Over the weekend, I was interviewed by Luke Grant from Radio 2GB/4BC where I dissected the policy failures that are driving the nation’s energy price shocks.

Below is a summary of the topics discussed.

Electricity prices soar by up to 9%

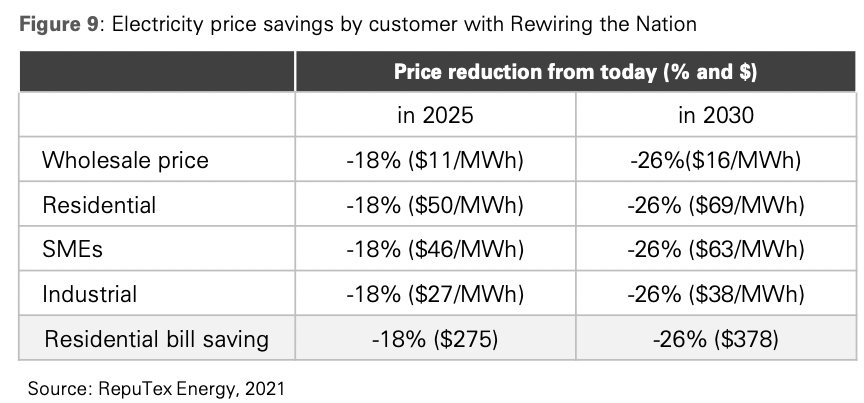

Labor’s 2021 Powering Australia Plan, released prior to the last federal election, promised that Australians would save $275 on their residential electricity bills by 2025 and $379 by 2030.

Instead, Australian Energy Market Operator (AEMO) reported that the average cost of producing electricity across the National Electricity Market (NEM) was $88/MWh over Q4 2024, which was 72% higher than the level promised by Labor.

Last week, the Australian Energy Regulator (AER) announced that electricity bills will rise by up to 9% from 1 July. The largest jump will be seen in NSW (up to 9%), whereas QLD will see prices rise by up to 6%.

The ruling by AER relates to the annual default market offer, which is calculated annually based on the wholesale cost of electricity, the cost of transporting electricity, and the cost of compliance with government rules and regulations.

Part of the rise in the default offer was attributed to increased network costs, which the AER said had jumped by between 2% and 12%.

Electricity costs will continue to rise

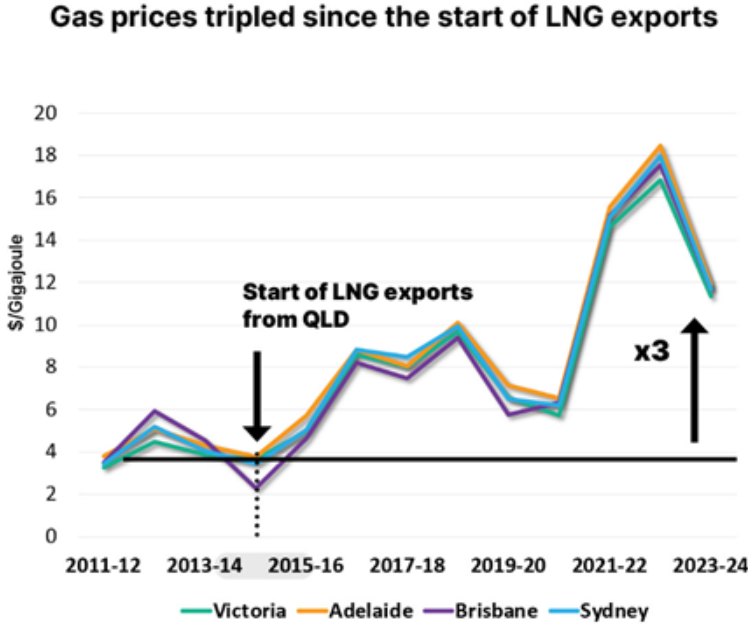

Australia’s East Coast is scheduled to begin importing gas late this year, which will lock in import parity prices of around $20 per gigajoule (versus around $12 currently).

