Alex Joiner, chief economist at IFM Investors, has published a series of charts illustrating the explosive growth in non-market (government-aligned) employment, which has pulled down the nation’s productivity.

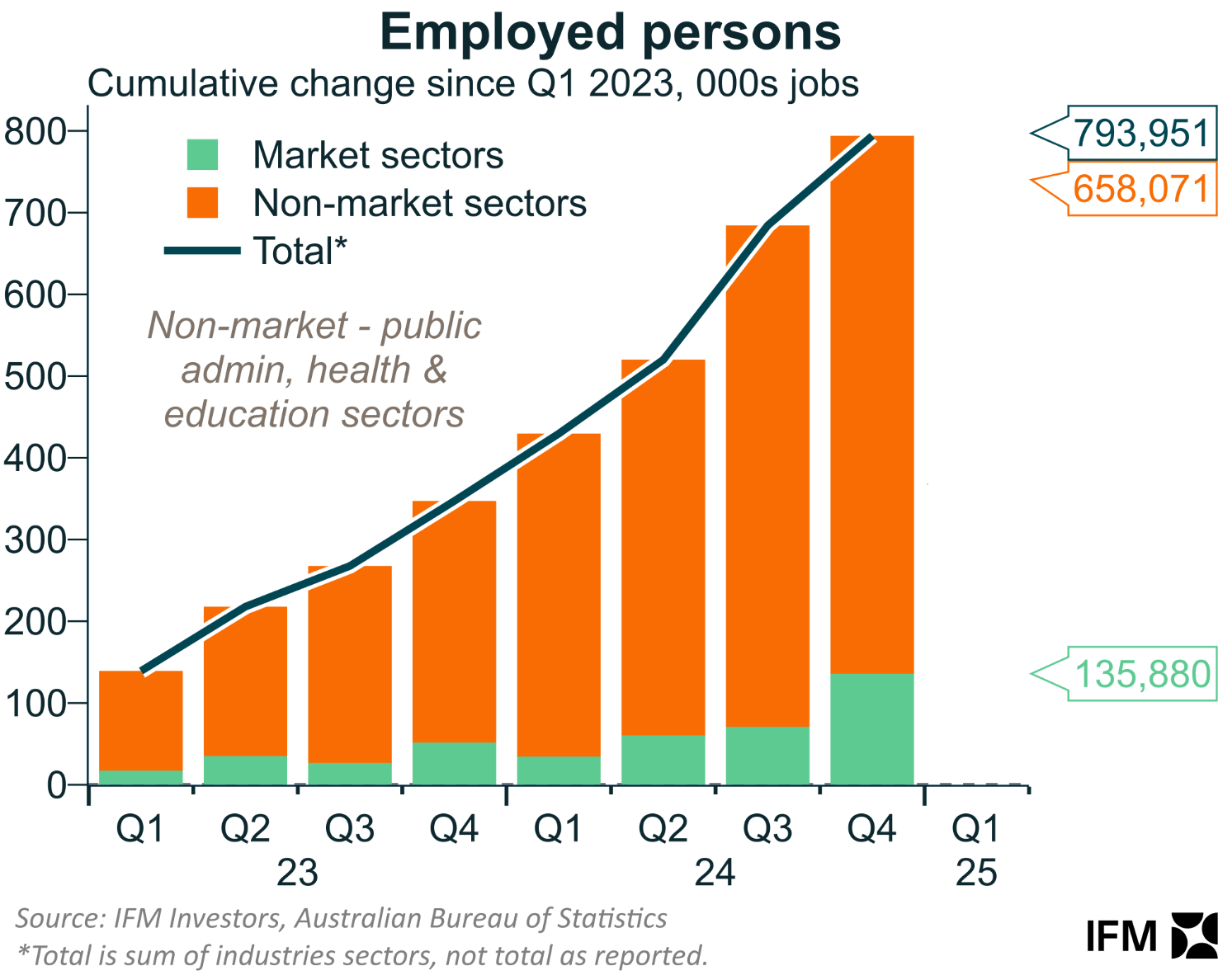

The following chart shows that since Q1 2023, 658,071 jobs have been added in the non-market sector versus only 135,880 jobs in the market sector.

This means that 83% of jobs created in Australia since Q1 2023 were in the non-market sector.

