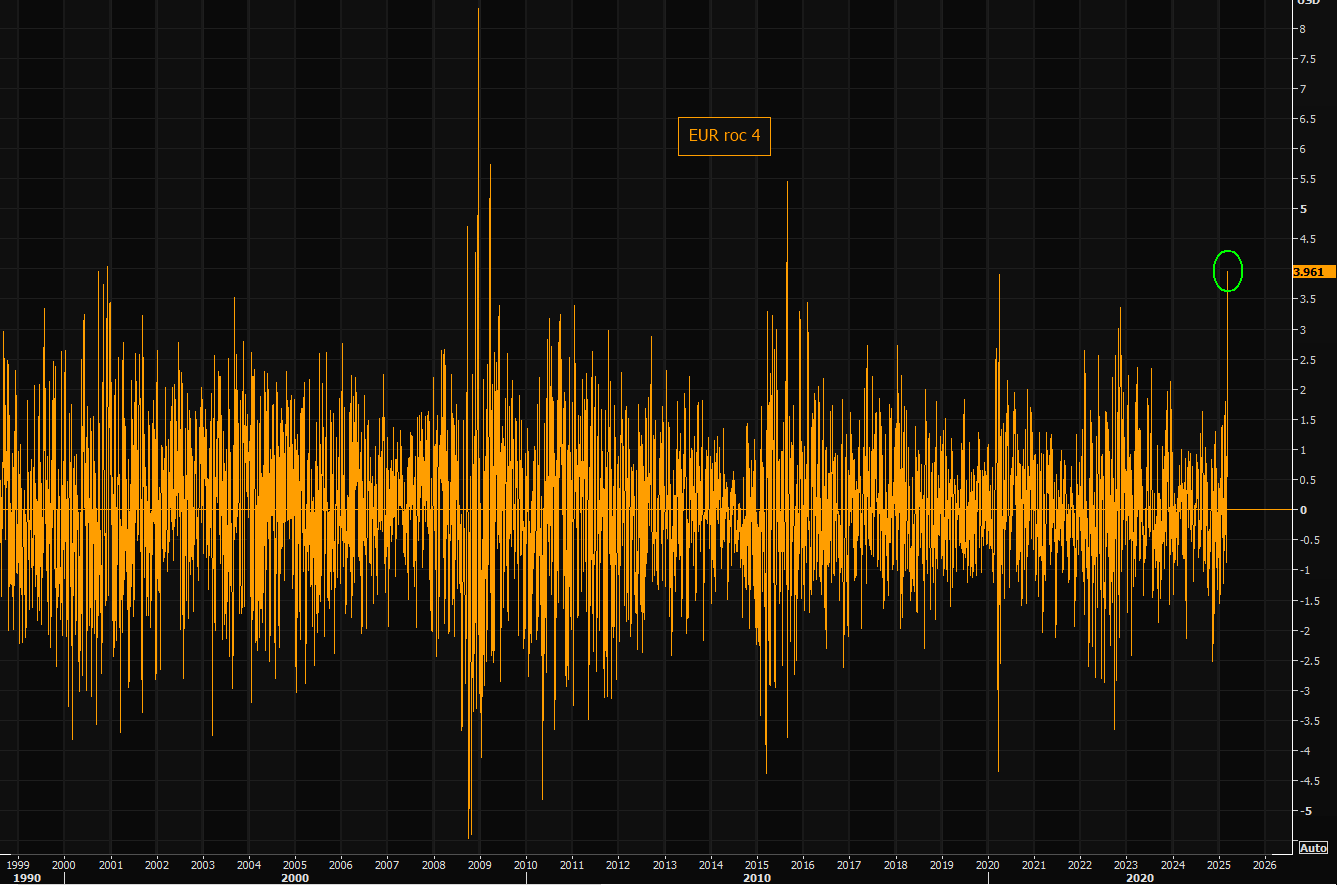

DXY is still getting pummeled. EUR is taking the lift up.

All things considered, AUD is still weak. Can’t catch EUR, catch dislocate DXY.

Lead boots!

Break, baby, break!