Before Australia began exporting gas from Gladstone, we paid around $4 a gigagoule.

Gas is the marginal price setter of electricity in the wholesale market, so the rise in gas prices will also push up wholesale electricity prices.

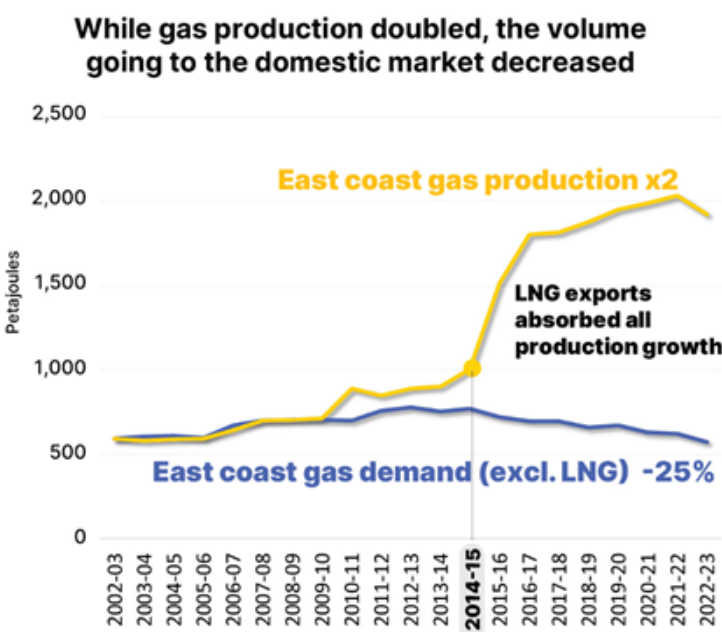

Australia’s east coast has doubled gas production in the last decade, but 25% less has been supplied to the domestic market, resulting in shortages and higher prices.

Late last month, the ACCC’s Gina Cass-Gottlieb lambasted the gas export cartel for using increasing amounts of domestic gas to meet commitments to foreign buyers.

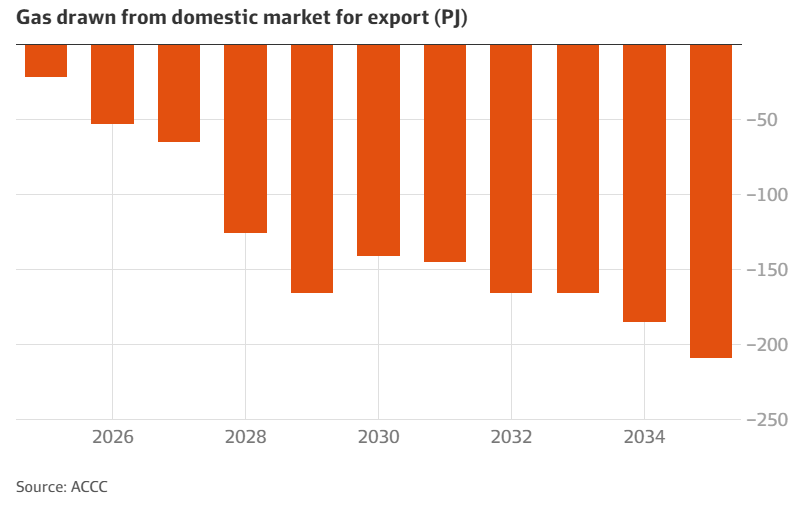

The ACCC claimed that Queensland’s major LNG exporters are forecast to collectively source 10 times more gas annually from the domestic market in 2035 than they will this year.

“One of the key elements we are seeking to prove in [the data] is that [the exporters] extract gas also from third-party suppliers who would otherwise be domestic suppliers of gas”, Cass-Gottlieb told a Senate hearing.

