DXY is maybe going to bounce.

AUD got an RBA wake up call from jobs.

Lead boots continue to stroll to Mar-A-Lago.

Oil CTAs threatening.

Advertisement

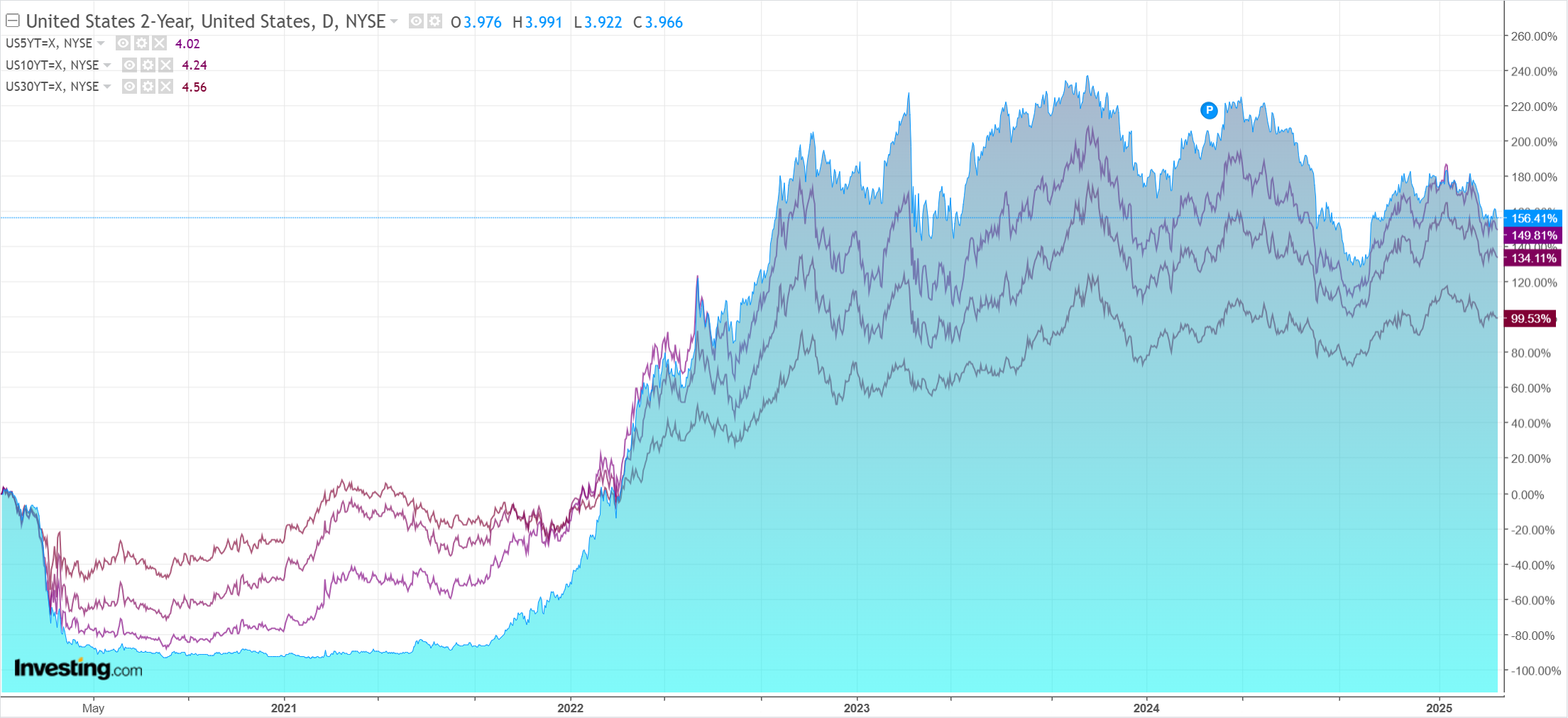

Sell copper before Goldman does.