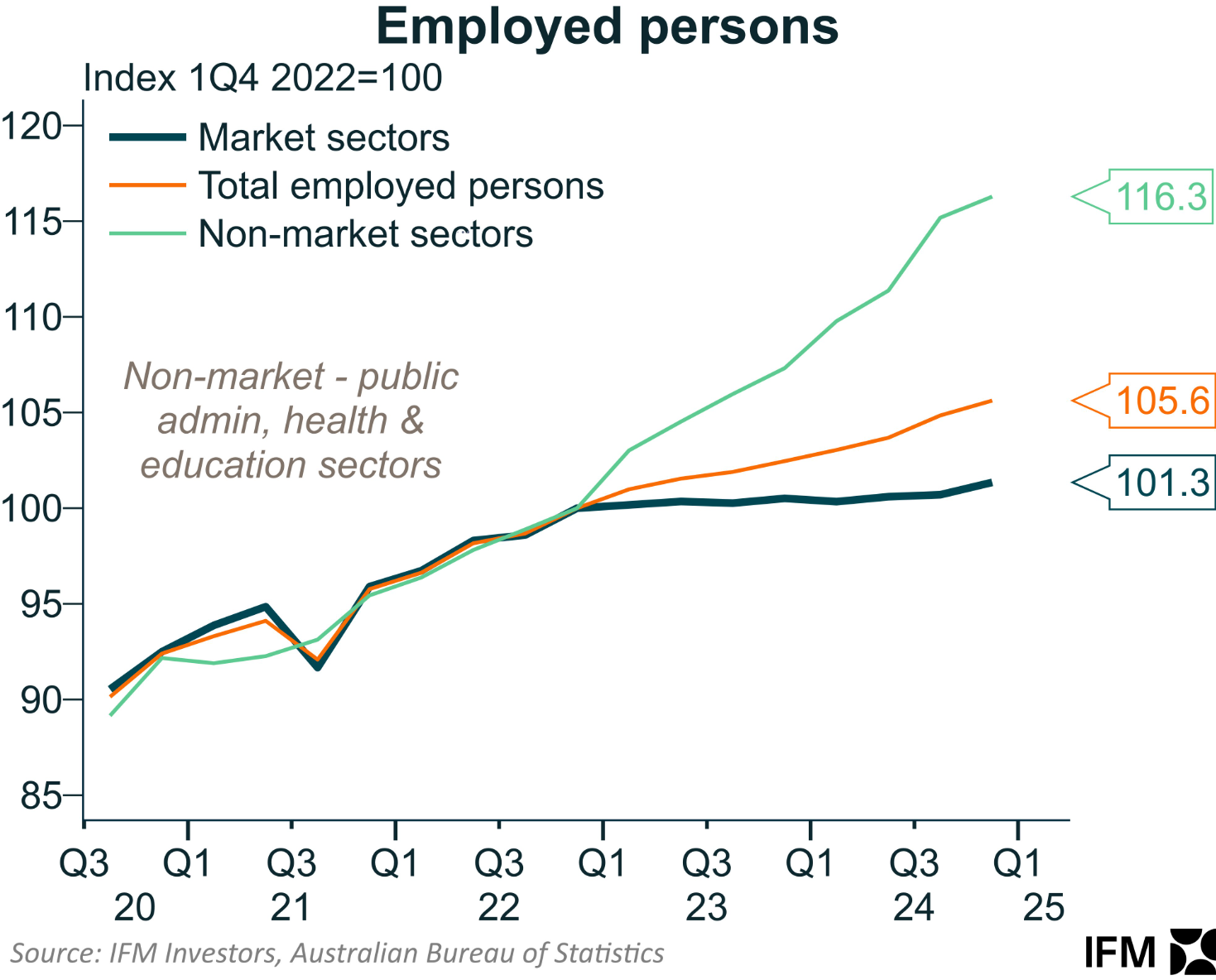

Alarmingly, the number of jobs in the market sector has only increased by 1.3% since Q4 2022, versus 16.3% growth in the non-market sector.