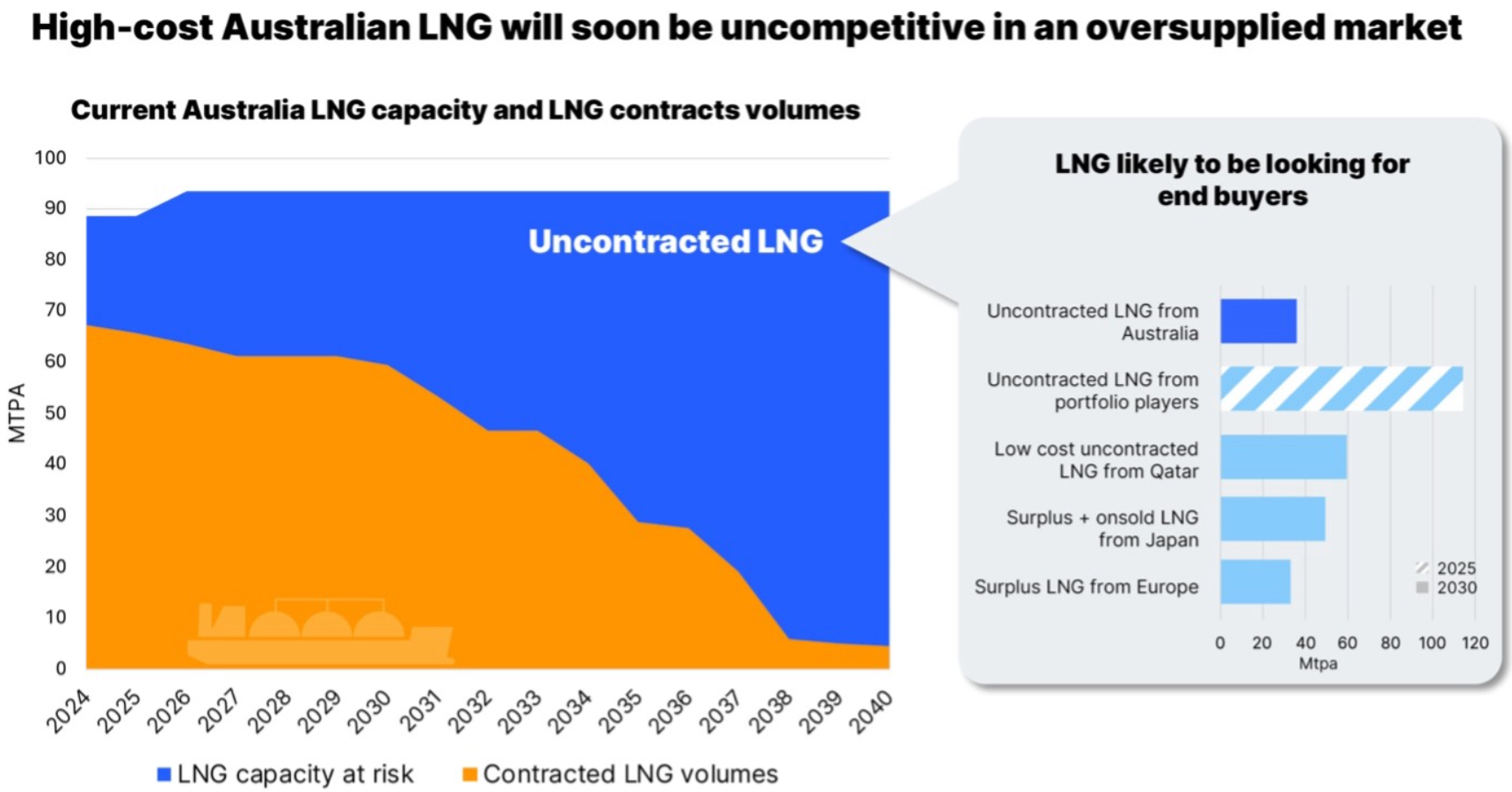

This is despite East Coast gas contracts expiring in the 2030s. Therefore, there will be no broken contracts or “sovereign risk” in stopping gas exports.

