Australian housing affordability is at an all-time low.

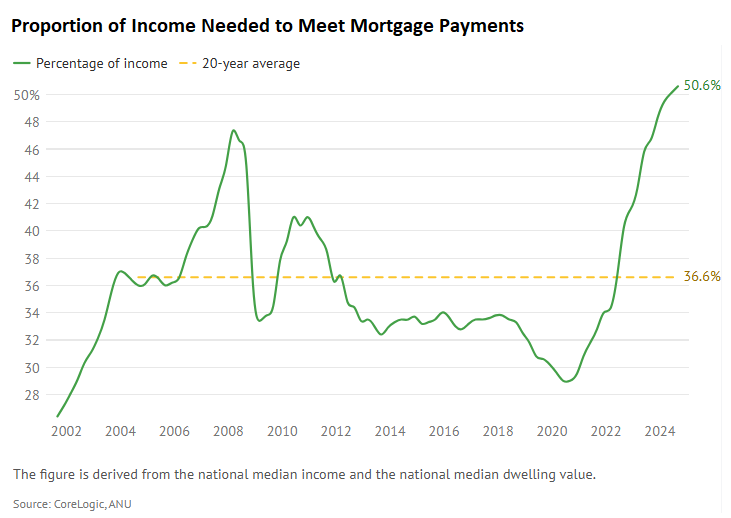

At the end of 2024, the percentage of income necessary to satisfy median-sized mortgage repayments reached a record high of 50.6%.

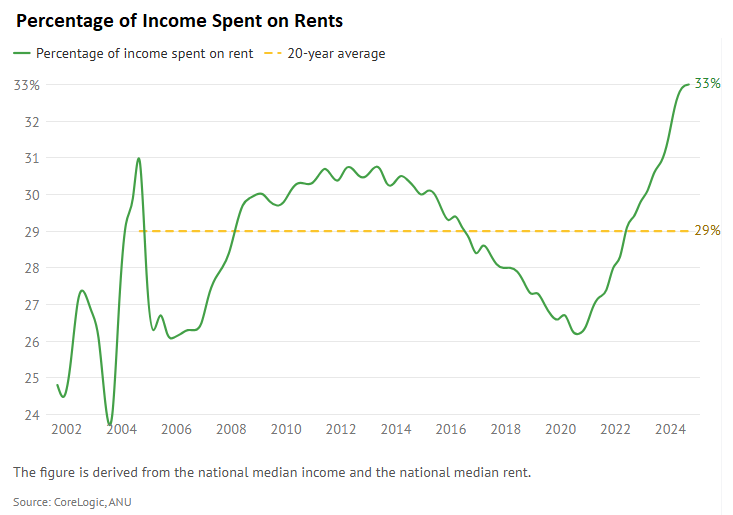

Rental affordability also dropped to a new low, making it tougher for first-time buyers to save a deposit.

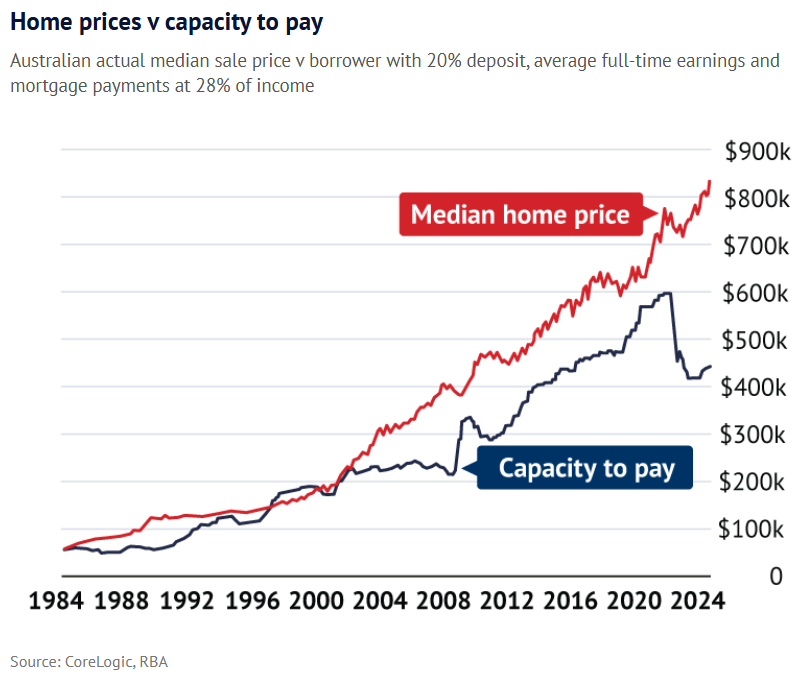

Prior to last month’s 0.25% interest rate reduction by the Reserve Bank of Australia (RBA), a record gap had formed between borrowing capacity and housing prices.

