Peter Dutton’s call for East Coast Australia to start reserving gas has drawn the usual vested interest shrieking in your mainstream media.

Most of it is utterly incoherent, and all of it creates a look suggesting that socially progressive media outlets love waking up with multinational capital and gas alongside them in the bed. Welcome to 2025 Australia.

Three pieces tell us about where our media and our energy suppliers and producers are in relation to us.

Let us go first to the Guardian with ‘Coalition’s gas plan unlikely to lower prices and could push up greenhouse gas emissions, experts say’.

The subheading underneath the Headline reads: ‘Body representing the gas industry says Peter Dutton’s plan is a ‘damaging market intervention that will drive away investment’.

Think about that for a moment – in a way that nobody at the Guardian obviously did.

If you went to a ‘Body representing’ the banking industry, would you expect to find a view supporting the idea that the banking industry should be able to make as much profit any way it likes, against the backdrop of a sentiment suggesting that nothing the banking industry ever did could possibly have a negative social effect, and that if it did it would likely be someone else’s fault, probably those borrowing money?

You could try that line of thinking again if you like. The property development lobby, the grocery retailers, the farmers federation, the miners, the University sector. Uncle Rupert serves it up every day. For guys like Innes Willox, it is their stock in trade.

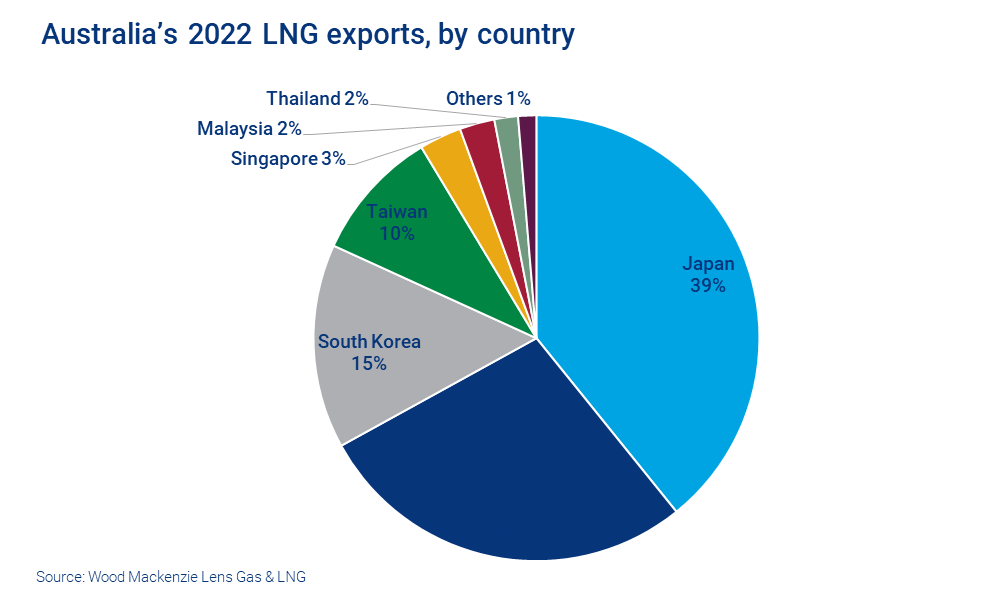

Where Australia’s gas exports ostensibly go

Then come back to the Guardian piece. It correctly gets Dutton positing that 50-100 petajoules could bring prices down from a current $14 to about $10 a gigajoule.

It serves up Stephanie Bashir

Stephanie is Founder and CEO of Nexa Advisory working with public and private clients to help them navigate the energy transition and accelerate their efforts towards a clean energy future.

She previously led the policy vision & strategy at AGL with a key focus on the reform of network regulation relating to new energy technologies & services. Stephanie played important roles in driving the clean energy transformation and establishing the national policy agenda around virtual power plants, and competition reforms in new energy technologies and services.

