Increasingly, it appears DXY is topped and EUR bottomed.

AUD follows EUR but it will be held back by CNY this time.

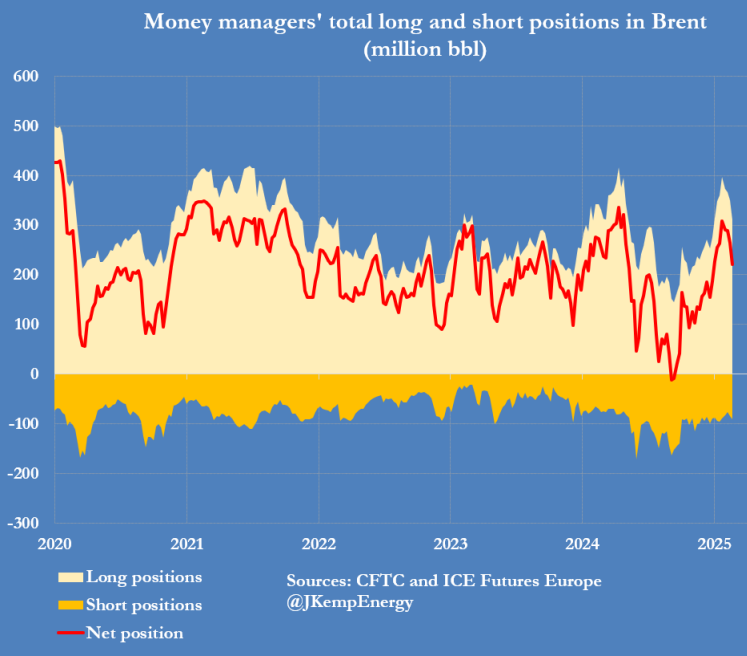

Gold up. Is oil about to do what it should, finally? Chinese demand growth is dead. OPEC to go ahead with production increase.

Bonus chart! There is room for lower oil.