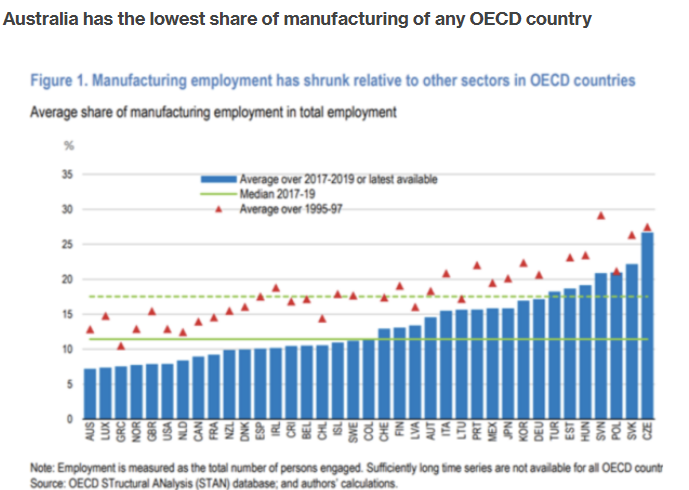

The manufacturing sector in Australia, already the smallest in the OECD as a share of the economy, has been disproportionately affected by the increase in energy costs.

Incitec Pivot has downsized its fertiliser production because of high energy costs. It closed its Gibson facility in Queensland in 2022, impacting 170 jobs. Incitec’s Geelong fertiliser business also closed last year, costing 40 jobs.

Incitec Pivot Fertilisers continue to process phosphate rock and manufacture ammonium phosphate fertilisers at our Phosphate Hill site, albeit the site is under strategic review.

Last year, Australia’s last major plastics manufacturer, Qenos, closed due to high energy costs, making Australia wholly reliant on imported plastics from China.

Australia’s only architectural glass manufacturer, Oceania Glass, closed last week after 169 years of operation.

Oceania Glass required large amounts of energy, particularly gas, to maintain the 2000-tonne furnace at the heart of its Victorian operations. The hyperinflation of East Coast gas and electricity costs, therefore, made Oceania Glass unviable. Now, Australia will have to import all of its glass from China.

Last week, Manufacturing Australia, which represents large East Coast gas users, called for a domestic reservation scheme and warned of price hikes once import terminals come online.

Manufacturing Australia wants a national gas reservation policy based on Western Australia’s model, which keeps 15% of exports available for the state’s consumers.

“In the long term, [LNG imports] are likely to do more harm than good, and Australia will never regain its energy cost advantage—nor secure the future of manufacturers that need competitively priced gas—if we entrench import parity pricing”, Manufacturing Australia chief executive Ben Eade wrote in The Australian.

“Australia doesn’t need imported gas. We should develop and reserve domestic gas for manufacturers and local customers, rather than pursue solutions that entrench import parity pricing. What’s required is political courage to ensure our abundant natural resources benefit the entire economy, not just the export sector”, Eade said.

Likewise, the Energy Users Association of Australia, whose members include Brickworks, claimed it was unfathomable that one of the world’s biggest LNG exporters was contemplating importing LNG.

“It’s a significant failure of policy, planning and production. It is like importing sand into the Sahara”, EUAA chief executive Andrew Richards said.

Sanjeev Gandhi, the CEO of $8 billion Australian chemical and explosives maker Orica, voiced similar concerns over the weekend.

“Orica operates in a global environment. I have got competitors in the Middle East, in North America (and) elsewhere in the world where they get much better gas prices than I do here in Australia”, Gandhi said.

“In a global market, how can I compete with them? There’s no way I can”.

Gandhi said that electricity prices have increased threefold over the past decade while gas prices have increase fourfold.

The push to the 82% renewable energy target is also raising electricity costs because of the massive investment required, which gets added to power bills.

Last month, Moody’s released a detailed analysis of Australia’s green energy transition, which it warned could raise real energy costs by 20% to 35% over the next decade, due to high transmission costs.

Infrastructure Victoria’s modelling, released this month, also showed that wholesale electricity prices will more than double over the next five years as coal-fired power plants are closed in favour of renewables.

Clearly, the failure to reserve gas and the drive towards the 2030 82% renewable energy target will drive up power costs, inflation, and the cost of living, and will further deindustrialise the economy.