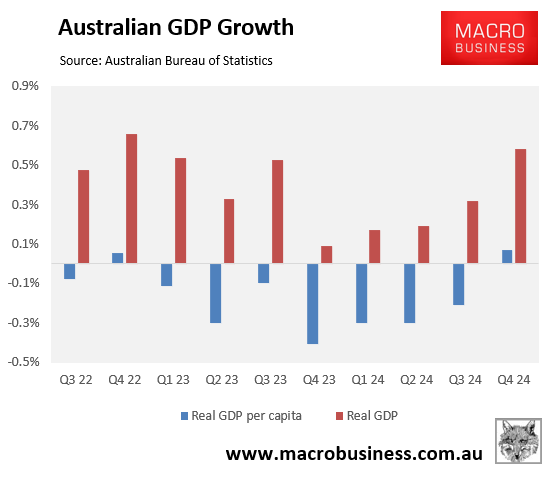

Wednesday’s Q4 2024 national accounts release from the Australian Bureau of Statistics (ABS) reported that the economy finally emerged from its per capita recession.

The economy has finally broken the record seven consecutive quarter streak of real per capita GDP declines with a 0.1% quarterly expansion (with eight out of the last 10 quarters recording a negative outcome).

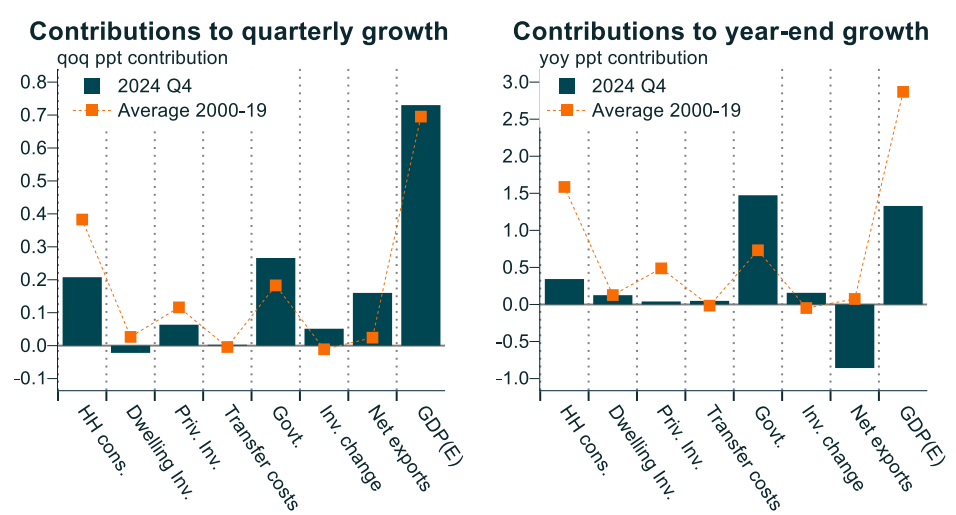

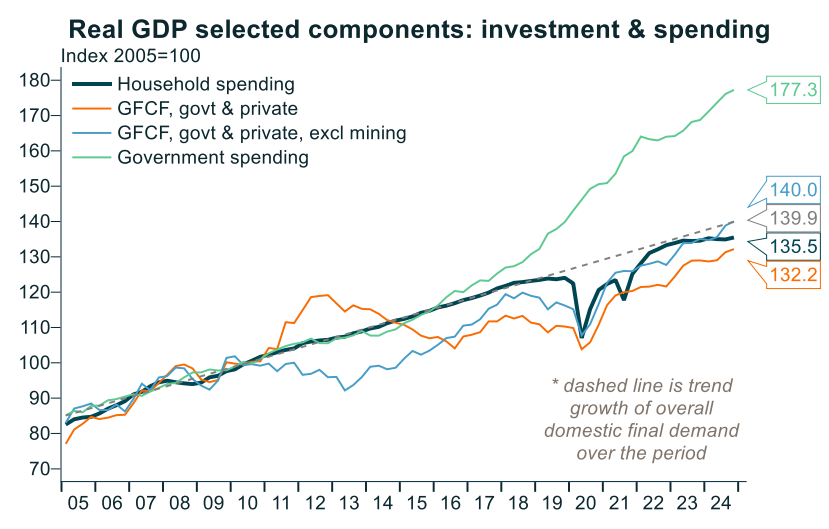

Alex Joiner, chief economist at IFM Investors, illustrates the drivers of Australia’s GDP growth below.