Then riffs Australian Energy Producers about which wikipedia tells us

The Australian Energy Producers (AEP), formerly known as the Australian Petroleum Production and Exploration Association (APPEA),[1] is a peak industry body representing Australia’s oil and gas exploration and production sector.

It then ushers in the woefully captured Tony Wood, the director of the Grattan Institute’s energy program, ‘who has previously worked in the gas industry’, Tristan Edis from Green Energy Markets, Joshua Runciman from IEEFA.

These all pooh pooh Dutton’s proposal, but none of them suggest what Dutton is positing is wrong.

Stephanie Bashir notes she has long proposed a reservation policy, which we dont have, but that Dutton’s pitch is merely lines in a speech.

Australian Energy floats the idea that those tough and resilient explorers and producers of gas may take their bat and ball elsewhere and exploit someone else.

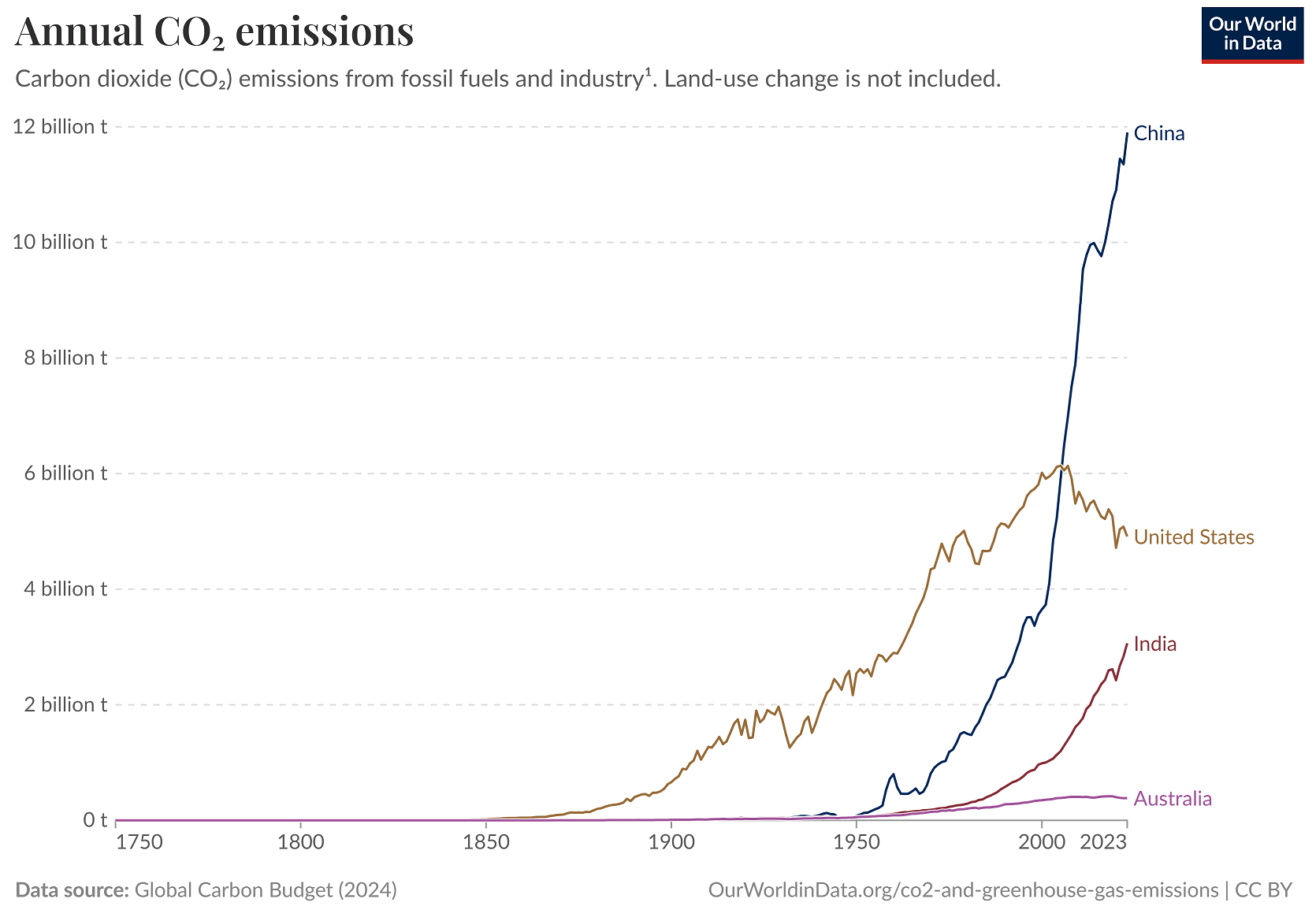

Tony Wood’s concerns are that Australia’s emissions would rise and the transition to renewables might slow.

Edis points to the observable fact that Australians would still likely have expensive energy, and Runciman rightly notes producers may ease back on production.