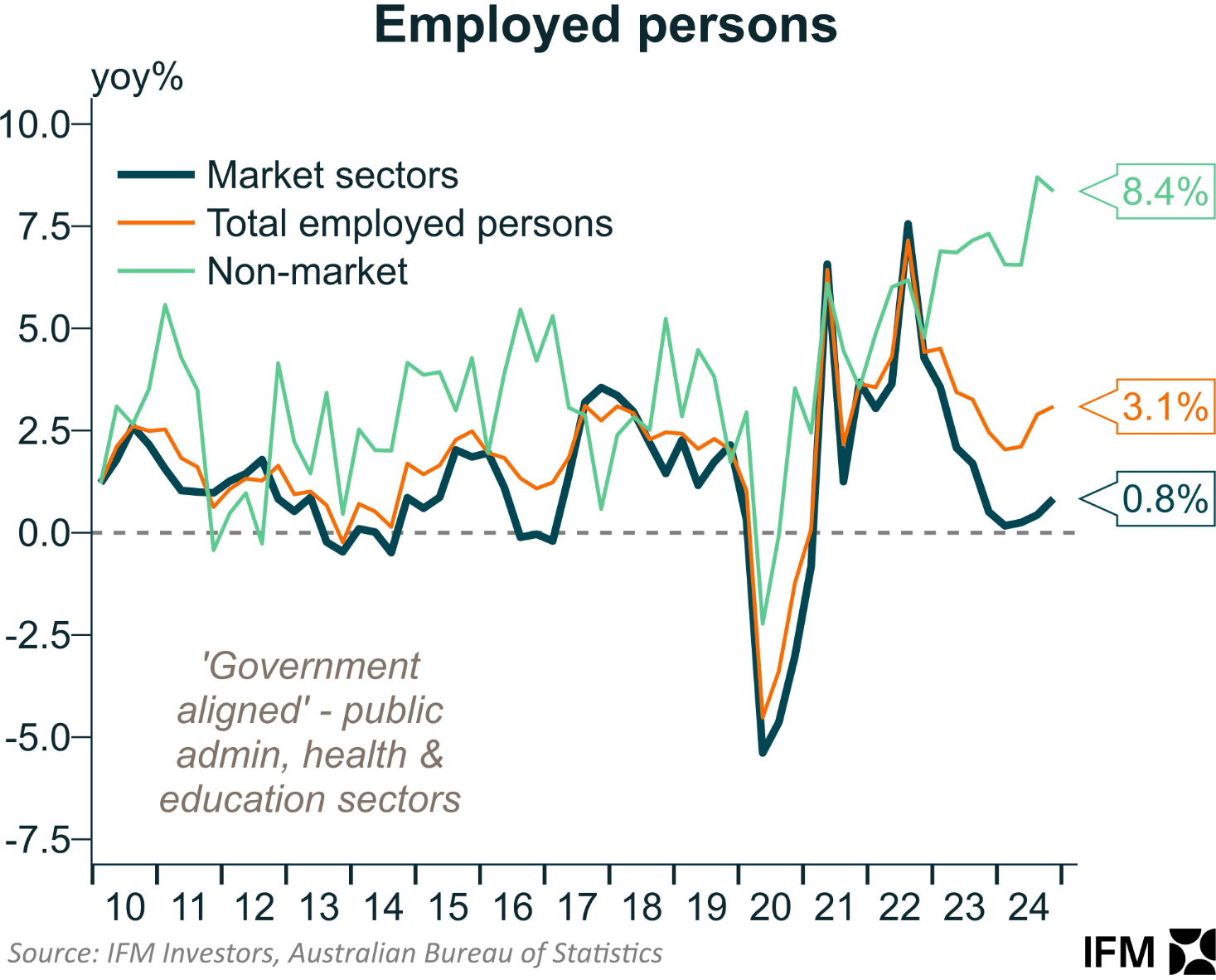

In the 2024 calendar year, job growth in the non-market sector ballooned by 8.4%, compared to just 0.8% in the market sector.

