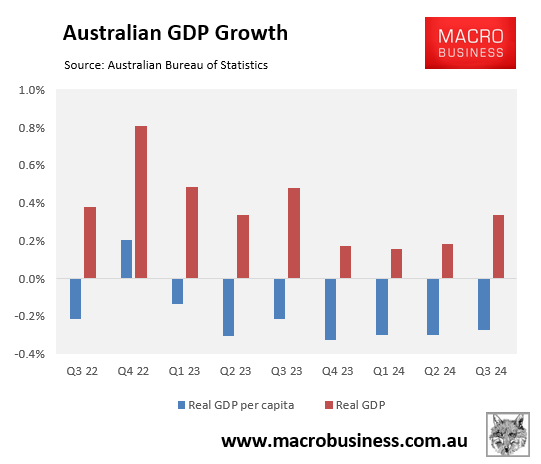

Australians have experienced the longest recession in modern history, with real per capita GDP falling for seven consecutive quarters as of Q3 2024.

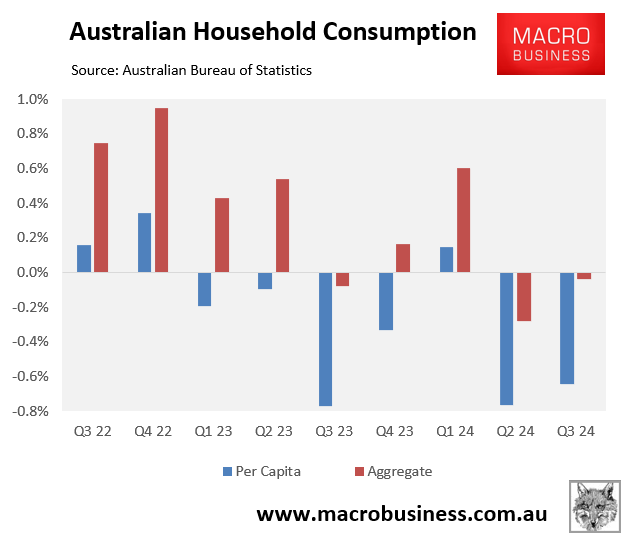

This reduction in per capita GDP has been driven by the household sector, where spending fell in six of the last seven quarters.

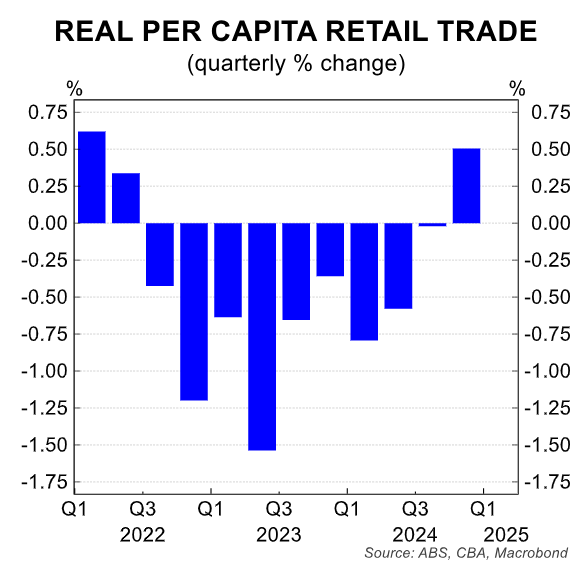

The latest quarterly retail sales data from the ABS reported that real per capita retail sales increased by 0.4% in Q4 2024, the highest growth rate since Q1 2022.

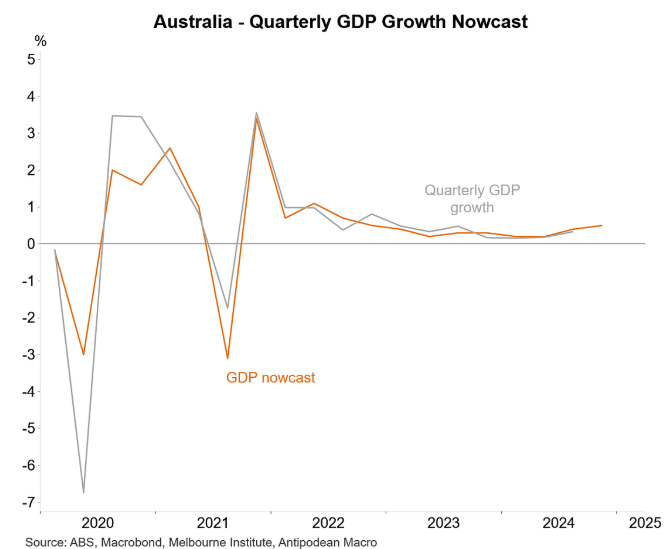

On Friday, Justin Fabo from Antipodean Macro published the Melbourne Institute’s latest nowcast of Australia’s Q4 GDP growth, which firmed to +0.5% for the quarter.

CBA also forecasts a 0.5% rise in aggregate GDP in Q4 2024.

The latest Statement of Monetary Policy (SoMP) from the Reserve Bank of Australia’s (RBA) forecasts that the nation’s population grew by 0.4% in Q4 2024. This would mean that Australia’s per capita recession finished in the quarter, with the economy eking out 0.1% per capita growth.

However, Westpac has forecast GDP growth of only 0.4% in Q4 2024, which would imply flat (0%) per capita GDP.

“Growth in per capita GDP is likely to have stabilised, after falling for seven consecutive quarters – the longest run of consecutive declines on record”, Westpac Senior Economist Pat Bustamante wrote on Friday.

