DXY is down.

AUD too.

Lead boots going nowhere.

Gold appears to be the new everything safe haven. Be careful if stocks turn margin call.

Copper is delusional. Other metals fading fast.

Big miners down.

EM ouch.

Junk stressy not enough.

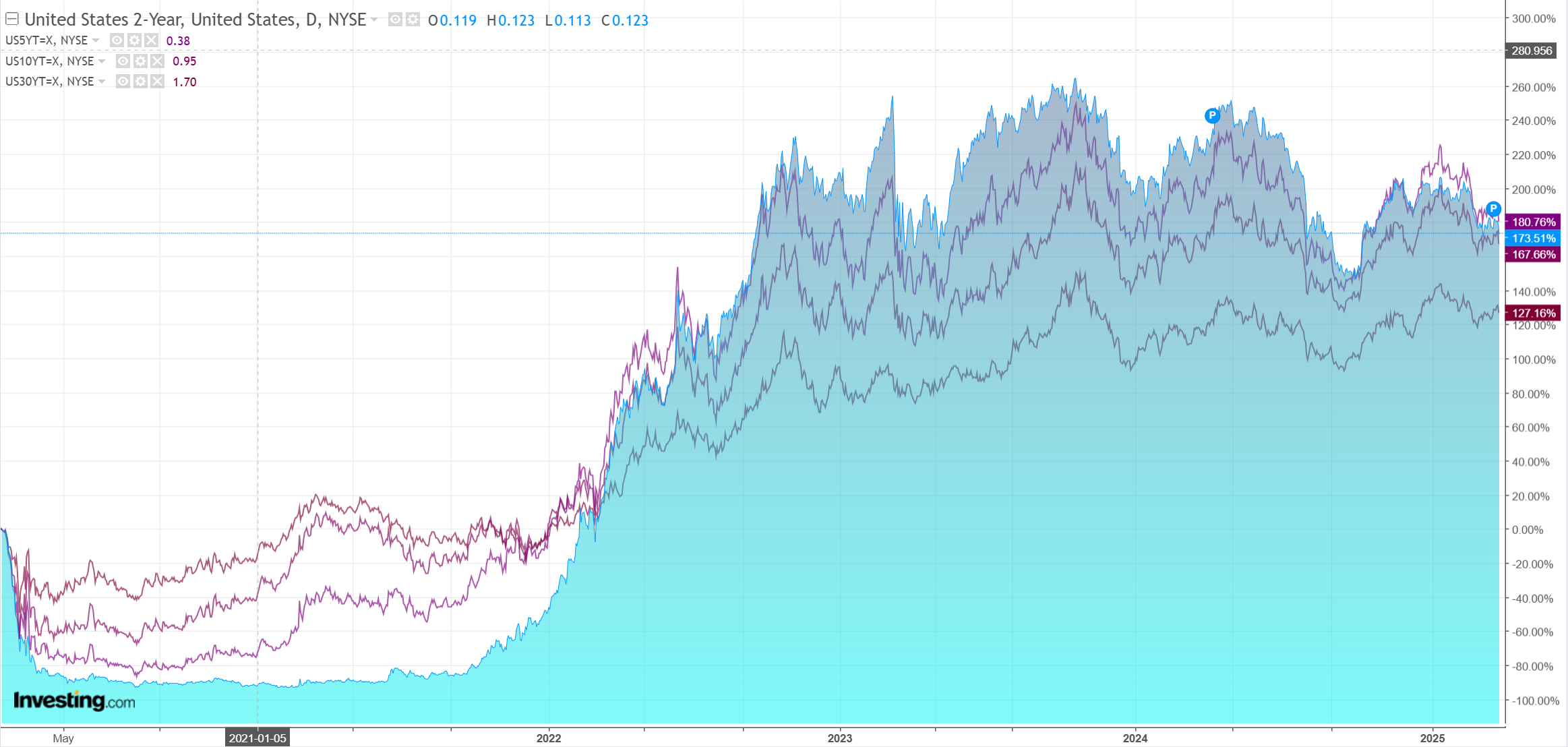

Yields fell.

Stocks monstered.

The AUD short is protecting the downside as the Bessent Plan rolls on.

This is taking some of the steam out of AUD hedging. Bloomberg.

