The face ripper is here as DXY falls and EUR rises.

AUD to the moon!

Lead boots are heavy.

Gold an unstoppable force. Death of oil.

Base metals sold the fact.

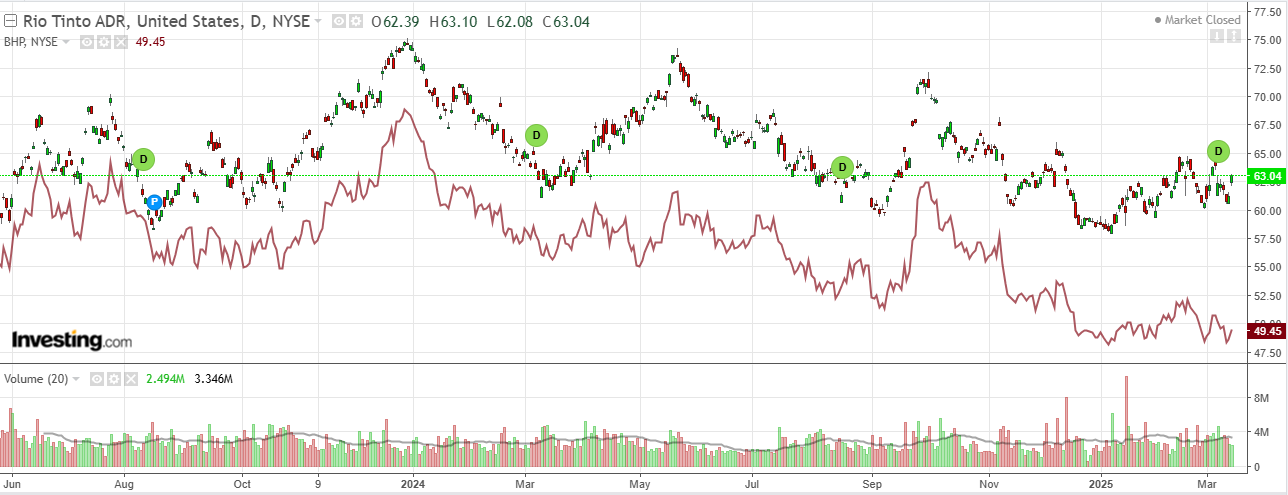

RIO’s copper is opening jaws to BHP.

EM meh.

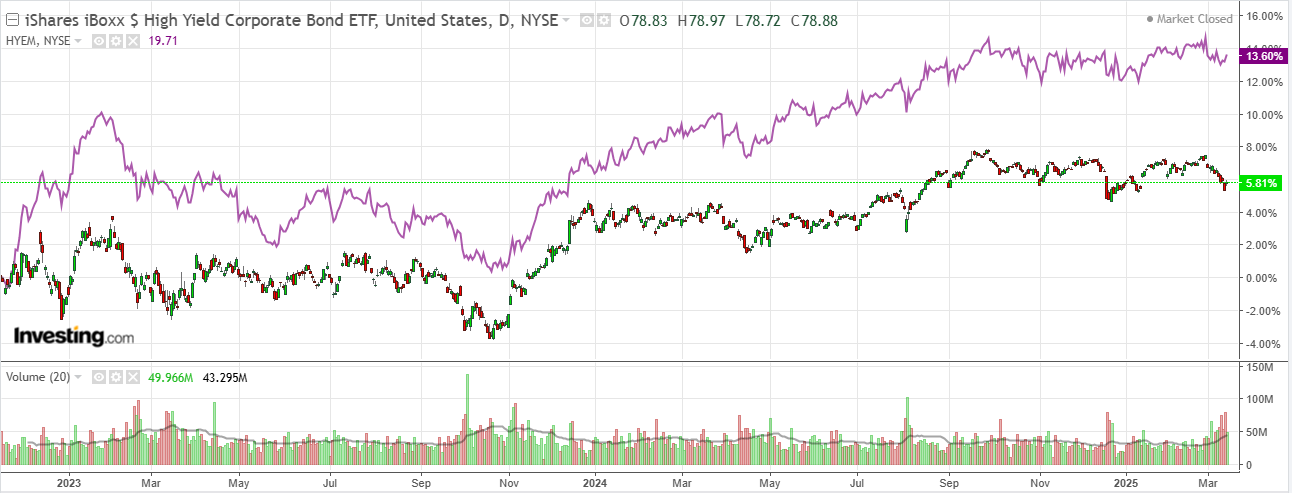

Junk firmed. Bad news for all.