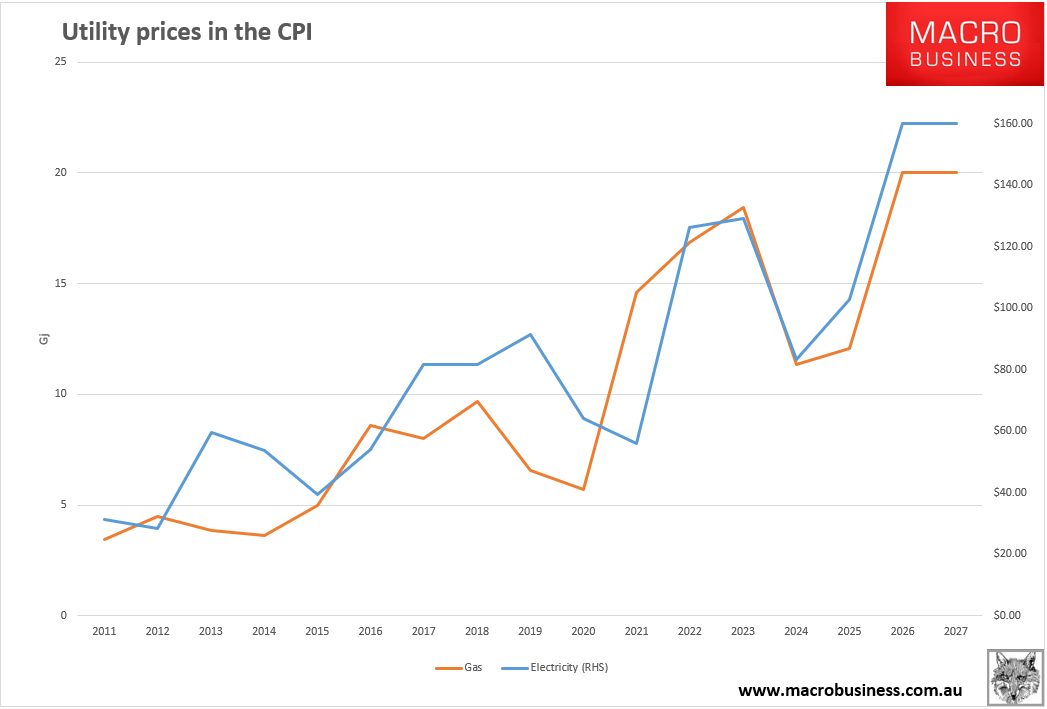

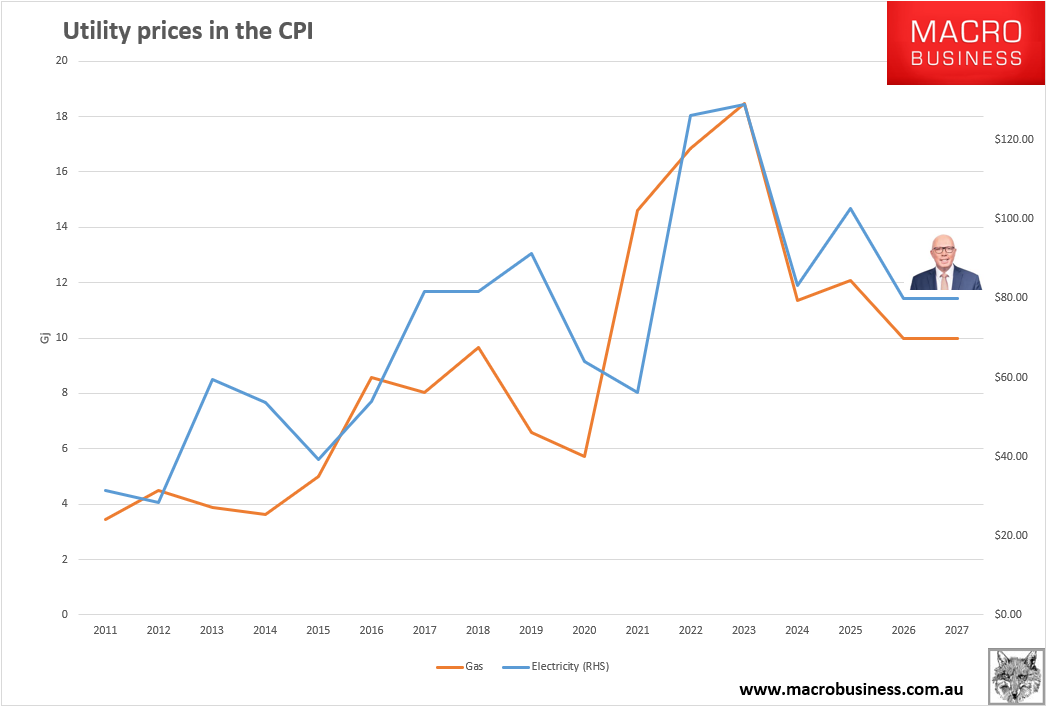

None address the price Australian consumers are paying right here and now for electricity, and the relationship this has with gas – which has been illuminated time and again here at Macrobusiness.

Australian gas and electricity prices are closely linked

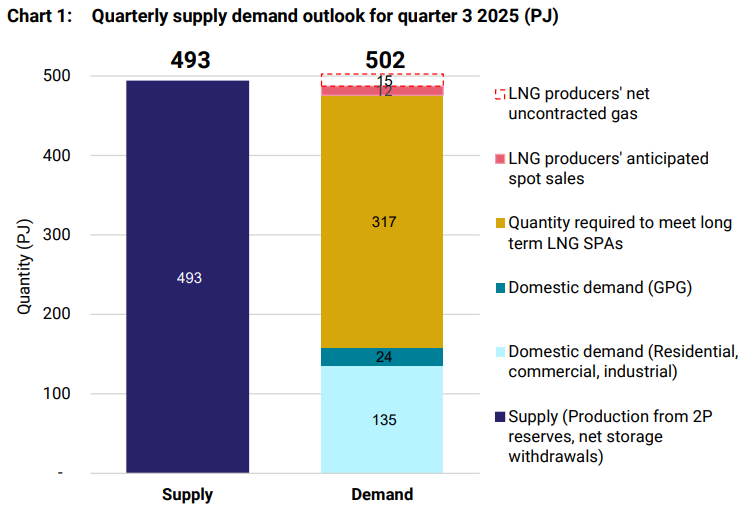

Nor do they mention that, without action. the East Coast market will begin importing LNG, driving prices nothward of $20 a gigajoule.

For the record. Australia’s emissions are less than 1% of those globally, and the gas Dutton is proposing be reserved in Australia would otherwise be burned anyway by the nations currently buying it. The emissions discussion is over there, namely China (where most East Coast gas exports go).

