DXY firmed last night.

AUD did too.

Lead boots are walking slowly up hill.

Bloody Brent won’t break.

Dirt decoupling!

Miners smashed anyway.

EM meh.

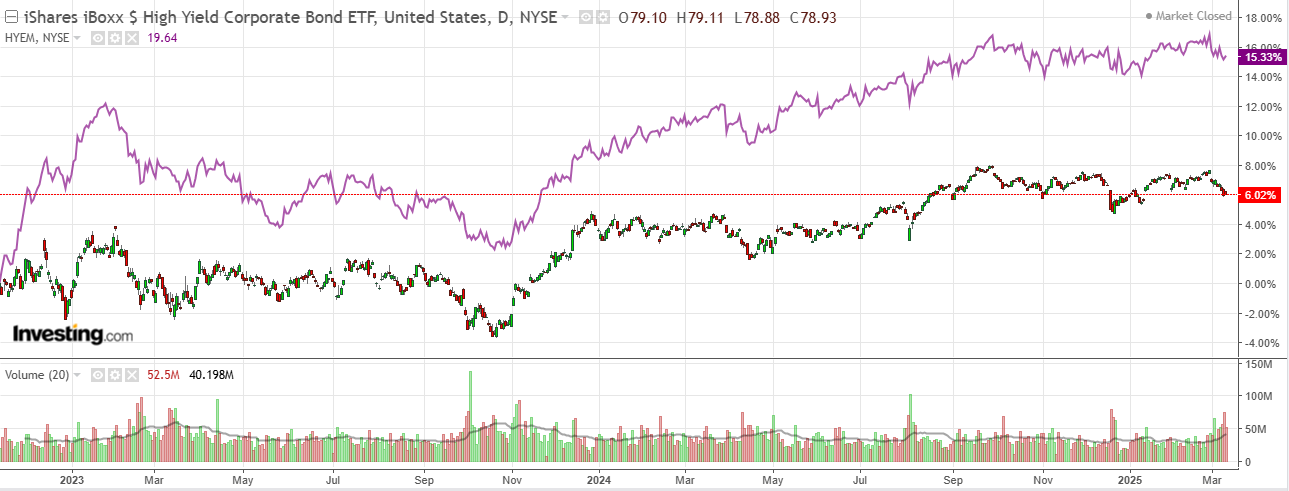

Stress creeping into junk. Not enough!

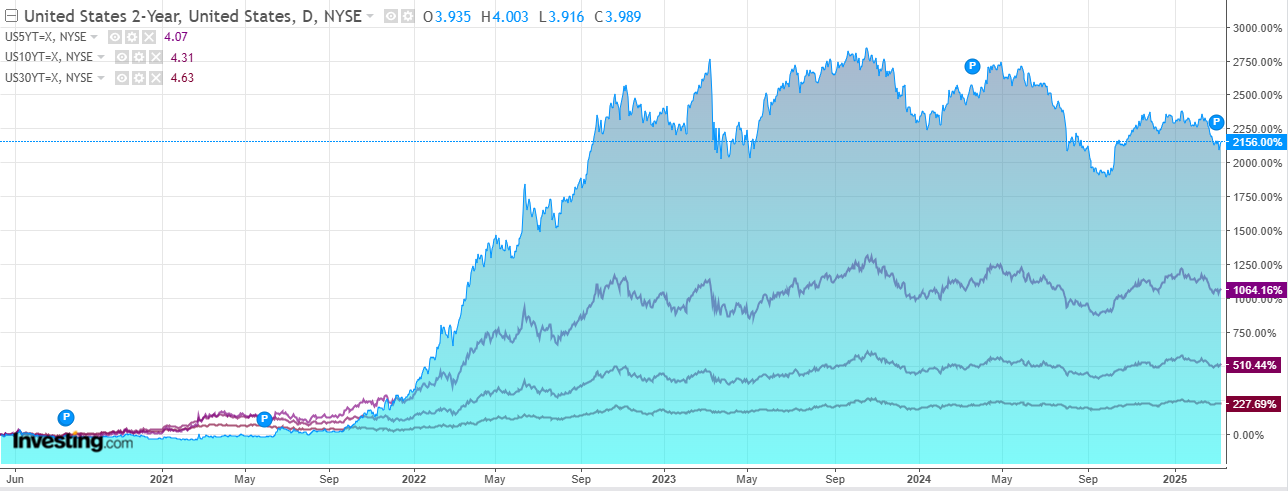

Yields up.

Stocks up.

It was a a soft US inflation print. Goldman.

February core CPI rose 0.23% month-over-month, below expectations, and the year-on-year rate ticked down to 3.12%.

The airfares and car insurance components swung from an 8bp boost to the core last month to a 4bpdrag this month, though these categories do not serve as source data for the PCE index.

The rent and owners’ equivalent rent (OER) components decelerated to0.28% in February.