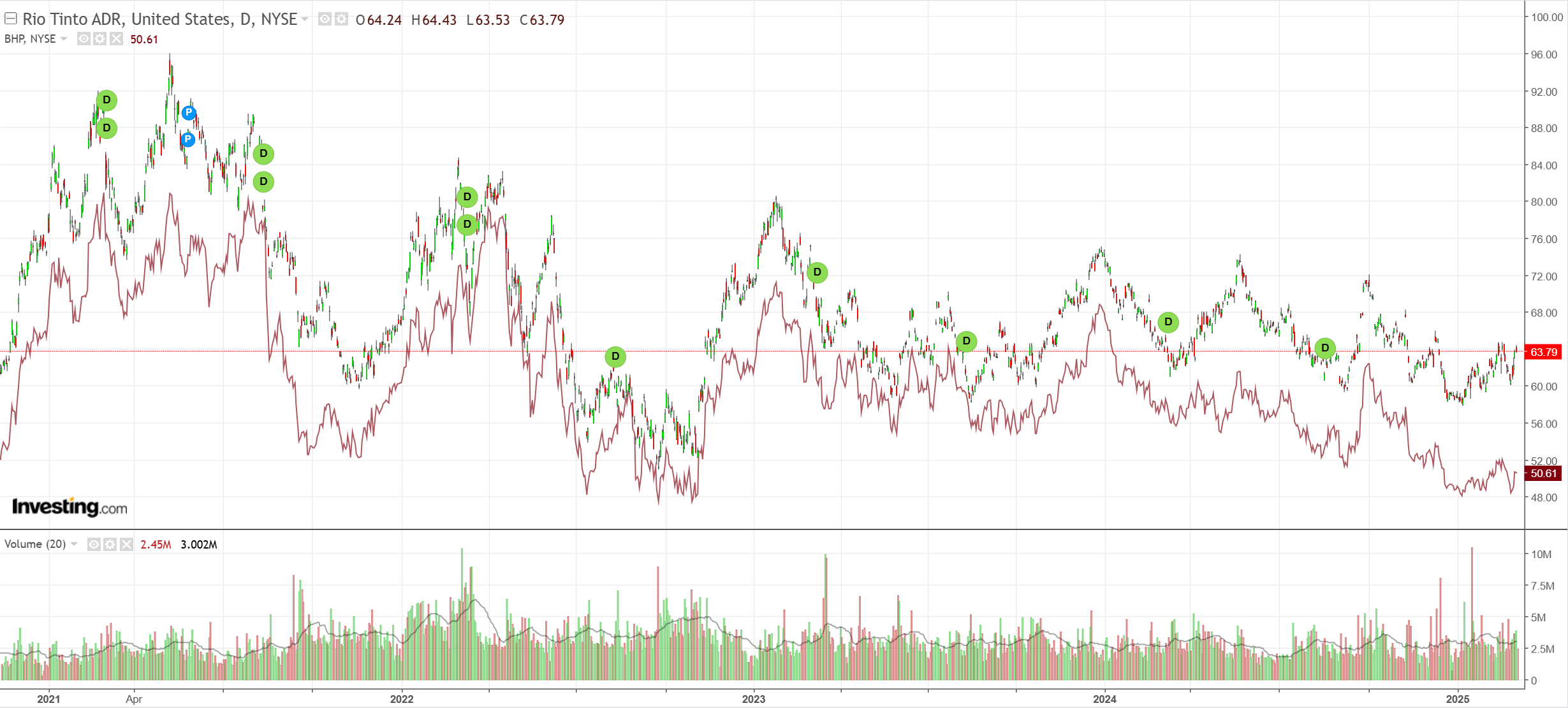

Metals relation sluggish outside copper.

Miners a bit of life.

EM still meh.

Junk turning a little threatening.

