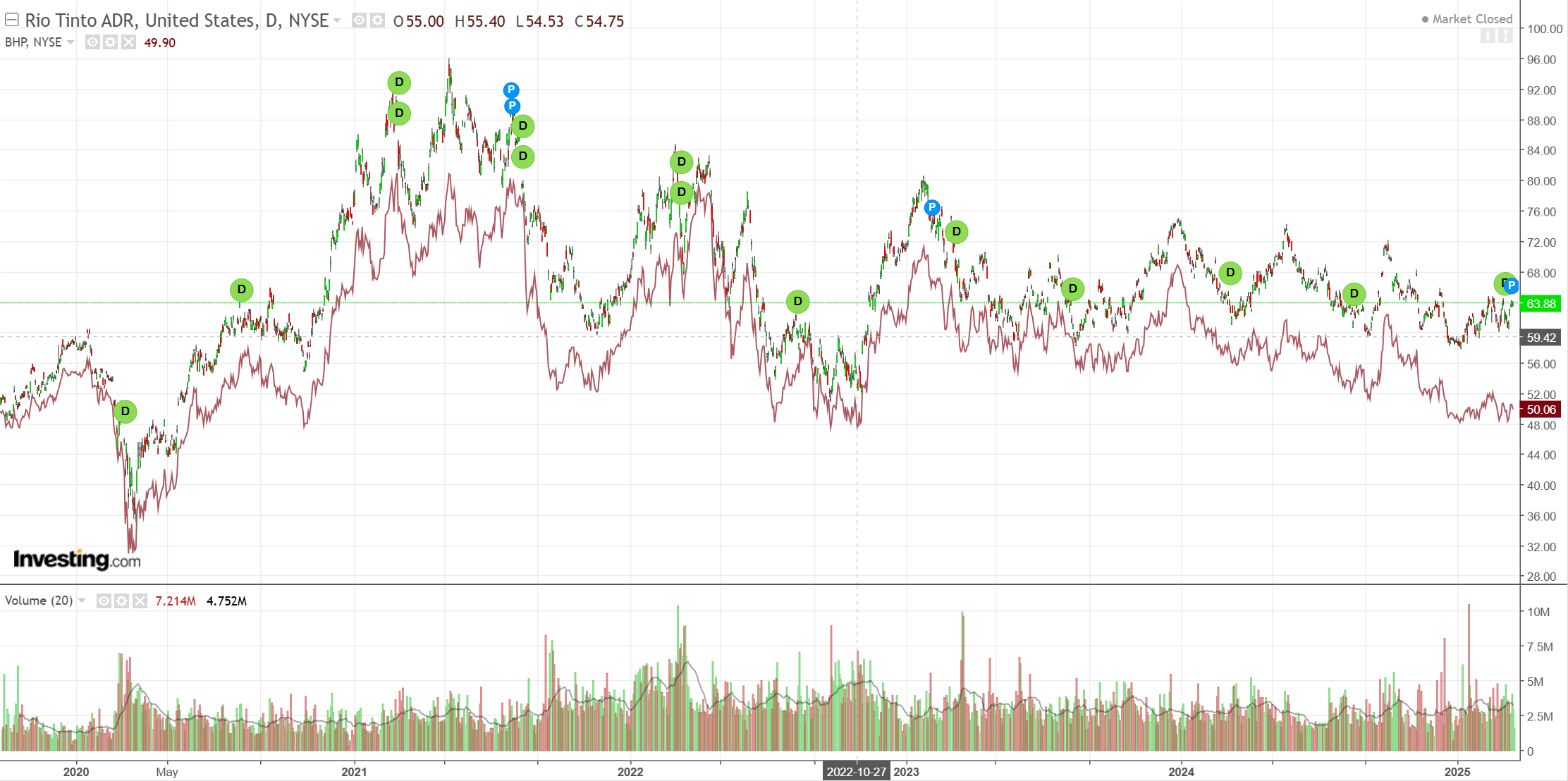

Big miners meh.

EM maybe.

Credit surged. Oh dear.