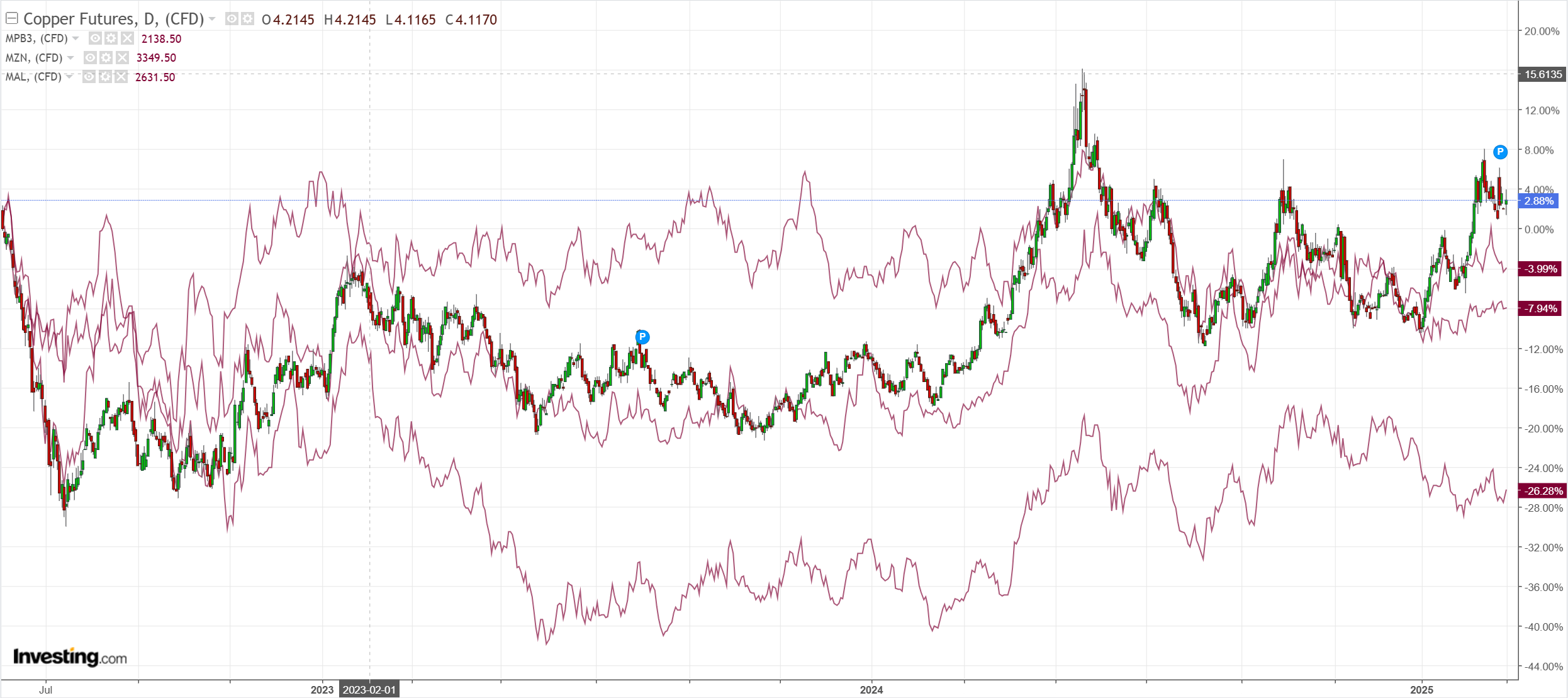

Commods meh.

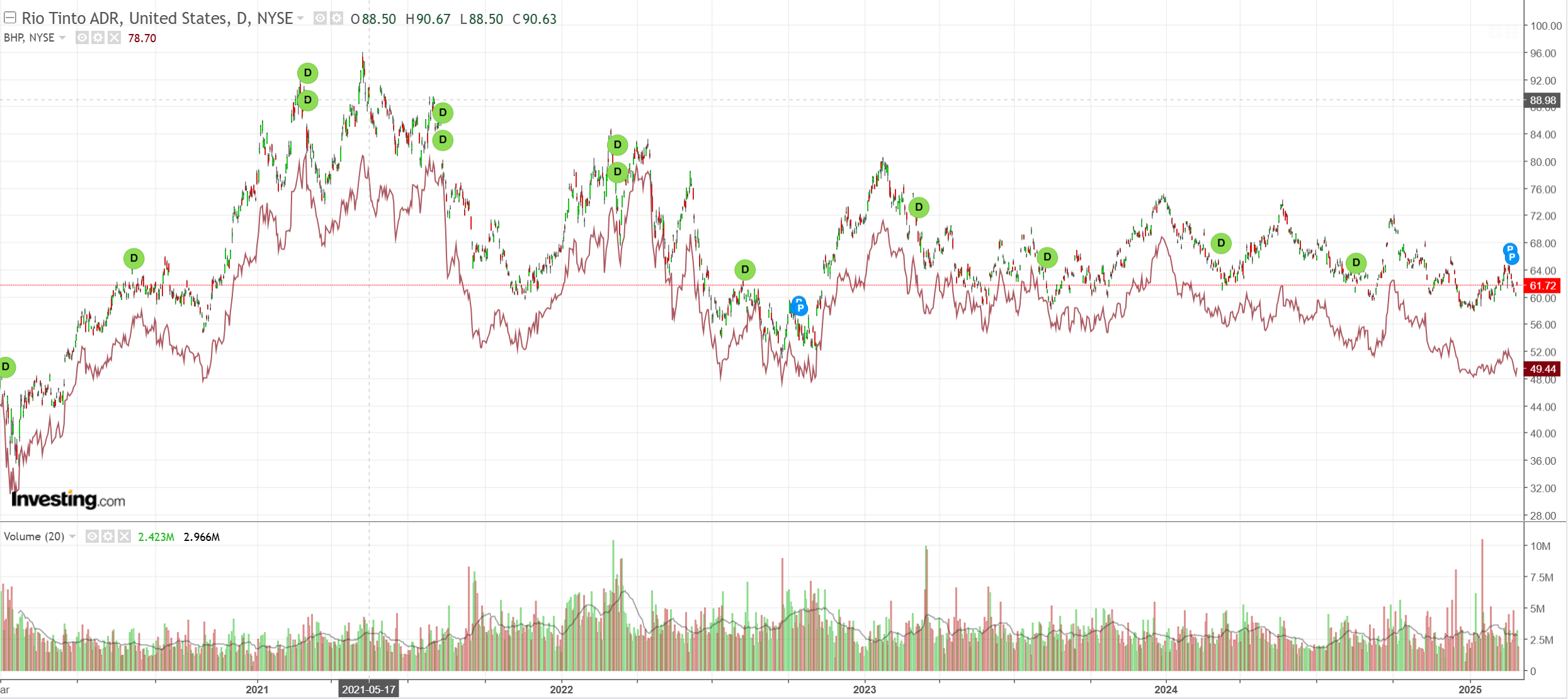

Mining dead cat.