That transition to renewables is creating immense social pain in the suburbs of Australia (which the Grattan Institute does an otherwise reasonable job of reporting) and all the good will to do something about global warming needs to be balanced against the energy carnage being experienced in Australian society, including the rapidly shrinking manufacturing sector.

Beyond that the Guardian piece, obviously trying to pour ordure on Dutton, gives us AEMO stating ‘supply gaps’ – which you and I can read as massive price hikes when we look at energy bills – on the radar. Is there any wonder Mr Dutton is floating gas reservation, or is the wonder that it has taken so long?

Australian gas and electricity prices are central to your cost of living experience

The ABC churns its Dutton gas plan take down with Jacob Grieber’s Energy expert slams Dutton’s ‘populist anti-market’ gas plan as self-defeating ‘betrayal’

Jacob brings in renowned gas cartel defender Saul Kavonic as representing MST Marquee, but Saul is known elsewhere as a mainstay for Credit Suisse with a background at Wood McKenzie.

There’s no problems with any of that, but let us observe from the get go that Saul represents very big energy and very big capital, and at that point you could go back to the questions up top. He burnishes his credentials by writing articles on energy policy for Uncle Rupert.

Is this man representing the interests of ordinary Australians paying extortionate energy bills or is this man representing the extortioners?

Jacob’s notes of Kavonic’s comments to clients:

But Saul Kavonic, head of energy research at MST Marquee said the Coalition’s plan would result in less gas being available to Australian users and potentially forcing exporters to curb shipments destined for valued regional allies including Japan.

He also likened it to Labor’s notorious 2022 election promise that household energy bills would fall under its watch.

“The Coalition have boxed themselves in here just like Labor did with its $275 lower price position,” Kavonic wrote in a note to clients obtained by the ABC on Friday.

“It may prove a political noose at the subsequent election. $10 per gigajoule will not sustain gas investment.”

Mr Kavonic said the Coalition’s policy would reduce investment in domestic supply capacity to the point that “breaking export contracts or gas shortages will be the inevitable result”.

At that point we see Kavonic is essentially arguing the producers will reduce investment and that Australia runs out of gas. He is also riffing the supply of ‘valued regional allies’ as a theme when those allies and others to whom we sell gas on long term contracts providing little return to Australia, They also regularly resell the supply they get from Australia, to achieve windfall profits by shipping them to Europe, which desperately needs the supply now that it has blown up its own access to Russian gas. Europe’s responses to its geopolitical exigencies are its own affairs, but the question for Australian consumers comes back to:-

‘Should we be paying for gas companies extracting Australian gas to prioritise the supply of European consumers at prices incorporating windfall profits for those buying Australian gas at bargain basement prices?’

and

‘Is supplying those European consumers at prices incorporating windfall profits for those buying Australian gas at bargain basement prices serving any greenhouse gas emission reduction outcome?’

The answer to both of those questions in the electorate that Peter Dutton is addressing is almost certainly ‘NO!’

Jacob’s piece reprises Australian energy producers warning of a local glut – which is precisely what Dutton and Australian energy bill payers would like – and then moves onto far firmer ground when it notes that local gas producer Santos is supportive of Dutton’s proposal, emphasising that it should only apply to uncontracted gas. Santos provides the gas industry’s first line of defence – the sanctity of contracted gas. It ‘supports’ the idea that ‘uncontracted’ gas may be reserved for Australians.

