DXY is through the trapdoor. EUR to the moon.

Even so, ‘risk off’ hit AUD.

Lead boots are walking to Mar-A-Lago.

Golden rocket. Oil abortion.

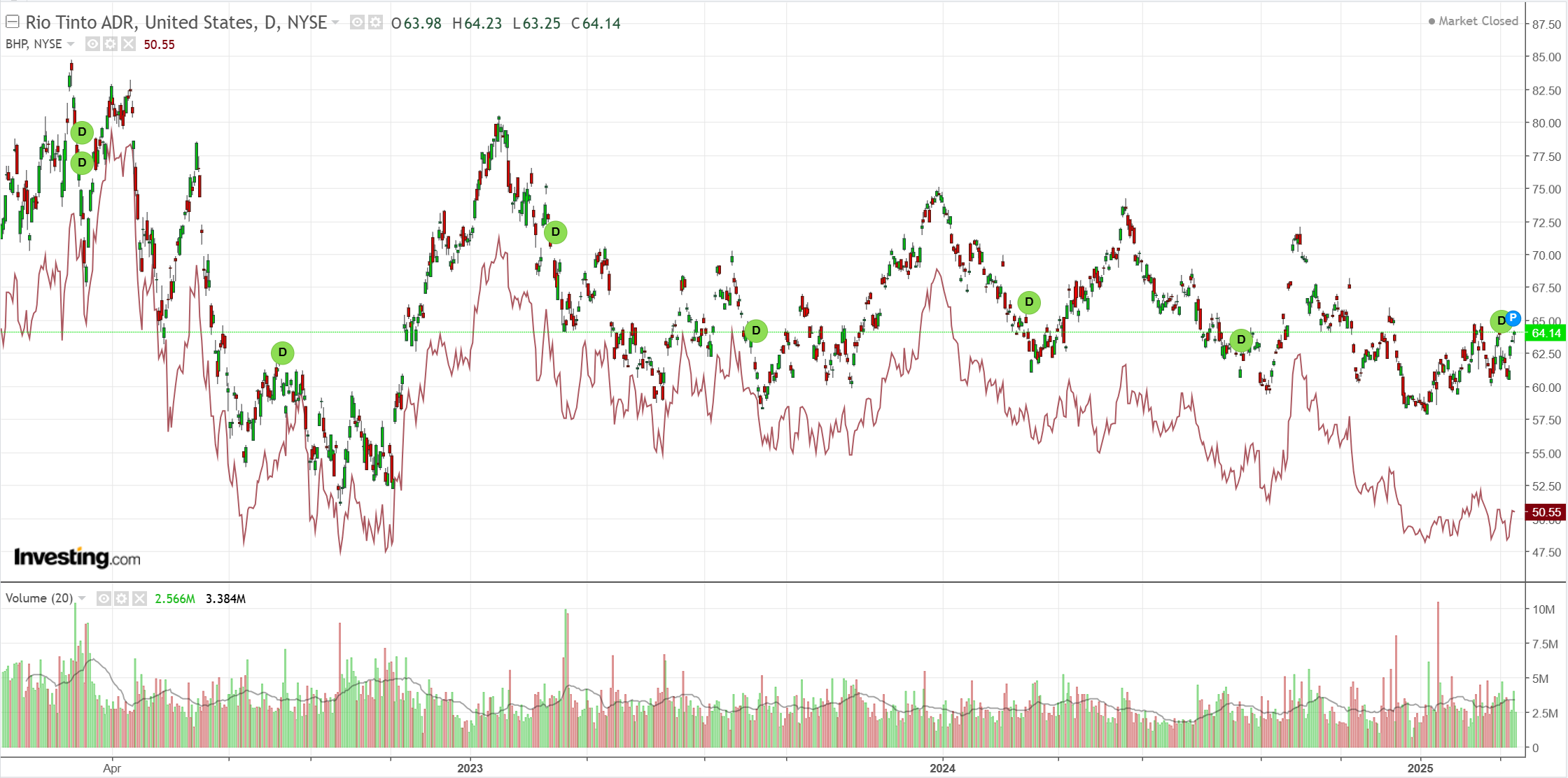

The world does not need Goldman’s copper play

Playing copper via diversified miners is stupid.

EM meh.

We need much more pain in junk.