EM meh.

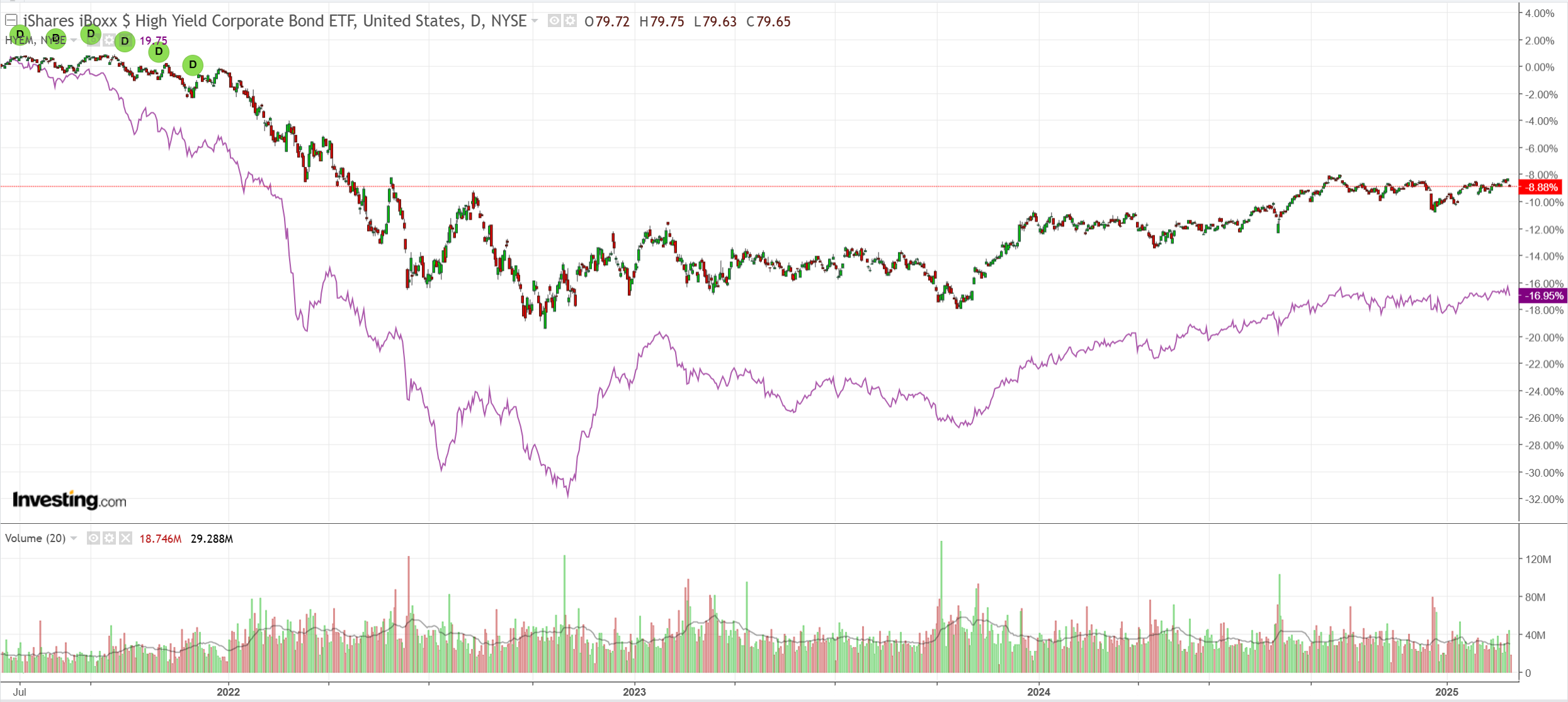

Junk meh.