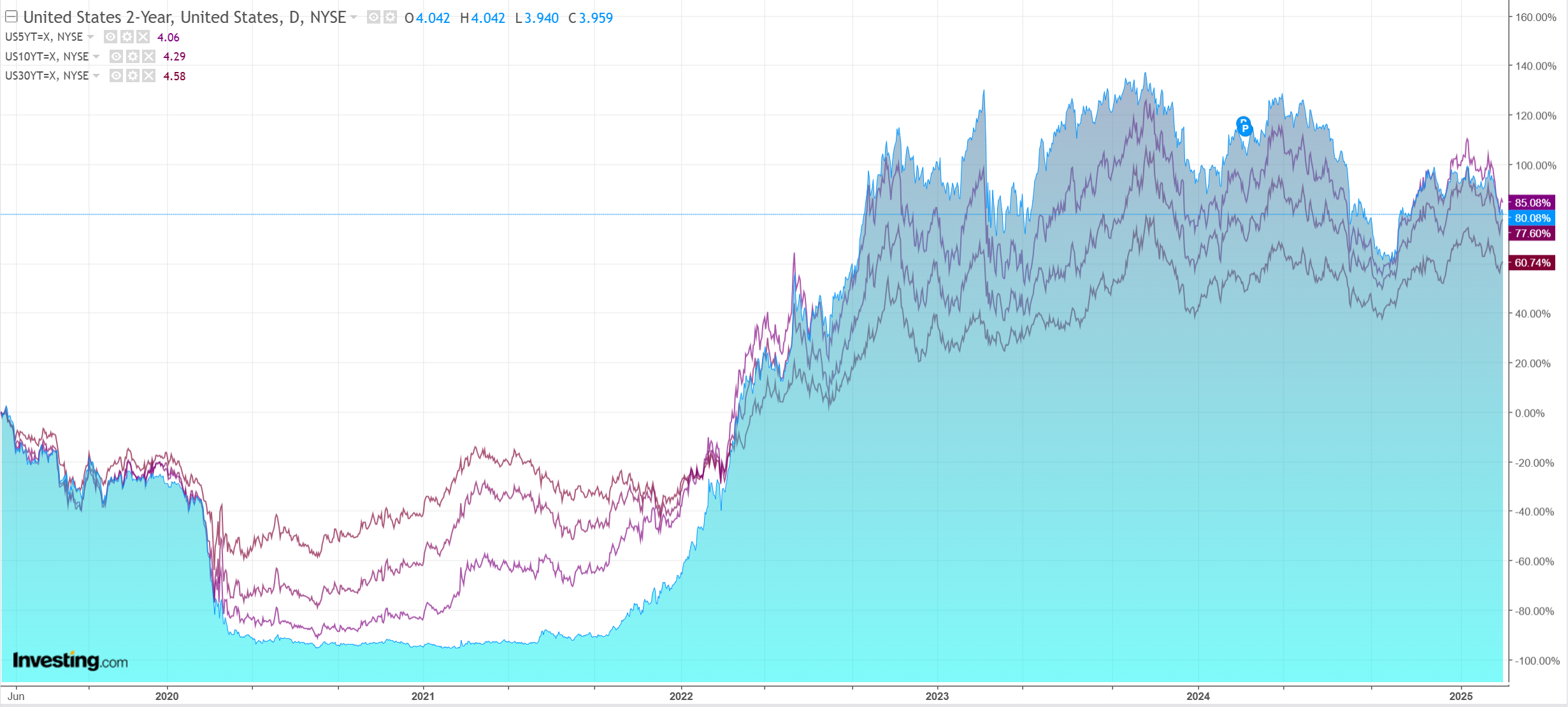

Yields sticky.

Stocks were hammered again.

The EUR trade is searing hot.

Goldman reckons its too hot.

“…there was zero macro interest in European Rates space in January. ZERO. Macro folks were all about US exceptionalism…. Macro folks are now all over the European fiscal expansion: same thing we saw with the US exceptionalism. Both trades are finished, over, pushed too much this week. The next step is either the fiscal story become a sovereign limited space story with bond vigilantes at work (and if you are long EURO on this scenario, well, better think twice) or we start doing the maths and realize there is money to be made in fading the European fiscal story.”

This call is early, especially if Ukraine is shoved towards pace, though hopes have receded there.

But there is no doubt about the overheating short term.

AUD follows EU!