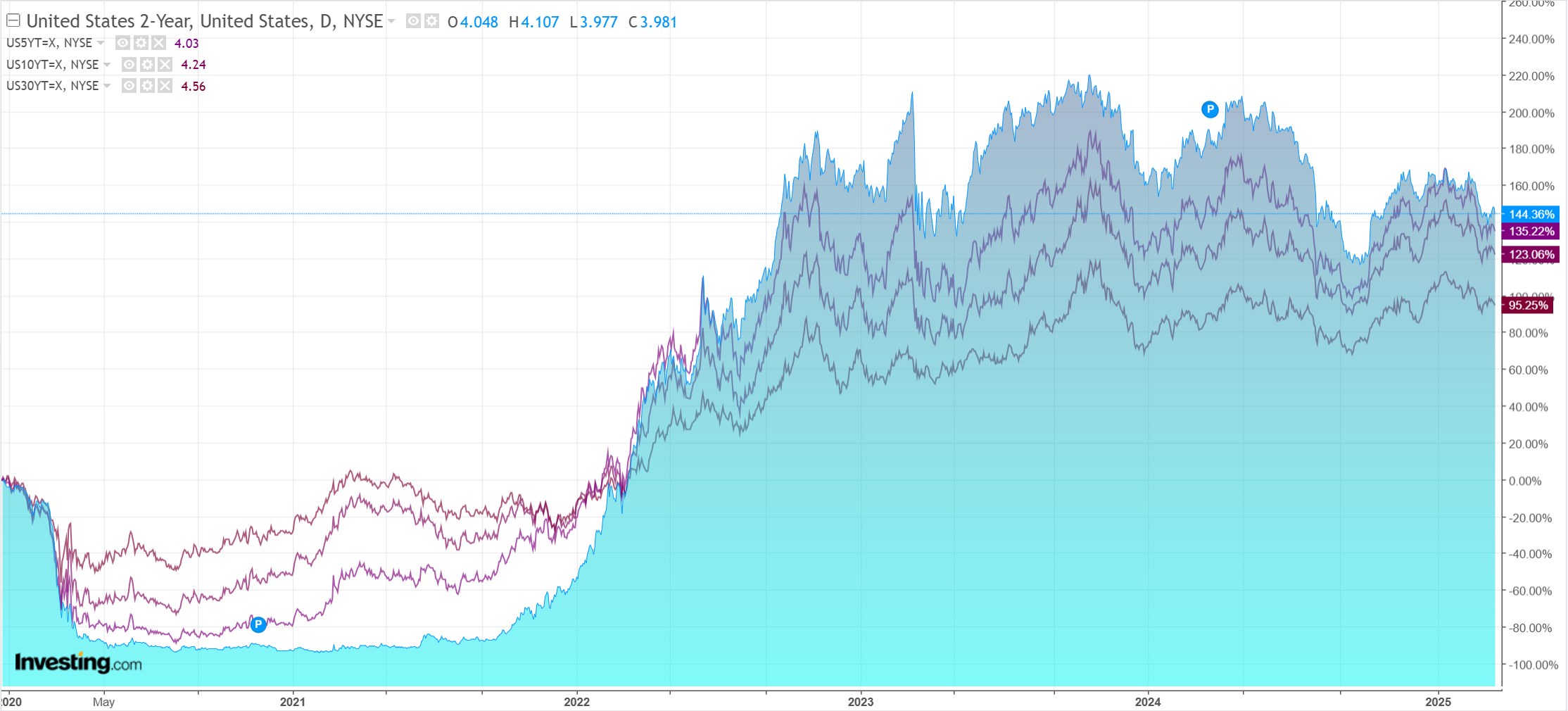

Yields down.

Stocks up.

Is it a sort of Fed put? UBS.

Dare anyone say “Fed put”.

Perhaps not quite, but the Fed’s message is consistent with its work from September 2018 – that reacting to the inflationary consequences of tariffs only makes the growth hit worse than it needs be.

Not quite the “Fed put” the markets have been hoping for, but in the scheme of things, the outcome of the Fed is a little more dovish than the market had expected.

The Fed shrugging off the inflationary signals from its models and instead preferring to line the dot plot up with the growth deterioration.

Amusingly, it appears we might go back and forth between no Trump put and some kind of Fed put to destroy equity markets with volatility.

But both are AUD bullish, so the short term remains up.