ANZ CEO Shayne Elliot described Victoria as “one of the toughest” places to do business. It is easy to see why.

The Victorian government introduced a payroll tax surcharge in the 2021-22 State Budget as part of a mental health and wellness levy, but only for businesses with a payroll of $10 million or more.

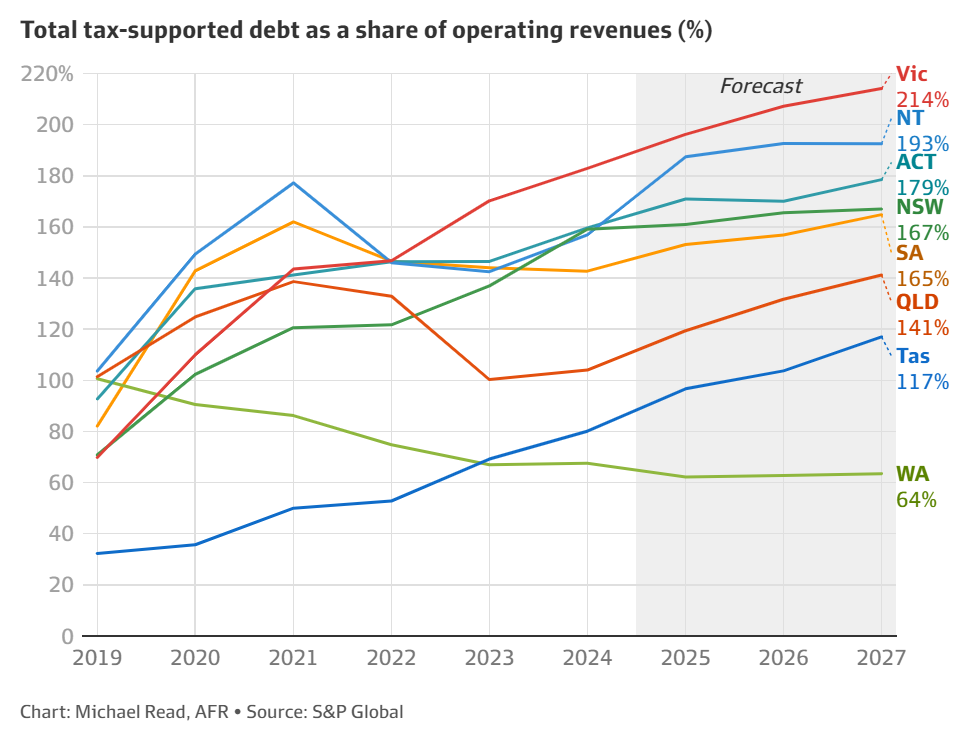

The State Budget for 2022-23 then raised payroll taxes on the same businesses as part of a 10-year Covid debt levy to help repay the government’s record borrowing during the pandemic.

The Victorian government followed up by hiking WorkCover premiums, which are borne by employers, by 42%, from 1.27% to 1.8% of a company’s employee pay.

The tax increases, alongside the weak state economy, have created a chilling effect on Victorian business.