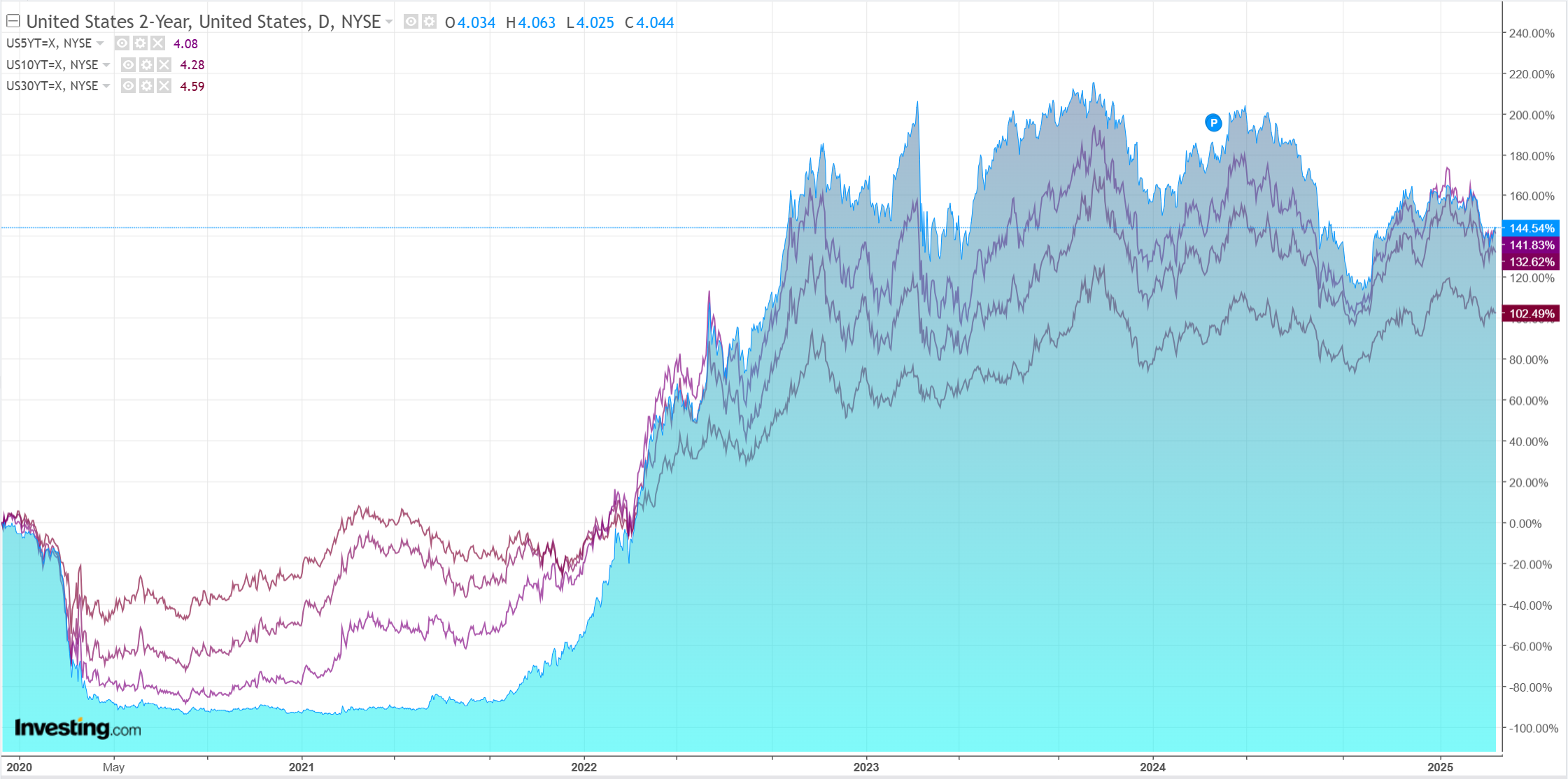

Yields eased. New inversion deepened.

Stocks smashed.

US industrial production and housing starts were pretty good, sending stocks into good news is bad news tailspin.

The golden rocket is something to behold, and it does not hurt AUD.

Traditionally, it has been a great support, though a lot less so since bulk commodities became the national income driver.

Gold is only about 7% of the terms of trade versus 75% for the bulks plus gas.

But gold does tend to rise when DXY falls, so it is not irrelevant in the short term to AUD. I can anticipate such moves.

As said previously, I am renting the AUD bull story short-term, but not buying it long.

When Scott Bessent has cut enough fiscal to break credit and push the US towards recession, not much is going to go up.