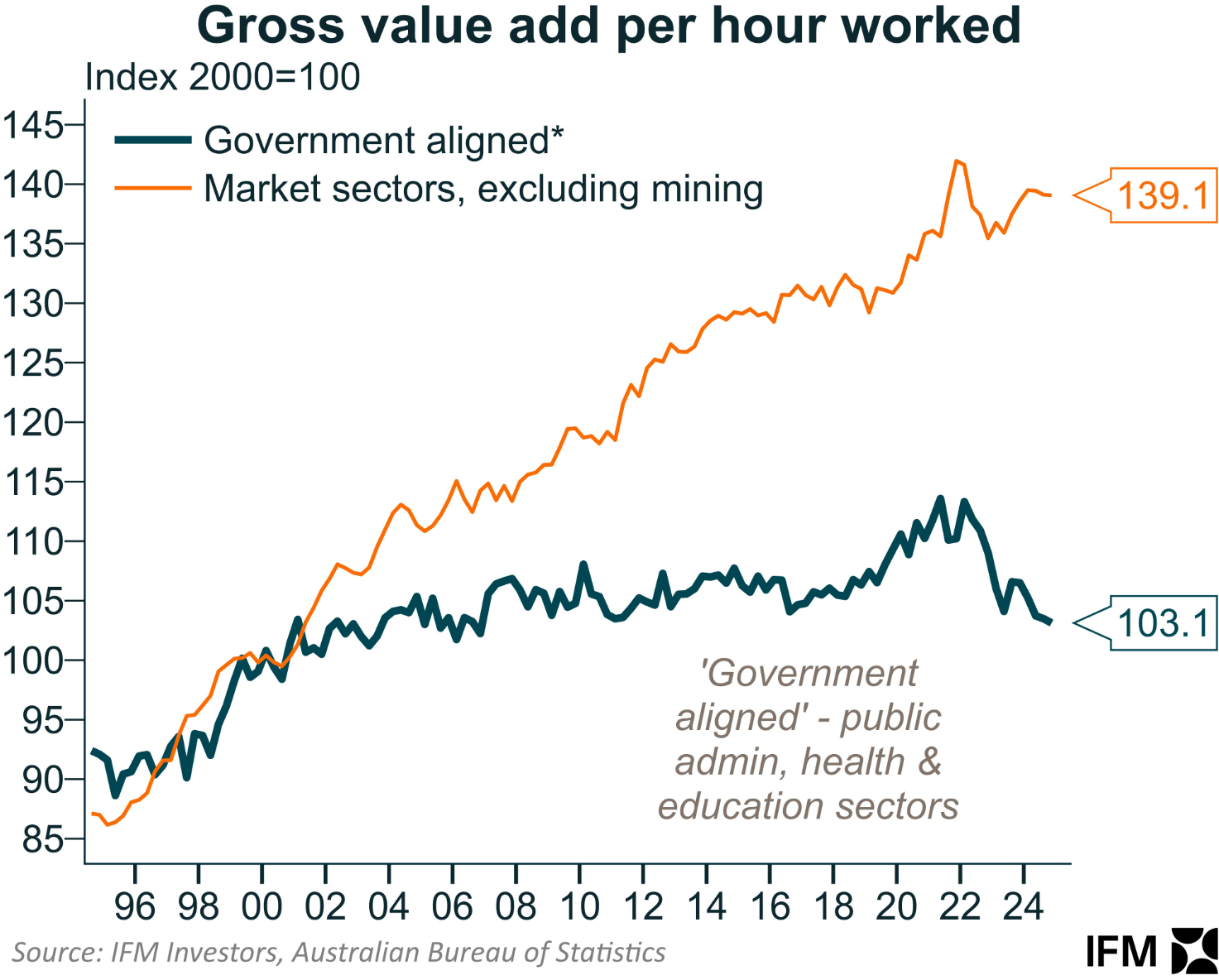

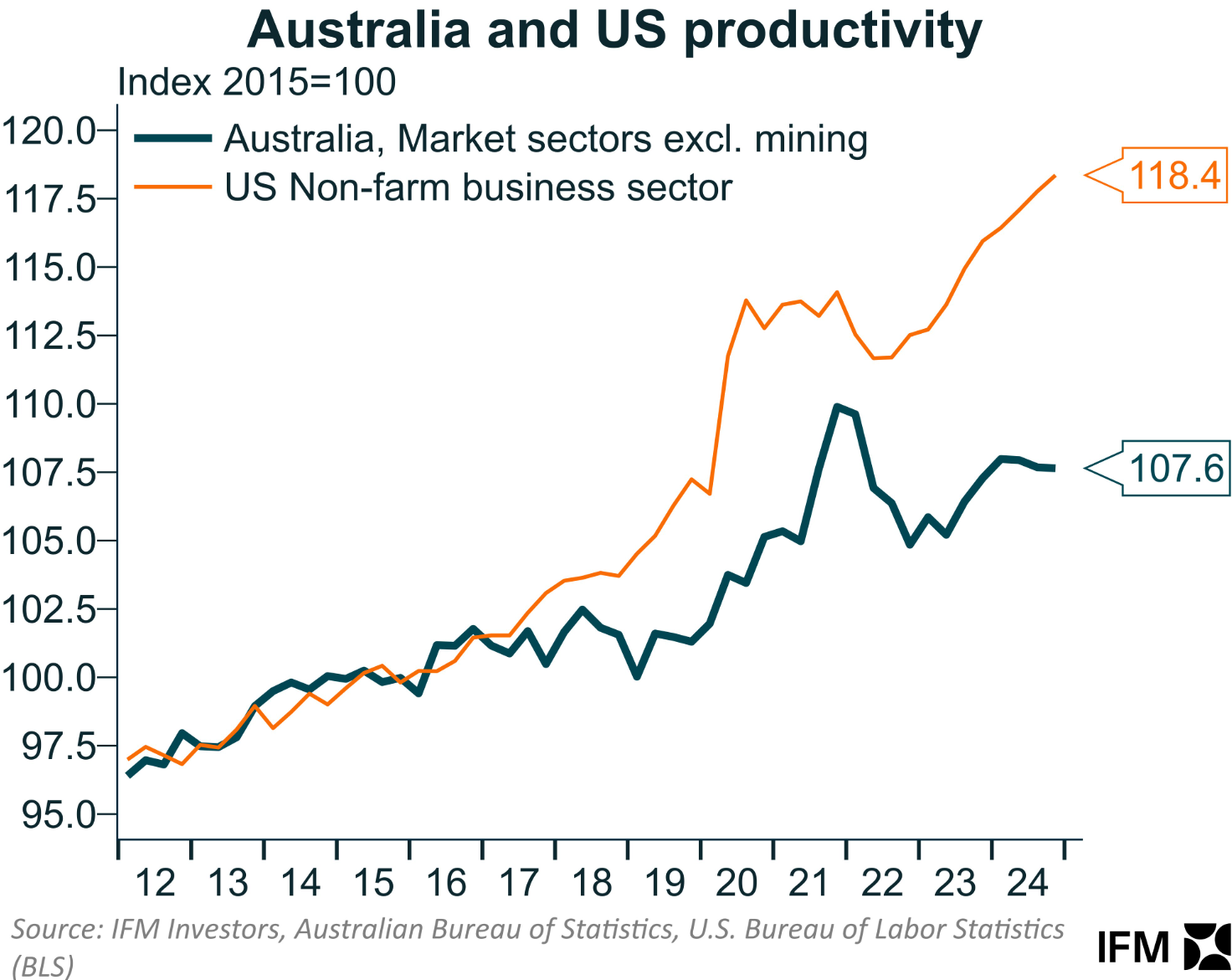

The following chart from Joiner illustrates the productivity conundrum facing Australia.

Gross value added per hour worked—a measure of labour productivity—is tracking at around 2001 levels across the ‘government-aligned’ public administration, health and education sectors. Productivity in these sectors has also declined sharply amid the recent employment boom.

By comparison, the non-market sector (excluding mining) has experienced solid productivity growth of around 35% since 2001.

However, Australia’s recent productivity growth in the market sector has been poor relative to productivity leader, the United States.

