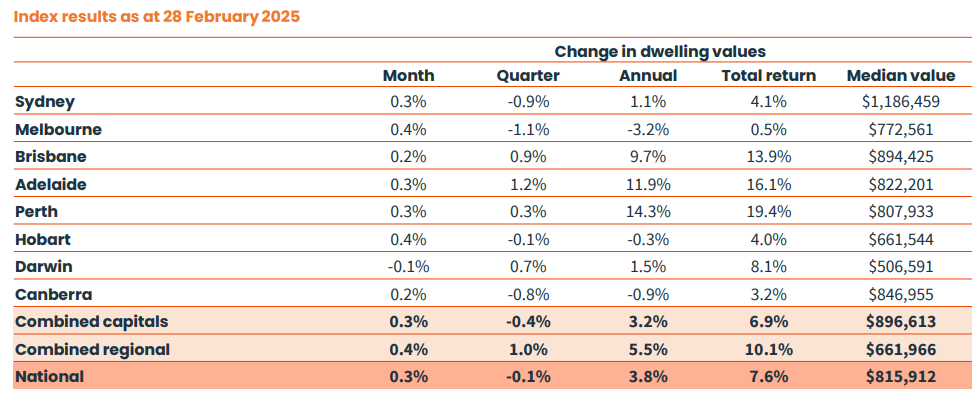

CoreLogic’s latest monthly house price report shows that Melbourne is now the cheapest major capital city housing market with a median price of $772,561 as of 28 February 2025.

Source: CoreLogic

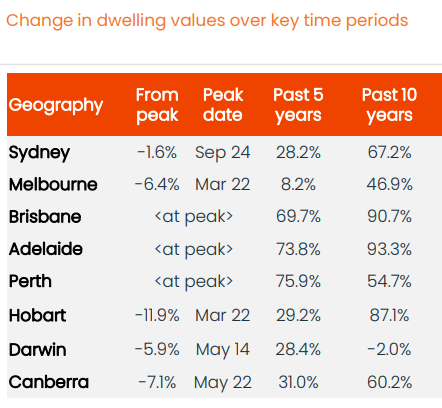

Melbourne’s relative affordability follows a value gain of only 8.2% over the past five years, versus a 38.9% increase nationally.

Source: CoreLogic

Melbourne-based real estate agent Adam Welling notes a significant turnaround in confidence among Melbourne home buyers following the 0.25% interest rate cut in February.

“We instantly saw higher selling prices being achieved at auctions or private treaties when the rate was cut”, he said.

“Week after week, we’re seeing buyers becoming more confident in buying before auction and there’s also been a rise in competitive bidding at auctions, which are both signs of a bull market”.

Welling was commenting on the Westpac Consumer Sentiment Index for March, which showed a 15.3% jump to 106 points regarding home buyer sentiment among Victorians, with the increase being the biggest of any state.

CoreLogic’s head of research, Eliza Owen, noted that Melbourne’s relative affordability is attracting interest.

“I think people are recognising it’s a good time to buy in Melbourne as this market has become more affordable, sitting about 6% below its peak in 2022”, she said.

Jacob Decru, a mortgage broker with Loan Market based in Melbourne, also noted that mortgage pre-approval volumes climbed by 30% over January and February compared with a year ago amid expectations of a rate cut.

“We saw a strong pick-up in first-home buyers and upgraders getting ready to buy, and those who were pre-approved are now going ahead with their purchases, unlike last year when they were just letting it expire or roll over”, he said.

“I think there’s a feeling that property markets will go up later this year and they don’t want to miss the boat”.

Scott Kuru, co-founder of property investment advisory Freedom Property Investors, has seen a threefold rise in demand from first-home buyers and investors in the past three months compared with last year.

“There’s real demand in the market, especially for those who are looking to get in before prices rise again”, he said.

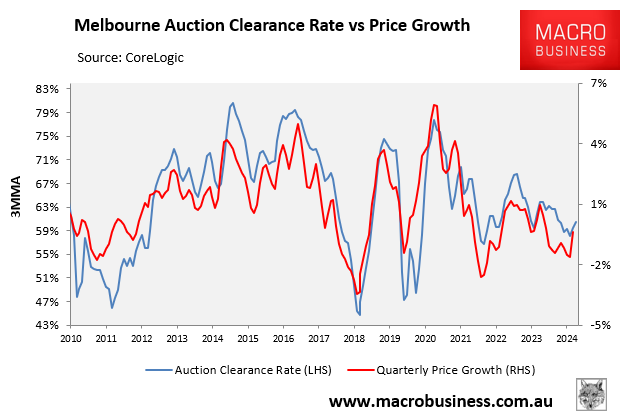

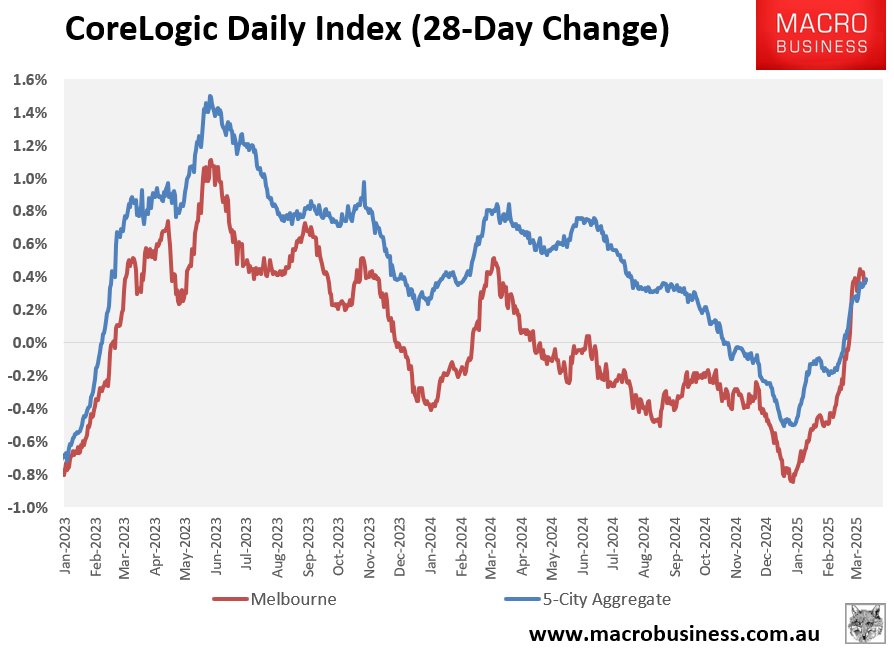

Indeed, there has been a bounce in the auction market, with clearance rates lifting over the past two months.

CoreLogic also recorded a 0.4% rise in Melbourne dwelling values in February, the first increase in 11 months.

The bargain hunters are moving in.