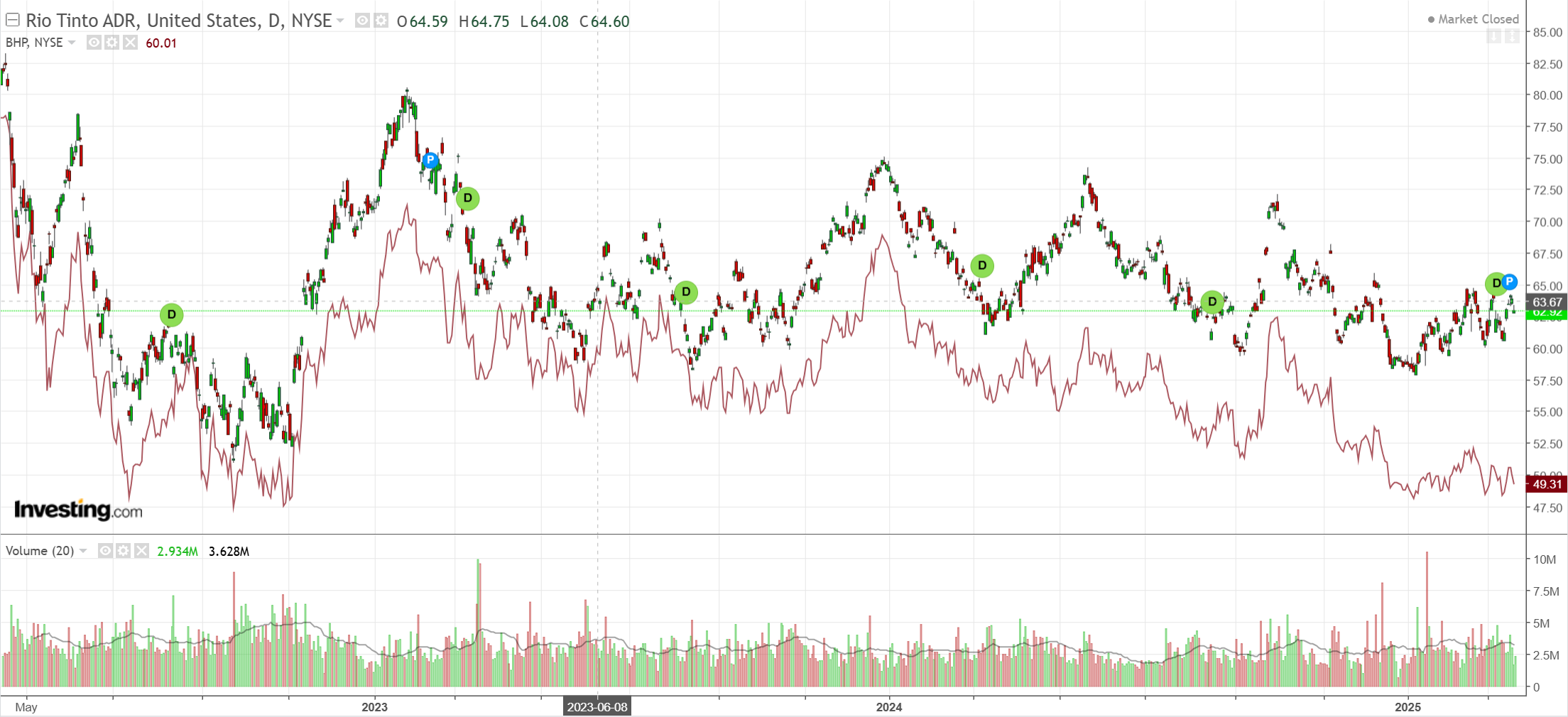

Big miners caput.

EM meh.

Advertisement

Junk serene is bad news for stocks.

Yields eased though.

As did stocks.

Advertisement

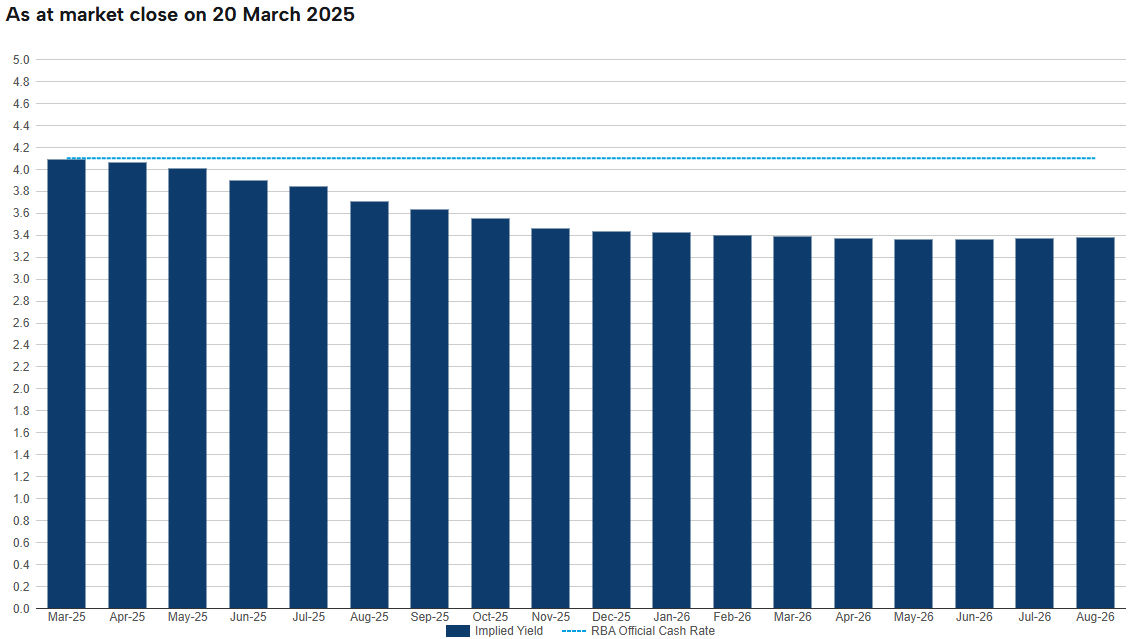

RBA futures have nearly added three cuts now, but not fast enough and not low enough.

By August-26, Australia will be in the throes of a massive Chinese trade shock of crashing goods import prices and crashing bulk commodity export prices.

Advertisement

This terms of trade slaughter will smash interest rates to pieces, humiliate the RBA again, skyrocket immigration (because it is the only growth driver left and the only lever Canberra ever pulls), and send the AUD to new lows.

IMHO!