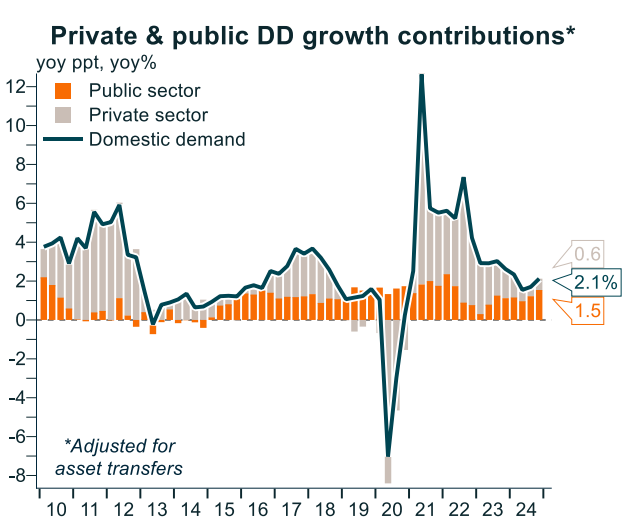

Government spending continues to drive the economy, contributing 1.5% to annual GDP and domestic demand in the 2024 calendar year.

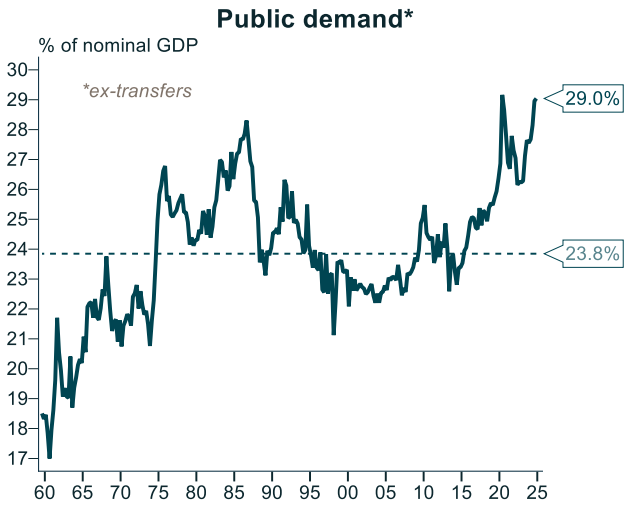

Public demand’s share of nominal GDP hit an equal record high of 29.0% in Q4 2024, well above the 23.8% long-run average.

The following chart from Joiner shows the voracious growth in government spending, which has risen by 77.3% since 2005, versus 35.5% for household spending.

