DXY is back and EUR flamed out.

AUD is getting kicked in the teeth.

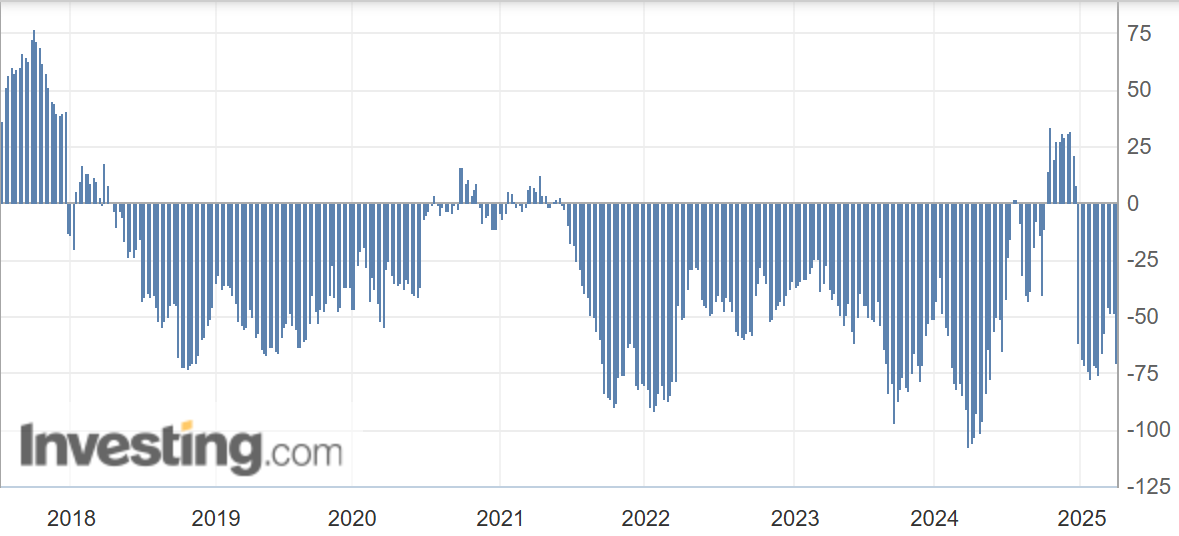

And the shorts have piled back in.

Lead boots tripped.

Trump will regret damaging Iranian oil output.

Commodities were hammered.

Big miners are in a big bear market.

EM yawn.

