Thursday’s dwelling approvals data from the Australian Bureau of Statistics (ABS) suggested that the nation’s housing shortage continues to worsen.

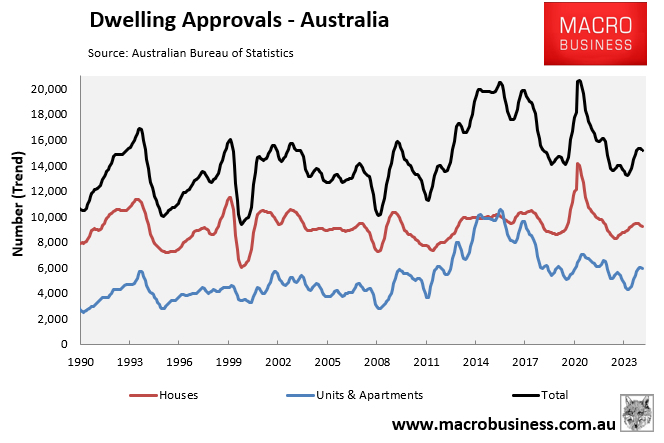

In January, only 15,142 homes were approved for construction, nearly 25% below the Albanese government’s housing target, requiring 20,000 homes to be built monthly for five consecutive years.

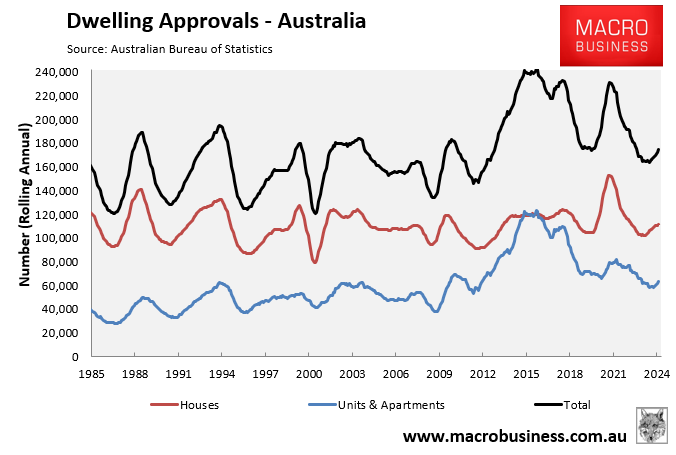

In the 12 months to January, 174,942 homes were approved for construction, which was around 65,000 (27%) below the government’s target, requiring 240,000 homes to be built annually.

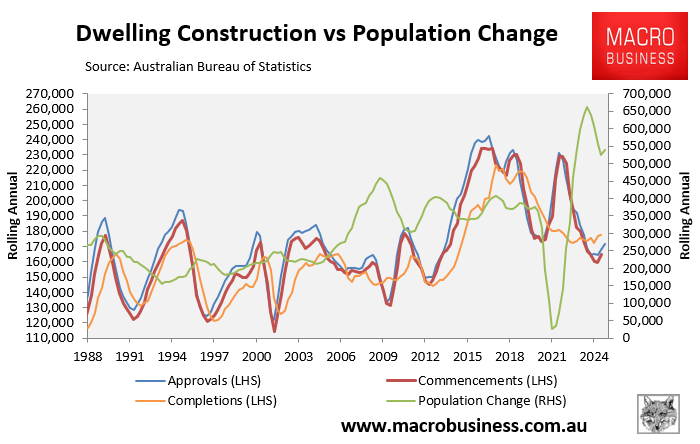

The following chart plots annual dwelling approvals, commencements, and completions against the nation’s population growth as of Q4 2024.

As you can see, an enormous gap exists between demand (population growth) and supply (construction rates).

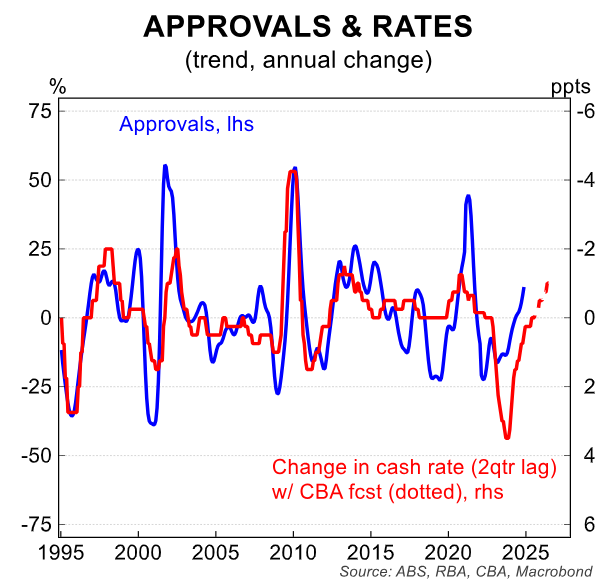

The good news is that interest rates are expected to fall by around 1% in 2025 (including February’s 0.25% cut).

Construction rates have historically been correlated with interest rates. Therefore, lower rates should facilitate a construction rebound.