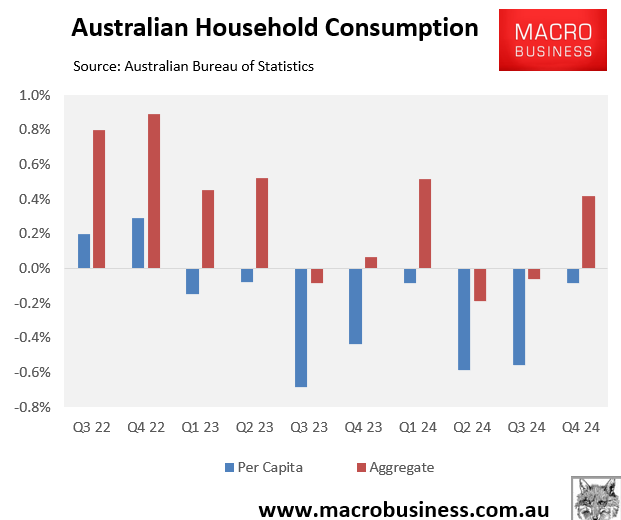

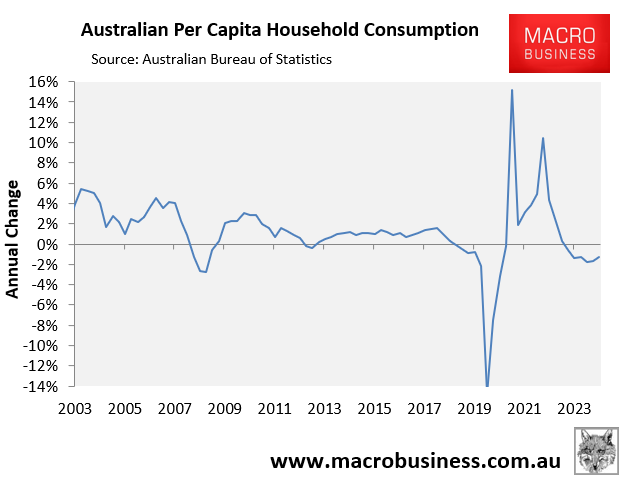

Meanwhile, Australian households remain entrenched in recession, with real per capita household consumption declining for eight consecutive quarters.

As a result, real per capita household consumption fell by 1.3% in 2024 and has fallen by 2.6% over the eight quarters.

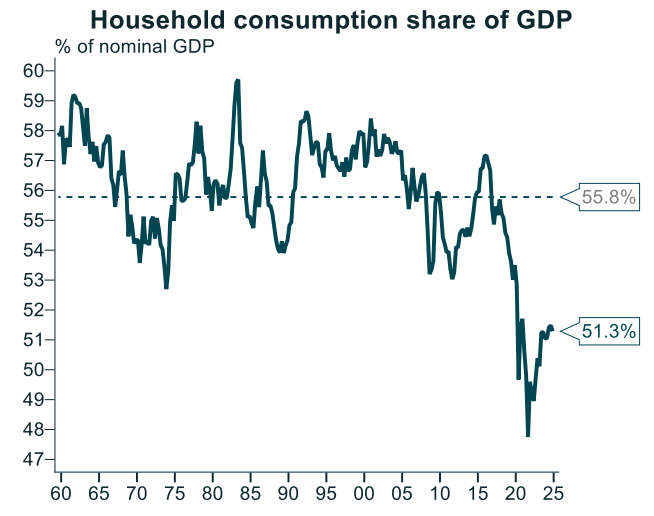

Household consumption’s share of GDP was only 51.3% in Q4 2024, well below the historical average of 55.8%.

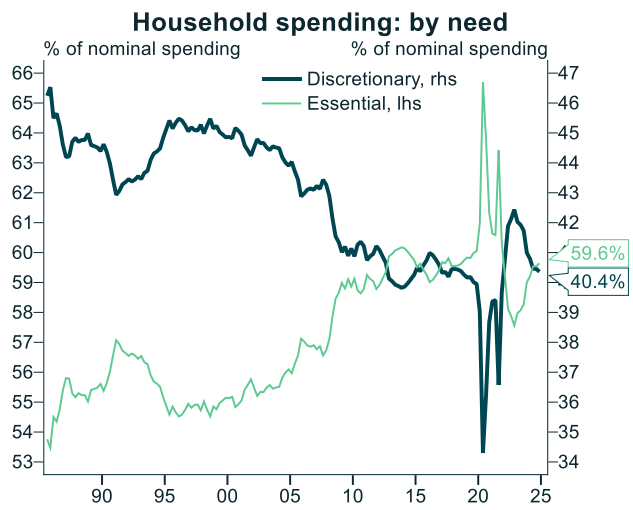

The share of household consumption spent on essentials has risen to a historically high 59.6%.