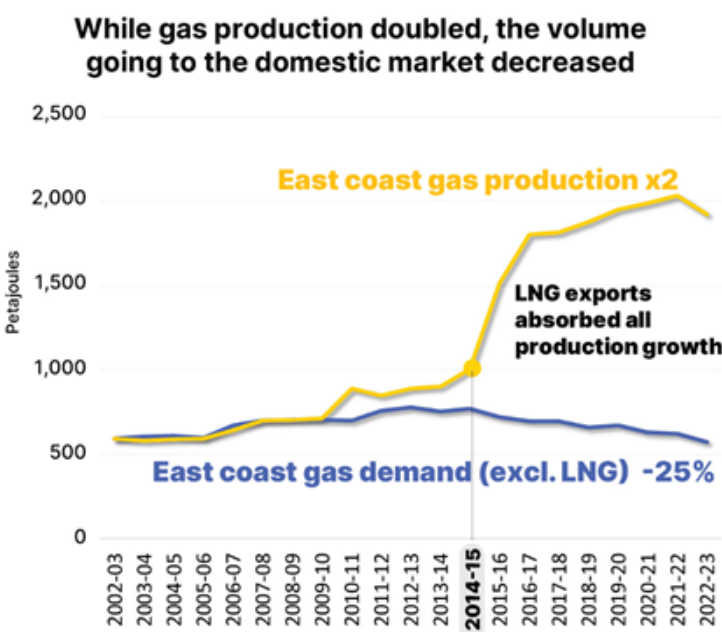

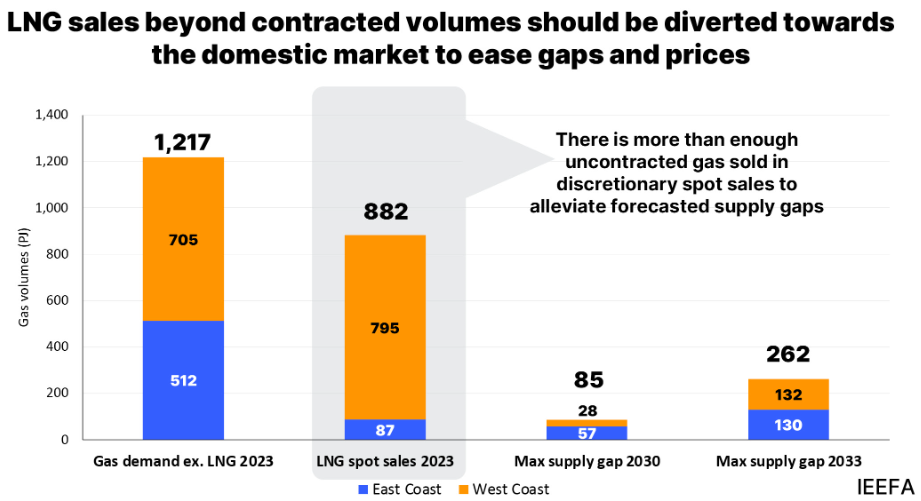

The volume of Australian gas being sent offshore which would need to be reserved to take pressure of Australian consumers is a drop in the ocean in comparison to the volumes being sent offshore

For anyone wondering that is Santos throwing smaller producers under a bus of only ever supplying a price capped domestic market, from the sanctity of being party to contracts with offshore buyers it is saying should be sanctified. It is trying to protect those offshore buyers from having to acknowledge, let alone explain, how it could be that Australian gas supplied to them under those contracts has been turning up in European gas storages at Rotterdam at considerably greater prices, and the idea that some of those sanctimonious ‘allies’ may in fact be ripping the Australian public off in the exploitation of Australia’s natural bequest.

After that sojourn, Jacob brings up the news that David Pocock, the Independent ACT Senator, has actually proposed something quite similar, in what could easily be something of a fright for both Dutton and his supporters and Pocock and his supporters (of whom I am often one).

After that ‘what did I do last night?’ moment, which provides a wide open door for the ALP to quickly get a gas reservation proposal together and sound moderate, Jacob trashes the brand of former Treasurer Frydenberg, and invites further questioning of Madelaine King’s priorities.

Better still, he reminds us that the AWU is proposing something a touch more electorate pleasing out there on the socio economic left of the ALP, in what could easily end up as a post policy coitus threesomes fright to remember moment with Senator Pocock and the Member for Dickson.

If Albo joins in then he the threesome and the electorate could almost have a gas love in.

Not impressed by any of this are the climate end of proceedings. Jacob wheels in David Close, director of the University of Queensland Gas and Energy Transition Research Centre, and brings back Tony Wood fresh from his appearance at the Guardian.

