DXY to the ground.

AUD follows EUR.

And lead boots.

Alas, oil refused to break.

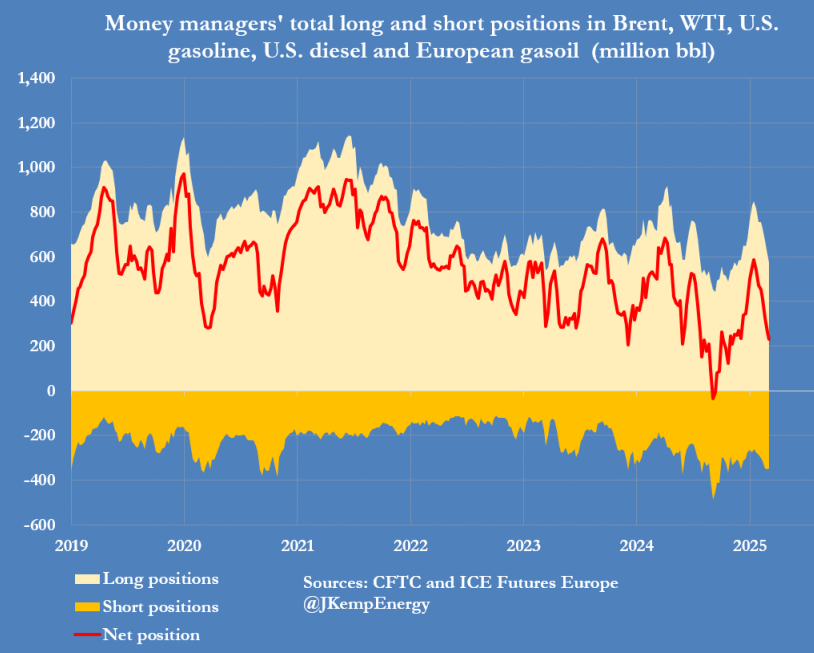

Bonus chart! Not much room left to sell.

Goldman has cornered copper.

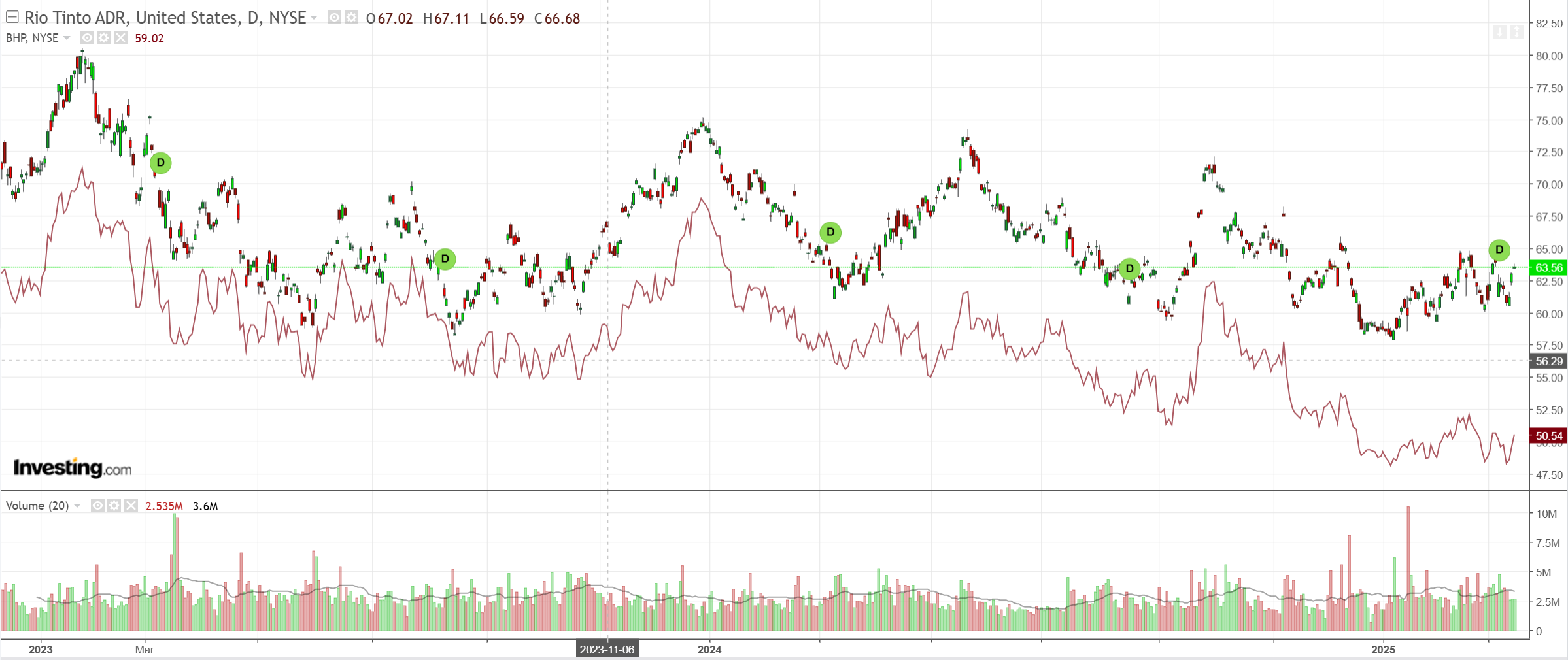

Miners meh.