The dollar, long a go-to hiding place during market selloffs, wasn’t rallying this time as investors rushed for safety. It was sinking, too, and fast as hot money poured into gold, the yen, European stocks — almost anywhere but the US.

“It’s unusual and very telling,” said Sidawi, who helps oversee bond investments at the firm. “The dollar, in an environment where it should be acting like a safe haven, is not.”

It is behaving precisely as one would expect if there is no need for a safe haven as markets lean into better global than US growth as fiscal stimulators like Europe and China suck in capital. This is why I have been short-term bullish AUD.

But, such decoupling trades are only good while US growth does not slow too much.

The moment markets sniff a real growth scare in the US, this dynamic will reverse violently, and DXY will take off.

Whether we get such a scare is the trillion-dollar question. The Market Ear.

TS Lombard says the DOGE initiative is beginning to show real economic impact through federal layoffs.

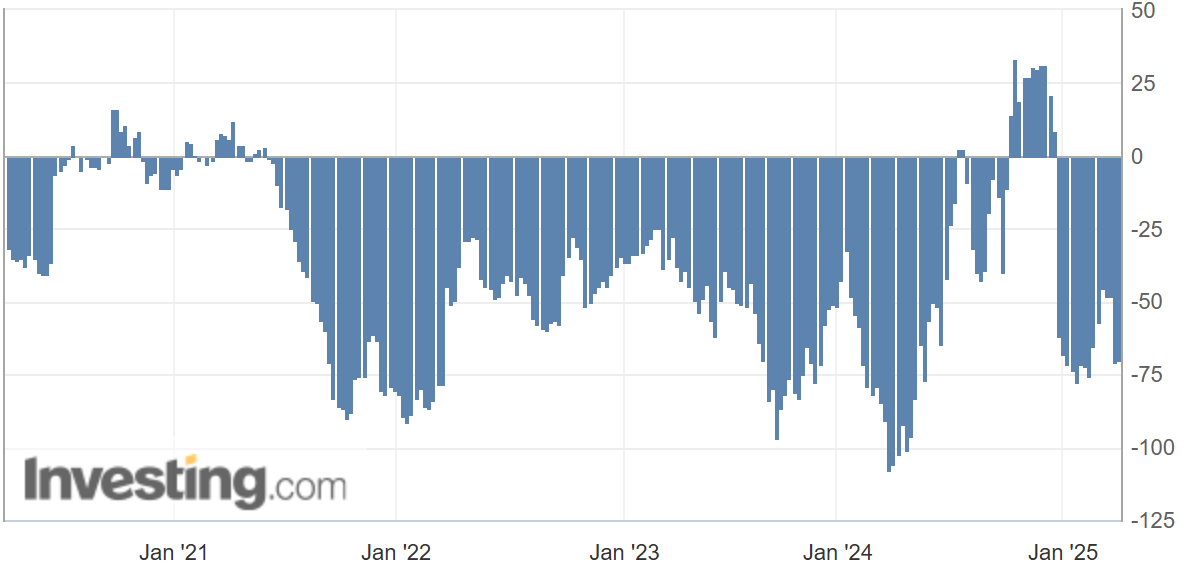

“This is one area where we are starting to see tangible economic effects,” the firm notes. Around 80,000 federal workers have already accepted buyouts, resigning now but staying on payroll until September. This is reflected in labor data, with government job losses spiking by 62,000 in February—the largest jump on record. DOGE is also targeting another 220,000 probationary employees by September. TS Lombard estimates the initial impact may be modest—a 20bps rise in unemployment that the private sector could likely absorb. But if indirect job losses (contractors, “shadow” workers) are included, total losses could exceed 800,000, pushing unemployment up by 50bps—“that’s where things start to get interesting.”

Source: Peterson Institute

TS Lombard warns that a 50bps rise in unemployment would push the labor market into Sahm rule territory—a threshold that typically signals the start of a recessionary trend.

“Once joblessness increases that much, it usually keeps rising—at least by another 150bps,” the firm notes.

With both layoffs and hiring already at very low levels, the labor market is in a fragile equilibrium. Former federal workers may struggle to find new jobs, and even a modest uptick in job separations could tip the balance.

Source: FRED

Watch US jobs.