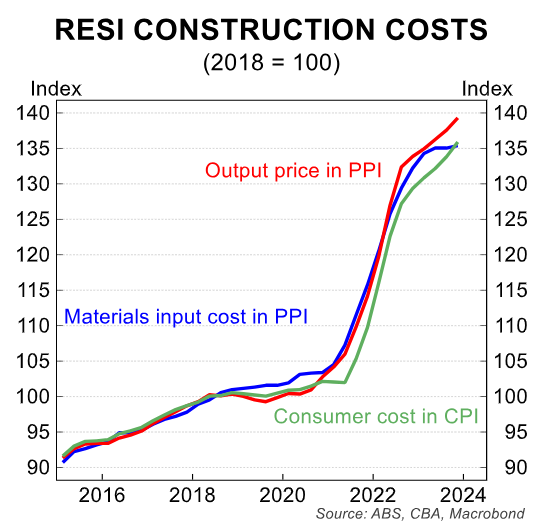

The bad news is that construction costs are around 40% above pre-pandemic levels.

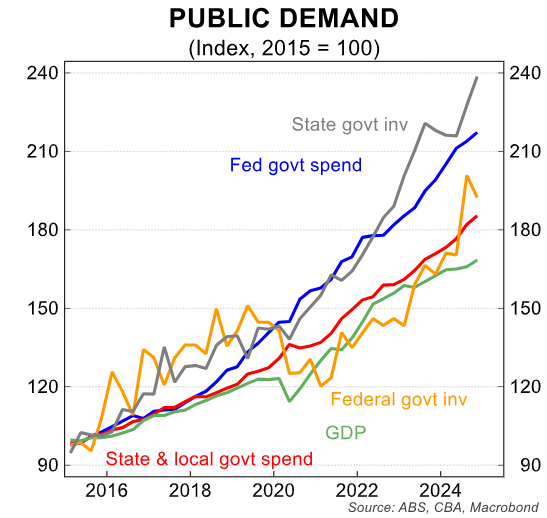

Government ‘big build’ infrastructure projects are also channeling labour and resources away from home building.

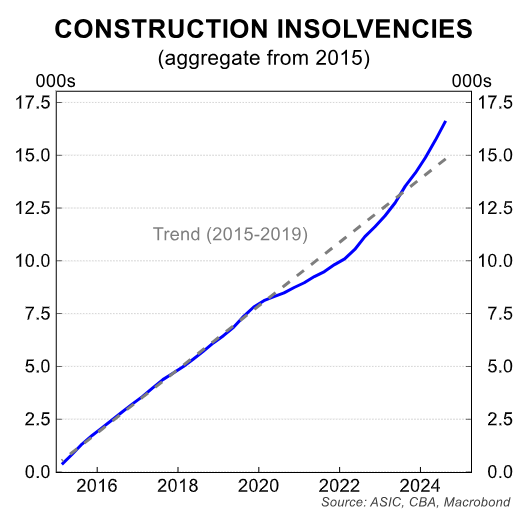

Many construction firms have also gone under in recent years.

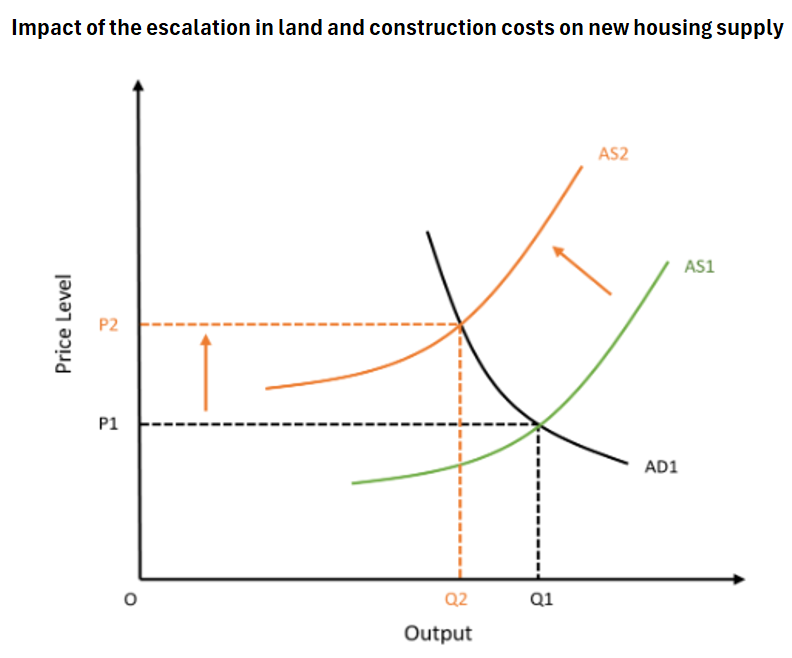

The result is that the supply curve for housing has shifted to the left, making it more expensive to build homes at each price point.

Australia, therefore, faces a prolonged period of soft dwelling construction.

Australia faces a worsening housing shortage if it doesn’t cut immigration to compensate for the decline in construction.