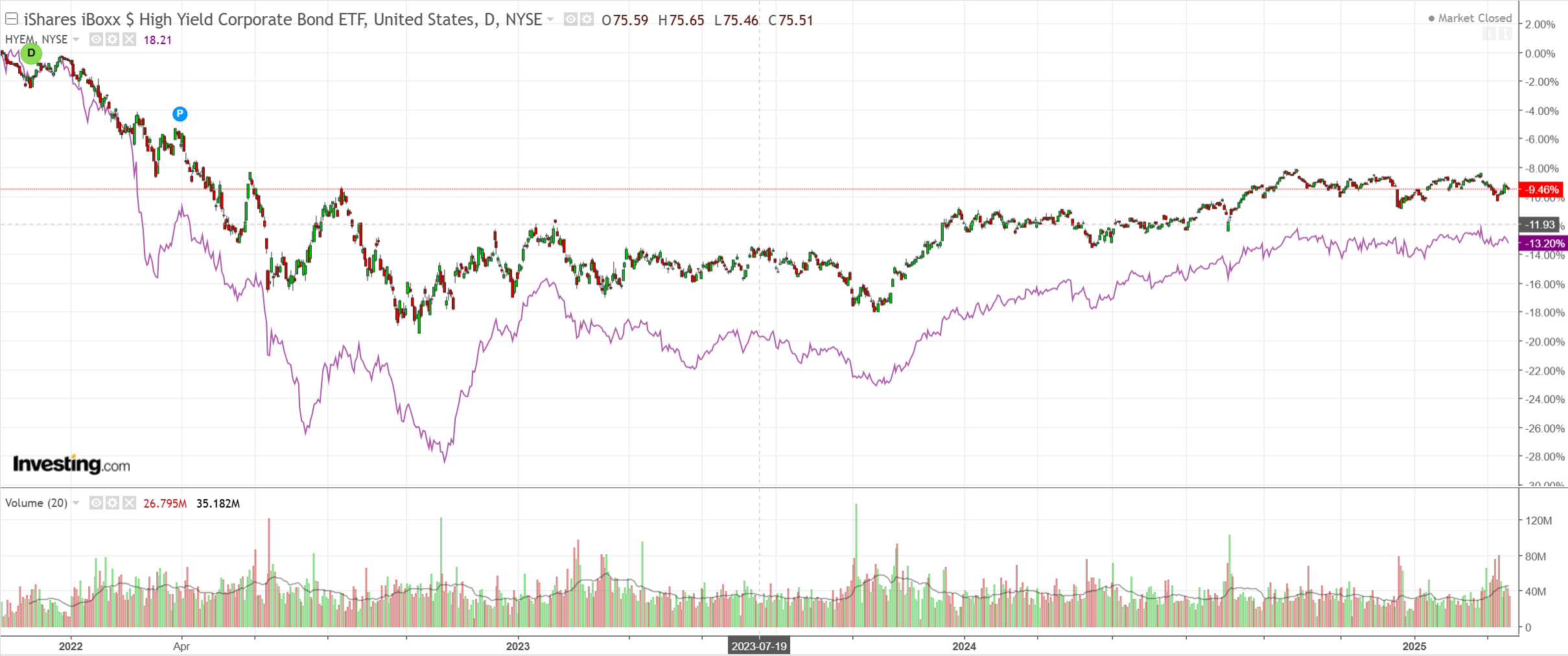

Junk stressed a bit. Need more.

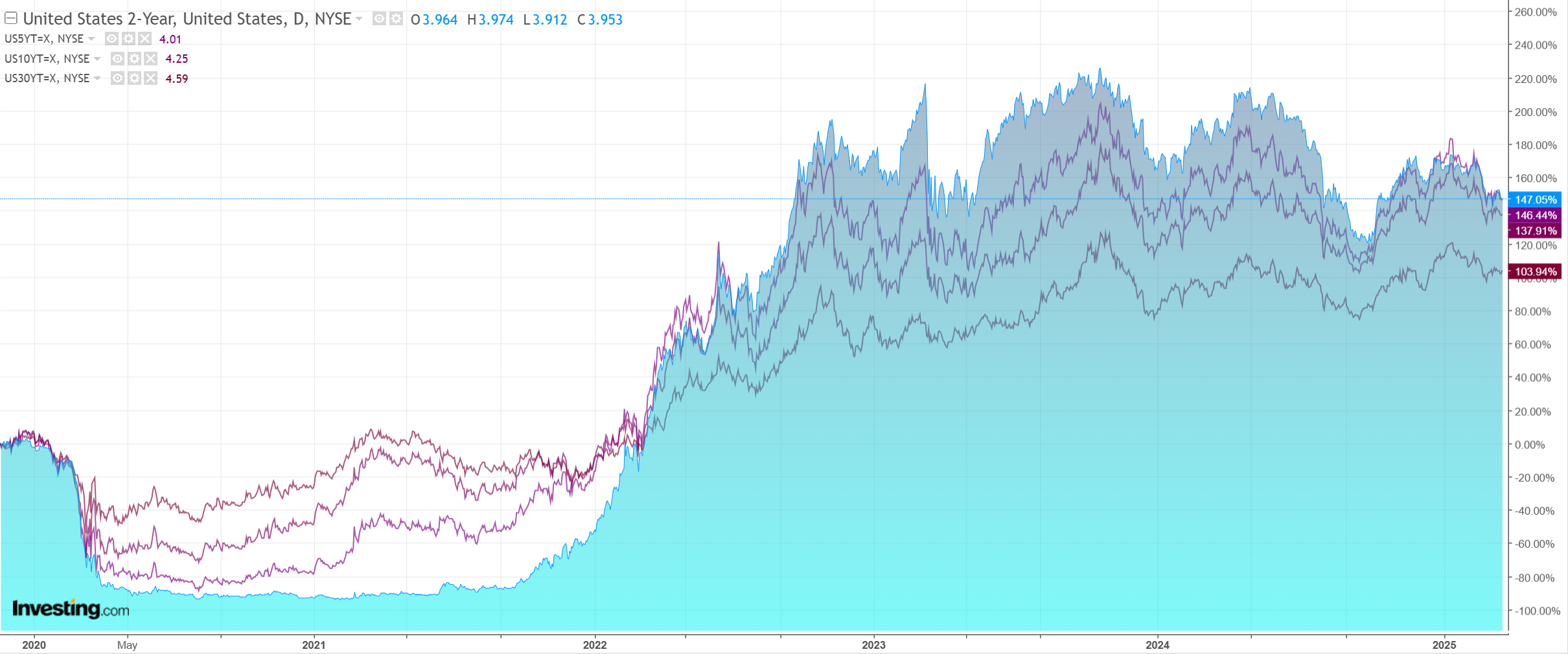

Yields flat.