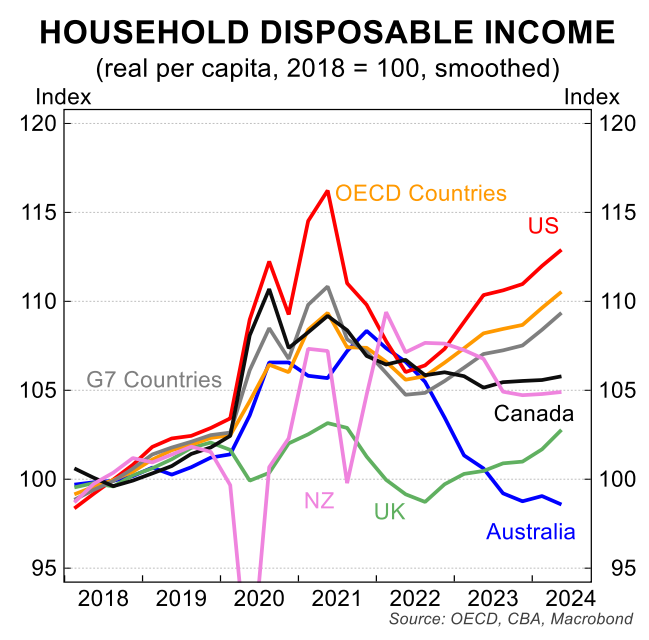

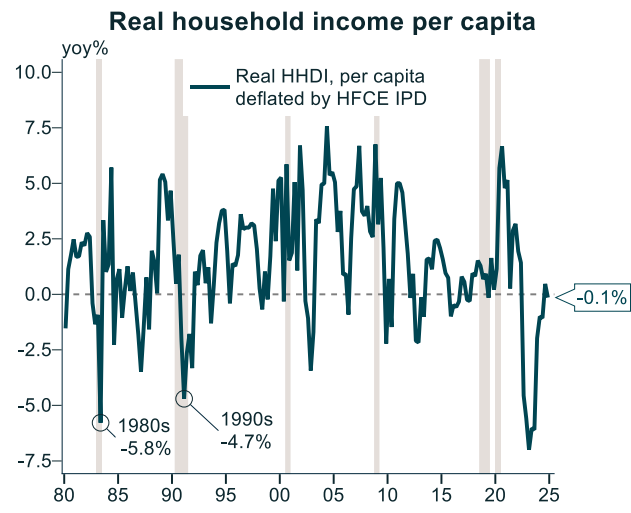

Australian households have experienced one of the largest real per capita disposable income declines in the advanced world.

The national accounts showed that real per capita household disposable incomes fell 0.1% in the Q4 2024 year (but rose in the quarter).