EM another crack.

Credit is fine. No good for stocks.

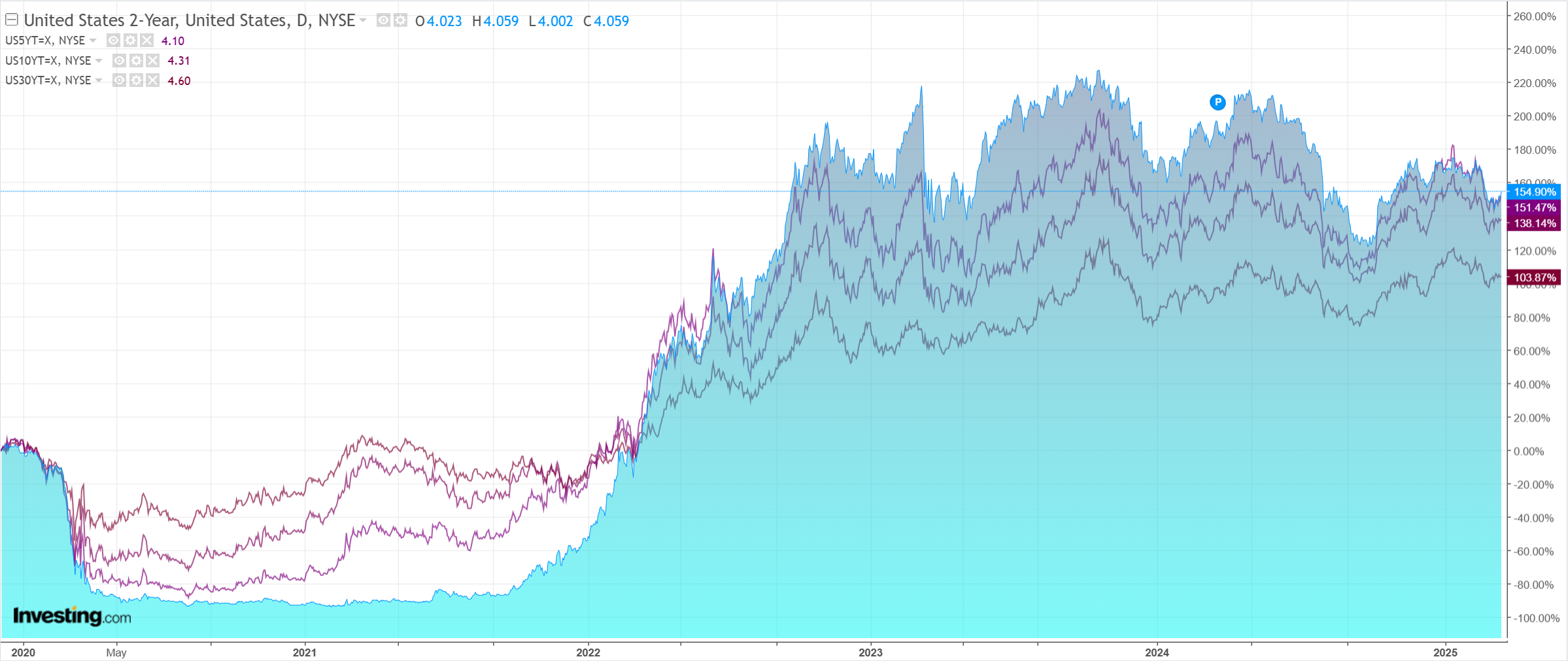

Curve smasher.

Stocks to the moon!

The impressive Treasury Secretary, Scott Bessent, maintained the rage as he told NBC’s Meet the Press Sunday that he’s not worried by the slump in US stocks, after about $5 trillion was wiped from the S&P 500’s value and the index tumbled into a correction. “Corrections are healthy,” he told NBC. Traders still don’t seem convinced. His comments are a blow to those harboring hopes that President Donald Trump will seek to cushion the market impact of his policies.

Wilting US consumption was enough to boost stocks now trading on bad news is good news in the hope that enough economic harm has been done to meet Bessent’s stage one plan, which is to crush inflation via austerity.

US retail sales rose by only 0.2% in February after a 1.2% drop in January.

I still don’t think it is enough, especially since stocks do, which is reversing the damage in credit quick smart.

Trump phase one needs a recession, or close enough to one, to force long-bond yields far lower, or there will be no subsequent recovery in the private sector.

The long bond is rock solid in its fiscal stimulus higher range.

I am happy to trade the decoupling of China and Europe for now via AUD but it’s a rent, not a buy.

When the US economy does break, assuming Trump holds his nerve, so will everything else.