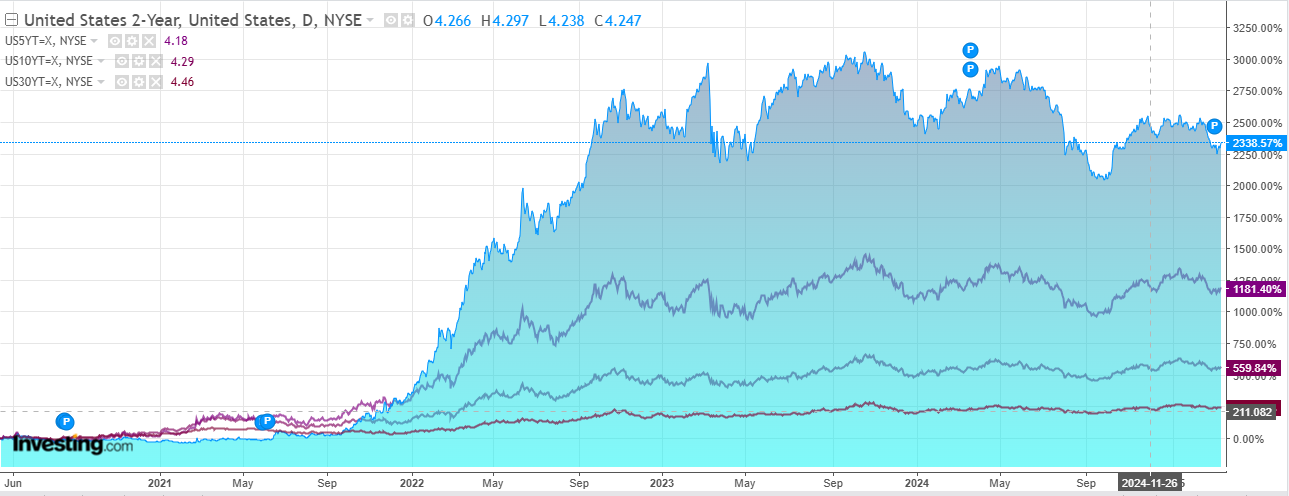

Yields up as Germany’s Merz got his fiscal deal.

Stocks to the moon!

Three points of news drove price action.

The US government has avoided a shutdown as Dems rolled over.

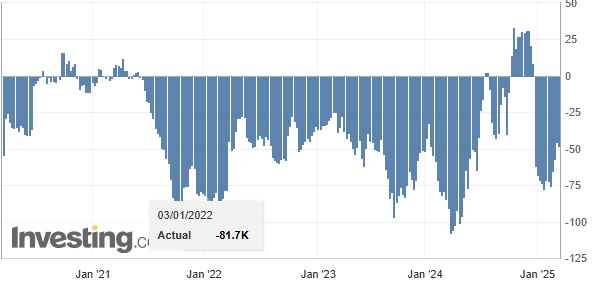

Second, a dump in US consumer confidence reassured the market that Trump phase one will end.

Of course, by rallying the market also undid the bad news being good so this ain’t no bottom.

Third, Germany got its fiscal deal. Deutsche.

Exempt defense spending over and above 1% of GDP from the debt brake,though with a broader definition of defense spending. This effectively allows for even more defense spending outside the debt brake than on the original proposal.

Establish a EUR 500 bn off-budget fund for infrastructure investment to be spent over 12 years, of which EUR 100bn are earmarked for the Climate and Transformation Fund, of which EUR 100bn go to the federal states, which must be in addition to a minimum 10% investment spend in the core budget.

Raise the net borrowing cap for the German states from 0% to 0.35%.

That ought to keep the pivot to Europe running a little longer. EUR is incredibly overbought but capital will flow its way so maybe it can chop through the long without too much price damage.

Meanwhile, AUD is still fairly heavily shorted so it is more exposed to the face ripper.

I don’t think the stock pain is over yet. Credit must crack first.

But the first face ripping counter-rally is here so AUD up while it lasts!