David says we run out of gas in the medium term because producers cut back on production, and Tony notes the popularity of Dutton’s proposal as well as concerns about the mechanics of it. But neither eschew the idea that it would provide significant relief in the electorate – noting the sanctity of those ‘contracted’ volumes which could be explored if we did look like running out.

Over at the Ninefax stable, the third part of our media threesome doing big business bidding is ‘Hard to see how lower pricing will emerge’: Experts doubtful of Dutton’s gas plan

They start with Tony Wood, who completes a trifecta with appearances in the preceding pieces, who again refers to the mechanics. But the Ninefax guys open up the story with the information pointing to who is enjoying who.

Queensland’s LNG sector currently sells most of its LNG under long-term contracts to overseas buyers in Asia, while shipping some of its surplus gas as one-off LNG deliveries on the international spot market.

However, two of the state’s three LNG producers – Origin Energy’s Australia Pacific LNG joint venture and Shell’s QCLNG – are key supplies to Australian consumers, too, together accounting for more than 40 per cent of the domestic east-coast market.

Yes, those companies you pay your energy bill to are those selling up Australian gas for burning off elsewhere. Most of it is long term contracts. You will recall Santos sanctifying those earlier.

It is interesting that the Ninefax piece refers to ‘some of its surplus gas’ which brings the question of why and how is this allowed to be sold anywhere but Australia if we have a national shortage?

Why isnt someone in Gladstone saying ‘You had best get this gas down to Sydney mate, they need it more down there’?

That supply shock is on the radar. Santos is OK with throwing the top of the right hand bar (in dotted red or pink) to the local consumers, but the question then becomes ‘how much of that mustard colour do we need?’

It also brings about the likelihood that real gas reservation in the interests of Australians will almost certainly involve exploring those long term contracts and where the gas sold under those ends up. If this gas is being resold into Europe, then the question arises of whether we should reserve that as well.

The Ninefax guys wheel out Macquarie analyst Ian Myles, before bringing Saul Kavonic back into play, and wheeling out the Australian Energy Producers to complete their mainstream media trifecta.

They do conclude with some upside being seen by the last remaining bastions of Australian manufacturing energy users.

So there you have it. Australian mainstream media commentary on Peter Dutton’s gas reservation proposals boils down to:

- Media references to a media release from Australian Energy Producers – all worrying about future supply, implying producers will go elsewhere.

- Media comments from the captured Tony Wood of the Grattan Institute – all noting the mechanics and operation of Dutton’s proposal, but agreeing it would have an effect and be popular.

- Media appearances from cartel defender Saul Kavonic echoing the Australian Energy Producers.

A couple of ring ins, and a sprinkling of acknowledgement it could reduce energy prices.

The key points to remember for the discussion are that:

- Australian gas production is primarily directed towards export markets.

- Global prices for gas are rising very rapidly driven by European demand for gas after the onset of the Russia – Ukraine war.

- Australian gas prices are very closely linked to and often the marginal price setter for Australian electricity prices.

- Australian gas and ergo electricity prices will continue to rocket if nothing is done and the East Coast begins importing gas.

- Australian electricity prices are very significant factors in inflation and cost of living pressures.

- Companies from nations buying Australian gas under long term supply contracts are selling the gas they buy from Australia and getting windfall profits.

- Some ‘surplus gas’ is also being sold offshore.

and

8. The electorate Peter Dutton is addressing would benefit significantly from cheaper gas, and therefore cheaper electricity this would enable. That electorate has been made one of the world’s most heavily indebted, also by government policy, meaning that until now politicians have run away shrieking from discussion of gas exports and the impact on Australians – and have preferred to talk up the exports and the need to make a green energy transition. In this Australia’s politicians and large global gas players have been cheered on by Australia’s mainstream media.

This is your mainstream media. Is it commenting on Dutton’s proposal (vis gas) in a remotely unbiased and credible manner in the interests of Australians? Nope.