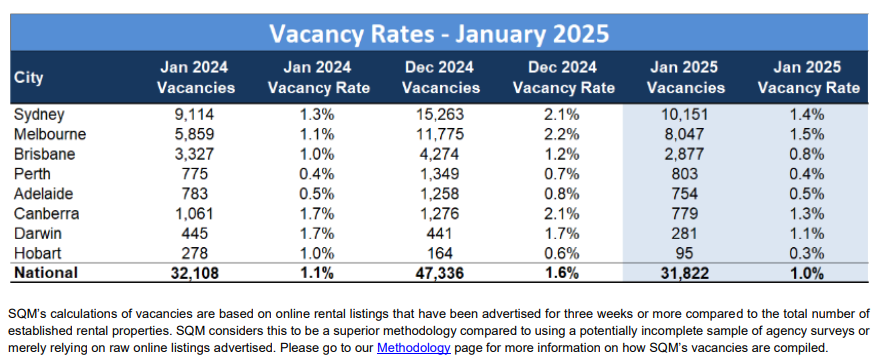

Last month, SQM Research released data showing that the national vacancy rate fell to just 1.0% in January 2025, down 0.1% year-on-year.

“The sharp decrease in rental vacancies strongly indicates Australia’s rental market crisis is not over and has potentially deteriorated at the start of 2025”, SQM Research noted.

Rental prices also recorded a sharp rise in January following a period of moderation in 2024. Capital city advertised rents rose by 1.6% over the month.

SQM Research managing director Louis Christopher suggested the tightening may not be an anomaly.

“Is this a one-off abnormality? Unfortunately, I don’t think it is, as our records of February listings to date are lower than what was recorded in January”.

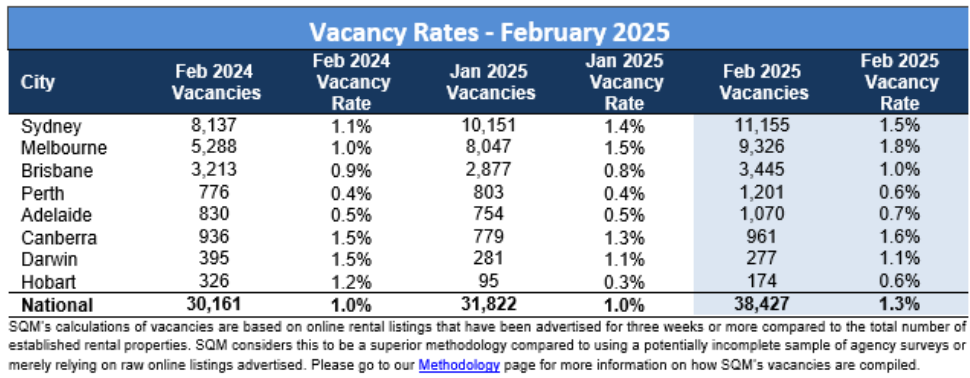

Thankfully, SQM Research’s latest rental vacancy report shows that the national vacancy rate rose to 1.3% in February, to be 0.3% higher annually.

Capital city asking rents also rose by 0.4% over the month.

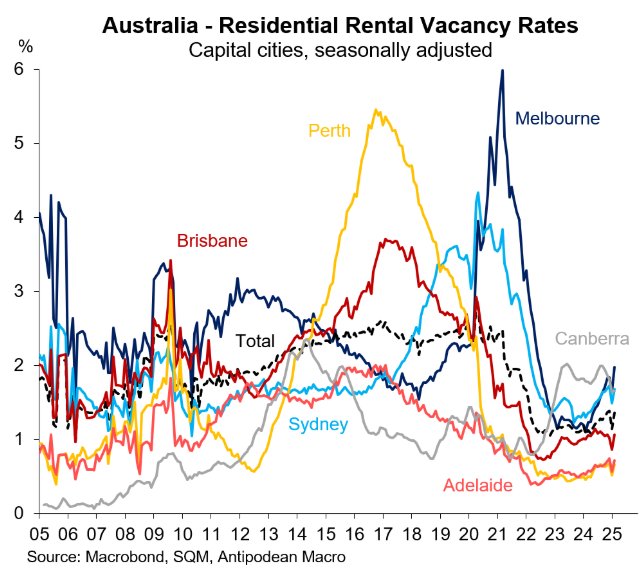

The following chart from Justin Fabo from Antipodean Macro plots rental vacancy rates across the capital cities.

SQM Research managing director Louis Christopher was surprised by the result and expects the vacancy rate to tighten in March. He also believes the “country remains in a rental crisis”.

“National rental vacancy rates rose somewhat in February, which was somewhat surprising to us given there was no increase in total rental listings. That suggests advertised rental properties were taking about 3 to 4 days longer to rent and occupy on average than January. But I don’t regard that as a material increase. I would not be surprised to see vacancy rates fall again in March which typically records the stronger rental demand”.

“Advertised rents continued to rise over the month for the capital cities, but not at the extreme pace that was recorded over 2021 to 2023. This suggests there has been an easing in rental growth expectations by landlords but nevertheless advertised rents are still rising faster than the overall inflation rate”.

“Overall, the data we have released today still suggests the country remains in a rental crisis, driven by a combination of excess population growth and multi-year lows in dwelling completions”.

Therefore, the rental crisis has eased somewhat but is far from over.