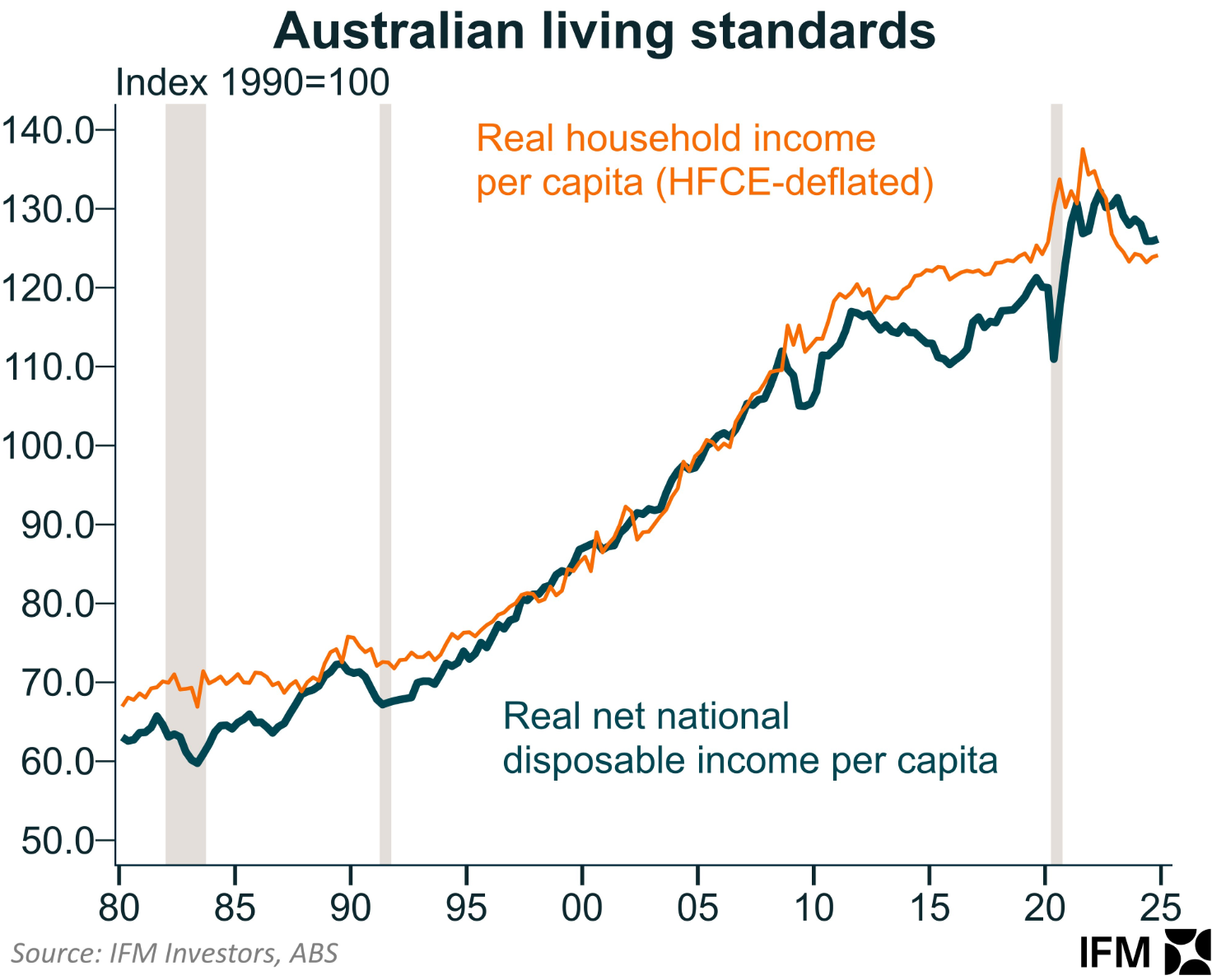

The collapse in living standards is summarised by the following chart from Joiner.

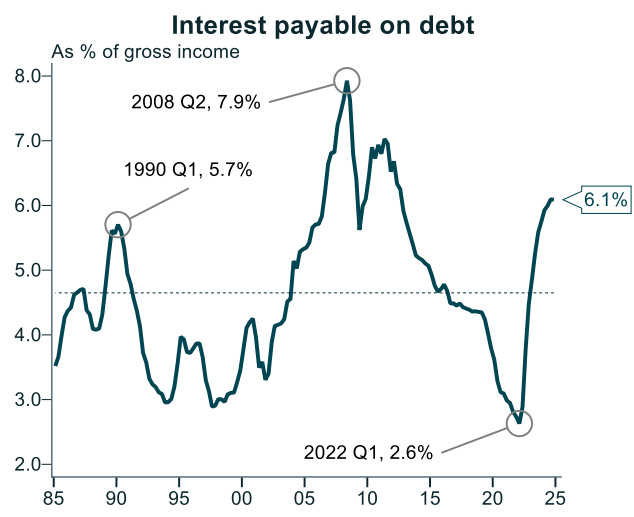

The surge in interest repayments has driven part of this decline in real household incomes.

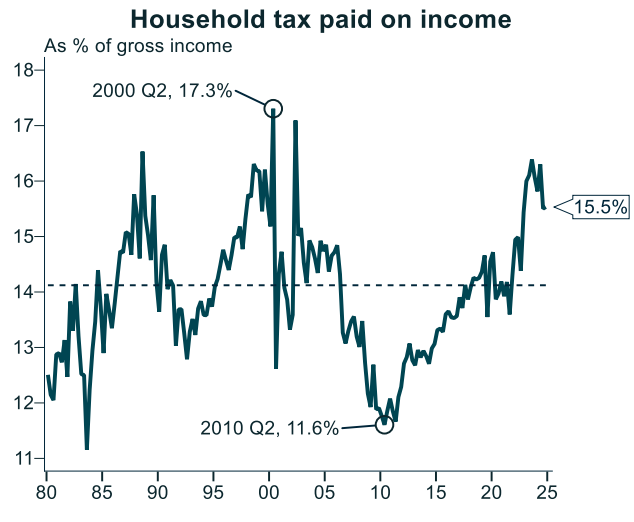

The rise in tax payments has also caused some of the decline.

While it is encouraging that the economy’s prolonged per capita recession officially ended in Q4 2024, the recession remains for Australian households.