DXY faded a little

AUD lifted a little.

Lead boots are at a standstill.

Gold pausing. Trump lunacy has overtaken oil as he smashes Venezuela and Iran while promising cheaper petrol.

Copper is insane. This is bad for everybody except Goldman Sachs.

Big miners sag on.

EM yawn.

Junk yawn.

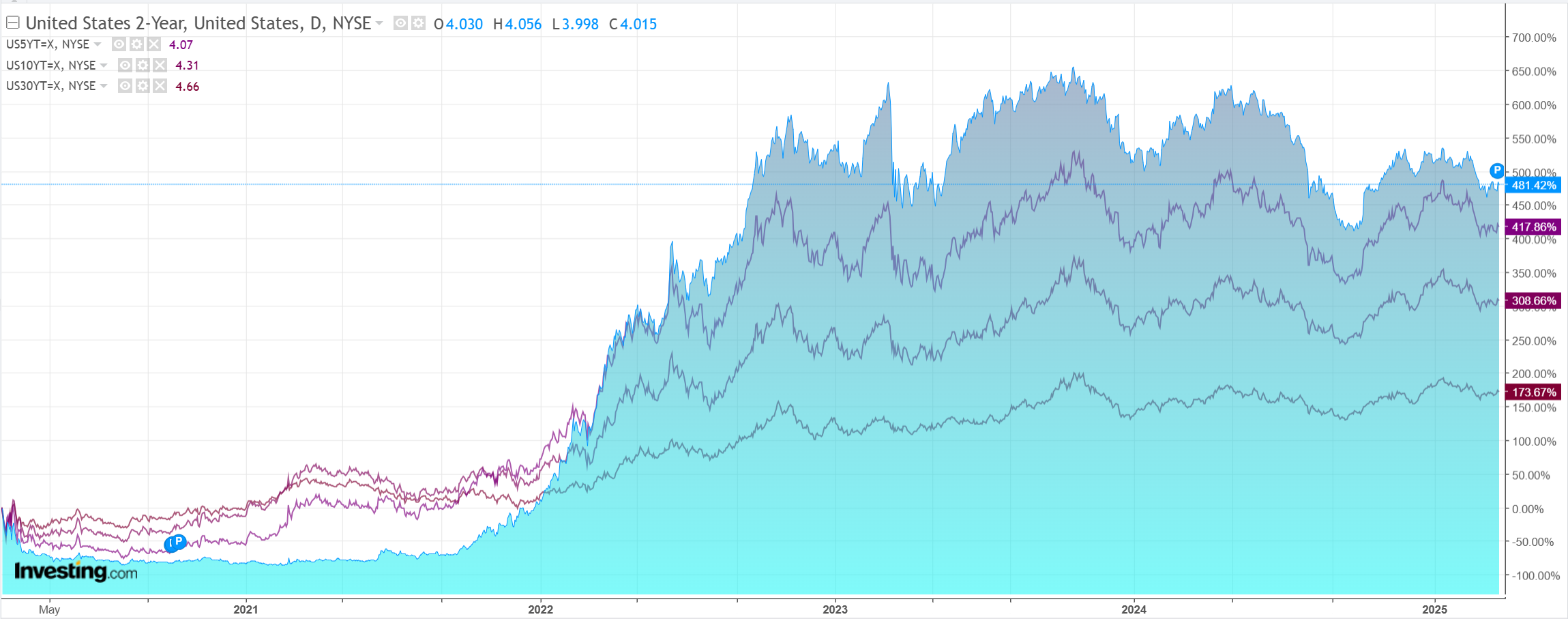

Yields eased.

Stocks firmed.

I honestly can’t tell you where we are going in the short term. The orange madman is too capricious.

There are arguments both ways.

Tariffs and a bear market rally could lift DXY and sit on AUD.

German and Chinese fiscal could suck in capital and lift the AUD.

I am more confident that the AUD goes lower over twelve months as the US private sector lifts with lower yields and the RBA is forced to cut than most think.

For now, forecasting the orange madman is impossible beyond his need for headlines.

Which is probably AUD bearish for now.