Based on details in the CPI report, we estimate that the core PCE price index rose 0.29% in February (vs. our expectation of 0.25% before the CPI release), corresponding to a year-over-year rate of +2.70%.

The last line is the kicker. Most of the soft CPI components aren’t in PCE so it was not a soft print so as the Fed is concerned. Hence yields up.

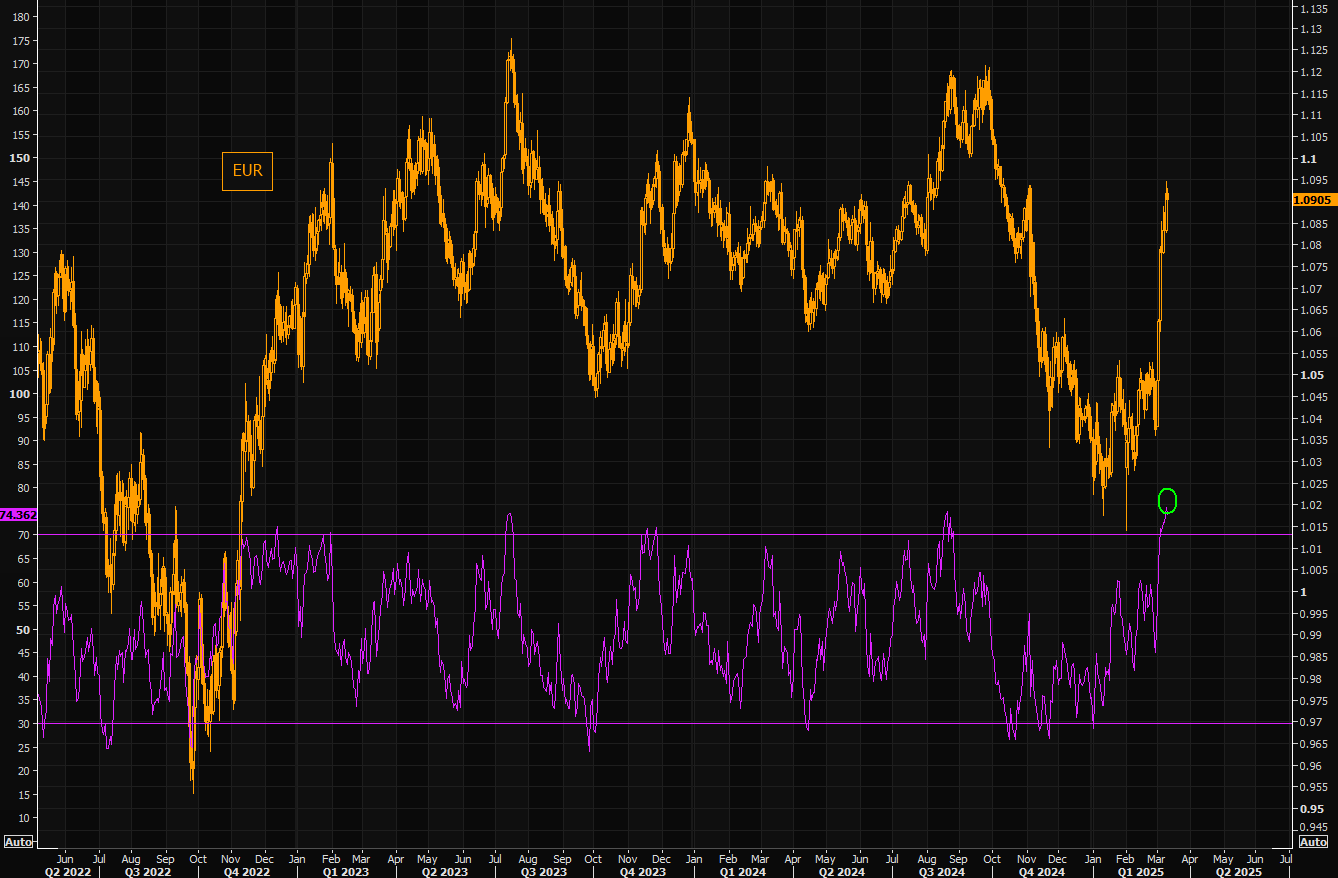

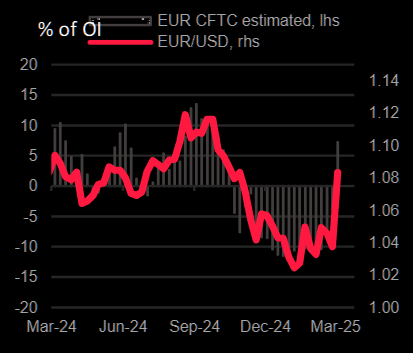

Nor is the the AUD “massively overbought”. But EUR is and that is going to add to an AUD headwind soon.

For the moment, markets are still trading some kind happy decoupling scenario as EUR and CNY rise versus a falling DXY (and attached economies).

This always happens before we get to the real business of a US recession with global spillovers and everything rolls over at once.

AUD is running out of headroom.