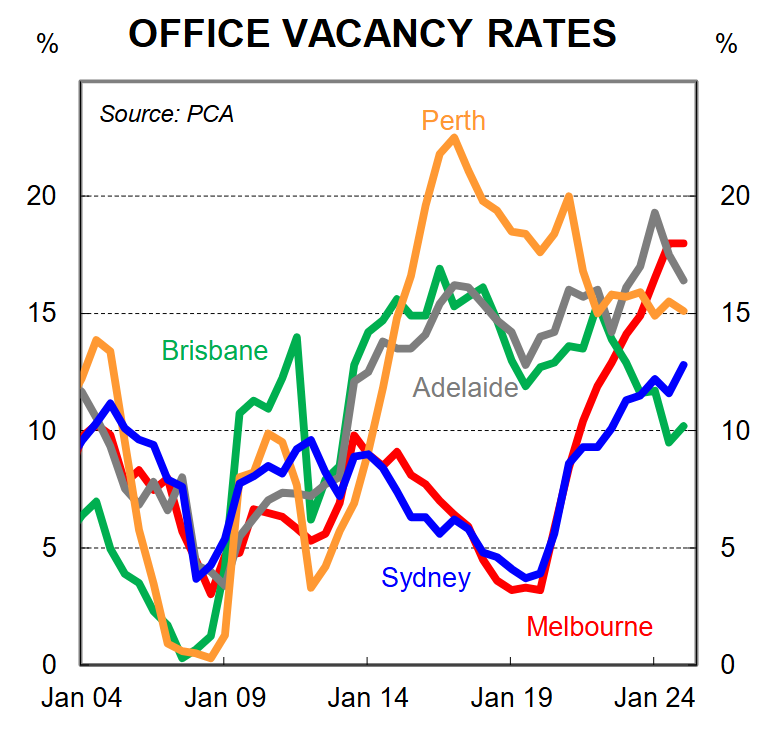

Melbourne’s office vacancy rate is the highest in the nation.

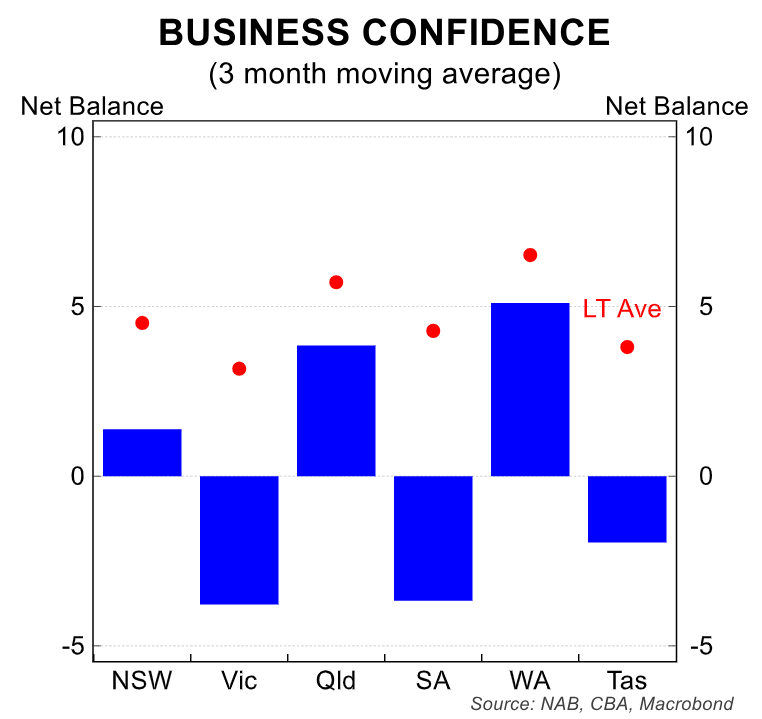

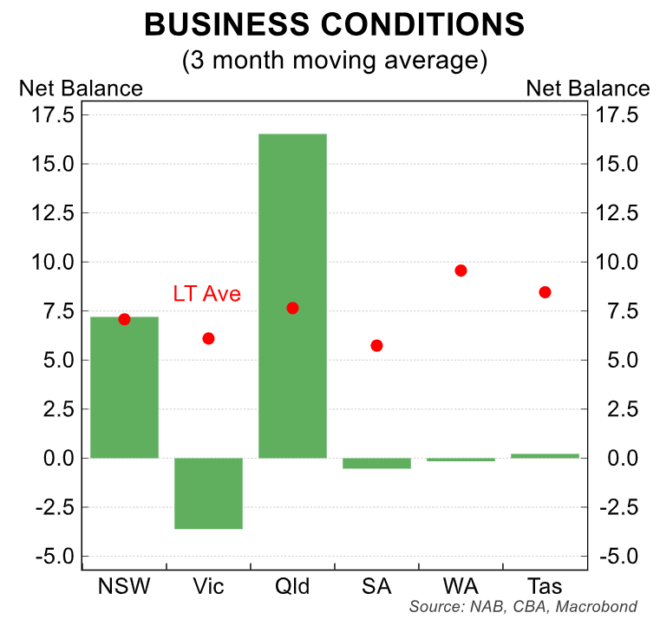

Business conditions and confidence have fallen the most in Victoria.