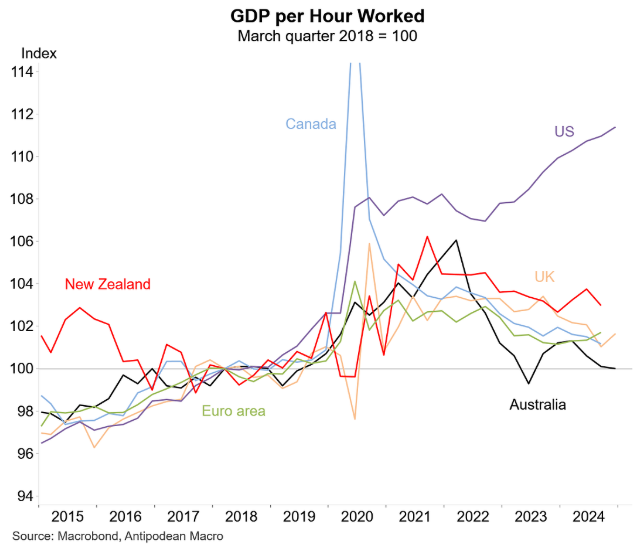

The upshot is that Australia’s labour productivity, as measured by GDP per hour worked, has ranked amongst the poorest in the advanced world in recent years.

It is difficult to see how the situation will turn around so long as the National Disability Insurance Scheme (NDIS) continues to expand aggressively, driving growth in non-market jobs.

Australia’s capital will also continue to shallow so long as its population via immigration continues to grow at a faster pace than business, infrastructure and housing investment.

Australia’s economy has become a productivity desert, so living standards will continue to flounder.