In January, Domain published a series of charts showing that Australia’s housing affordability was the worst in recorded history.

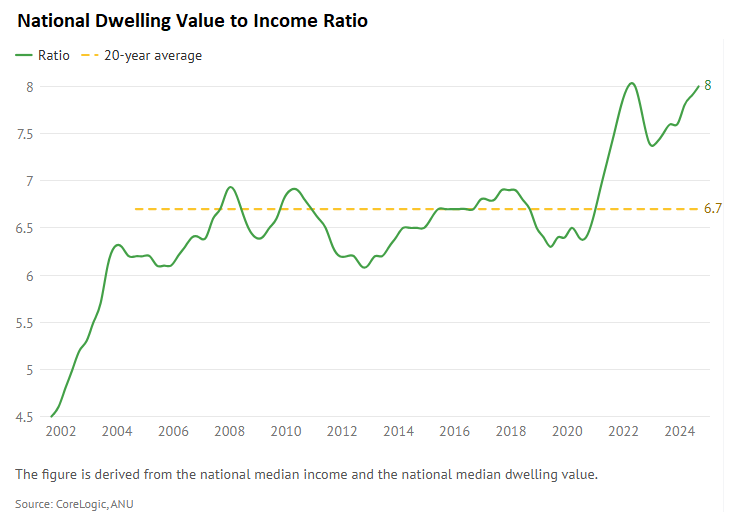

The national dwelling value-to-income ratio hit an equal record high of 8.0 in Q3 2024, up from a 20-year average of 6.7.

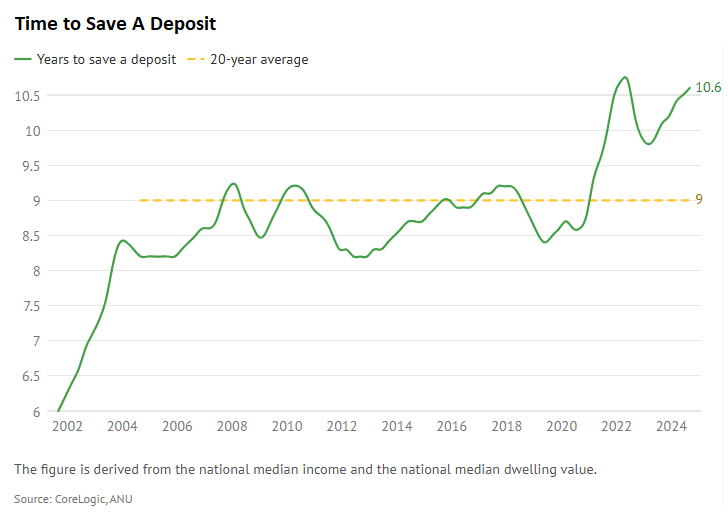

The amount of time taken for the median-income household to save a deposit on a median-priced home was 10.6 in Q3 2024.

Although this was slightly lower than the record high of 10.7 in Q2 2022, it was well above the 20-year average of 9.0.

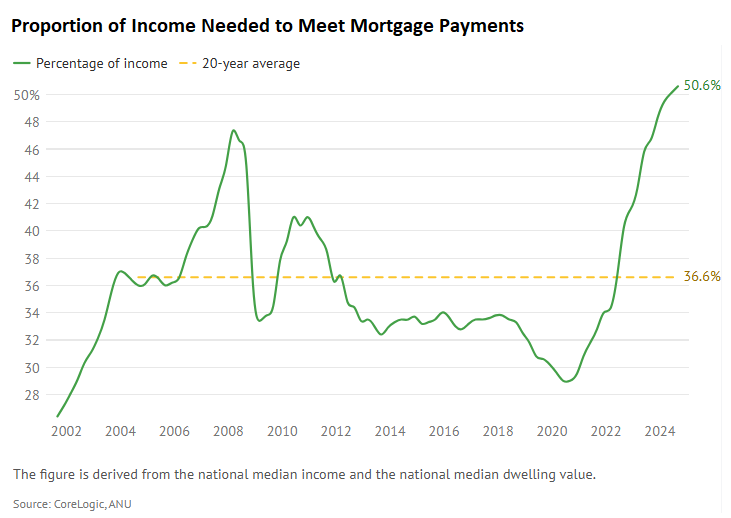

The share of income required by the median-income household to meet mortgage repayments on the median-priced home hit an all-time high of 50.6% in Q3 2024, well above the 20-year average of 36.6%.

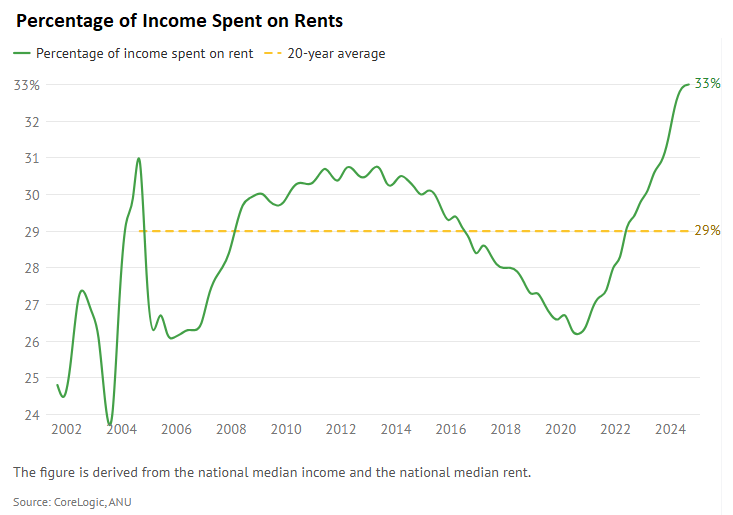

Finally, the share of income a median household needed to pay the median rent was a record high 33% in Q3 2024, well above the 20-year average of 29%.