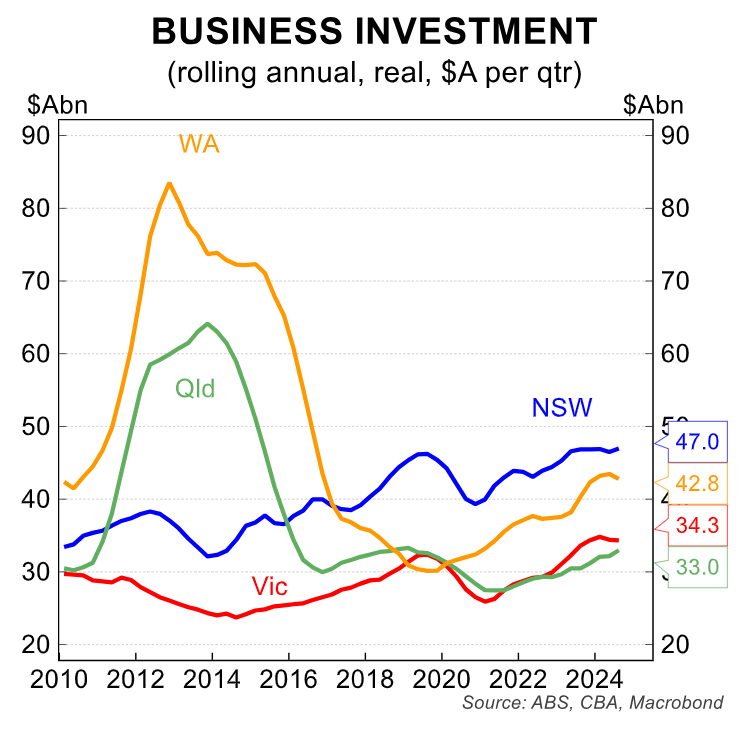

Victoria’s business investment has also been stunted. It is well below NSW and Western Australia and is only marginally higher than Queensland, which has a far smaller economy and population.

The AFR’s Chanticleer parsed the company reporting season and noted that many major Australian companies are concerned about the failing Victorian economy.

Ryan Stokes, the chief executive of industrial conglomerate SGH, declared the Victorian economy was in recession and warned that the state was suffering capital flight.

“I’d say development capital is probably fleeing Victoria for other jurisdictions where there aren’t the same land tax penalties, where there isn’t the same windfall gain tax, etcetera”, Stokes said.

Wesfarmers chief executive Rob Scott also sees Victoria as the laggard.

“We’ve seen slower growth on the business side and a more cautious consumer”, he said.

“I think there have been a number of decisions that were made that were clearly bad for business and bad for households. Having the highest payroll tax in the country certainly doesn’t help”.

“It would be really hard to justify an investment in Victoria. That’s why most of our investment is occurring in Western Australia”, Scott said.

Ross Du Vernet, the chief executive of property giant Dexus, says Melbourne remains the toughest market for his business.

“The lack of leadership and direction there means that it’s going to be tough for the foreseeable future”, he said.

Other major companies raising concern about Victoria included the following, according to Chanticleer.

JB Hi-Fi identified the Victorian construction sector’s fragility as a barrier to growth in its commercial operations.

ARB, a manufacturer and seller of four-wheel drive equipment, said that aftermarket sales increased in all Australian states except Victoria during the December half.

Chief executive Anthony Heraghty of Super Retail Group, which owns Rebel, Macpac, and BCF, identified two specific areas of difficulty for the company’s Super Cheap Auto business: the faltering New Zealand economy and Victoria.

Property developer Stockland noted the Victorian housing market’s deterioration. Victoria is the only state where the company is having to offer rebates to sell house and land packages, with annual lot sales currently averaging between 6000 and 7000, down from the 15,000 that Stockland would expect to sell in a “normal” year.

Bendigo Bank head Richard Fennell said Victoria is “facing some economic challenges and housing arrears are slightly higher there”.

The business environment will only worsen as Victoria’s state debt swells and its credit rating is further downgraded.

Unfortunately, Victoria has become the nation’s largest economic sinkhole.