Stocks flat.

AUD volatility continues. Whether it is actually recovering is a moot question. Every time the shorts are squeezed out a little, they come roaring back on poor bad news flow.

But this limits the downside, too. So we are stuck in this volatile sideways pattern.

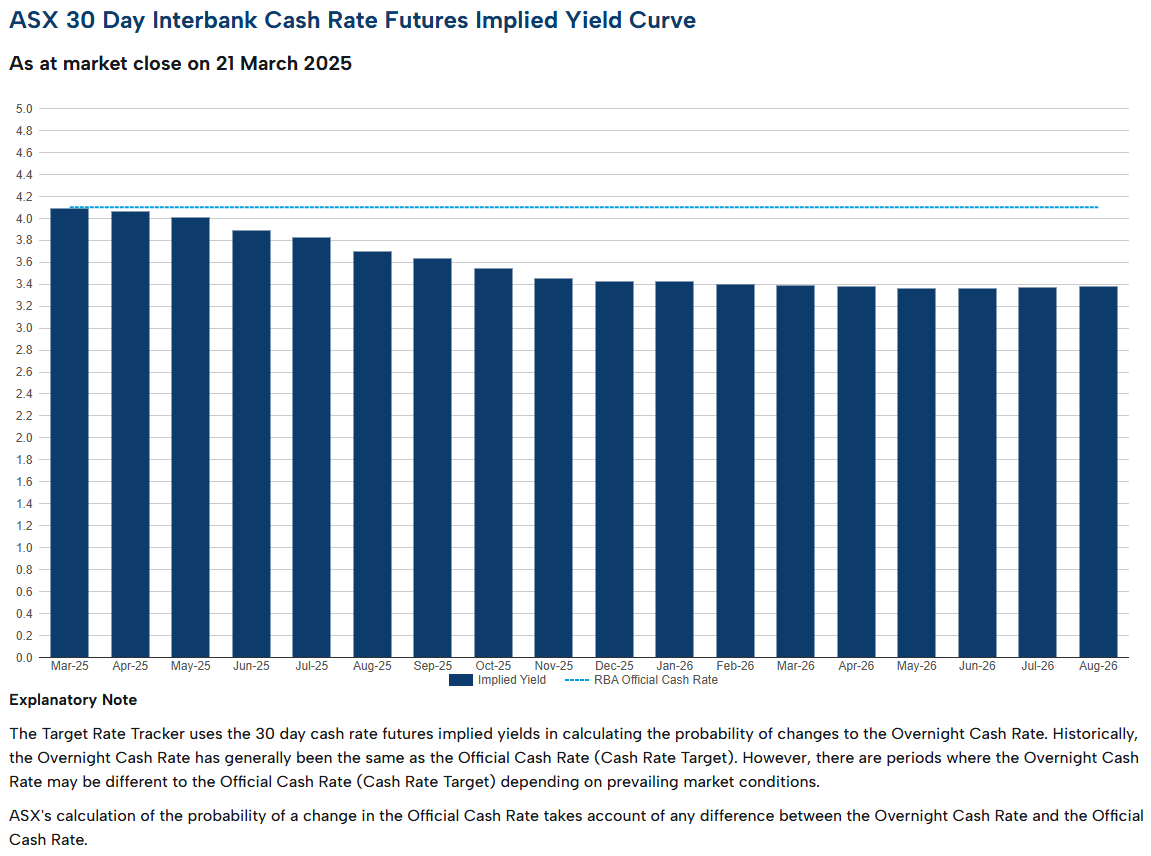

That said, AUD was weak against EUR too, so soft local jobs data is playing a role as markets increasingly discount RBA hawks. Three cuts are now priced over the next year.

It will be more. The NAIRU doesn’t exist in Australia. Here it is the NAIRI (Non-Accelerating Inflation Rate of Immigration).

It’s not going to slow with Labor/Greens in power.

Trumps’s April 2 tariff on everybody is fast coming into focus for markets too, and with the EUR overbought and oil oversold, we may be headed into a short-term DXY bounce.

Looks like an AUD soft patch.