DXY is a falling stone. EUR to the moon!

AUD followed the latter but can’t catch it.

Lead boots stuck in concrete.

Oil and gold meh.

Copper looks uber-bullish. Thanks Goldman!

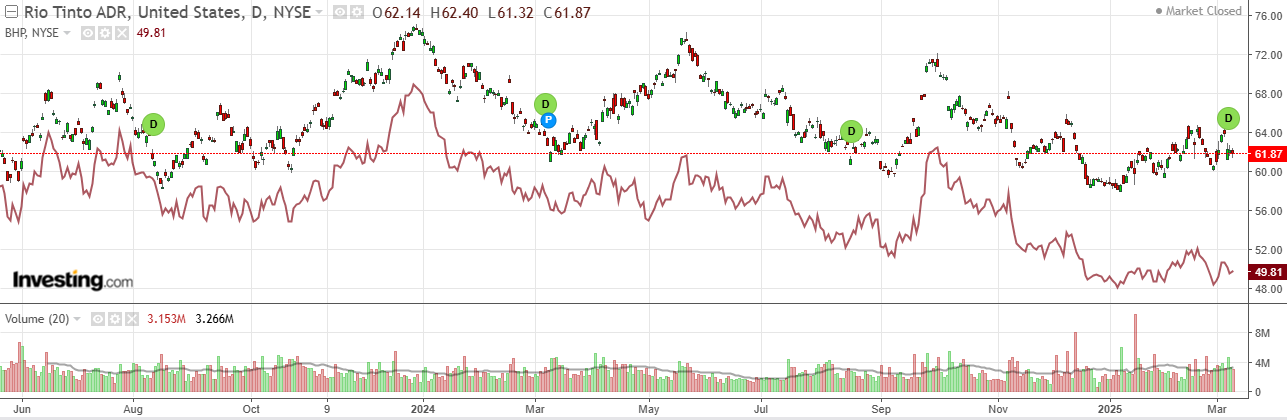

Miners meh.

EM meh.

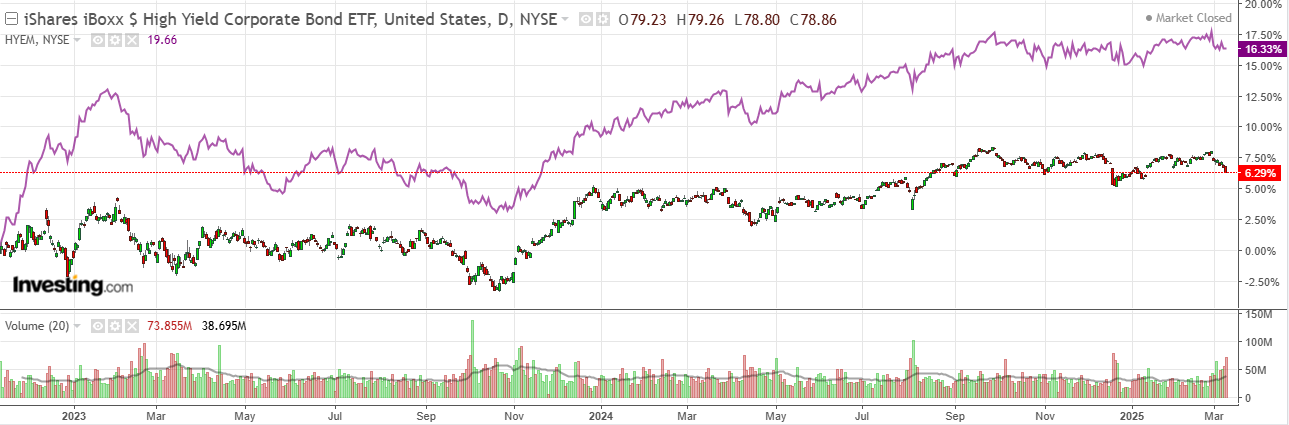

Junk a little down move but much more needed if US growth is really going to slow.

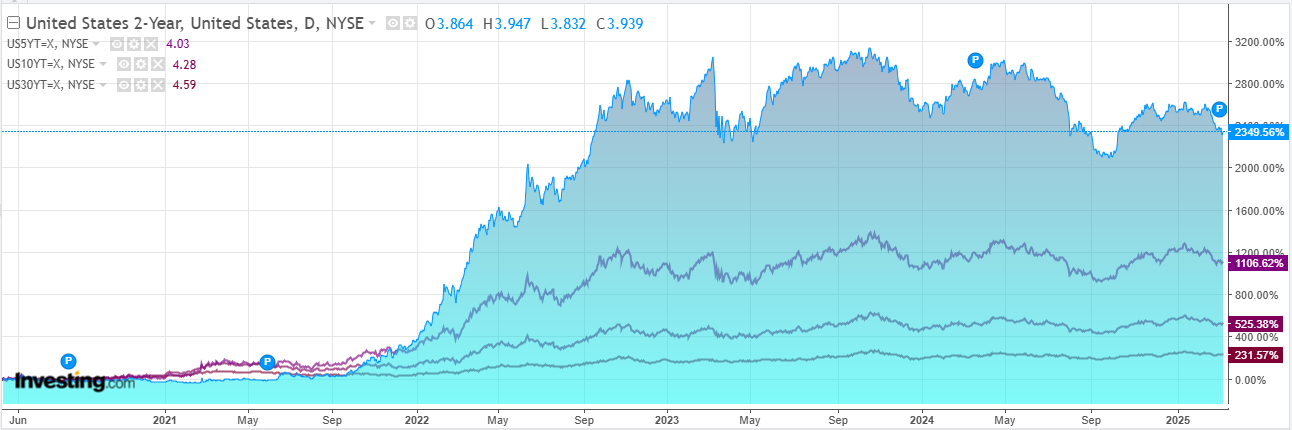

Yields meh.

Stocks down again.

January JOLTS were out a pretty unchanged but this predates DOGE so was especially market moving.

The big one is tomorrow in US CPI. BofA,

We forecast that February headline and core CPI rose by 0.3% mom.

While this would be a notable moderation from January, it would still be a sticky-high print.

We expect the increase in tariffs on China to boost core goods excluding used car prices.

Core services inflation, meanwhile, should moderate but remain above levels consistent with the Fed’s target.

In short, CPI data should reinforce our view that inflation progress has stalled.

That is the consensus and won’t please anybody.

It might actually work to lift AUD if markets interpret it as a need to intensify DOGE, though if stocks tank that won’t stick.

Some ugly dynamics are at large for all markets so I can’t see AUD getting far until the air clears.