While further RBA rate cuts will help to address the affordability gap, a recent Finder survey found that nearly one-third of Australian consumers polled would consider a 40-year mortgage if it reduced their monthly repayments to a more manageable level.

According to Finder’s data, just three lenders in Australia currently provide 40-year mortgages, two of which are solely for first-time home purchasers.

However, as the concept of a mass market gains traction, the major banks are expected to begin offering 40-year mortgages.

The SMH’s money columnist Victoria Devine warned that 40-year mortgages would see more Australians retire with large mortgage debts and increase the amount of interest paid:

According to the ARC Centre of Excellence in Population Ageing Research, 36% of Australians are retiring with a mortgage. Considering that figure was 23% just 10 years ago, this is cause for serious concern.

Say you take out a loan of $600,000 on a 30-year mortgage term. With an interest rate of 5.99%, the monthly repayments will come to $3594, while the interest paid over the lifetime of the loan will be $594,206.

By comparison, on a 40-year mortgage you’ll save $296 on the monthly repayments – which come in at $3297 – but the interest paid over the lifetime of the loan will grow by $243,422 to $837,628.

According to Canstar data, an individual on a full-time wage would be eligible to borrow up to $24,000 more on a 40-year mortgage than they would on a 30-year term, while a couple working full-time could borrow up to $48,000 more…

Let’s be clear: these extended mortgages are about banks making more money, plain and simple. That’s quite literally their business…

Adding a full decade onto mortgage terms just so that people can afford to own a home is a sign of how far things have gone the wrong way…