Therefore, according to this data, Australian housing was highly unaffordable on every measure.

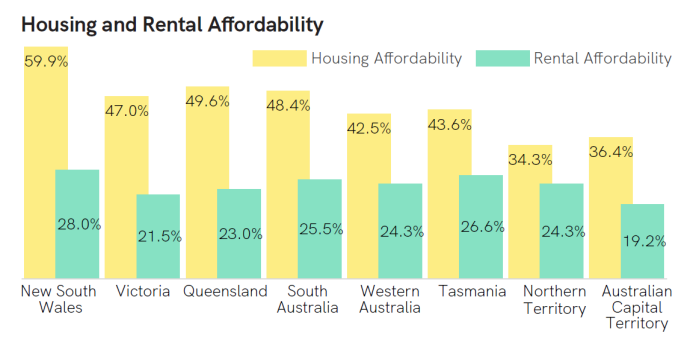

Last week, REIA published its own affordability data, which confirmed that Australia’s housing affordability crisis has deepened in Q4 2024.

Source: REIA

“This marks the third consecutive quarter in which housing affordability has declined to a new all-time low”, the media release stated. “The average loan repayment now consumes 50.1% of median family income, a 1.4 percentage point increase and the highest proportion since REIA began monitoring in 1996”.

“Housing affordability declined across all states and territories”.

“The average loan size rose to $665,977, a 3.9% increase over the quarter and an 8.4% increase over the past 12 months. All states and territories recorded increases in average loan sizes”, the REIA said.

There was a sliver of good news with the REIA reporting that rental affordability improved marginally in Q4 2024.

“The proportion of income required to meet median rents decreased slightly to 24.7%, a drop of 0.2 percentage points over the quarter. However, it remains 0.7 percentage points higher than the same period last year”.

The REIA also believes that housing affordability should improve somewhat in 2025.

“Looking ahead, there are potential improvements in affordability in 2025. The Reserve Bank of Australia (RBA) cut interest rates by 0.25% in February, with further reductions anticipated”.

“Historically, each 0.25% rate cut leads to a one percentage point decrease in the proportion of income required to service a mortgage. Additionally, rising vacancy rates could help slow rental price growth”.

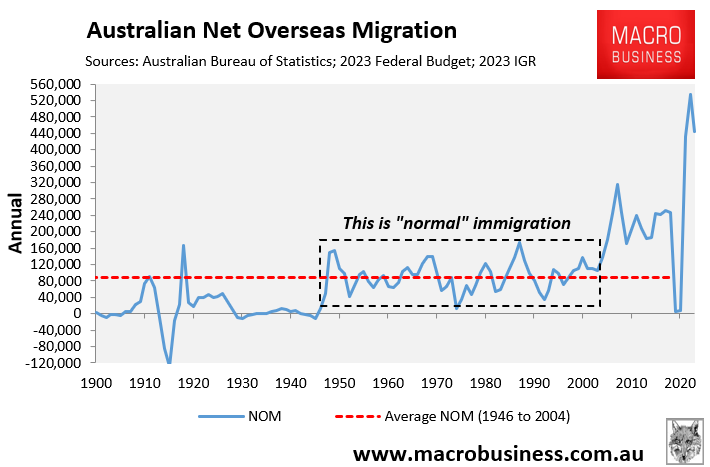

The single most effective solution to Australia’s housing affordability crisis is to significantly reduce net overseas migration.

Excessive immigration is catastrophic for housing affordability, and first home buyers and tenants in particular, because:

- It drives up rents directly, negatively impacting tenants and making it more difficult for prospective first-time buyers to save a deposit.

- It puts upward pressure on home prices, making home ownership even more difficult to obtain.

- It forces Australians to live in smaller homes (e.g., shoebox apartments) or farther from the city centre.

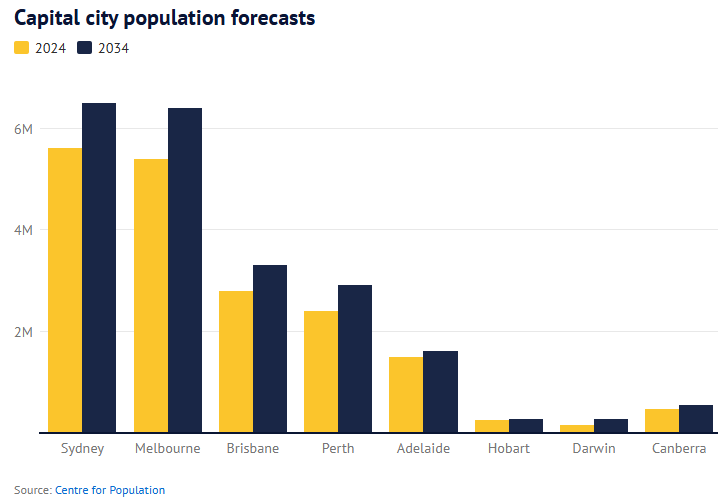

December’s Population Statement from the Australian Treasury’s Centre for Population forecast that the nation will grow by 4.1 million people over the next ten years, most new residents settling in Sydney, Melbourne, Brisbane, and Perth.

The projected 410,000 annual population increase—similar to the current population of Canberra—will ensure that population demand continues to outstrip supply, upward pressure on rents and prices.

Net overseas migration must be slashed if housing affordability is to sustainably improve.