Goldman on the currency fantasy.

We remain skeptical of a centrally-planned currency accord, but open to the possibility that shifting government policies around the globe could bring about the right conditions to weaken the Dollar.

The market and macro set-up heading into either the Plaza Accord or the Smithsonian Agreement was very different than it is today, so they are not the right blueprint.

And, one important thing has not changed—for FX intervention to be successful, it helps for market forces to be pushing in the same direction as the intervention.

That was the case before both of those seminal currency pacts; it is not the case now.

But, unlike in the 70s and 80s, the FX market today is not centrally controlled, and private capital dictates the Dollar’s direction.

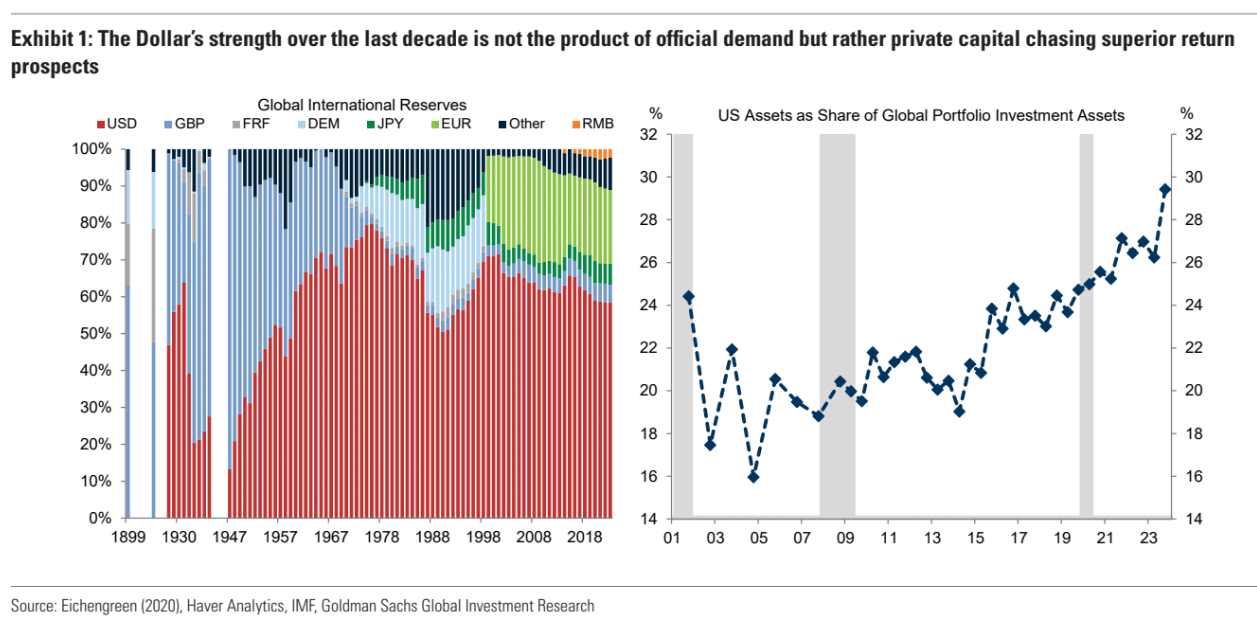

The strong Dollar of the last decade is not the product of official demand—reserve managers have been trimming their Dollar holdings through much of that period—but private capital from other developed markets chasing superior return prospects (Exhibit 1).

We have long maintained that the most plausible route to a currency “deal” would be to put this into reverse through a shift in the mix of fiscal support.

Namely, fiscal consolidation in the US and stronger spending from key trading partners like the European Union and China that both raises their domestic demand and curtails the new US administration’s penchant for protectionist policies would go a long way towards achieving this outcome.

Commitments of this sort now form a central tenet of the so-called “Mar-a-Lago Accord,” and where we coincidentally have some sympathy with the theory.

Readers are probably already familiar with this set-up, given I have been discussing it as a key driver of AUD valuations in the last few months.

I am even more skeptical than Goldman.

Rising fiscal spending is probable in both Europe and China, but sucking that into defence in the former and the structural hostility to decentralisation in the latter limit the spillovers for everybody else.

This has a double negative impact on the AUD because it means commodity demand is stagnant as the Chinese depression continues while bulk commodity supply skyrockets.

If the rhetoric of a Mar-a-Lago Accord rises, it will pressure the AUD at the margin, but, fundamentally, the outlook remains gloomy.