Forty-year term mortgages can safely be added to the list of terrible ideas…

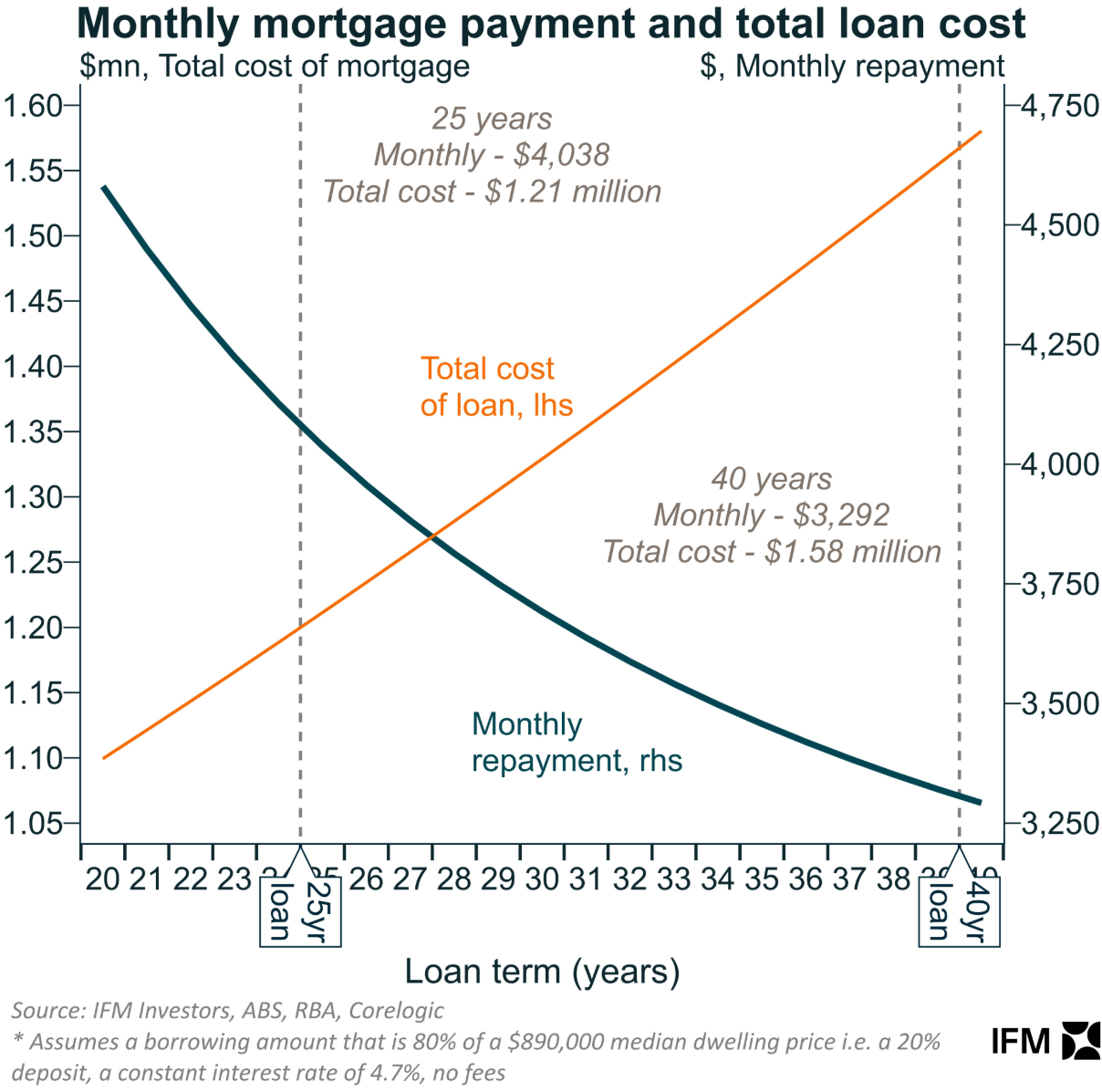

The chart below, created by Alex Joiner of IFM Investors, shows how a lengthier 40-year mortgage term increases borrowing capacity.

Longer loan terms decrease monthly repayments, but total payback costs grow, and more Australians may carry mortgage debt into retirement.

Extending mortgage terms is another obvious attempt to increase house demand and trigger a new price boom.

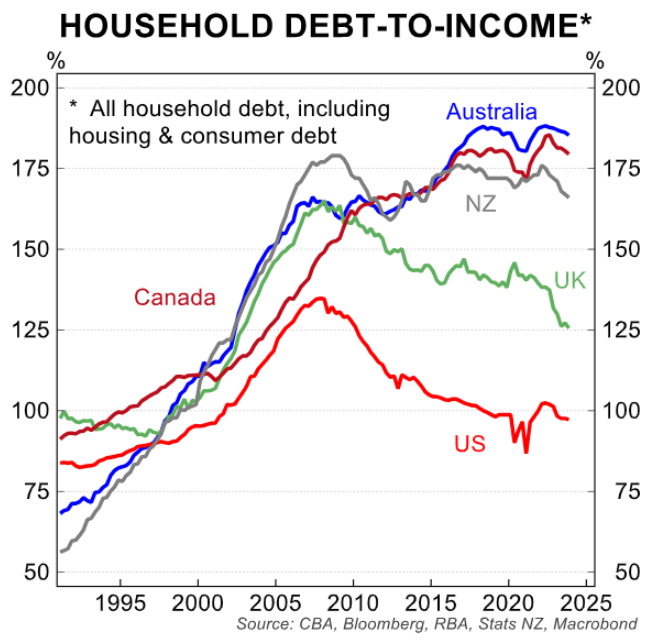

Allowing households to borrow more for their homes would achieve the same thing it usually does: increase debt levels and long-term housing costs.

This century has supplied abundant empirical evidence for how the story will conclude.

Neither politicians, banks, nor the real estate lobby want more affordable housing since it would require lower pricing.

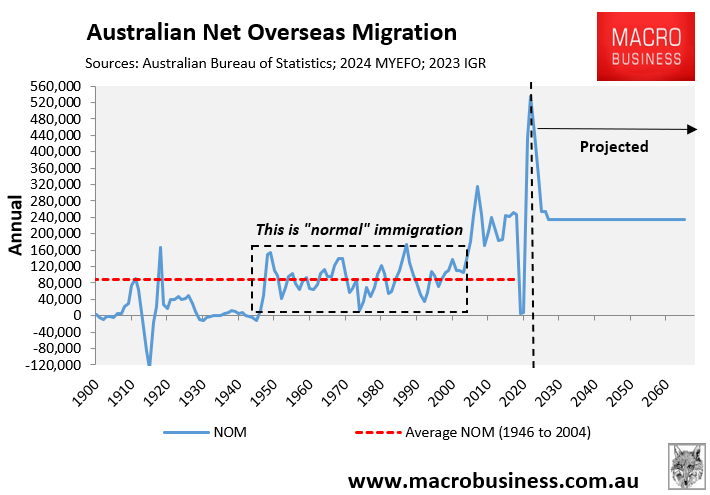

They would never advocate for reducing immigration to moderate, sustainable levels of less than 120,000 per year so that housing supply can keep up with demand.

Our politicians will not enact broad-based tax measures to shift economic activity away from housing speculation and towards constructive pursuits.

Instead, politicians and the real estate sector pretend to care by enacting false solutions for prospective first-time buyers while purposefully boosting housing prices through self-defeating demand-side stimulus measures.