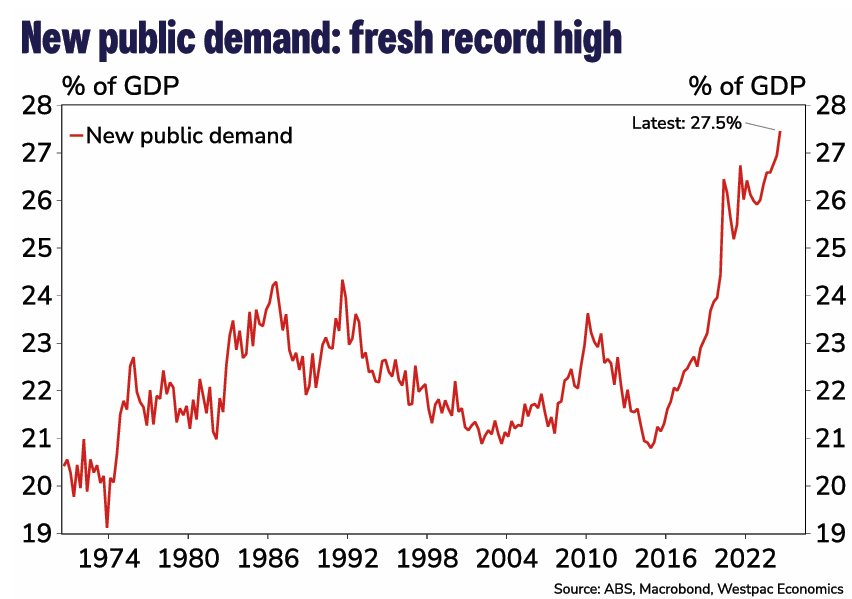

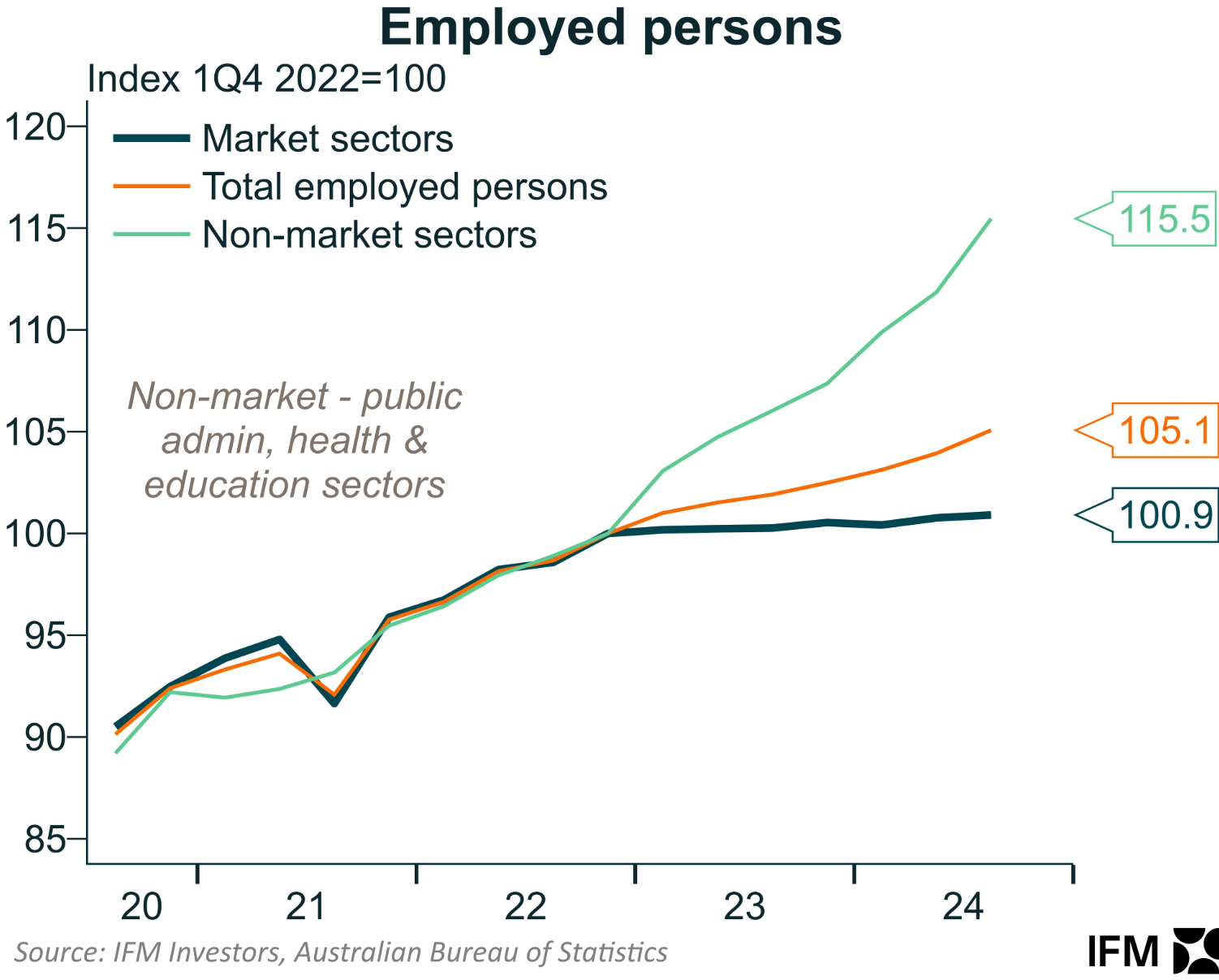

The Australian economy remains structurally weak, with record public spending holding up GDP and job growth.

Australia’s private sector likely remained in recession in Q4 2024.