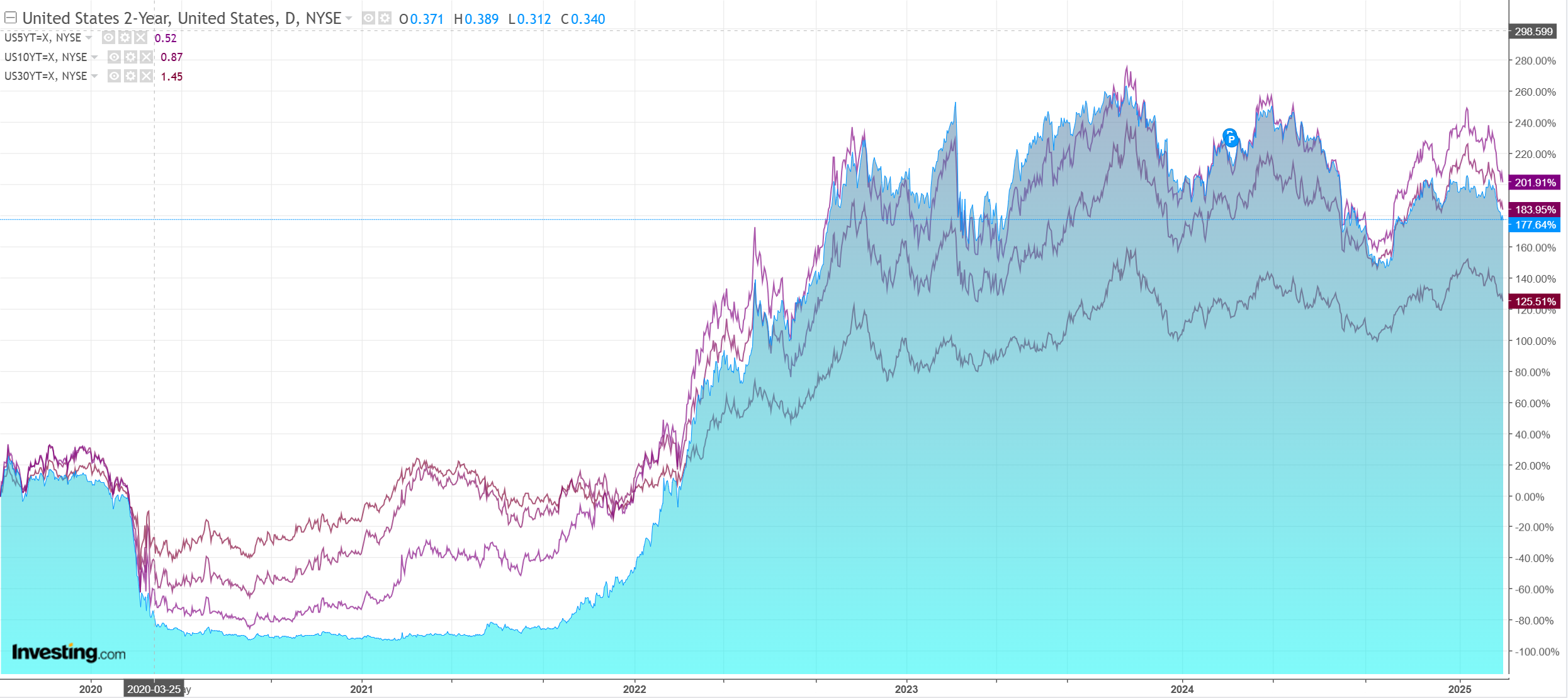

Yields follow oil.

The big handoff is European stocks versus US.

Two factors are converging.

The US is going to flirt with recession for good reason.

Treasury Secretary Scott Bessent was just questioned if we’re in a recession.

“We’re seeing the hangover from the excess spending in the Biden 4 years. In 6 to 12 months, it becomes Trump’s economy.”

Translation: They want the market crash soon. https://t.co/NfSOVRpQV0 pic.twitter.com/QzryPJT1IO

— Financelot (@FinanceLancelot) February 28, 2025

Second, Europe is going to come out of recession. Deutsche.

We turned neutral on EUR/USD last week following what we perceived to be a material shift in German fiscal policy. Since then, the size of this shift is becoming even larger and more pronounced. According to credible news reports, CDU/CSU and SPD are now in discussions over setting up two off-budget funds for defence and infrastructure, amounting to EUR 400 bn and EUR 400-500 bn respectively, or about 20% of GDP jointly. Even if spent over ten years, this would be about as much money as the country has invested in East Germany since reunification: a fiscal regime shift of historic proportions.

This also frees up more on-budget spending and will presumably spread through the EU.

Trump is obnoxious but not all evil. Europe and especially Germany should have been stimulating domestic demand like this over a decade ago. That it is being forced to now is a good thing.

The plan for the US economy is also good, though the risk is in the execution, which is chaotic.

For forex, this is a pretty straightforward pivot to EUR. If capital starts to chase Europe, EUR could rise materially, and it has an especially good story if peace arrives as well.

AUD follows EUR, though it will be held back by CNY and tariffs on China.